If you live with your parents and drive their car, then you can stay on your parents’ car insurance policy as long as you’re part of their household. But once you move out you’ll need to get your own insurance policy (if you have your own car).

You may also have to get your own car insurance policy if you own your own car, unless they’re co-owners. That said, you can usually get much lower car insurance rates if you stay under your parents’ insurance — especially if you’re under 25.

How long can you be on your parents' car insurance?

You can stay on your parents’ car insurance policy indefinitely as long as you’re living with them. In fact, insurance companies usually want every driver in a household to be listed on a car insurance policy. So if you’ve got your license and you live with your parents, you may need to be listed on their insurance.

You can even stay on your parents’ car insurance after you’re married. Keep in mind that your spouse may also have to join your parents’ policy if you’re all part of the same household.

There’s not an age limit for staying on your parents’ car insurance. You’ll just have to get your own car insurance after you move out of your parents’ house and have your own car, since it’s no longer your primary residence.

Can I be on my parents’ car insurance if the car is in my name?

You may be able to stay on your parents’ car insurance if you own your own car, but it depends on the company. You should expect the cost of your parents’ insurance to go up when you add a vehicle, but it will probably still be cheaper than getting a separate policy for your own car.

If you live with your parents but their insurance company won’t let you add a car you own to their policy, you’ll have to shop around for your own car insurance. You may need your parents to list you as an excluded driver on their policy so you don’t wind up insured under two policies, but that also means you won’t be able to drive their cars.

Can I be on my parents’ car insurance if I’m away at school?

You can stay on your parents’ car insurance while you’re at school as long as your parents’ house is still your primary residence. Students can also bring their cars with them to campus and remain on their parents’ car insurance

That said, it’s a little bit cheaper for your parents if you don’t bring one of their cars to school with you. Most companies offer away-from-home or distant student discounts for families with college-aged drivers who don’t have a car with them at school.

Pros and cons of staying on your parents’ car insurance

It’s a great idea to stay on your parents’ car insurance if you can. For one thing, it’s easier. Insurance companies usually require any drivers living in a house to be added to a policy, so it might be a hassle to get your own policy and remove yourself from theirs.

