Buying car insurance for a Smart car is similar to purchasing insurance for any other compact car. When shopping for auto insurance for a Smart car, you'll have to consider what types of protection you need and how high to set your coverage limits.

Compared to other types of cars, it may be easier to find cheap auto insurance for a Smart car, even if you live in a crowded city where rates are typically higher for most people. While the average cost of insurance for a Smart car can be less than average, we still recommend comparing auto quotes to ensure you find the best rates near you.

How car insurance for Smart cars works

Car insurance for a Smart car isn’t different from car insurance for any other type of vehicle. It still offers the same financial protection from at-fault accidents and other sources of property damage. If you own a Smart car, getting the right amount of insurance is still a matter of considering which types of coverage you need and how high to set the limits of your coverage.

Smart cars have been discontinued in the U.S., so it's possible that they could cost more to buy and repair in the future. However, right now, with Smart car's relatively lower purchase price compared to conventional vehicles, you might feel tempted to lower your coverage levels by declining collision and comprehensive coverage, which can be expensive to add.

Since Smart cars have a relatively low purchase price to begin with, they don’t represent as big an investment as a larger, pricier car. However, if you're a daily driver, it would be wise to invest in comprehensive and collision coverage to protect your Smart car in case it’s damaged or stolen — especially if you live in a crowded city, where Smart cars are most popular.

→ Learn about how much car insurance you need for your vehicle

Cost of insurance for a Smart car

Smart cars cost less to insure than other cars, on average. Because of the small size of Smart cars, they cost less to make and do less damage than other vehicles that are much bigger. For these reasons, it's often cheaper to insure a Smart car compared to larger vehicles.

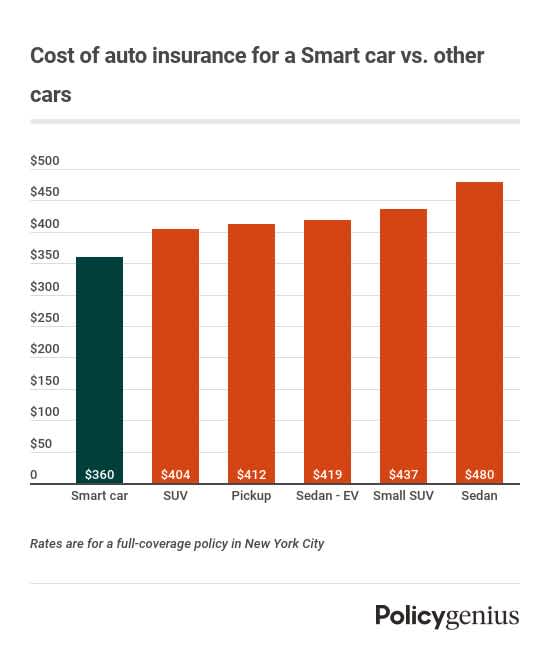

Based on a comparison of rates in New York City, Policygenius found that the average cost of car insurance for a Smart car is 16% cheaper than it is for more conventional vehicles. While the average combined cost of insuring these larger vehicles is $430 per month ($5,165 per year), the cost of insuring a Smart car is $360 per month — a difference of $839 per year.

Insurer | Monthly cost | Annual cost |

|---|---|---|

GEICO | $167 | $2,009 |

Progressive | $322 | $3,869 |

Average | $360 | $4,325 |

Allstate | $399 | $4,792 |

State Farm | $431 | $5,170 |

Liberty Mutual | $482 | $5,787 |

Rates are for full coverage in New York City

While the cost of car insurance for a Smart car is cheaper than coverage for other types of vehicles, your premium will vary depending on your location, how much coverage you need, your age, your driving record, and more.

Your insurance provider also affects what you pay for car insurance. In fact, we found that the cost of insuring a Smart car can vary by hundreds of dollars per month depending on your insurance company. In New York City, for example, car insurance from GEICO is 54% more affordable than average, while Liberty Mutual's rates are 34% higher.

Other factors that affect Smart car's insurance cost

As with any car, the cost of your auto insurance for a Smart care is determined by a number of personal factors, including:

How high or low you set your deductible

Your age and driving experience

Any past violations, tickets, or accident

Your location and ZIP code

How often you drive

Your credit history and insurance score

The cost of your policy will also be tied to what type of coverage you add to your policy. While you must carry a minimum amount of car insurance to drive, there are also other types of coverage you might want to consider including in your policy. Adding coverage like roadside assistance or rental car reimbursement, or others, will mean more protection but higher premiums.

Regardless of your personal history or the amount of coverage you want to carry, the best way to get your lowest rate is by requesting quotes from more than one insurer and comparing your options before you buy.

Car insurance discounts for Smart cars

Car insurance discounts are a good way to save on the cost of insurance for a Smart car. Though Smart cars are unconventional, the same discounts usually apply to them as traditional cars. If you're looking for cheap insurance for your Smart car, you could save money by:

Owning an electric model of your car

Going multiple years without an accident

Avoiding tickets and traffic violations

Paying your premiums on time, or all at once

Completing a defensive driving education course

Additionally, your car's features could affect your rates. If your vehicle has anti-theft devices, like an alarm system, steering wheel lock, or is kept in a garage, you could get cheaper car insurance.

Methodology

To find the cost of a Smart car, Policygenius compared rates from five of the largest insurance companies in the U.S. for a sample 30-year-old single driver living in the New York City area. Our sample driver owned a 2017 Smartcar FourTwo. We gathered quotes from:

GEICO

State Farm

Progressive

Allstate

Liberty Mutual

Additionally, we also found the cost of insurance for a Smart car relative to the cost of covering other types of vehicles. To do this, we gathered rates from every insurance company in the New York City area for a 30-year-old driver without a history of insurance.

For this portion of our study, Policygenius analyzed car insurance rates provided by Quadrant Information Services. Some carriers may be represented by affiliates or subsidiaries. Rates provided are a sample of costs. Your actual quotes may differ.

All rates in this study are for drivers insured for full coverage. For the purposes of this study, this means that their policies carried the following limits:

Bodily injury liability: 50/100

Property damage liability: $50,000

Uninsured/underinsured motorist: 50/100

Comprehensive: $500 deductible

Collision: $500 deductible