A handful of car insurance companies offer professional discounts to nurses and other healthcare workers. We found that GEICO, Liberty Mutual, Farmers, Nationwide, and Travelers all have special insurance discounts for nurses.

Most car insurance discounts for nurses lower the cost of a policy by less than 10%, but the amount you’ll save varies by company. The best way to find the company that has the best car insurance rates for nurses is by shopping around and comparing quotes before you buy.

Companies with car insurance discounts for nurses

Nurses can save on their auto insurance at some of the largest insurers in the country (although not every car insurance company offers discounts for nurses). Most of the time, nurses can get auto insurance discounts by joining a professional medical organization.

The following companies do offer car insurance discounts for nurses:

GEICO: There are nearly two dozen medical-related professional groups that partner with GEICO for lower rates, including the Association of Women's Health, Obstetric and Neonatal Nurses (AWHONN).

Liberty Mutual: If you're a member of the American Association of Registered Nurses, you may get a discount when you apply for car insurance with Liberty Mutual.

Farmers: While Farmers doesn't provide a comprehensive list of partnering groups, nurses are one of many types of workers who may qualify for a discount on their car insurance rates.

Nationwide: Members of the American Nurses Association and the American Association of Nurse Anesthetists, along with other professional groups, could get discounted coverage from Nationwide.

Travelers: Like Farmers, Travelers offers affinity discounts to a wide variety of professional nursing organizations, though it doesn't list all of its partners online.

Unfortunately, car insurance discounts for nurses aren’t as common as other discounts. Since nurses’ discounts are only offered at some companies, we recommend reading about the most common discounts offered by the best companies.

Other types of insurance discounts for nurses

Nurses can get discounts for more than auto insurance. For example, if you’re a property owner, you might be able to get a nurses’ discount on your homeowners or renters insurance.

You may also qualify for a discount on your life insurance with Prudential if you’re a nurse. The company partners with the American Nurses Association and offers discounts to healthcare workers on term life and accidental death and dismemberment policies.

Nurses organizations with car insurance discounts

There are lots of organizations that partner with carriers to offer car insurance for healthcare workers, including nurses.

If you’re a nurse (or nursing student) who is a member of any of the following professional groups, check to see if your membership qualifies you for a discount on car insurance:

American Association of Registered Nurses

American Association of Nurse Anesthetists

American Nurses Association

American Public Health Association

Association of Women's Health, Obstetric and Neonatal Nurses

Health Occupation Students of American

How much do nurses save on car insurance?

