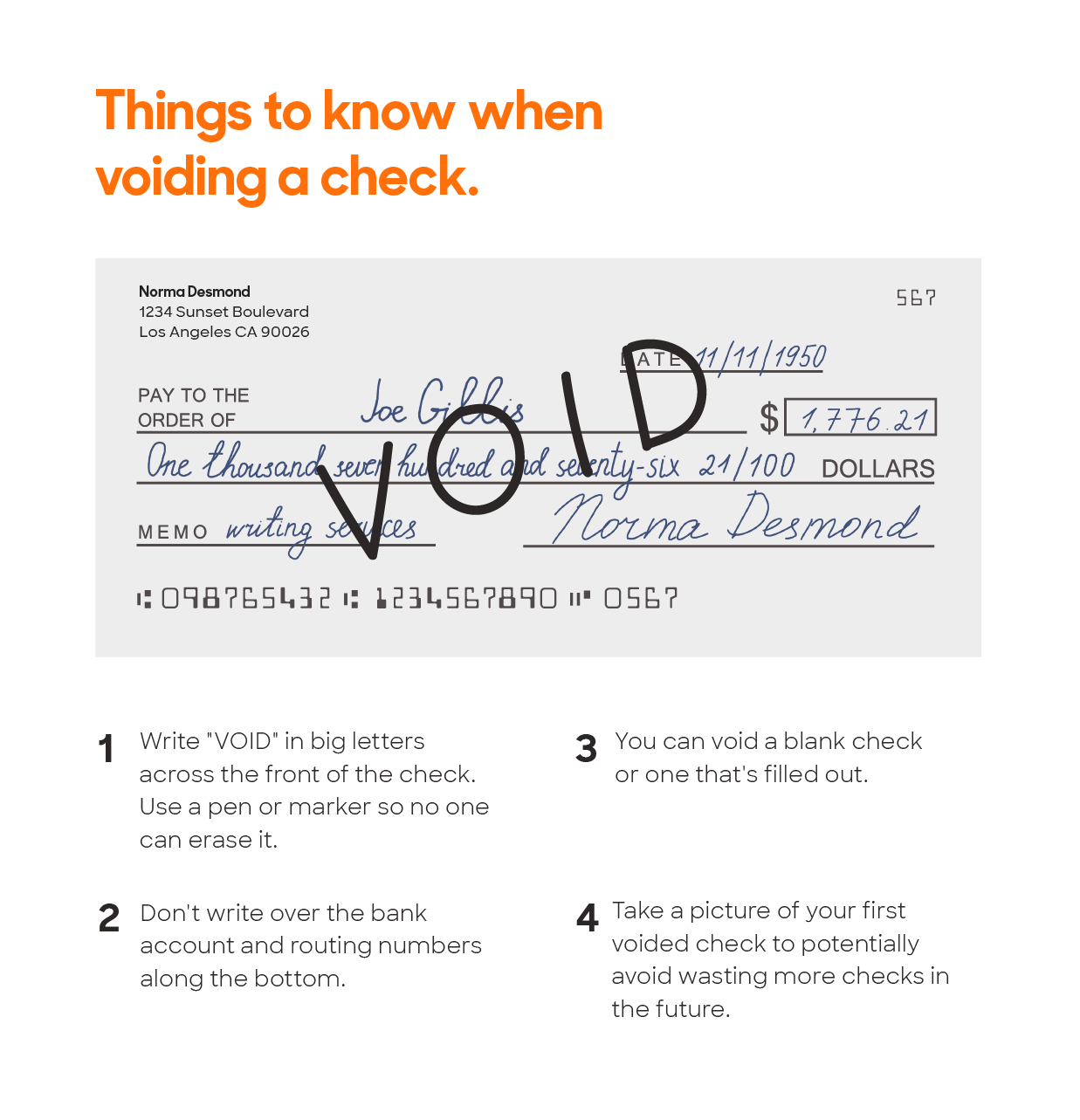

To void a check, all you need to do is write the word “VOID” across the front of the check. Write in big letters that ideally go across the areas where you enter information. Use a pen or marker that shows up well on the check. The goal is for the word “VOID” to be clear and unerasable.

If you’re using the check in order to share your bank account information, make sure you do not write over the bank information — the numbers printed along the bottom of the check. In many cases, it’s acceptable to send a picture of a check. If that’s the case, void a blank check and then take a picture of it. Anytime you void a blank check, it’s useful to take a picture so you can use it in the future if necessary.

Anyone can void a check and you can do it whether the check is blank or whether you’ve already filled it out. Either way, banks will not accept a voided check.

In this article:

Why to void a check

Voided checks are useful because they allow you to share your bank account number and your bank routing number without having to worry about someone actually using the check.

Sometimes when you want to set up direct deposit or recurring payments using a physical form, the other party will ask you to include a blank check. This is common when scheduling automatic mortgage payments. However, you don’t want to just give away a blank check in case someone fills it out and tries to cash it. Send a voided check instead.

Again, just make sure not to write over the printed numbers at the bottom of the check. This is the information they actually need.

Voiding a check is also a safety precaution. It allows you to cancel a check you don’t need anymore. Perhaps you didn’t use a check but still need the name or information written on it, and so don’t want to rip it up yet. Voiding it allows you to see the writing without the risk that you lose the check and someone else uses it. Even if you plan to rip up the check immediately, voiding it is an easy, extra measure against fraud.

What if you don’t have checks?

Checks are only available with certain banks accounts, namely a checking account or money market account. If you don’t have one of these or if you just don’t have checks, there are some potential alternatives.

First of all, sending a blank check is usually a part of filling out a physical form. You can usually avoid a physical check and set up payments online. Your lender, payee, or employer’s human resources service probably has an online dashboard where you can simply type in your bank account and routing numbers.

When there’s no digital option, you may be able to share your account information over the phone.

If you have simply run out of personal checks, you can visit your bank and ask for a counter check. This is a blank check that you can use just like any personal check. However, you may need to pay a fee to get a counter check. The check also won’t have your account number. You will need to write it in. The bank’s routing number should already be on the check.