Since the new ACA health insurance exchanges launched last October, there's been a seemingly endless stream of news stories, mostly about rollout problems, health insurance cancellations, enrollment numbers, or personal anecdotes that are quickly repurposed as political fodder.

But what about the shopping experience? Once you sign up for an account on an ACA health insurance exchange, what is it like to compare different plans and ultimately select the "right" one?

After helping consumers navigate the New York marketplace, we decided it would be interesting to switch hats and see what the experience is like from the consumer's perspective. We ran through the typical shopping journey of a consumer using the internet and the phone to research plans.

We found that the experience online and on the phone varies across insurance companies. And shopping is still a pain, although some features required by the Affordable Care Act make it easier. Here's our quick rundown on how to minimize shopping headaches and reach a final decision with confidence.

Spend the first few minutes looking at each plan on your state's ACA health insurance exchange before you call anyone. We know, you'd rather let someone else deal with this, but you'll be able to make a smarter choice (and ask better questions on the phone) if you've at least glanced over each plan's official "Summary of Benefits and Coverage" document. These summaries are a new requirement under the ACA that makes it easier to compare plans apples-to-apples.

About those official summaries: find them, download them, save them, print them, take notes on them. They're your new best friends.

Generally, you can find answers to a lot of typical questions with only a few minutes of online browsing. Realistically though, you should expect mixed results—but it's still worth the quick look.

Including online research and a phone call, expect to spend around half an hour per plan — unless you have a lot of questions or you run into a troublemaker. For the first three companies it took an average of 25 minutes to answer all 5 of our questions. But it took almost twice as long for the last company, for reasons we'll go into below.

If you don't feel like you're getting the info you need to make a decision, there are people who can help (at no charge). Each marketplace has "Navigators" to assist consumers. But be prepared for long wait times to reach one (upwards of 40 minutes in our experience during peak calling times). Or call a broker listed on the exchange. In either case, you'll be asked to share some personal information like name, age and income level.

Now let's go shopping!

Getting Started

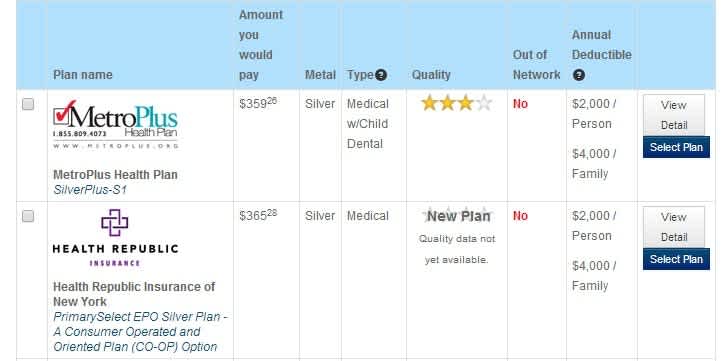

New York is one of the states to successfully run its own exchange, and we created a consumer account in mid-December without too many hiccups. We quickly reached a page of silver tier plans matching our target premium of around $400 a month (note: the experience we describe would be the same for any price level).

While marketplace listings can't show every detail, they displayed enough basic facts (like premiums and deductibles) for us to narrow down our choices. New York also provides a star rating based on customer satisfaction and plan quality, but some companies on the exchange don't have ratings yet, so we couldn't use it.

We decided to comparison shop four similar plans from four different providers: MetroPlus, an HMO serving residents of NYC; Oscar, an insurance startup; Health Republic, a nonprofit co-op (member-owned) insurance company; and Empire BlueCross BlueShield, the New York state subsidiary of the insurance giant WellPoint.As far as questions, we tried to come up with five "typical" questions someone might ask (although every person will have his or her own list of deal breakers):

What dental coverage is available?

Does the plan pay for a specific prescription drug?

How many outpatient mental health visits per year would be covered?

What's the coverage for emergency treatment out of state?

Does the insurer offer any sort of 24-hour medical assistance (for example a doctor or nurse hotline)?

With our plans and list of questions in place, we were ready to start comparison shopping.

Round 1: Looking for Answers Online

Broadly speaking, there are three places to look for answers online. The first is on the exchange, where every plan has a details page that lists key features broken down by categories required by the Affordable Care Act.

The second is on the "Summary of Benefits and Coverage" document that we recommended above. This is provided by each insurer, and you can find a link to it at the bottom of each plan's details page. Although the summary repeats a lot of what's on that details page, it also explains some of your rights as a consumer, and it lists the insurer's toll-free number. You can easily print this to refer to (and scribble notes on) while you shop.

The third place to look is whatever other documentation an insurer provides, but in this area don't expect to see much consistency. Some companies will link you directly to additional documents, while others will make you dig for them or offer marketing materials in place of hard facts. Some companies may opt to provide information in more web-friendly ways like searchable databases, while others will stick to the ever popular PDF format.

So how was our online experience?

