Note: For more recent surveys on Americans and healthcare, see our 2017 surveys on Obamacare benefit and provision knowledge and universal health insurance.

Everyone loves game shows, right? There’s nothing better than sitting around with a group of friends, yelling answers at the TV while you try to prove how much smarter you are than your buddies. Except most of the time you end up getting the answer wrong and cursing at Alex Trebek while he smugly reads out the correct answer from a card.

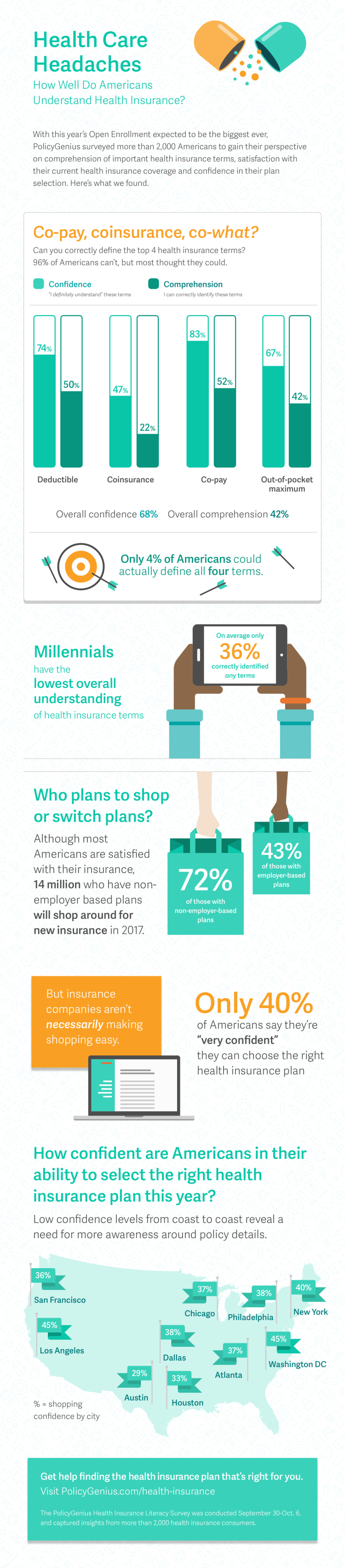

Turns out, health insurance is kinda the same. Policygenius’ survey of 2,000 American health insurance consumers found that 96% of Americans overestimate their understanding of health insurance concepts.

Health insurance can be pretty complicated, but it’s also something we all (legally and financially) need in our lives, whether we’re getting it through our employer or shopping for it on our own. Surely we’ve absorbed some knowledge of how to calculate out-of-pocket max or what the heck co-insurance is over the years of using our insurance, right?

Well, we wanted to find out. So, with Open Enrollment right around the corner, we partnered with Radius Global Research to conduct a survey in ten of the biggest cities in America – New York City, Los Angeles, Chicago, Philadelphia, Dallas, San Francisco, Washington DC, Austin, Atlanta, and Houston – to learn just how much people know about health insurance. Additionally, we asked people to indicate how often they used their insurance, how satisfied they are with their current plan and how confident they are in their ability to choose the right plan for their needs this year.

Here’s what they knew – and what they thought they knew.

People think they know more about health insurance than they actually do

Most people know what a premium is when it comes to their insurance, because they have to pay it every month. But we asked if they could define four other key health insurance terms: deductible, co-insurance, co-pay, and out-of-pocket maximum.

Here’s how well people understood and could correctly identify each term:

Who knew what?

We got a pretty fair demographic representation of our great nation, with a wide mix of respondents across gender, age, income, and location. How did they fare against one another? We pitted them in gladiator-style matches to find out.

Men vs women

If you’ve ever watched a ‘90s standup comedy routine, you know that men hate asking for directions. They apparently also hate asking what health insurance terms mean.

The average gap between what men and women think they know is pretty large – 72% to 64%, respectively. However, when it comes down to actually defining things correctly, men edge out women only by a slim 44-41%. The gap between perceived and actual knowledge is much wider for men than it is for women.

Millennials vs baby boomers

Millennials are terrible snake people who are ruining America by not moving out of their parents’ home (or something), but their biggest crime might be not knowing a lot about health insurance.

65% of Millennials (age 25-34) say they “definitely” know what the four terms we asked them were, which is right up there with the other age groups. For comparison, 71% of Baby Boomers (55-64) say they “definitely” know the terms.

But when it comes to actually knowing the terms, there is no contest: only 36% of Millennial respondents answer correctly, compared to 47% of Baby Boomers.

Millennials average the worst out of all of the age groups, which isn’t particularly surprising. They could be shopping for health insurance for the first time after getting released from their parents’ plan, and they don’t have as much experience navigating the ins and outs of practical insurance use.

