Home and auto insurers are embracing new technology to make policy distribution, pricing, and claims more efficient, but consumers are wary of tech that raises privacy concerns or removes the human element completely, according to the Policygenius Home & Auto Insurance Technology Survey 2021.

The following findings are based on responses from a survey of a nationally representative sample of 1,500 Americans age 25 and over, conducted via Google Surveys from June 4 through July 2, 2021.

Consumers still appreciate a human touch

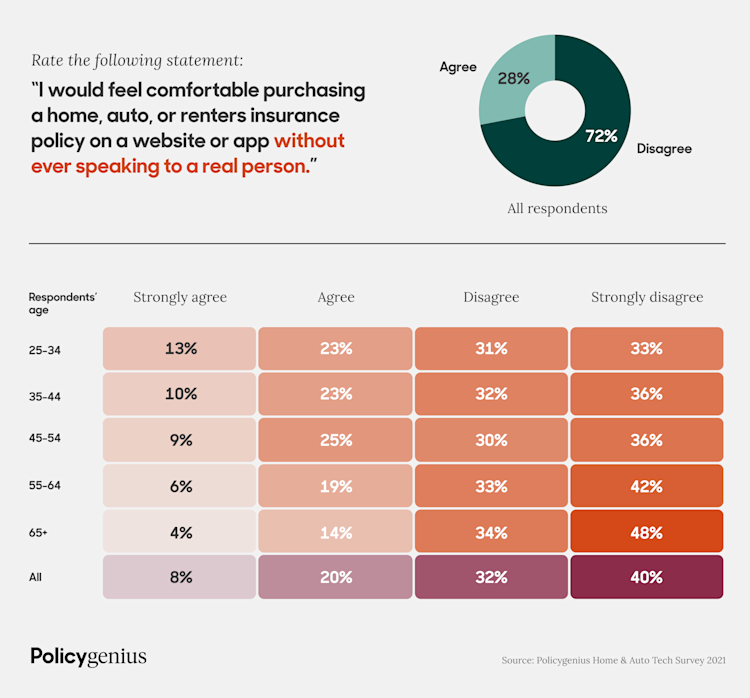

As some insurance companies pivot toward AI-powered distribution, underwriting, and claims, consumers still prefer the human element when it comes to purchasing and using their coverage. In fact, 72% of consumers said they wouldn’t feel comfortable buying home, auto, or renters insurance online without ever speaking to a real person, and 64% wouldn’t feel comfortable filing a claim on a website or app without human interaction.

Buying insurance

Respondents of all ages expressed discomfort with exclusively digitized insurance products. Two in three (66%) consumers age 25 to 54 said they were uncomfortable purchasing insurance online without talking to a human. More than three in four (78%) consumers over 55 felt similarly.

Filing claims

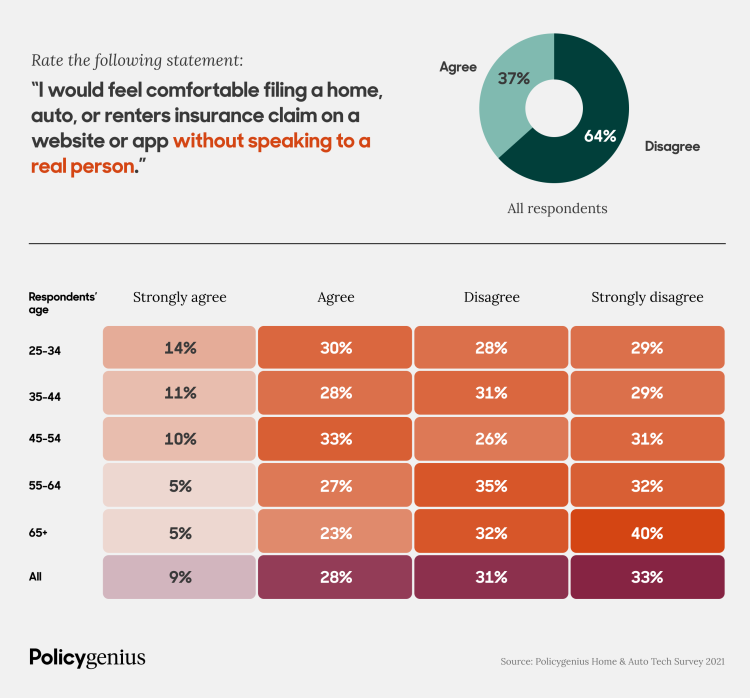

Most consumers favor at least some communication with an actual human during the claims process: Around 64% said they wouldn’t feel comfortable filing a home, auto, or renters insurance claim online without interacting with a real person.

