Health insurance is supposed to make medical care more affordable, but 41% of Americans with health insurance have avoided medical care because they knew or feared their health insurance wouldn’t cover the cost, according to the Policygenius 2022 Health Insurance Survey.

While insurance coverage has increased significantly since the Affordable Care Act took effect in 2010, [1] these results indicate health care is still too expensive for many insured people.

Many insured Americans have avoided medical care due to cost

Two in five Americans with health insurance have avoided medical care because they knew or feared insurance wouldn't cover the costs. Even among insured Americans who make $80,000 a year or more, 37% said they have avoided medical care because of concerns over cost.

"A sizeable portion of Americans cannot afford their deductibles and are functionally underinsured, despite getting health insurance through their employers," says Suzanne Delbanco, executive director for Catalyst for Payment Reform, a nonprofit that represents employers that purchase health care and advises them on how to get the best value out of their health benefit spending.

At the same time, Americans have become increasingly responsible for paying for medical care out-of-pocket via deductibles, which have grown faster than wages over the past decade. [2]

While many people are eligible for subsidies on individual plans from the federal and state health insurance exchanges, these marketplace plans may still be more expensive than coverage from an employer or the government.

The result is that for many Americans, cost is an important consideration — and often an obstacle �— when it comes to getting the health care they need.

Many insured Americans ration prescription drugs due to cost

Meanwhile, 32% of insured Americans said the cost of a prescription prevented them from taking the full dose of a prescribed medication. Even among people who said they get “good financial value” from what they pay for health insurance, 27% said cost kept them from taking the full dose.

Americans consistently spend more on prescription drugs than people in other countries, and price increases have accelerated in 2022; in July, the average list price per drug in the U.S. rose a whopping $250. [3] In the case of one commonly taken medication, insulin, lawmakers recently attempted to cap monthly out-of-pocket costs at $35, but Republicans blocked the bill. [4]

Perceived value varies by type of plan

Despite these apparent limitations in health insurance coverage, 57% of insured Americans at least somewhat agree with the statement “I get good financial value from what I pay for health insurance.”

However, the level of agreement varies by type of health insurance. For example, 61% of Americans with Medicare or Medicaid at least somewhat agree they get good financial value from what they pay for health insurance, compared to 52% of Americans with group plans and 47% of those with individual plans from a state or federal marketplace.

This discrepancy may be due to who bears most of the costs with these plans. State and federal governments cover most of the costs for Medicaid and Medicare recipients. Employers usually subsidize premiums for group plans, but workers have borne more of these costs over time. [5]

For marketplace plans, consumers are responsible for most of the cost of their plan, though government subsidies have become more generous because of COVID-19 relief legislation. [6] But even these subsidies average only $67 per consumer per month, [7] while a bronze marketplace plan, the cheapest available, averages $343 a month. [8]

Accessing mental health care is a challenge for many Americans

Among insured Americans who have seen a mental health provider, 47% have had their provider decline to take their insurance. Among those Americans, 28% opted to pay another way, 40% found a different provider who accepted their insurance, and 25% stopped seeking care altogether. Only 6% were denied a claim after seeing their provider.

An increasing number of people have sought mental health treatment over the past two years thanks in part to the pandemic, but access to care has not necessarily improved to meet the demand.