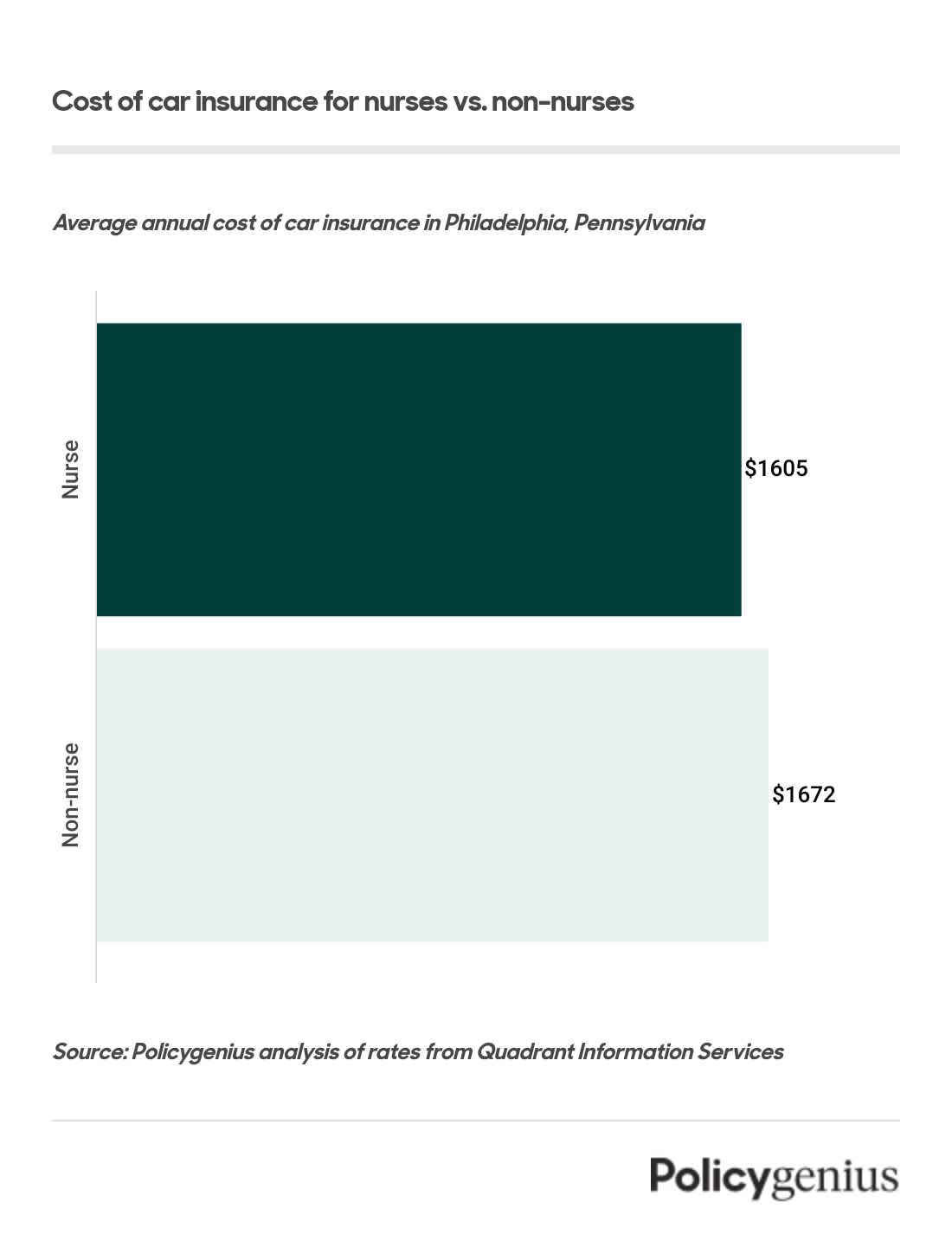

We found that nurses can save an average of $67 per year on a full-coverage car insurance policy. That discount isn’t much — just about $5 per month — but if you compare rates you may find that some companies have better discounts for nurses.

The company that gives nurses the best car insurance discount is Liberty Mutual. We found that at Liberty Mutual, nurses received a discount of $144 per year on car insurance. That said, you may qualify for more discounts by speaking with an agent or broker directly.

How to get discounts on auto insurance for nurses

Car insurance discounts for nurses are pretty minor compared to the other car insurance discounts available from most major companies. As a nurse who’s a part of an affinity group, the amount you save will probably be less than 10%.

If you’re a nurse (or studying to be a nurse), here are some ways to see if you're eligible for savings:

As a member of a professional organization for nurses, check with any nursing group you're a part of to see whether your membership benefits include a discount with a specific insurance carrier.

If you're a current or former student, see if your nursing program is affiliated with an insurance company. It's common for insurers to partner with colleges and universities across the country to offer car insurance discounts for nursing students.

If you're not a member of a professional nurse’s group or a nursing student, some companies still offer generic discounts for nurses that don’t require membership in a professional group.

If your organization partners with an auto insurance company to offer discounts for nurses, they can usually refer you straight to the company so you can apply for discounted coverage.

You won’t have to get referred by a professional nurses group if your auto insurance company offers generic discounts just for being a nurse.

Other ways nurses can lower their insurance premiums

You may be able to save a little money with car insurance discounts for nurses, but it’s important to take advantage of other ways to save. The other ways that you can lower your insurance costs may be even better than a discount for nurses.

Here are some of the reliable ways nurses (or anyone else) can find affordable car insurance:

Know when it’s time to switch companies: Shop around for car insurance when it’s time to renew, even if you’re happy with your company. This is the best way to find the cheapest insurance rates.

Get the insurance that matches your job: If you’re a travel nurse who’s away from your insured vehicle for long periods of time, a per-mile or non-owners insurance policy may be better (and cheaper) for you.

Have the right amount of coverage: You may not need a full-coverage policy if you own your car outright and it’s an older model with lots of miles on it.

Bundle your home and auto insurance: If you don’t already get your home or condo insurance from the same company as your car insurance, you could save money by bundling the policies together.