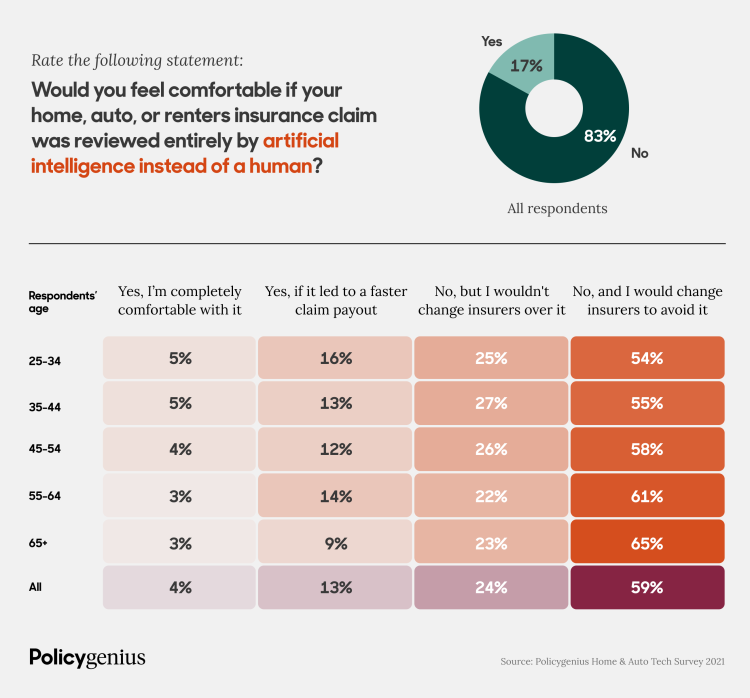

Insurers are utilizing advances in artificial intelligence and machine learning to improve claim efficiency, accuracy, and fraud detection, but consumers are overwhelmingly opposed to AI reviewing their claims from start to finish. Just 17% of consumers said they would feel comfortable if their home, auto, or renters insurance claim was reviewed exclusively by artificial intelligence. Almost 60% said that they were so uncomfortable with this scenario that they would take the extra step of changing insurance companies to avoid it. When broken down by age group, both younger and older generations expressed discomfort entrusting their entire insurance claim to AI.

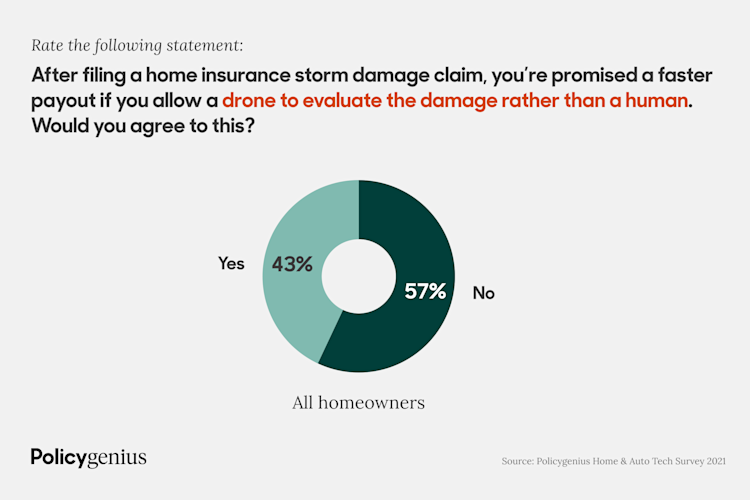

Several home insurers have turned to commercial drones to improve property inspections and expedite damage assessments after large scale natural disasters, but most consumers still prefer a human claims adjuster. [1] [2] Less than half of homeowners would agree to let a drone evaluate their property rather than a human during a home insurance storm damage claim, even if it led to an expedited insurance payout.

Privacy concerns outweigh financial savings

There may be tradeoffs to using new technologies like telematics (for usage-based car insurance) and smart home devices (like water sensors, doorbell cameras, or thermostats) to earn discounts and savings on home and auto insurance. While “pay-as-you-drive” car insurance and smart home technology can make sense if your goal is to cut costs, these products have also been associated with privacy concerns.

Telematics

Consumer interest in telematics, the technology behind usage-based car insurance, reached new heights in 2020 and it appears to have a strong long-term outlook. [3] Around 43% of drivers said they would use an app that collects data about their driving behavior and location if they were offered a discount for doing so. But of those drivers, 74% said they would only use such an app if it lowered their rates by more than half. The majority of drivers surveyed didn’t think telematics was worth any insurance discount.

Dashcams

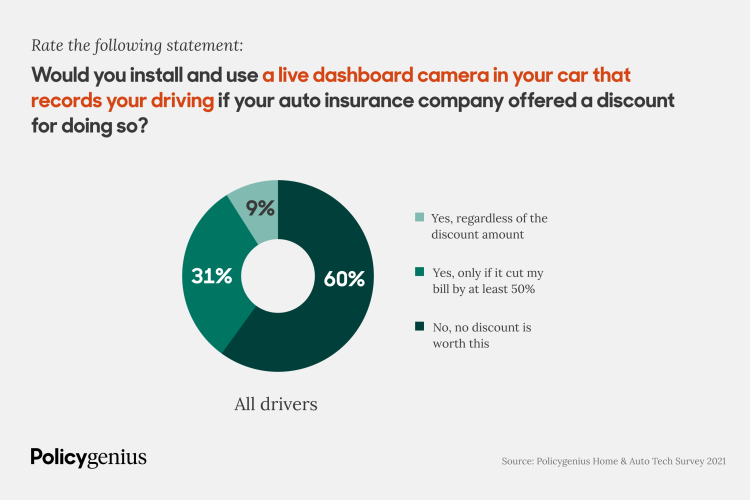

Few insurers currently offer a dashcam discount, but these devices can provide other important insurance benefits. If your insurer asks for proof that you weren’t at fault during a collision, for example, a dashboard camera recording of the accident may be all the evidence you need for a successful claim.

