A routing number, which is officially called the ABA routing transit number, is a nine-digit string of numbers that corresponds to a bank, credit union, or other financial institution. You use the routing number in conjunction with an account number to make an electronic payment or to write a check.

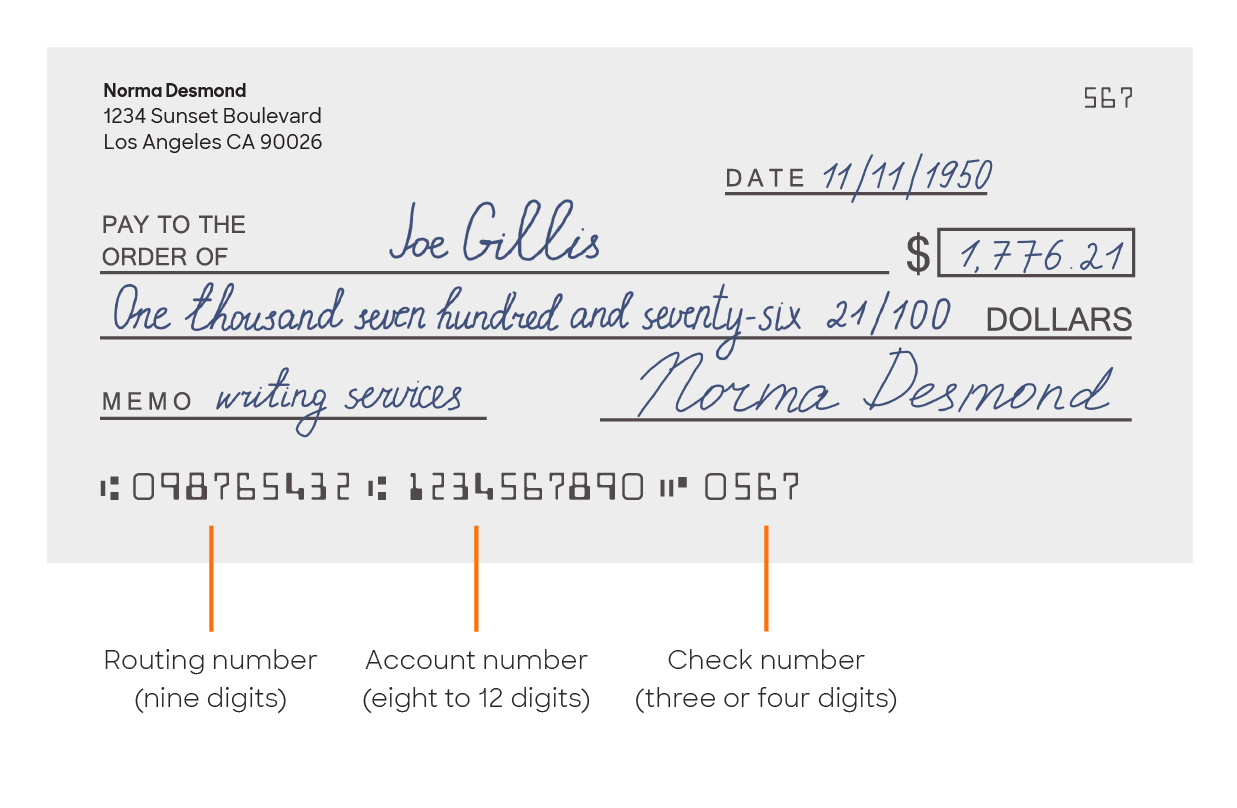

The routing number on a check can be found at the bottom of the check’s front side, next to the account number, and below the memo and signature lines. You can also find the routing number by logging into your bank account online and checking your bank statement. If you don’t have access to either, you can get your routing number by contacting the bank directly.

Routing number vs account number

You can use your bank account to make and receive payments. But to initiate a transaction using your bank (or credit union), you need two pieces of information: your account number and your ABA routing number.

Your bank account number should be kept confidential, except when used in a transaction. It has between eight and 12 digits, depending on your bank or credit union. Your savings account will have a different account number than your checking account, but both your checking and savings account should have the same routing number if you opened them in the same location.

Your routing number is public information. You can even find the routing number online by going to the American Bankers Association (ABA) website and using its search function, or simply Googling the name of your bank plus your state. Think of the routing number like a shared address for all the branches of a particular bank or credit union in your area.

The routing number indicates where an account at a bank is located. Every branch of a bank in the same location use the same routing number. For example, the routing number for all Chase banks in New York City is 021000021; if your bank account is with a Chase in Brooklyn, your checks will have the routing number 021000021. But if you opened your account at a Chase bank in Montana, your checks will say 044000037 for the routing number.

Even online banks and federal credit unions have both routing and account numbers.

Where can I find my routing number?

Your ABA routing number can be found on the bottom of any personal check issued by your bank. You can also log onto your bank’s website. The routing number may be listed on the page itself, or you may need to locate it on your bank statement. You can also call or email your financial institution to get that information.

The routing number on checks may be surrounded by other numbers, so it’s important to differentiate between them. In addition to the routing number, you may see some of the following:

Your bank account number, usually following the account number on the same line. It will be written in the same typeface as the routing number, which is for electronic scanners to read.

The check number, which identifies a specific check in the checkbook. The check number is three or four digits and may be listed both in the corner of the check and the bottom of check on the same line as the account and routing numbers. A check number can help you track a payment by recording whether a check with that number was received by the payee.

What do I need my routing number for?

The nine digits of your routing number need to be entered whenever you use your bank account for an electronic payment. The following types of transactions and transfers require both an account and routing number:

Setting up direct deposit, for which you might need a voided check with the routing number visible.

Making an electronic funds transfer, such as paying your utility bills, life insurance premiums, or mortgage balance.

Receiving an electronic funds transfer, such as when you sell an item online.

Depositing money in another person’s account, such as bringing cash or a check to their bank.

Setting up your account with your financial institution’s website.

The routing number will identify your bank to the payment processing center — an automated clearing house (ACH) — and let it know that the account belongs to a specific institution in a specific area.

You may not always need your routing number whenever you cash or deposit your check at a branch location. That’s because you’re already present at the location, so as long as you have your debit card and PIN available, you should be able to access the account.