Updated December 2, 2020: Emotional health is a crucial part of personal well-being, but individuals who have depression and other mental health disorders frequently go without therapy or professional treatment. Therapy is expensive, and people are often unsure about whether a health plan covers it, or how to go about finding out.

Each year, less than half of the 16 million American adults who experience major depression receive treatment, according to the National Network of Depression Centers. Overall, one in five of the 44 million people with mental health conditions are not getting professional care, according to Mental Health America.

It’s disheartening that so many go without, given that insurance coverage of mental health services has improved greatly in the past decade. Many health plans are now required to provide equal coverage for mental health care and medical care, thanks to provisions of the Mental Health Parity and Addiction Equity Act and the Affordable Care Act.

Figuring out whether your health plan covers therapy can be a lot of work.

“When you’re overwhelmed with a mental health concern, that typically means your cognitive resources are tapped out,” says Lynn Bufka, associate executive director of practice research and policy at the American Psychological Association. “Navigating health benefits takes a lot of cognitive resources — even for someone like me who works in mental health and is familiar with insurance.”

This guide can help you figure out whether your health insurance covers therapy or other mental health treatments.

Does all health insurance cover therapy?

Many health plans do, but not all. The federal parity law essentially requires health plans that offer mental health coverage to offer comparable benefits compared to medical coverage. For example, if your insurance has a $20 copay for seeing an allergist, it can’t require a $40 copay for seeing a psychotherapist. The benefits must be equal or better.

The federal parity law applies to:

Employer-sponsored health plans for companies with 50 or more employees

Individual health plans purchased through the health insurance exchanges created under the Affordable Care Act

Children’s Health Insurance Program

The law does not apply to small companies with fewer than 50 employees. It also excludes some state plans, like those that cover teachers, as well as Medicare.

“Medicare is not under the federal parity law, but it often does cover mental health benefits,” says Bufka.

Does my health plan cover therapy?

Start your research at your health plan’s website. Your mental health benefits should be spelled out in plain language in your plan details. Look on your health insurance card to find the web address. You may need to create an online account to see all your plan information.

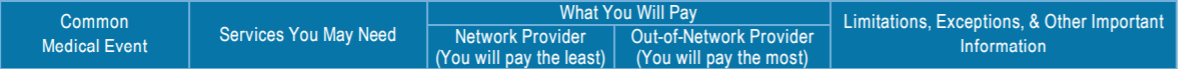

Here’s a sample table from the Centers for Medicare and Medicaid Services similar to what you might see on your insurer’s website:

You’ll see your copay or coinsurance for various mental and behavioral health services. Like with medical care benefits, your costs will be significantly lower with in-network mental health providers than with out-of-network providers.

If you need help understanding your plan, ask your human resources representative at work to walk you through the details. Or call your insurance company and ask about coverage for mental health.

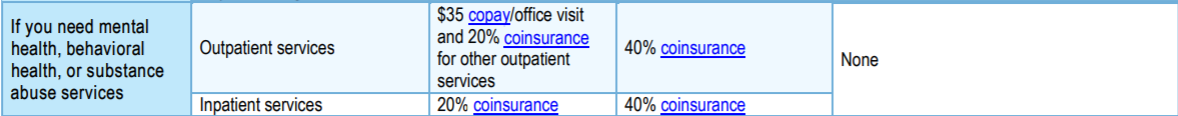

Is there a deductible?

You might have a deductible that you have to pay yourself before the plan starts paying benefits. It could be anywhere from $500 to more than $5,000, depending on the plan.

You can find this information in your plan details too. Look for a table like this:

You may have satisfied some or all of the deductible already by paying copays for prescription medication or doctor visits. If not, you may need to pay for therapy out of pocket until the deductible is met.

Is the therapy medically necessary?

“Insurance doesn’t cover all therapy, all the time,” says Bufka. “If I’m stressed because of a move, it may not be covered. But if I have a mental health condition, the parity law says the therapy should be covered.”

That doesn’t mean you must have a formal diagnosis before you can seek therapy.

“The psychologist can put a provisional diagnosis for the initial visit,” Bufka says.

For insurance purposes, the mental health provider might enter a diagnostic code for depression or panic disorder, but the code can change in future visits.

Is an in-network therapist for me?

Often the best option for keeping therapy costs to a minimum is to choose a mental health provider from your health plan’s network. With this approach, you’ll have confidence that the therapist accepts your insurance and that you’re paying the least amount. However, it might feel like you’re choosing a therapist with limited information, which can be disconcerting given the importance of a good therapeutic relationship.

“How do you find someone who is good to see you? Most providers have some skills for treating anxiety or depression,” says Bufka. “But if you’re dealing with something like panic attacks, obsessive-compulsive disorder, trauma, eating disorders or addiction, those are areas that you’d like someone to have specific training.”

In that case, look through the in-network practitioners for someone who lists a specialty that matches your needs.

Also, be practical and choose someone in a convenient location, says Bufka. “Realistically, location matters. If they are an hour away from your house, you might not be as motivated to go as if they are 15 minutes away.”

What if I want to see a therapist who is out-of-network?

You may prefer to find a therapist through personal recommendations from trusted friends or family members, or your primary care doctor. However, those therapists might not be in your insurance network, or might not accept your insurance.

In that case, you can still use your mental health benefits if you have coverage for out-of-network providers. But you’ll probably pay more. In the sample chart above, you’d pay only a $35 copay for an office visit with an in-network therapist. But out-of-network, you’d pay 40% of the provider’s fee yourself.

Some therapists don’t accept any insurance, or might not accept your insurance.

“One challenging thing in some areas of the country is that mental health care is often still provided by solo practitioners,” says Bufka.

Therapists who handle their own billing might not accept insurance or limit the number of plans they take. If you see such a therapist, you’d have to pay for the visits yourself, then submit a claim to your insurance company for reimbursement.

Get help

If all this research feels like more work than you can handle, and your energy levels are low, it can be appropriate to enlist help from a good friend. (Or hire a friend.)

“Sometimes friends know you are overwhelmed and they want to help, but they don’t know how,” says Bufka. “If they are willing, ask someone who might have a little more energy to help you do the research.”

Get financial news & advice sent straight to your inbox each week. Sign up for the Easy Money newsletter here.

Image: Nastia Kobzarenko