One surprising consequence of the COVID-19 pandemic has been a wave of Americans leaving their jobs, now referred to as the Great Resignation. To put the Great Resignation in perspective, the Bureau of Labor Statistics says the “quit rate” hit a 20-year-high in 2021 [1] . But far more people may have left their jobs this year if they didn’t have to consider losing employer-sponsored health insurance, according to the Policygenius Health Insurance Literacy Survey 2021.

As in past years, the survey also found that many Americans aren’t familiar with basic health insurance concepts, potentially leading to adverse health and financial consequences.

The following findings are based on responses from a nationally representative poll of 1,401 adults, conducted by YouGov from Sept. 10 through Sept. 13, 2021.

The ‘Great Resignation’ might be greater without employer-sponsored health insurance

“Job lock” is a term economists use to describe the tendency of employer-sponsored health insurance to discourage people from changing jobs.

Scott Barkowski, a health economist at Clemson University, says it’s “kind of an odd arrangement that you get health insurance from your job.” Companies began offering health insurance as a benefit to attract workers during World War II, and government incentives solidified it as a norm in the following years. In other countries, health insurance is not provided by employers. For example, in Canada and the United Kingdom, the government pays for health coverage regardless of employment status.

“The fear is that because we’ve created this unnatural link between health insurance and jobs that people might be staying at a job they’re not necessarily the best match for because they can get the health insurance they need there,” Barkowski says.

