When shopping for a vehicle, older drivers can find the best cars for seniors by considering safety, visibility, and comfortability. The best cars for seniors are also affordable and are cheap to insure.

It’s essential to plan ahead before you shop for the best car for older drivers, so you can pick a car that’s best for your needs.

Explore related topics

What are the best cars for seniors?

The best cars for seniors drivers are safe, comfortable, and affordable. Comfort and affordability are a matter of personal preference and budget, but what about safety?

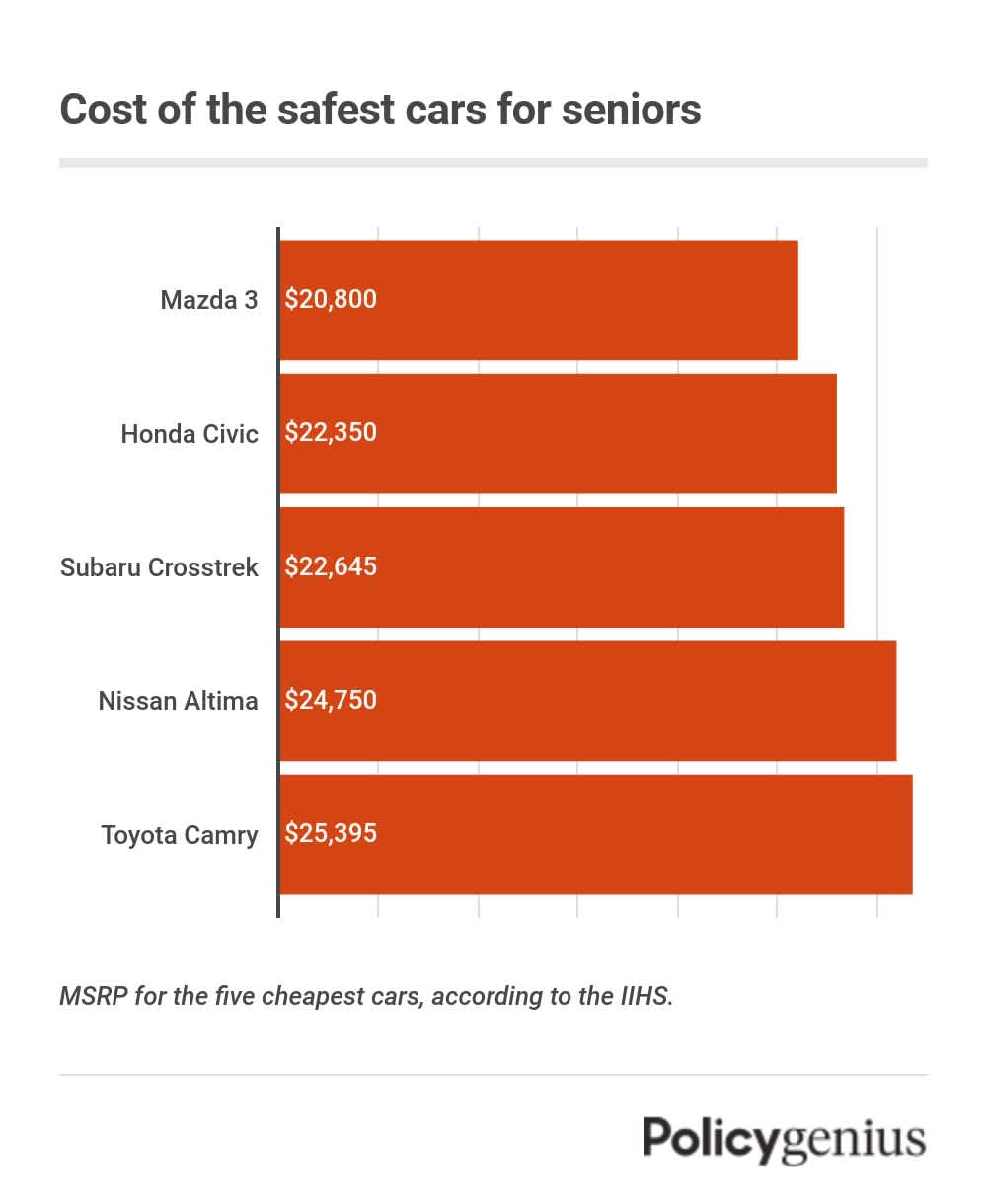

According to the Insurance Institute for Highway Safety (IIHS), which measures cars on both their ability to avoid crashes and on how well they fare in collisions, these are some of the safest cars on the market [1] :

