The cheapest car insurance company in New Jersey is GEICO, which offers coverage for an average of $84 a month or $1,007 a year. NJM, State Farm, Amica, and Plymouth Rock are the other cheapest auto insurance companies in New Jersey.

It’s a good idea to compare quotes before you buy car insurance. Comparing quotes makes finding affordable rates easier — and it helps you avoid paying more than you need to.

Average cost per month | ||

|---|---|---|

GEICO | $84 | |

NJM | $105 | |

State Farm | $123 | |

Amica | $131 | |

Plymouth Rock | $132 |

Cheapest car insurance companies in New Jersey

Best car insurance in New Jersey

The best car insurance company in New Jersey is USAA, which scored the highest on J.D. Power’s 2023 Auto Insurance Survey for the Mid-Atlantic region. [1] This survey measures how policyholders in the region feel about their insurance company’s customer service, billing, claims, and price.

Since USAA is only available if you’re affiliated with the military, Erie has the best score of any insurance company available to the general public.

Company | Score | |

|---|---|---|

1 | USAA | 877 |

2 | Erie | 863 |

3 | The Hartford | 840 |

4 | NJM | 834 |

5 | CSAA | 827 |

Cheapest car insurance companies by age in New Jersey

Teens and young drivers pay more for car insurance, because their inexperience behind the wheel means they’re more likely to get in an accident and file a claim.

Typically, rates for young drivers fall as they approach the age of 25 and age-out of the highest-risk age group, but if you’ve just gotten your license or you’ve got accidents and violations on your record, turning 25 might not mean lower rates.

Age | Cheapest company | Average cost |

|---|---|---|

16 | GEICO | $2,221 |

18 | GEICO | $2,217 |

21 | GEICO | $1,671 |

25 | GEICO | $1,223 |

30 | GEICO | $1,030 |

35 | GEICO | $1,005 |

45 | GEICO | $987 |

55 | GEICO | $888 |

60 | GEICO | $904 |

65 | GEICO | $907 |

70 | GEICO | $939 |

Choosing the right car insurance company in New Jersey

There’s no one right car insurance company that works for every driver. Since car insurance costs are based on so many individual factors — your age, driving history, credit score, and address — the right car insurance company for you may be different from the best option for your neighbor.

That’s why the key to finding your best rates is shopping around. Policygenius can help you see options from top car insurance companies, so you can choose the policy that’s best for your needs (and your wallet).

