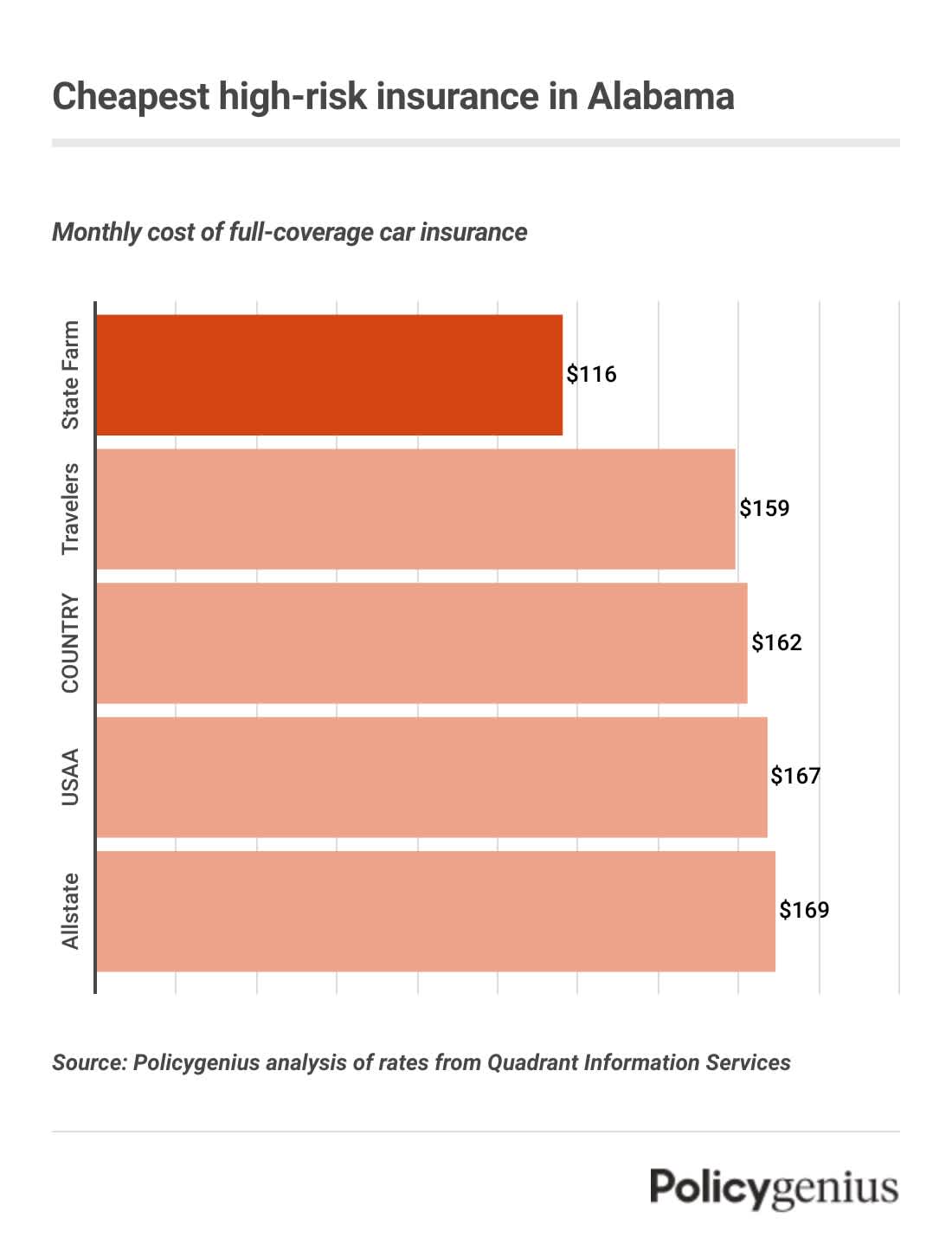

Cheapest high-risk insurance in Alabama

State Farm has the cheapest high-risk insurance in Alabama. Insurance from State Farm costs high-risk drivers $116 per month, or $1,394 a year — 48% cheaper than the statewide average for drivers with the same profile.