Around two in five (40%) drivers said they would install and use a live dashboard camera if their insurance company offered a discount for doing so. But of those drivers, around 78% said they would only use one if it cut their bill by at least half.

Smart home devices

Smart thermostats and other cloud-connected devices can lead to a safer and more secure home, lower utility bills, and insurance discounts, but consumers aren’t completely sold on the so-called Internet of Things. Just one in three (32%) said they would install a smart home device that collects personal data, even if doing so reduced their home or renters insurance rates by more than half. Around 57% said no discount would be worth this potential invasion of privacy.

Video doorbell cameras

Despite reported concerns over privacy and hacking, smart doorbell cameras have taken off in recent years, according to a report by Strategy Analytics. [4] These high-tech gadgets can help deter burglars, and some insurance companies will apply a home security discount to your policy if you install one. But video doorbell cameras have also been the subject of scrutiny in recent years.

Amazon’s Ring, for example, has partnered with more than 2,000 police and fire departments across the U.S. and in the past has encouraged its users to share any “suspicious” video footage through the device’s integrated Neighbors app — a feature that has reportedly led to racial profiling. [5] [6] [7] [8] [9] [10] When reached for comment, Ring told Policygenius its Neighbors app has strict community rules, moderators, and user-flagging tools that are intended to limit racial profiling and other forms of prejudice. Ring also said it doesn’t currently have facial recognition technology in any of its devices or services and will neither sell nor offer facial recognition technology to law enforcement. However, they have reportedly filed facial recognition patent applications in recent years, and Google’s Nest Hello currently uses this technology. [11] [12]

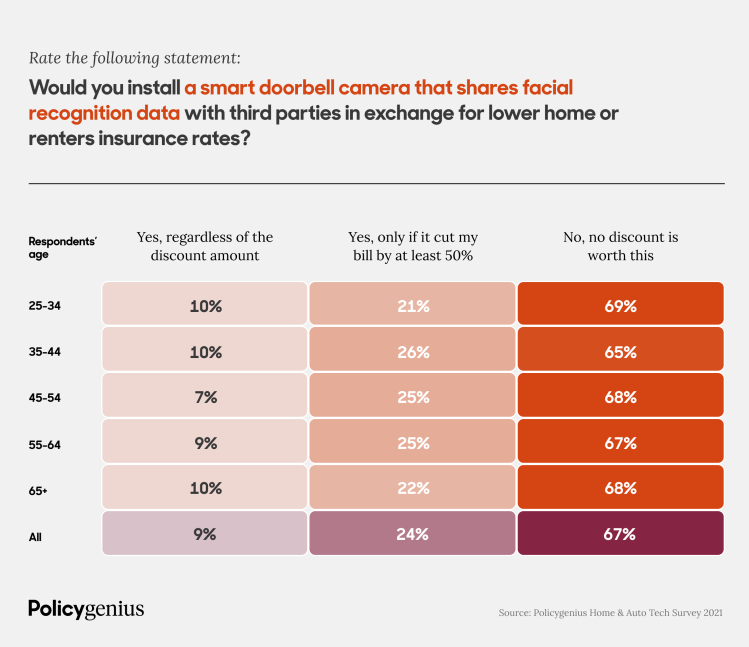

As of 2020, 10% of U.S. households with broadband internet reported owning a video doorbell, up from 7% in 2017, according to market research firm Park Associates. [13] But in spite of their increase in popularity, most consumers aren’t on board with smart doorbell cameras and facial recognition tech. In fact, 67% said that no home or renters insurance discount would be worth installing a smart doorbell camera that shares facial recognition data with third parties. Just a quarter of respondents said they would agree to this even if it cut their insurance bill in half.

Age didn’t seem to play a role in consumer appetite for these products, either. Across every age group, the share of consumers who responded “no” was virtually the same.

Tech giants and home & auto insurance don’t mix

As recently as 2018, Amazon reportedly discussed offering homeowners insurance to complement its suite of connected smart home devices. [14] Those discussions seem to have lost momentum since then, and it’s unclear whether a move into homeowners insurance is still on the cards for the tech behemoth.

Two in three (67%) consumers we surveyed said they wouldn’t be comfortable with a major tech company like Amazon insuring their home or car. Around 40% said it would make them “very uncomfortable.” Amazon declined a request for comment on these survey findings.

Methodology

Policygenius commissioned Google Surveys to poll a nationally representative sample of 1,500 home, auto, and renters insurance policyholders aged 25 and older. People we surveyed who have auto insurance were referred to as “drivers”; those who have homeowners insurance were referred to as “homeowners.” The average margin of error for responses is +/- 3.23%. You can find a more detailed description of Google Surveys’ methodology here.

Percentages were rounded to the nearest whole number, so some totals may not add up to 100.