City vs city

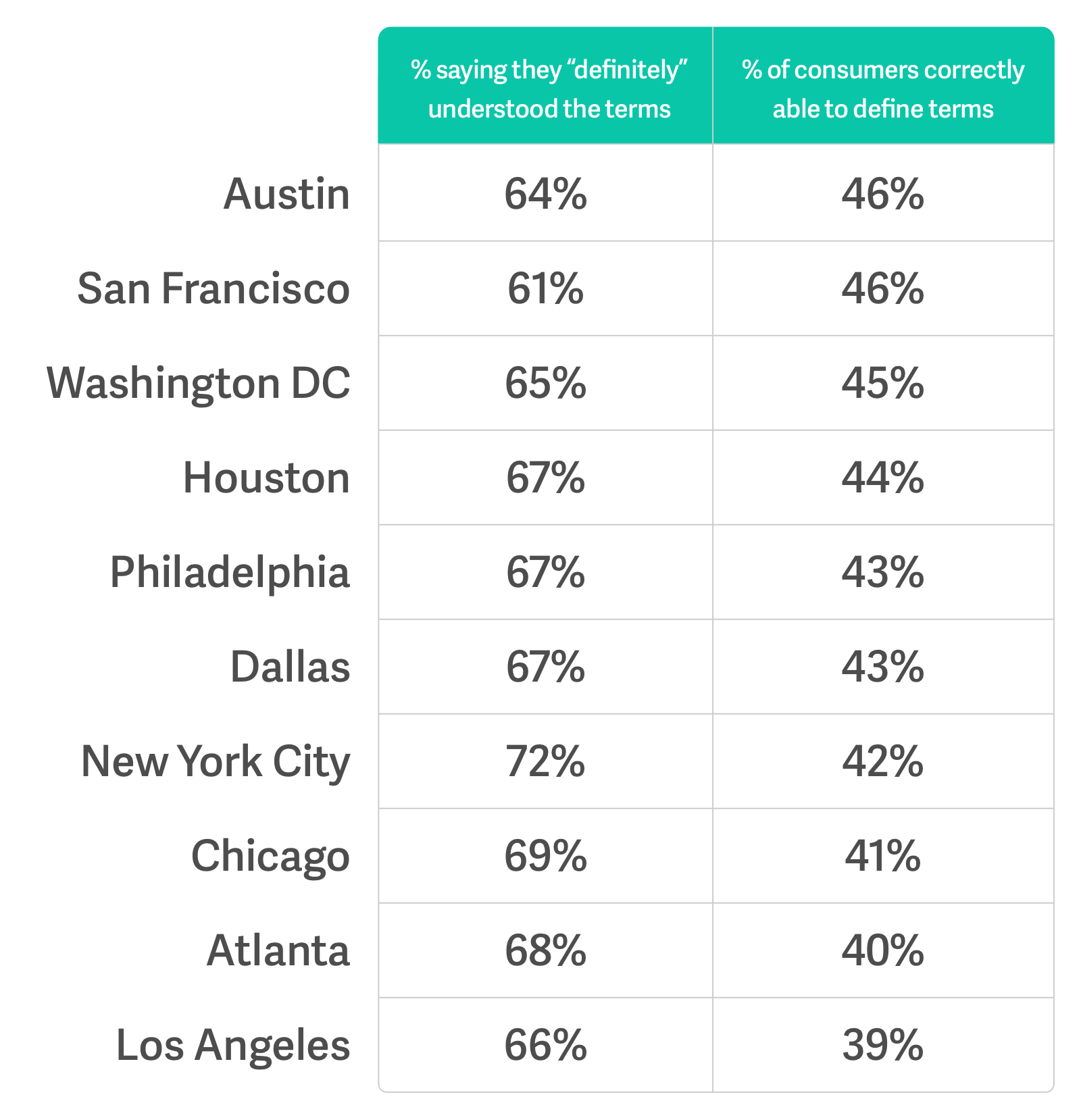

Which cities did the best when it came to knowing what they thought they knew?

Average confidence vs comprehension scores

New York City has the largest gap between confidence and comprehension – what they think they know and what they actually know – while San Francisco has the smallest gap.

People are mostly satisfied with their current plans

There’s been a lot in the news about Obamacare premium hikes, but a surprising amount of people are actually satisfied with their current health insurance plans.

Overall, 70% of consumers are happy with their current plan. Satisfaction is higher among people with employer-provided plans, as well as among people who use their insurance two or more times in the past twelve months.

However, that’s not going to stop people from shopping around: 49% of respondents are at least looking at new plans, if not definitely switching. Additionally, 73% of people who shop for their own insurance are planning on shopping around, compared to only 43% of people who get insurance through their employer.

But people aren’t confident in their ability to choose a plan

Despite a Donald Trump-level of overconfidence in what respondents think they know, respondents are much more humble when it comes to their ability to actually choose a plan.

Only 39% of respondents are very confident in their ability to choose the right plan for their needs, while 12% are not at all confident. People who use their insurance more often are more confident in their ability to choose a plan that’s right for them.

If you think about it, that makes sense: someone who’s used their insurance multiple times in a year knows where the pain points are and where they’re lacking coverage. On the other hand, if you don’t use your plan often, you might not have an idea if it’s the best one for you – or how to find one that will better meet your needs.

Why does this matter?

While you’re probably wildly entertained by statistical comparisons, this is probably the point where you ask yourself what this all means.

A LOT of people will be shopping. Open Enrollment runs from the beginning of November through the middle of December, except for some states. Over 14 million people could be looking for new health insurance plans, making it the biggest Open Enrollment period ever.

Overconfidence can be dangerous. Outside of Special Enrollment Periods, Open Enrollment is the only time when you can buy health insurance throughout the year. That means if you don’t understand what a deductible is, or what your out-of-pocket maximum is, you could be stuck with a plan that’s outside of your budget for the entire year. Knowing what these terms mean, and what they mean for your finances, can save you a lot of headaches – or worse.

People need educational resources. So confidence clearly doesn’t equal comprehension, so where should people turn to find this information? When Policygenius started offering insurance more than two years ago, we knew that giving people access to tools and information was one of the best ways we could help them. That’s why, with our health insurance launch, we’re taking the same approach: our Policygenius Magazine goes in depth into every health insurance topic you could imagine, and we have a best-in-class Health Insurance Learning Center with state-by-state resources, a comprehensive health insurance FAQ, and – conveniently – a glossary with all of the need-to-know health insurance terms to get you through Open Enrollment. And when you choose a health plan with Policygenius, we walk you through every step so you know exactly what you’re getting.

Survey results

For more information, we’ve included links to the fully survey findings, a press release announcing the survey insights and infographics with the findings from each surveyed city.