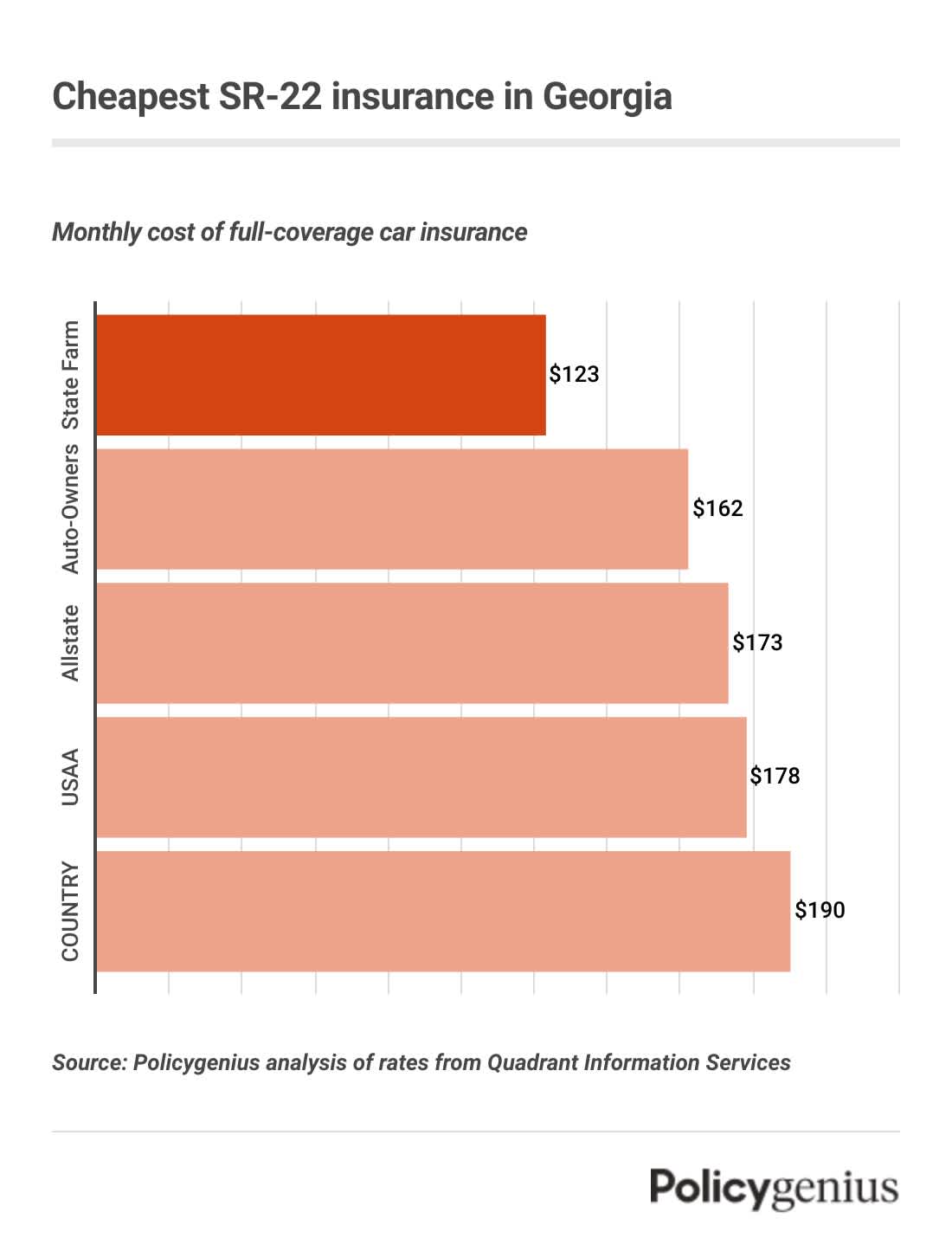

Cheapest SR-22 insurance in Georgia

We found that State Farm has the cheapest SR-22 insurance in Georgia. On average, car insurance for someone who needs an SR-22 costs $123 per month, or $1,480 per year. That’s 49% cheaper than the statewide average.

You can also find some of the cheapest SR-22 insurance in Georgia at Auto-Owners, Allstate, and a few others. But rates depend on the driver, so comparing car insurance quotes before buying is a good idea.

Company | Average monthly cost of SR-22 insurance | Average yearly cost of SR-22 insurance |

|---|---|---|

State Farm | $123 | $1,480 |

Auto-Owners | $162 | $1,944 |

Allstate | $173 | $2,079 |

USAA | $178 | $2,139 |

COUNTRY Financial | $190 | $2,285 |

Progressive | $215 | $2,575 |

Georgia Farm Bureau | $220 | $2,643 |

Central Mutual | $239 | $2,872 |

Safeway | $241 | $2,893 |

What is SR-22 insurance in Georgia?

An SR-22 is a form that your car insurance company files for you to prove that you’re insured — so SR-22 insurance it’s actually a product, it just refers to regular car insurance with an SR-22 form attached. In Georgia, drivers have to have at least the following amounts of car insurance:

Bodily injury liability (BIL): $25,000 per person, $50,000 per accident

Property damage liability (PDL): $25,000 per accident

In Georgia, you may need an SR-22 if you’re caught driving uninsured or to get your license back after a suspension for serious driving violations (like driving under the influence). [1]

Having to get SR-22 insurance in Georgia makes your rates more expensive, since you’re viewed as more likely to make a claim. You may also have to pay a fine, the amount will depend on your violation. For example the fine for not having car insurance is up to $310.

How an SR-22 and SR-22A are different

Georgia requires drivers who were caught driving uninsured more than once to have an SR-22A, which is a separate form. Insurance companies will file an SR-22A for you just like they file an SR-22,

You must have SR-22A on record for three years. An SR-22A also requires a filing fee (which you’d have to pay more than once if you let your coverage lapse during the three years).

How to get SR-22 insurance in Georgia

If you need an SR-22, the first place to start is with your current car insurance company. If you already have a policy, you can ask your current insurance company to file an SR-22 for you.

But if you don’t already have car insurance or your current company won’t file an SR-22 for you, you can meet Georgia’s SR-22 insurance requirements by following these steps:

Find a company that will offer you coverage: Insurance companies will file the SR-22 for you, but not every company will offer you coverage if you need an SR-22. If you’re a high-risk driver, you may need to shop around .

Pay the fees that go along with your driving violation: Driving violations usually come with a fine that you’ll have to pay before you’re able to drive again, even if you’re able to prove you’re insured.

Don’t let your policy lapse: If your policy lapses while you're supposed to have an SR-22 on record, you will have to pay your fines again and you won’t be able to get another SR-22 for at least 12 months after the first one was filed.

Non-owner SR-22 insurance in Georgia

Even people who don’t own cars can be ordered to file an SR-22 and show proof of car insurance. Non-owner insurance, a special kind of limited coverage for people who don’t own a vehicle, can provide you with basic coverage and allow you to get your license back.

Just like with a regular car insurance policy, you can have your car insurance company file an SR-22 with the state when you get a non-owners policy. Non-owner insurance is cheaper than a standard policy since it usually has low limits and doesn’t include any of the coverage you need if you actually own a car.

Not many companies offer non-owners insurance, and even fewer offer non-owner insurance with an SR-22. If you’re in Georgia and you need to get non-owners insurance, plan to call a few companies (carriers don’t offer this coverage online) to find a policy.