Our expert analysis found that Travelers and COUNTRY Financial also have cheap car insurance rates for high-risk drivers. Since the cost of coverage can vary by company, it’s a good idea to compare quotes from different car insurance companies before buying a policy.

Company | Average monthly cost of SR-22 insurance | Average yearly cost of SR-22 insurance |

|---|---|---|

State Farm | $116 | $1,394 |

Travelers | $159 | $1,905 |

COUNTRY Financial | $162 | $1,939 |

USAA | $167 | $2,003 |

Allstate | $169 | $2,032 |

Safeway | $177 | $2,125 |

GEICO | $212 | $2,548 |

Auto-Owners | $217 | $2,607 |

What is high-risk insurance in Alabama?

High-risk car insurance isn’t a specific type of coverage, it’s just a regular car insurance policy but for someone who doesn’t have a clean driving record. High-risk car insurance is more expensive than standard car insurance because insurance companies see high-risk drivers as more likely to file a future claim.

In Alabama, you may need to find high-risk insurance if you’ve been caught driving without insurance, committed a serious driving violation, or you rack up 12 driver’s license points in a two-year period.

Since 2013, Alabama has checked that drivers stay insured using its Online Insurance Verification System (OIVS).

If you’re an Alabama resident and you’ve been asked to verify that you’re insured, you must have a car insurance policy with at least the following coverage limits:

Bodily injury liability (BIL): $25,000 per person, $50,000 per accident

Property damage liability (PDL): $25,000 per accident

Unlike other states, Alabama doesn’t require SR-22 forms, but drivers may still have to be able to prove they’re insured after a traffic stop or accident. Uninsured drivers have to pay fines of $500 to $1,000 depending on their history. You’d also have to pay $200 to $400 to reinstate your license.

High-risk driving forms in Alabama

There are a few forms that high-risk drivers may be required to file after a violation or when they’re caught driving without insurance in Alabama.

SR-13: You must submit this form to prove you’re insured within 30 days of an accident that causes an injury or at least $250 in property damage.

SR-21: If you’re wrongly reported for driving uninsured, submit this form to prove you were actually insured at the time of an accident or traffic stop.

SR-58: You can submit this form to Alabama’s Department of Public Safety after you’re no longer liable for the damages you caused in an accident.

SR-59: You can submit this form if you’ve agreed to a plan for paying back damages you cause in an accident.

How to get SR-22 insurance in Alabama

If you’re a high-risk driver, you can find insurance in Alabama by following these steps:

Find a company will insure you: Not all companies offer car insurance to drivers who don’t have clean records, so finding coverage as a high-risk driver might take some time and shopping around.

Provide your personal information: You will need the driver's license and Social Security numbers of everyone in your household (including yourself), your car’s vehicle identification number (VIN), and your address before you can get a policy.

Be sure to pay your reinstatement fees: Alabama requires high-risk drivers whose license has been suspended to pay a reinstatement fee. Depending on your violation, you may not be able to drive before paying the state’s fees.

Non-owner high-risk insurance in Alabama

If you don’t own a car but commit a driving violation, you may still need to get car insurance and prove to the state that you’re insured. A non-owner policy is one way to have an active policy without owning a vehicle.

Non-owners insurance provides drivers who don’t own a car with basic liability coverage. A non-owners policy can make sure you have enough car insurance to drive legally in Alabama.

It’s also cheaper than a regular car insurance policy because it doesn’t include any coverage for the vehicle itself, like comprehensive or collision coverage.

You may have to reach out to a few companies if you need non-owner SR-22 insurance. Not all companies offer non-owners coverage, especially to high-risk drivers. Also, most companies don’t offer non-owner insurance online. You’ll have to call companies directly or work with an independent agent to get covered.