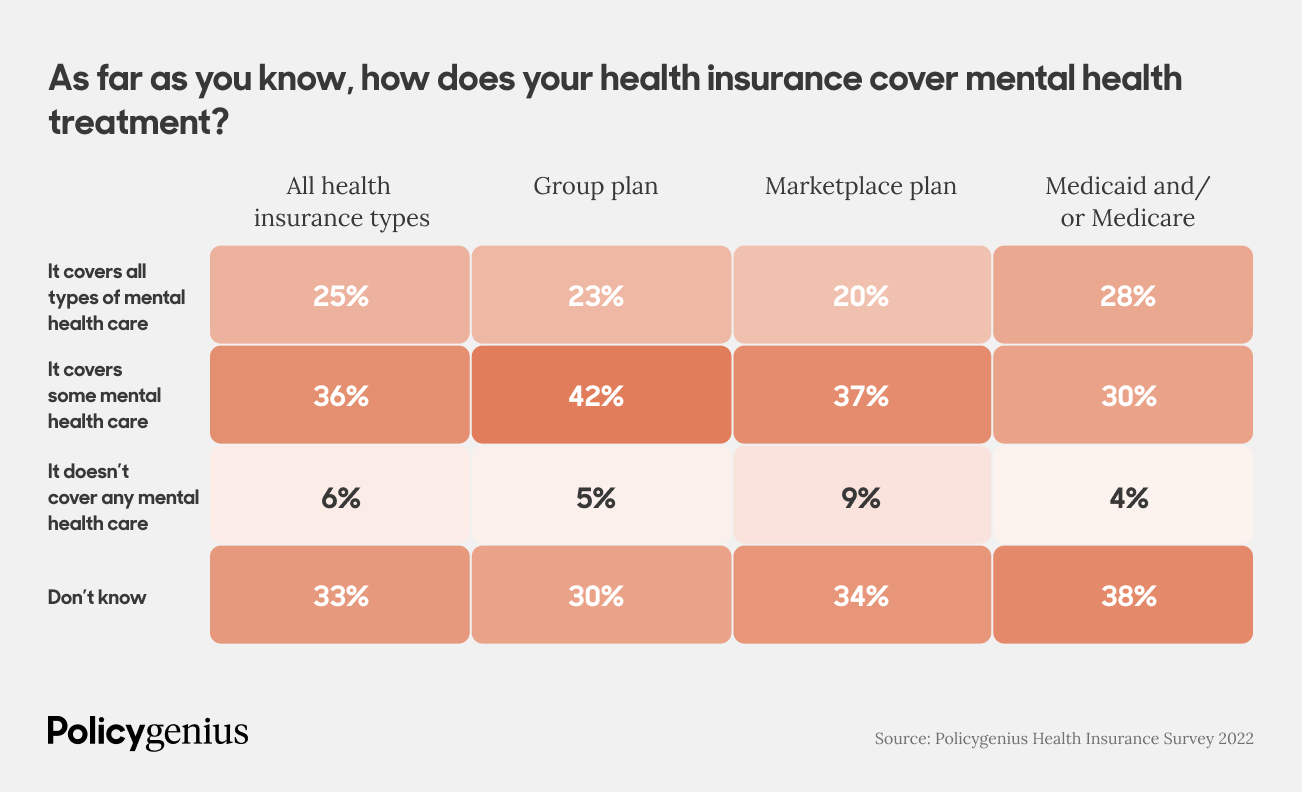

One issue is that many people with health insurance (33%) don’t know whether their plan covers mental health treatment. And while health insurance plans are expected to provide “parity” in coverage between physical and mental health services, the reality is that many mental health practitioners don’t take insurance, [9] as it’s often less cost-effective for the provider.

The little-known way to get free COVID tests

More than 62% of insured Americans said you can get free at-home COVID tests through the government. This is still mostly true: While the federal government suspended its free at-home test program in September because of a lack of funding, many state and local governments still offer free at-home COVID tests.

But it’s far less well known that you can get free at-home COVID tests through insurance; only 39% of Americans with insurance said you can get free tests this way. Tests are either free at the point of sale if your plan has direct coverage, or you can get them reimbursed by your insurance company. [10]

Few people take full advantage of health savings accounts

A growing number of American workers have access to health savings accounts, [11] which allow you to save money and pay for medical expenses tax-free. But few insured Americans are aware that you can invest the money saved in an HSA in stocks, bonds, and other investments, or that any gains are also tax-free.

Only 8% of Americans with health insurance are aware of this last benefit, according to the survey. The same percentage of insured Americans mistakenly believe you can use HSA funds to pay utility bills tax-free.

With the increasing popularity of high-deductible health plans, which make you eligible for HSAs, more Americans could take advantage of the full benefits of these accounts.

Methodology

Policygenius commissioned YouGov to poll 2,371 Americans 18 or older, of whom 2,008 confirmed having health insurance at the time of the survey. The survey was carried out online from Sept. 26 through Sept. 28, 2022. Of the 2,371 respondents, 31% had group plans through their employers or membership organizations; 8% had an individual plan through the federal or state marketplaces; 39% had Medicaid and/or Medicare; 6% had either COBRA, a short-term health plan, or TRICARE; and 15% either didn’t know whether they had health insurance or didn’t have health insurance (these respondents were filtered out for the remaining questions). The results have been weighted to be representative of all U.S. adults. The average margin of error was +/- 3%.