About 15 million people will lose their health Medicaid coverage when the COVID-19 public health emergency ends, according to projections from the federal government. The U.S. Department of Health and Human Services declared the public health emergency on Jan. 27, 2020, and has renewed it every 3 months, most recently on Oct. 13. [1] It’s not clear when the emergency declaration will expire, but the government has warned health care providers to get ready for its expanded health care coverage to end. [2]

The biggest effect will be on Medicaid recipients, says Gail Wilensky, senior fellow and project director for Project HOPE, a global health and humanitarian relief organization. Wilensky wrote an article in the Journal of the American Medical Association’s Health forum about the consequences of the end of the health emergency.

Before the pandemic, states regularly reassessed whether Medicaid recipients still met the income and other eligibility requirements for the program, which uses a combination of state and federal funds to assist with health care costs for people with limited income. During the public health emergency, states were required to keep people enrolled or they lost federal funding.

“If they are not eligible under the rules, generally because of their income status, the state will not have to continue having them on Medicaid,” Wilensky says.

Some states have made plans to help people transition to other coverage. For example, Arkansas set up a call center to reach out to Medicaid recipients to update their contact information to make sure they receive renewal communications. [3] But not every state is being so proactive, though Health and Human Services Secretary Xavier Becarra has said he would give the states 60 days notice once the public health emergency is set to end.

What to do if you lose coverage

If you lose Medicaid coverage, there are organizations that can help you understand your options for health coverage. You can use HealthCare.gov to find officially trained and certified organizations that are required to provide impartial information on finding health coverage (be sure to specify you're looking for assisters if you don’t want to talk to agents or brokers). For many people who end up making too much money to qualify for Medicaid but don’t get health insurance through an employer, a plan from the state or federal insurance marketplace is likely the best bet for coverage.

Losing Medicaid coverage will qualify you for a special enrollment period, giving you 60 days to sign up for a plan on the marketplace. When picking a health insurance plan, make sure to weigh all the costs, which can include:

The premium, the amount you pay every month to stay covered. The Biden administration’s coronavirus relief package includes expanded subsidies for premiums available to most people who sign up through the marketplaces. [4]

Deductibles, the amount you pay before health insurance coverage kicks in. In general, if you pay a higher premium, you’ll have a lower deductible. If you pick a plan with a high deductible, make sure you have enough savings to cover it in the event of an emergency.

Copays, a set amount you pay when you receive certain medical services.

Coinsurance, the percentage of health care costs you pay after you've met your deductible.

You should also make sure the insurance plan’s network includes a primary care doctor and any specialists you need to see in your area. While health insurance plans can be costly, going without insurance can be even more expensive.

“What people shouldn’t do is be uninsured because of the financial and medical exposure that leaves you facing if you have any kind of serious illness,” Wilensky says.

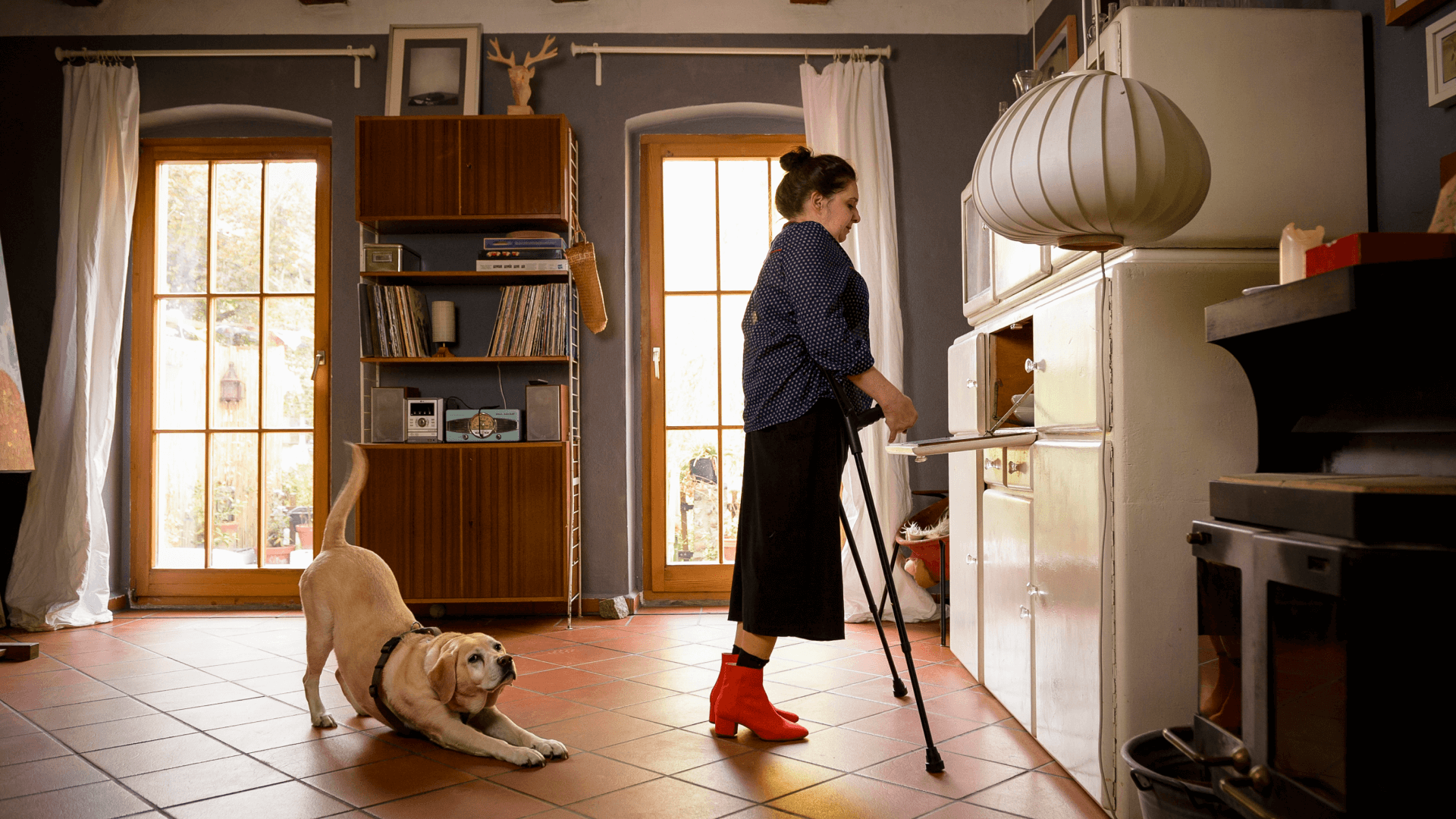

Image: jacobia dahm / Getty