Knoxville is a beautiful, historic city situated on the Tennessee River and home to one of America’s premier universities. Knoxville is also home to a lot of renters — 54% of the city’s occupied housing units are rentals^, and just about all of them should be covered by renters insurance.

Renters insurance ensures that your personal belongings are protected. There are countless reasons you should consider renters insurance if you live in Knoxville, from rate affordability to weather-related damage to break-ins. Read on to learn more about why renters insurance makes sense for Knoxville residents.

Best renters insurance in Knoxville

Insurance Company | Monthly Cost - $500 Deductible | Monthly Cost - $1,000 Deductible |

|---|---|---|

State Farm | N/A ‡ | $12.25 |

Allstate | $28.00 | $26.00 |

Travelers | $38.00 | $34.00 |

Stillwater | $22.83 | $20.50 |

Lemonade† | N/A | N/A |

‡ $500 deductible option not available

† Not available in Knoxville Methodology: We pulled renters insurance quotes online from five of the most popular insurance companies: State Farm, Lemonade, Allstate, Travelers and Stillwater. Quotes were for policies with $500 and $1,000 deductibles for a 30-year-old male apartment renter. We deferred to the most comparable coverage amounts when identical policies were unavailable.

Coverage type | State Farm | Allstate | Travelers | Stillwater | Lemonade |

|---|---|---|---|---|---|

Property Coverage | $20,000.00 | $20,000 | $30,000 | $20,000 | N/A |

Liability Coverage | $100,000.00 | $100,000 | $100,000 | $100,000 | N/A |

Medical payments to others | $1,000.00 | $1,000 | $1,000 | $2,000 | N/A |

‡ Lemonade not available in Knoxville

Understanding renters insurance quotes

Yes, renters insurance protects your personal property if it is damaged or stolen, but it’s so much more than that. If someone is accidentally injured in your home and they require legal or medical expenses, that financial responsibility is lifted off of your shoulders with renters insurance.

If you’re forced to move out of your apartment because of hazards like fire or water damage, renters insurance provides you and your family with additional expenses to cope with that unfortunate chain of events. So if you normally spend $400 a month on groceries for your family, renters insurance may cut you a check for $500 instead, since you’ll be forced to eat out instead of cook. Loss of use may also supply funds for hotel expenses and additional car mileage if the need arises.

Here’s a rundown of the components you should look for in a policy when comparing renters insurance quotes.

Property coverage: reimbursement for lost, stolen, or damaged property.

Liability coverage: covers legal expenses in the event someone is injured in your residence and they sue you.

Loss of use: covers temporary living expenses if your residence becomes uninhabitable.

Medical payments to others: covers medical costs in the event someone is injured in your residence and requires medical treatment.

We’ve got a full explainer of what renters insurance covers here.

Is renters insurance legally required in Knoxville?

While landlords and management companies are allowed to make renters insurance a requirement as terms for signing a lease, it is not currently law in Knoxville or the state of Tennessee to purchase renters insurance.

Reasons to buy renters insurance in Knoxville

Renters insurance is among the most affordable insurance types to buy, and considering most of your important and expensive personal belongings are in your residence or storage unit, it's impractical to not own renters insurance.

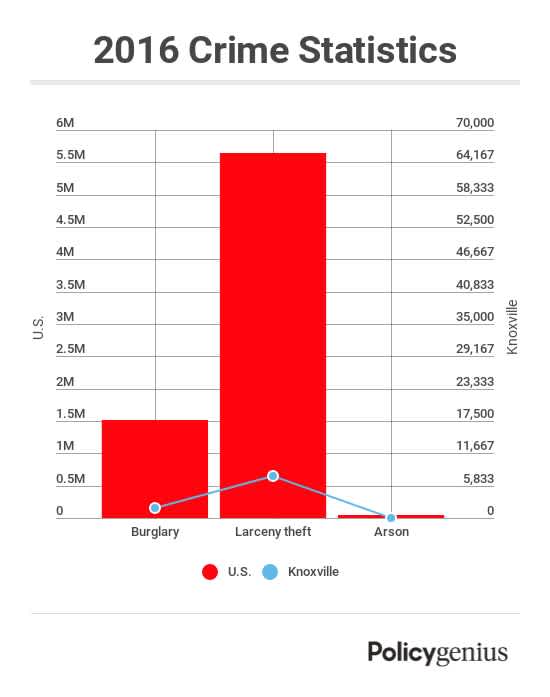

Knoxville, like most cities, deals with property crime, and while the city’s burglary rate has mostly decreased over the last decade, property crime (arson, larceny, burglary) per capita is more than twice the national average.† Renters insurance is a nice safeguard to have, given the high theft and break-in potential of urban areas.

Weather unpredictability is another reason to consider renters insurance, and Knoxville residents know all about that. While tornados aren’t as common as they are in western parts of the state, folks in Knoxville still experience a fair share of thunderstorms, especially during the region’s wet season (March-August).‡

Keep in mind that renters insurance will cover personal belongings impacted by wind or hail, but won’t cover flooding from the nearby Tennessee River — a natural gem but common hazard for Knoxville residents.

Helpful resources

Knoxville residents looking for more information on renters rights and resources should check out the following:

Fair Housing Knoxville: City of Knoxville program that seeks to establish decent and proper living conditions for residents

Knoxville Insurance Group: Local renters insurance resource for Knoxville residents

Knox Housing Partnership: Knoxville-based non-profit dedicated to providing affordable and sustainable housing opportunities in an effort to strengthen communities of Knoxville

Knoxville County Community Action Committee: Knoxville-based non-profit assisting the community’s low-income residents with everything from housing opportunities to financial assistance for rent payments

^ 1. U.S. Census

† 2. FBI CDE

‡ 3. Weather Spark