The earlier you buy disability insurance, the lower rates you'll pay throughout your life, which is a great thing as you move through your 30s, 40s and beyond. Try buying an LTD policy in your 40s and you might end up looking at a monthly premium the size of a car payment.

But there's another benefit that's even more important, which is that it means you'll have a policy with better coverage than if you wait until you're older to buy.

An LTD policy that you already own will come in handy if something serious sidelines you for half a year in your mid-30s. But if you wait to buy a policy after that, not only will you have missed a chance to take advantage of it, it probably won't cover any future health issues that are similar to ones you had before buying the policy. Insurers usually exclude any health issues that could be caused by a pre-existing condition.

It's easy to see how dramatic the difference can be with a hypothetical scenario:

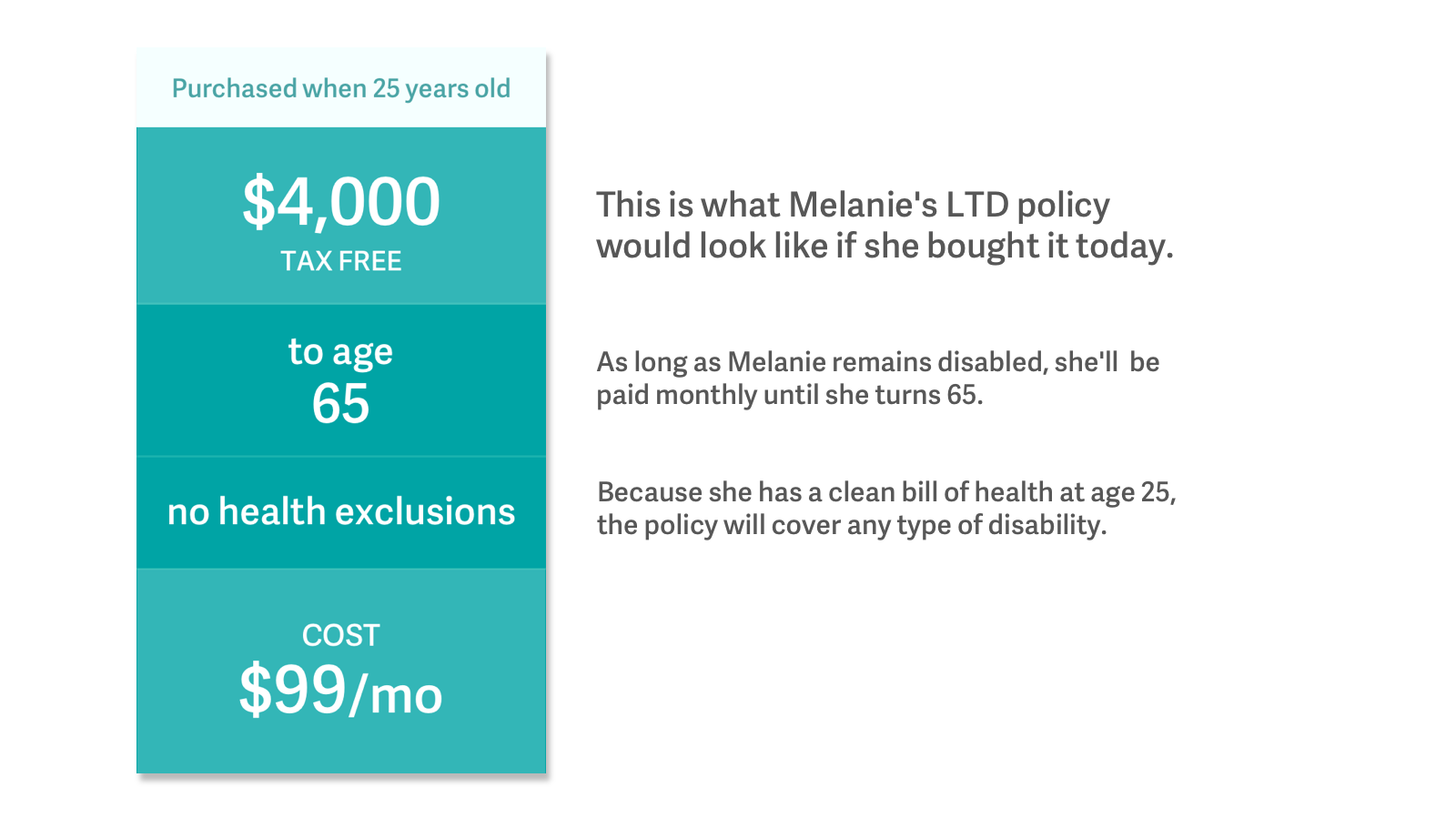

Buying LTD at 25

Melanie is a 25-year-old software engineer in good health. She buys a long-term disability policy now, while she's still young and healthy. The policy will start paying her a monthly, tax-free benefit 90 days after she becomes disabled, and will keep paying for as long as she’s disabled up to age 65. There are no exclusions added to the policy, other than the default ones that apply to everyone (like self-inflicted injuries or disabilities due to war). The policy also comes with a guarantee that (a) the insurer can't raise the premium so long as the policy remains in effect in its current state, and (b) the insurer can't cancel the policy as long as Melanie keeps paying the premiums. For this policy, Melanie will pay $99 a month—and because of the guarantees listed above, this rate will stay the same for the next 40 years unless Melanie asks the insurer to increase the benefit amount.

Melanie's policy is pretty much the gold standard for long-term disability insurance. It has everything you'll look for when you shop for one:

the maximum benefit amount for your salary;

a benefit period that lasts until retirement, regardless of when it starts;

a promise to pay even if you start working again so long as it's in an unrelated field;

protection from premium increases and policy cancellation; and

multiple opportunities to increase the benefit amount in the years to come.

Say at 29 years old, she starts having problems with her digestive track and goes to her doctor, where she learns that she has Crohn's disease. Let's say at 40, complications from surgery leave her unable to work for six months. Fortunately for Melanie, the LTD policy she bought when she was 25 covers her after her short-term disability runs out, so for the remainder of her recovery period she receives the tax-free $4,000 monthly benefit. In addition, Melanie returns to work confident that if something like this happens again she'll still be covered.