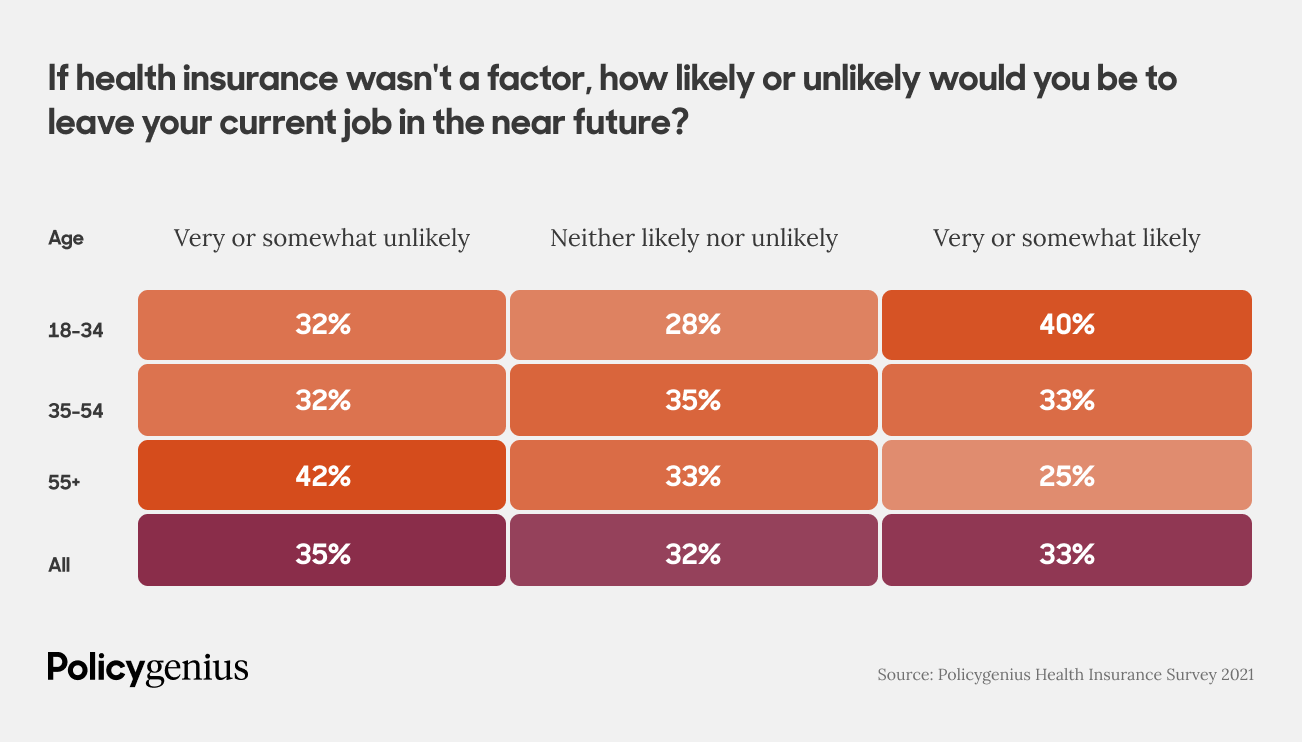

While this is difficult to measure empirically, one in three Americans with health insurance who work either full or part time (33%) said they would be at least somewhat likely to leave their job in the near future if health insurance wasn’t a factor. Among 18- to 34-year-olds, 40% (with a margin of error of 7%) said they would be very or somewhat likely to leave their job if health insurance wasn’t a factor.

Health insurance may be holding back entrepreneurs

Health insurance job lock may not only be keeping people from quitting their jobs, it may also be keeping people from starting their own companies. More than one in four Americans with health insurance (26%) say they would be very or somewhat likely to start their own business if health insurance wasn’t a factor, including 13% of people 55 and over.

Social media is impacting health insurance decisions

9% of people use social media as their primary source of health insurance information, compared to 28% for traditional media, 27% for friends and family and 22% for government websites. People whose primary source of health insurance information is social media are more likely to have ever avoided COVID-19 testing (39% of those getting most of their health insurance information from social media vs. 14% of those relying most on other sources) and treatment (20% vs. 8%). 39% of people who use social media as their main source of health insurance information say they’ve avoided COVID-19 testing, compared to only 11% of people who rely on government websites.

“People don’t have an understanding of what their health insurance covers,” says Jean Edward, a professor at the University of Kentucky College of Nursing and a nurse scientist at UK HealthCare’s Markey Cancer Center.

Americans are leaving health insurance money on the table

As part of the American Rescue Plan, a $1.9 trillion stimulus law passed in March 2021 in response to the pandemic, the Biden administration greatly expanded subsidies for health insurance plans purchased on the federal and state exchanges. Because of these expanded subsidies, 48% of people who purchased health insurance through the Affordable Care Act from Feb. 15 through Aug. 15 received coverage for $10 or less per month, according to the federal department of Health and Human Services [2] .

The Affordable Care Act, passed under the Obama administration, created the federal health insurance exchanges and provided subsidies to help people pay for their premiums, based on income. Today plans purchased through the ACA are a better deal than ever because of the amount of financial assistance available. However, the Policygenius survey found only 30% of insured Americans are even aware they can receive financial aid.

Many people had trouble verifying six true statements about American health care policy. For example, only 28% of adults with health insurance were aware that there’s no penalty for going without health insurance. While there was a penalty through 2018, it was repealed starting with 2019 plans. Failing to understand how health insurance works can have financial and health consequences because it’s so complicated, Donovan says.

“We work with patients who will sign up for a plan and not realize that their benefit structure means they have such a high deductible that they can’t afford to get their planned surgery,” Donovan says.

The consequences of this can be dire: Edward, the University of Kentucky College of Nursing professor, has found in her research that, among people diagnosed with cancer, there is a link between low health cost literacy and greater financial hardship [3] . It can be difficult and confusing to learn what health insurance plans cover, including from the insurance companies themselves, she says.

“You need someone to translate this information in a culturally and linguistically appropriate way for certain groups,” she says.

There are resources available to learn more about how health insurance works, including:

The Patient Advocate Foundation and HealthCare.gov can also help connect people with assistance in person or over the phone. A community health center can also assist with health care cost questions.

Methodology

Policygenius commissioned YouGov to poll 1,410 Americans 18 or older, of whom 1,227 confirmed having health insurance at the time of the survey. The survey was carried out online from Sept. 10 through Sept. 13, 2021. The results have been weighted to be representative of all U.S. adults. The average margin of error was +/- 3%