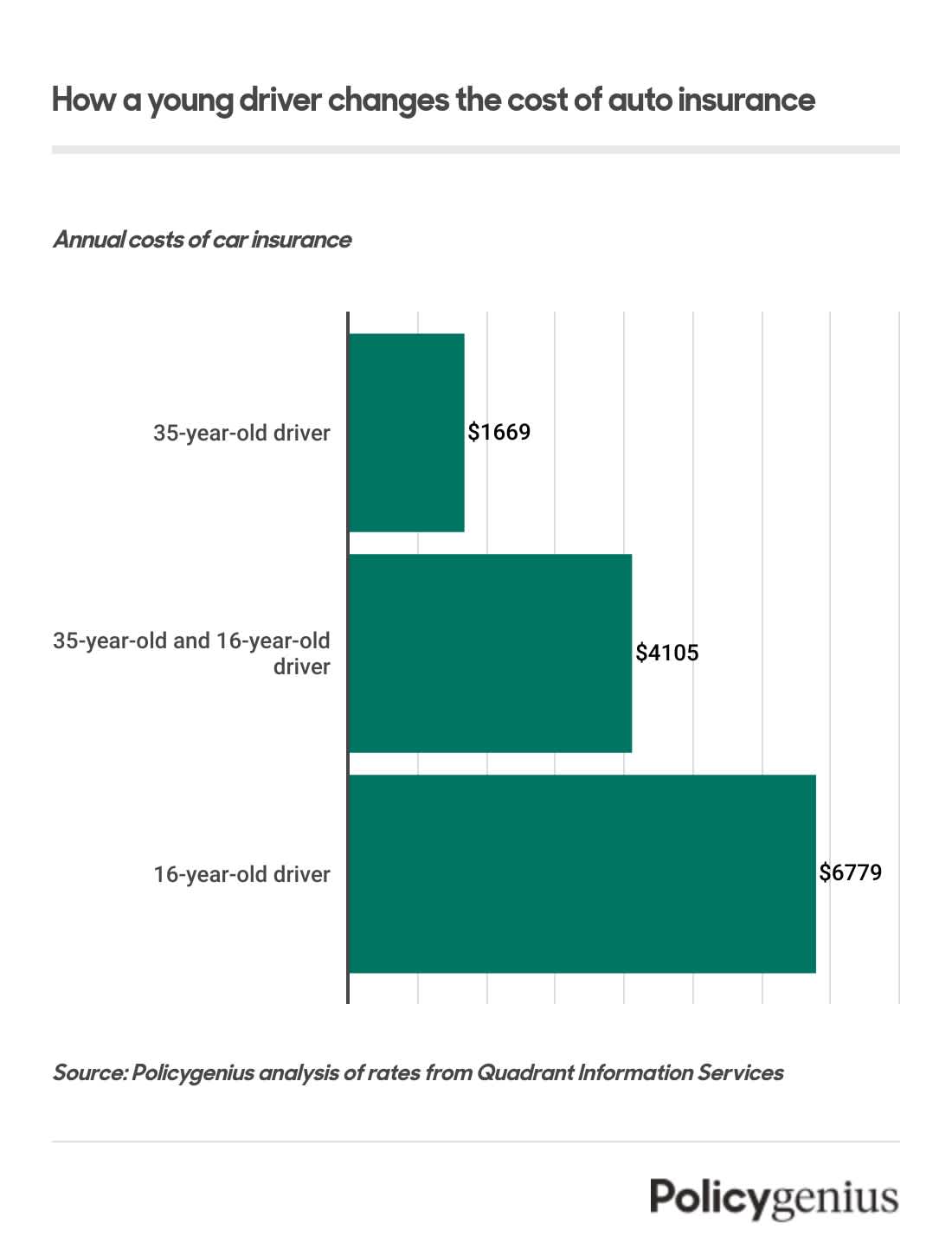

Another benefit of staying on your parents’ insurance is that it’s much cheaper for new drivers to join an existing policy. We found that it costs newly licensed drivers an average of $2,674 more per year to get their own policy instead of than to joining a family one.

The downside of staying on your parents’ policy is that their family’s car insurance rates will go up.

Once you join your parents’ policy, their rates may go up by hundreds or even thousands of dollars per year, especially if you’re under 21 or have an accident on your record.

Bottom line: Staying on your parents’ car insurance helps bring costs down, especially if you just got your license. But it may also make their premiums too expensive.

Can I drive my parents’ car without being on their insurance?

You can drive your parents’ car without being on their insurance as long as you don’t live with them anymore.

Your parents’ insurance extends to cover you even if you’re not on the policy through what’s called “permissive use.” Permissive use just means that an insurance policy automatically covers people who borrow a car occasionally, even if they’re not on the policy.

If you have your own car and your own car insurance policy, your insurance can help cover the costs if you get into an accident while driving your parents’ car — but if you don’t have a car, you don’t need your own policy. Still, it might be a good idea to get non-owners insurance if you drive your parents' car a lot.

How to lower car insurance rates for teens on their parents' policy

If you’re a brand-new driver, your parents’ car insurance rates probably went way up when they added you to their policy. But there are some tips for saving on car insurance even after adding a teen driver to a policy Some ways to save include:

Making sure you get the best deal: Parents can be sure they’re getting the best rates for their car insurance by shopping around and comparing quotes when it’s time to add another driver to their policy.

Maintaining a high GPA: Student-aged drivers who join their parents’ policy can earn a discount on car insurance by keeping high grades while they’re in school.

Completing a young drivers education course: Some companies have special discounts for newer drivers who complete a special drivers education course. If you join a parent’s policy, this is an easy way to lower your rates.

Joining a fraternity or sorority while at school: Insurance providers offer discounts to some fraternities and sororities who are affiliate partners. If an organization you’re a part of works with your insurance company, make sure you get the discount.

Keeping a clean driving record: Your parents’ insurance will go up even more if you’re involved in an accident or get a ticket. You can keep rates lower if you avoid getting any bad marks on your driving record.

Dropping extra coverage that you don’t need: Instead of keeping full-coverage on an old and inexpensive car that you own outright, consider dropping the extra coverage and lowering the overall cost of your policy.