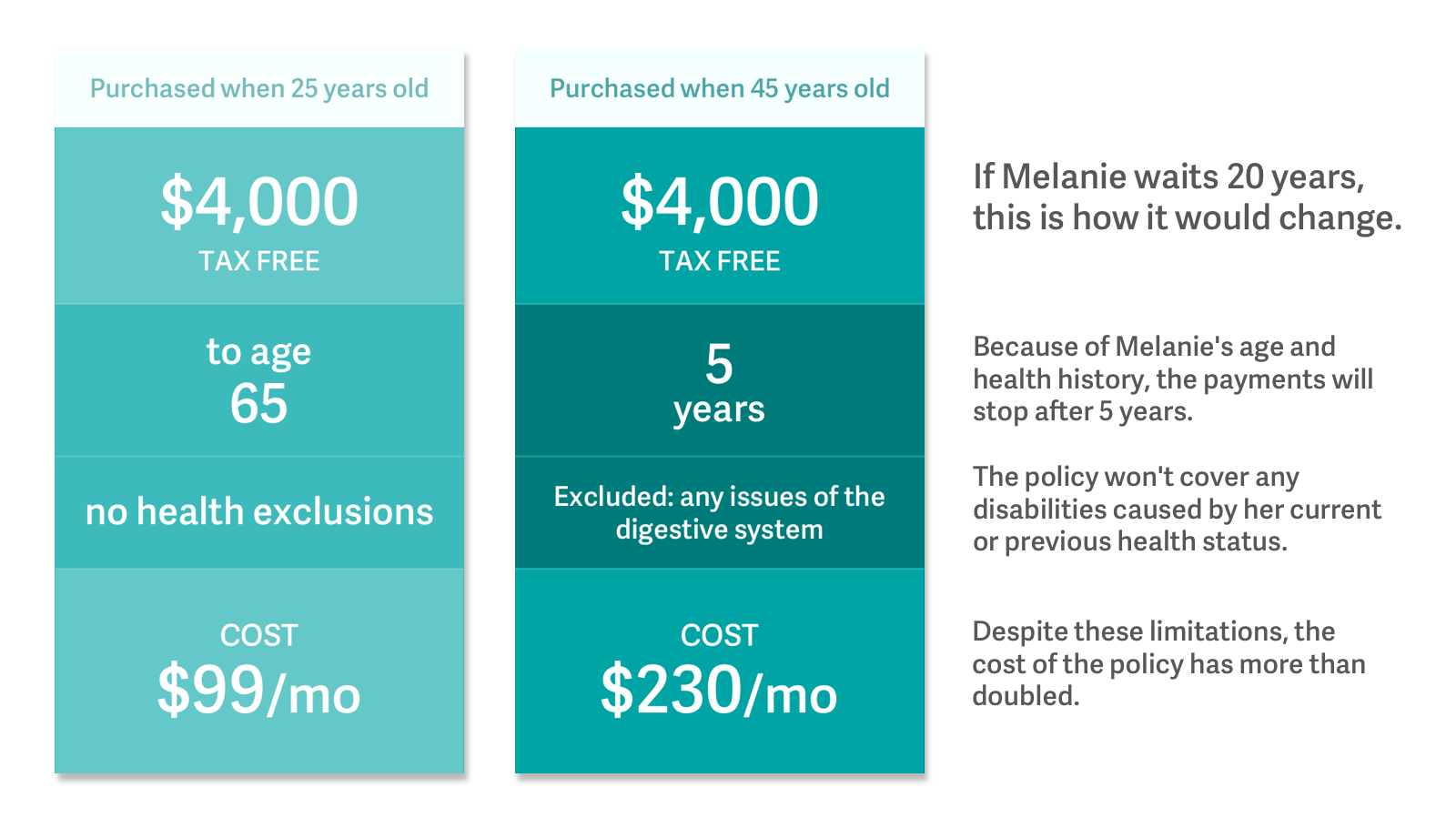

Waiting to buy LTD at 45

Now let's look at the same scenario, but this time around Melanie waits until she's 45 to shop for LTD insurance. Melanie decides in her 20s to forego a long-term disability policy right now — she's still got student loans to pay off, and she hasn't exactly met her earning potential yet. She makes a promise to herself that when she's older and better able to afford a monthly payment, she'll buy some LTD coverage.

At 29, the same health scenario plays out: diagnosed with Crohn's, periodic flare-ups through her 30s, surgery at 40, complications that prevent her from working for 6 months, and employer-sponsored short-term disability for the first 90 days. After those 90 days end, Melanie taps into her savings to cover the remaining 3 months that she's out of commission. That 3 month stretch without any income, and with the burden of unexpected medical expenses in addition to her regular bills, knocks her retirement savings strategy off course a little, but the damage isn't too severe. Melanie decides to get coverage, but they all come with the stipulation that anything related to her previous medical conditions will be excluded, which makes the policy a lot less useful for Melanie's particular situation. In addition, the limited coverage it does provide comes at a considerably higher monthly cost than she expected, especially on her new budget. And on top of that, the benefit period offered to her is much shorter than what she could have gotten at 25: only 5 years instead of up to age 65.

Finally, in our example—which uses actual quotes—if we assume Melanie keeps the policy until she turns 65, she would save about $7,500 in premiums if she buys when she’s 25 instead of 45. Not only that, but she’ll have saved herself from some big expenses from the medical issues she faced in her mid-30s.

Long-term disability seems like a "nice-to-have" layer of protection when you're young, and in many ways it is. It's more likely that if you need it at some point, you'll need it when you're 37, not when you're 27. But LTD insurance doesn't age well; the longer you wait to buy it, the more expensive and less comprehensive it will be. As far as financial protection goes it's easy to overlook the value of LTD before you turn 30. But, should something happen ten or fifteen years down the line, it can make the difference between paying your bills and filing for bankruptcy. And no matter what your current age is, it will never be cheaper for you than it is today, which is why the best time to get a long-term disability insurance policy is now.