The IIHS determines its list of safest vehicles by rating headlight quality, front crash prevention, roof strength, head restraint, and other safety features.

The IIHS’s rankings are a useful way to find the best cars for seniors because its list is broken down by vehicle type and size.

Rank | Car | MSRP |

|---|---|---|

1 | Mazda 3 | $20,800 |

2 | Honda Civic | $22,350 |

3 | Subaru Crosstrek | $22,645 |

4 | Nissan Altima | $24,750 |

5 | Toyota Camry | $25,395 |

6 | Honda Accord | $26,120 |

7 | Subaru Outback | $27,145 |

8 | Ford Explorer | $33,745 |

9 | Toyota Highlander | $35,405 |

10 | Volvo XC60 | $45,650 |

11 | Tesla Y | $59,990 |

What should seniors look for when buying a car?

The best car for most seniors may not be the best for you, depending on your needs. That said, there are some general categories to consider when looking for the best cars for older drivers.

1. Safety features

Many of the best new cars for seniors come with warning systems to help prevent accidents, like lane departure warning and forward collision warning alarms. These features tell older drivers when something dangerous is happening, like drifting between lanes or approaching the car in front of you too quickly.

2. Visibility

Senior drivers should make good visibility a priority when buying a new car and double check all these features before purchase. The best cars for older drivers will have wide windshields that you can easily see out of, plus mirrors, blindspot detection, and a backup camera.

3. Comfort

The best cars for seniors are comfortable. This means that older drivers should be able to get into and out of their vehicles easily. The best cars should also provide lumbar support and the ability to control your vehicle’s interior temperature.

4. Features for drivers with disabilities

Some seniors may need cars with special features that make driving easier. The best and safest cars for these senior drivers will have tools like hand and foot controls, adaptive cruise control, or pedal extensions that make it easier for older drivers or those with disabilities to use their cars.

5. Average cost of car insurance

Older drivers should also keep car insurance costs in mind while shopping. The best cars for seniors are cheap to insure, along with being affordable and safe.

We found that the best car for seniors when it comes to safety and car insurance affordability is the Subaru Outback. The Outback costs $1,744 per year (or $145 per month) for seniors to insure.

Vehicle | Annual cost | Monthly cost |

|---|---|---|

Subaru Outback | $1,744 | $145 |

Toyota Highlander | $1,818 | $152 |

Ford Explorer | $1,822 | $152 |

Honda Civic | $1,925 | $160 |

Toyota Camry | $1,949 | $162 |

Honda Accord | $1,990 | $166 |

Tesla Model Y | $2,884 | $240 |

Average costs for seniors to insure the safest cars.

Insurance rates may be more (or less) expensive depending on factors that are specific to you.

These include your address, credit score, and driving history.You should compare rates to ensure you find the cheapest insurance for your vehicle.

Methodology

Policygenius analyzed the cost of car insurance for seniors using rates provided by Quadrant Information Services. These rates were for a sample driver in every ZIP code across all states, including the District of Columbia.

Our sample driver carried a policy with the following limits:

Bodily injury liability: $50,000 per person, $100,000 per accident

Property damage liability: $50,000 per accident

Uninsured/underinsured motorist: $50,000 per person, $100,000 per accident

Comprehensive: $500 deductible

Collision: $500 deductible

Some carriers may be represented by affiliates or subsidiaries. Rates provided are a sample of insurance costs. Your actual quotes may differ.