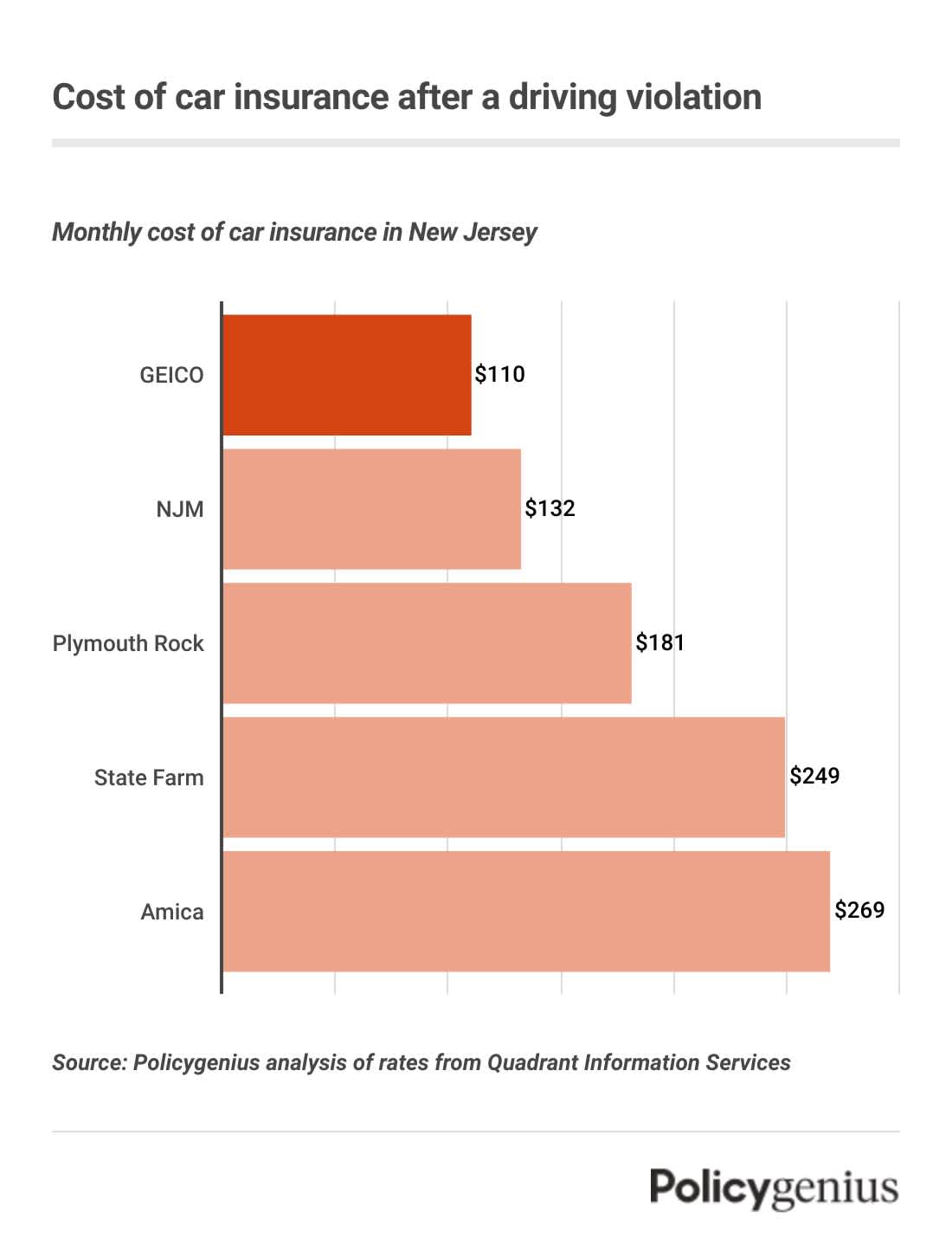

Car insurance rates for drivers with driving violations in New Jersey

If you’re a high-risk driver with an accident or driving violations on your record, your car insurance will be more expensive, there’s no way around it. But, while it can be hard to find cheap car insurance without a clean record, it’s still possible.

The cheapest car insurance company in New Jersey for coverage after a violation or accident is NJM.

GEICO | NJ Manufacturers | State Farm | Amica | Plymouth Rock | |

|---|---|---|---|---|---|

At-fault accident | $1,401 | $1,337 | $2,422 | $2,252 | $2,436 |

Suspended license | $997 | $1,706 | $5,680 | $5,454 | $2,334 |

Open container | $2,024 | $1,620 | $2,208 | $5,454 | $2,083 |

Expired registration | $997 | $1,620 | $2,208 | $1,795 | $2,168 |

Driving without lights | $997 | $1,620 | $2,208 | $1,795 | $2,168 |

Running a red light | $997 | $1,620 | $2,208 | $1,795 | $2,168 |

Following too closely | $997 | $1,620 | $3,326 | $1,795 | $2,168 |

Hit and run | $2,024 | $1,620 | $2,208 | $5,454 | $2,334 |

Not-at-fault accident | $997 | $1,337 | $1,495 | $1,599 | $1,627 |

Passing a school bus | $997 | $1,620 | $3,326 | $1,990 | $2,168 |

Reckless driving | $1,713 | $1,620 | $3,326 | $4,147 | $2,334 |

Cheapest car insurance after an accident in New Jersey

The cheapest car insurance company in New Jersey after an at-fault accident is State Farm. On average, car insurance from State Farm costs $72 a month, or $865 a year with an accident on your record.

Rates for drivers with an at-fault accident | |

|---|---|

NJM | $1,337 |

GEICO | $1,401 |

Amica | $2,252 |

State Farm | $2,422 |

Plymouth Rock | $2,436 |

Cheapest car insurance for drivers with a DUI in New Jersey

A DUI or DWI can cause your car insurance rates to go up. Drivers in New Jersey pay an average rate of $2,225 per year for car insurance, but drivers with a DUI pay almost double that, with an average rate of $4,050 per year.