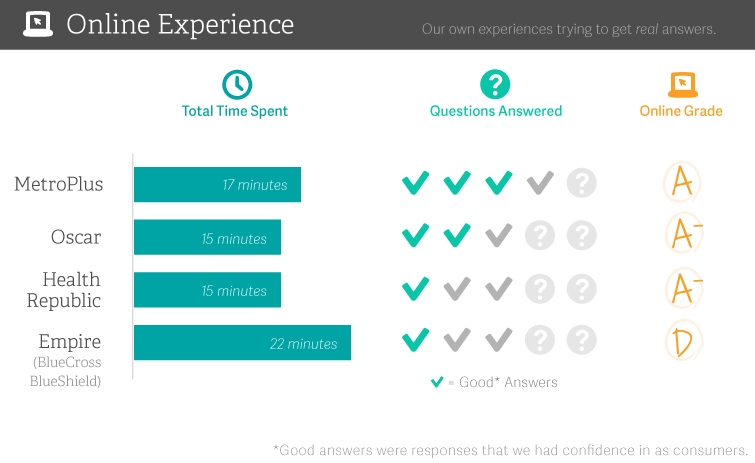

Finding documents on MetroPlus took a few extra clicks, but once we found them they were substantial enough to justify the time spent. Oscar's summaries were all grouped on one page with confusingly similar file names, but we quickly forgave this small inconvenience when we saw that its drug formulary was a searchable database, which let us find an answer to our drug coverage question in seconds. Health Republic's documents were generally easy to find.

So far so good, we thought. But then we moved to our fourth candidate, Empire BlueCross BlueShield, and things came to a screeching halt.

The link Empire provided for its summary document led us instead to a confusing gateway page with no option for marketplace shoppers. We lied and picked the "Member" option, but not every shopper is going to feel like doing this (and no shopper should have to). Once we were through the gateway, Empire showed us a list of over 2,000 documents. After some trial-and-error filtering we cut the list down to 16 choices. Then we had to go back to the listing on the exchange and find a four-letter code. And just like that, we had a degree in library science the summary.

Our search for Empire's drug formulary fared no better. The direct download link was broken, and the 404 error page redirected us to the company's home page. We eventually found a list of formularies with subtitles like "Generic Premium - Downstate," but then the drug was listed in one document but not in another with a similar name, which left us without a definitive answer.

In total we spent 1 hour and 9 minutes looking for answers on our own. MetroPlus took about 17 minutes, partly because there was a lot more documentation to access compared to the others, while Oscar and Health Republic took a little over 15 minutes each. Empire, which offered up about the same amount of info as the previous two, still took almost 22 minutes because we spent so much time searching for things.

As for how many questions we answered unequivocally, we managed a couple per insurer. We figured the drug question would be the easiest to answer and it was (not counting Empire), and depending on how many extra details an insurer offered we were sometimes able to resolve one or two more.

Round 2: Getting Help Over the Phone

We'd found all we could online, so we were ready to try the phone next. Here's where the summary came in handy again because it listed the insurer's toll free number at the top of the first page.

First, a note to those of us who have grown more comfortable with the self-service nature of the internet: It's totally okay to call someone before you make a final decision. In fact you're pretty much expected to, which is probably why some insurers don't put a lot of effort into extra online documentation.

Fortunately, every person we spoke with was friendly and at least somewhat helpful. (The helpfulness varied.)

Having said that, we found that not every company was equally enjoyable to deal with. One in particular—you might be able to guess which one—left us half-wishing we hadn't called.

Also, the hold times we experienced may not represent what happens outside of the frenzy of open enrollment (we ran our call experiment a few times in December during the end-of-year rush). And while quality may vary, depending on the particular rep you get on the phone, we think the following experiences are representative of our several interactions with the insurers.

Let's look at better experiences:

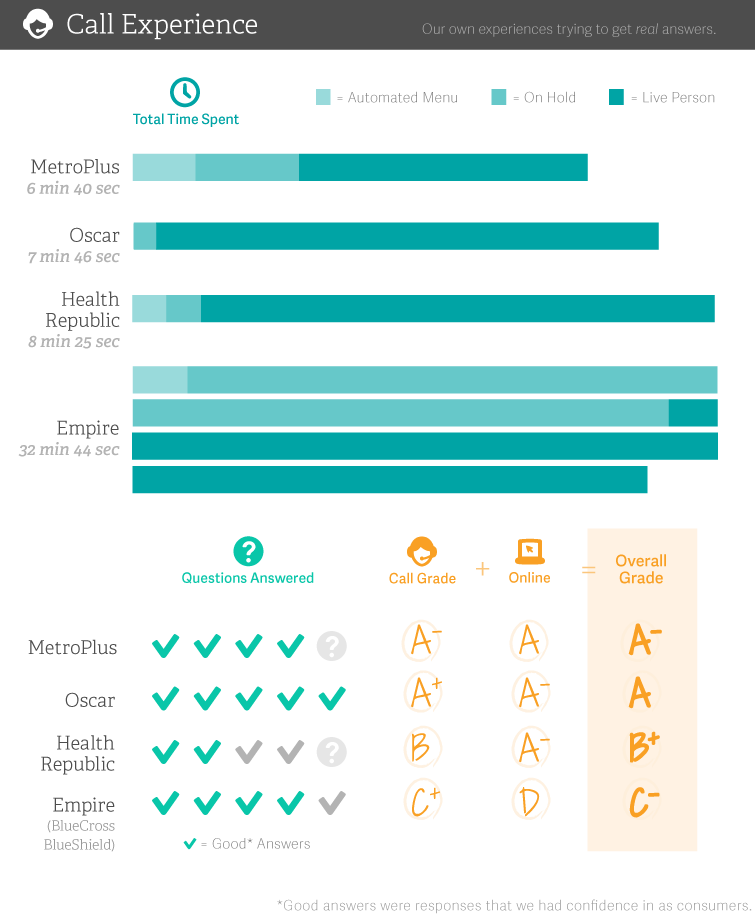

The MetroPlus rep's no-nonsense personality seemed appropriate for the NYC region that this HMO serves, but there was a communication misfire when we asked whether there was a 24-hour helpline. She thought we were asking about on-call policies of individual primary care providers, and after the third attempt she began to grow impatient with us so we moved on. She answered the other four questions with ease and never put us on hold. Duration of call: 6 minutes, 40 seconds.

Oscar pleasantly surprised us by skipping a menu tree altogether and placing us directly into the call queue—we were talking to a live person in just over a minute. He answered most of our questions without hesitation and put us on hold only once for about half a minute while he confirmed the details of out-of-state coverage. When we asked the drug coverage question he walked us through the online search interface and helped us find the answer. Duration of call: 7 minutes, 46 seconds.

The Health Republic representative was hands down the friendliest and we reached him even faster than we reached Oscar's guy. But this call was the least fruitful. The rep put us on hold twice to find answers, and four of his answers were actually just phone numbers, which put us back at the start of the "call someone for help" round. Duration of call: 8 minutes, 25 seconds.

And then there was Empire BlueCross BlueShield. Let's start with the duration of the call: 32 minutes, 44 seconds—four times longer than any of the other three insurers.

What would make the call stretch to half an hour? Well, it took 6 1/2 minutes to reach a customer service rep, but her job was not to answer any questions. Her job, it turned out, was to ask questions. She asked for our name, contact info and financial status, and then placed us back on hold where we waited another 18 1/2 minutes for an agent who could help us.

That agent was the most knowledgeable of everyone we talked to. She had an immediate and useful answer to our dental question, and she quickly confirmed that the company had a 24-hour nurse helpline. She even gave us a detailed answer to the drug question.

But was talking to her worth giving Empire our personal information and listening to hold music for over 25 minutes? None of the other companies asked for any personally identifiable information at all, but that's because they had customer service reps on hand to help field general questions like ours. Empire pushed us directly to an agent, which took longer and unexpectedly shifted the discussion into a much more personal space.

We even told the first Empire rep that we had the exact name of the plan and all we needed was someone to look at it with us, and she said it wouldn't help because of how their system was set up, which frankly sounded like an all-purpose excuse and not an actual explanation.

Some Final Lessons on ACA Health Insurance Exchange Shopping

We learned that online research is best for three things: broadly comparing plans, downloading the summary documents and getting a general feel for the insurance company's business style. Some companies might offer additional documents that you can explore for really detailed answers, but the average shopper should be fine with the summary and details page. When it comes to specific questions about coverage, you'll probably find some answers and will have to save the rest for when you call.

We had good-to-excellent encounters with the people we spoke to at all four companies. The quality of answers was uneven, though, which is why we were glad that we did some independent online research first.

In this specific experiment, the smaller and newer insurers provided a far better call experience than the huge, established insurer. Calling Empire was equivalent to plugging oneself into a giant corporate machine that's been finely tuned to monetize every customer encounter. They were the only insurer that asked for personal and contact information during the call and we found out why a week later: marketing materials mailed to us. We think it's poor form to add 20+ minutes to the (stressful and already time-consuming) shopping experience to capture a lead generation opportunity. It's that kind of behavior that makes consumers dread insurance shopping.

We didn't start out by trying to rate these four companies specifically—we picked them because they all had marketplace plans that matched our search criteria, and because taken together they cover a large range of insurer types. We still can't tell you which health insurance plan is the best, because that depends on your specific situation. What's important is that you know how to find the right answers so you can make that decision on your own.

Have you shopped for health insurance on an ACA health insurance exchange? We'd love to hear about your experiences in the comments. If you have questions about shopping for health insurance please email us at geniushq@policygenius.com. This post was originally featured on Huffington Post