But drivers with a DUI can still save money by comparing quotes from multiple companies. For example, NJ Manufacturers has an average rate for drivers with a DUI of $1,620 per year, which is 60% cheaper than the average rate for drivers with a DUI and 37% cheaper than the state average for drivers with a clean driving record.

Rates for drivers with DUIs | |

|---|---|

NJ Manufacturers | $1,620 |

GEICO | $2,024 |

Plymouth Rock | $2,083 |

Amica | $5,454 |

State Farm | $5,680 |

Cheapest car insurance for drivers with a speeding ticket in New Jersey

A speeding ticket can also raise your car insurance rates. New Jersey drivers with a speeding ticket on their record pay an average of $3,214 per year for car insurance, almost $1,000 more than the average rate for drivers without a speeding ticket.

According to our research, GEICO, NJ Manufacturers, and State Farm had the cheapest average rates for car insurance after a speeding ticket in New Jersey.

Rates for drivers with speeding tickets | |

|---|---|

GEICO | $997 |

NJ Manufacturers | $1,620 |

Plymouth Rock | $2,168 |

State Farm | $2,565 |

Amica | $2,905 |

Cheapest car insurance for drivers with bad credit in New Jersey

Having a good credit rating will help keep your car insurance costs down, while a low credit score likely means you’ll pay more for car insurance.

Rates for drivers with bad credit | |

|---|---|

Selective Insurance | $2,023 |

NJ Manufacturers | $2,117 |

GEICO | $2,257 |

Amica | $2,791 |

State Farm | $3,113 |

Cheapest car insurance companies in New Jersey by city

The cheapest car insurance company in your city depends on local factors, including crime, population density, traffic and congestion, the overall number of accidents, and more. Here are the cheapest car insurance companies in New Jersey’s 10 largest cities.

Largest cities | Cheapest company | Average yearly rate for the cheapest company | Overall citywide average |

|---|---|---|---|

Newark | GEICO | $1,489 | $3,264 |

Jersey City | GEICO | $1,087 | $2,897 |

Paterson | GEICO | $1,403 | $3,199 |

Lakewood | GEICO | $1,254 | $2,446 |

Elizabeth | GEICO | $1,313 | $3,160 |

Edison | GEICO | $1,050 | $2,259 |

Woodbridge | GEICO | $1,038 | $2,345 |

Toms River | GEICO | $956 | $2,126 |

Trenton | GEICO | $1,151 | $2,546 |

Clifton | GEICO | $1,244 | $2,775 |

Buying car insurance in New Jersey

New Jersey requires all drivers to have at least a minimum amount of car insurance in order to be legally allowed to drive. All drivers in New Jersey must have at least the following amounts of coverage:

Bodily injury liability coverage per person: $25,000 (Standard)

Bodily injury liability coverage per accident: $50,000 (Standard)

Property damage liability coverage: $5,000/$25,000 (Basic/Standard)

Personal injury protection: $15,000 per accident, plus up to $250,000 for severe injuries for a standard policy (Basic/Standard)

Uninsured/underinsured motorist coverage: Must match liability limits if purchasing a standard policy

Standard vs. basic car insurance policies: Under New Jersey law, drivers can select a “basic” car insurance policy. These policies offer very limited coverage at a reduced rate, so drivers who can afford to buy well-over the amounts required by law should do so.

New Jersey is a no-fault state: This means that each driver's own car insurance pays for their medical bills after a car accident, regardless of who was at fault. New Jersey drivers are required to have at least a minimum amount of PIP coverage, which is the coverage that pays for injuries after an accident.

How to get cheap car insurance in New Jersey

There are several ways to get cheap car insurance in New Jersey, including:

Always compare costs: Shop around to make sure you’re getting the best deal

Get discounts: Insurance companies offer discounts for things like safe driving and paying your premium up front as opposed to monthly billing. Make sure you know what you qualify for

Bundle policies: Bundling insurance means getting more than one type of insurance policy from the same company, like auto and home together — this can usually earn you savings on both

Reshop yearly: Before renewing your policy, check to see if you could be getting the same coverage at a better rate from another company

Find car insurance in your city: