Many Americans lack the basic home insurance knowledge necessary to make sure they’re getting the right amount of coverage at an affordable cost, a new Policygenius survey found.

American homeowners may be unknowingly under-insuring themselves, buying less coverage than they need and leaving their homes unprotected in case of a catastrophe. Conversely, some homeowners may be over-insuring themselves, buying more coverage than they actually need and over-paying year after year.

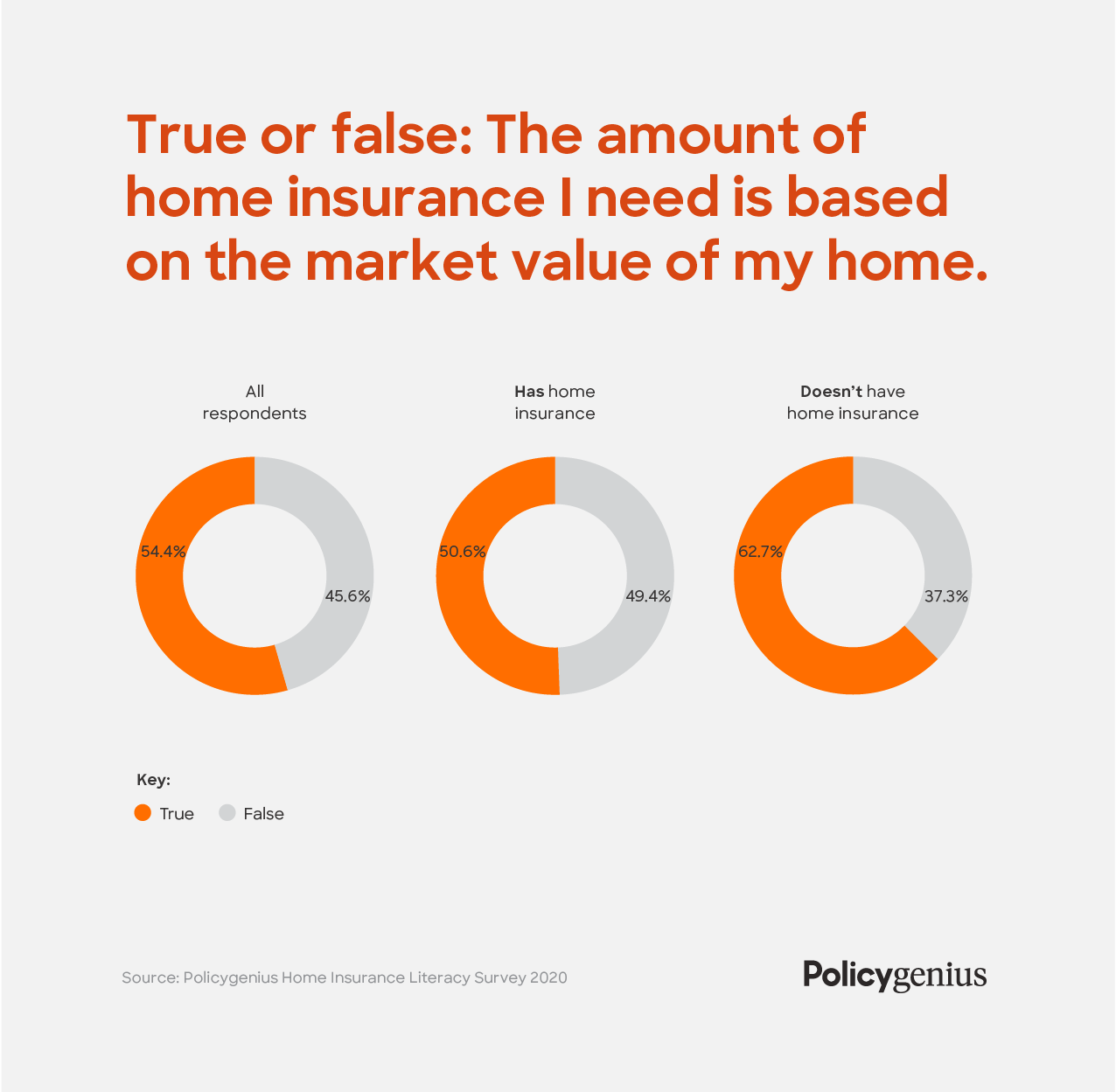

Nearly half (49.4%) of all homeowners surveyed mistakenly believe that the amount of home insurance coverage they need should be based on their home’s market value.

Home insurance coverage should actually be based on a home’s rebuild cost, meaning how much it would cost to fully rebuild the home if it were destroyed, not how much you would get for it on the current market.

Rebuild cost and market value can actually be dramatically different — “Apart from the fact that market value will include the cost of the land itself, the selling price of a property ultimately comes down to whatever a seller can get for it,” Fabio Faschi, property and casualty team lead at Policygenius, explained.

Homeowners who base their home insurance coverage on their home’s market value may be getting less coverage than they’d need if their home had to be rebuilt, or they may be paying for far more coverage than they’d actually need.

Missing out on chances to save

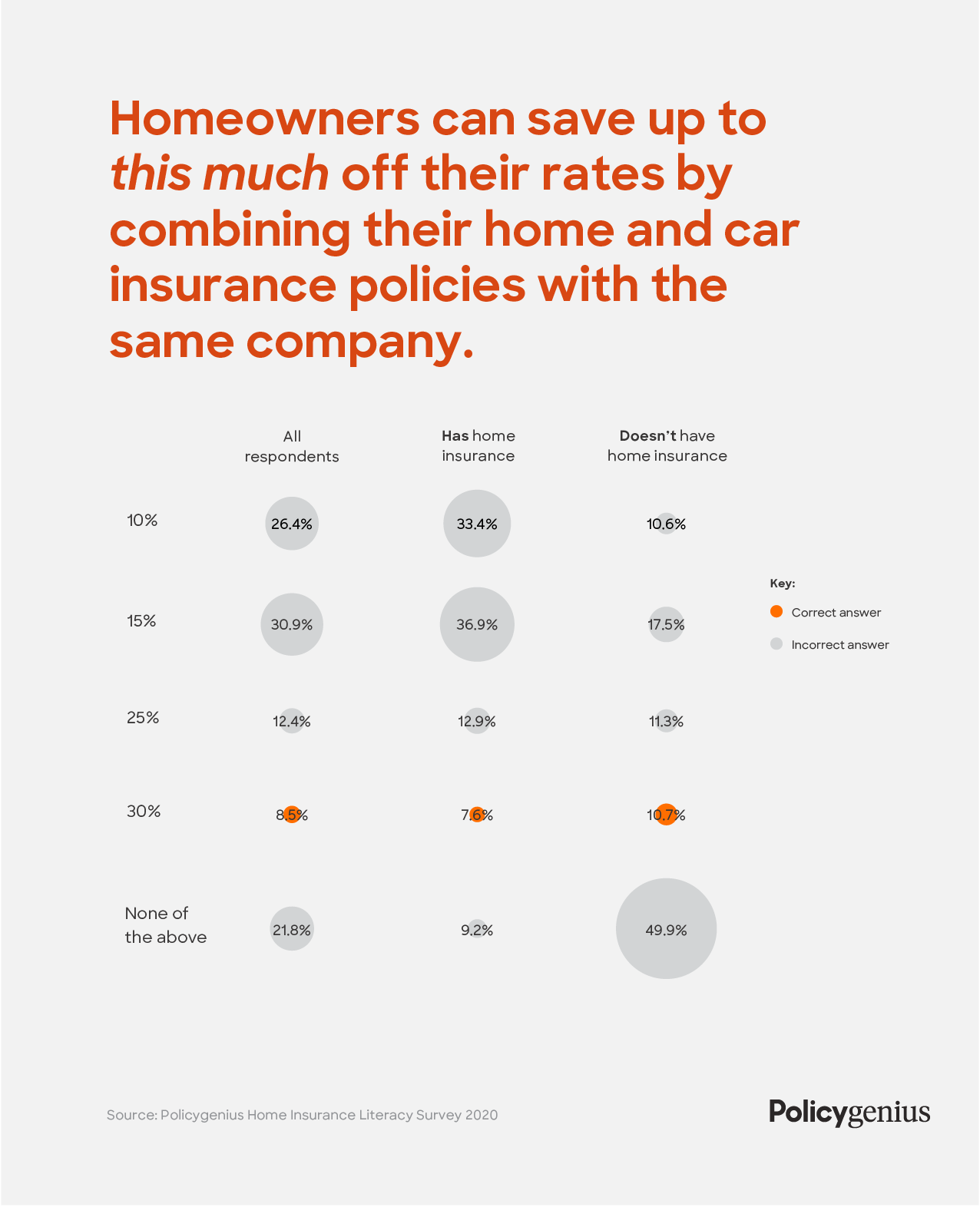

Another reason homeowners may be overpaying for home insurance? They’re not taking every opportunity to save. Over 80% of homeowners underestimated how much shoppers can save by buying their home and car insurance from the same company, known as “bundling.” A third (33.4%) of homeowners guessed they could save just 10% by bundling, when real life savings can be much higher.

Policygenius has found that our customers have saved an average of 30% by combining their home and car insurance when they shop with us — much more significant savings than homeowners guessed are even possible.

Homeowners also don’t realize that certain updates to their home or changes to their policy can save them money. A surprising 40.4% of homeowners didn’t realize that installing a security system in their homes could save them money on their home insurance, and 53.4% of homeowners didn’t know that going several years without filing a claim could also earn them a discount.

“Having a clean claim record, additional home protection systems, or simply having a brand new home can ultimately all save you money on your insurance,” Faschi explained.

Earth, wind and fire: What’s covered and what isn’t?

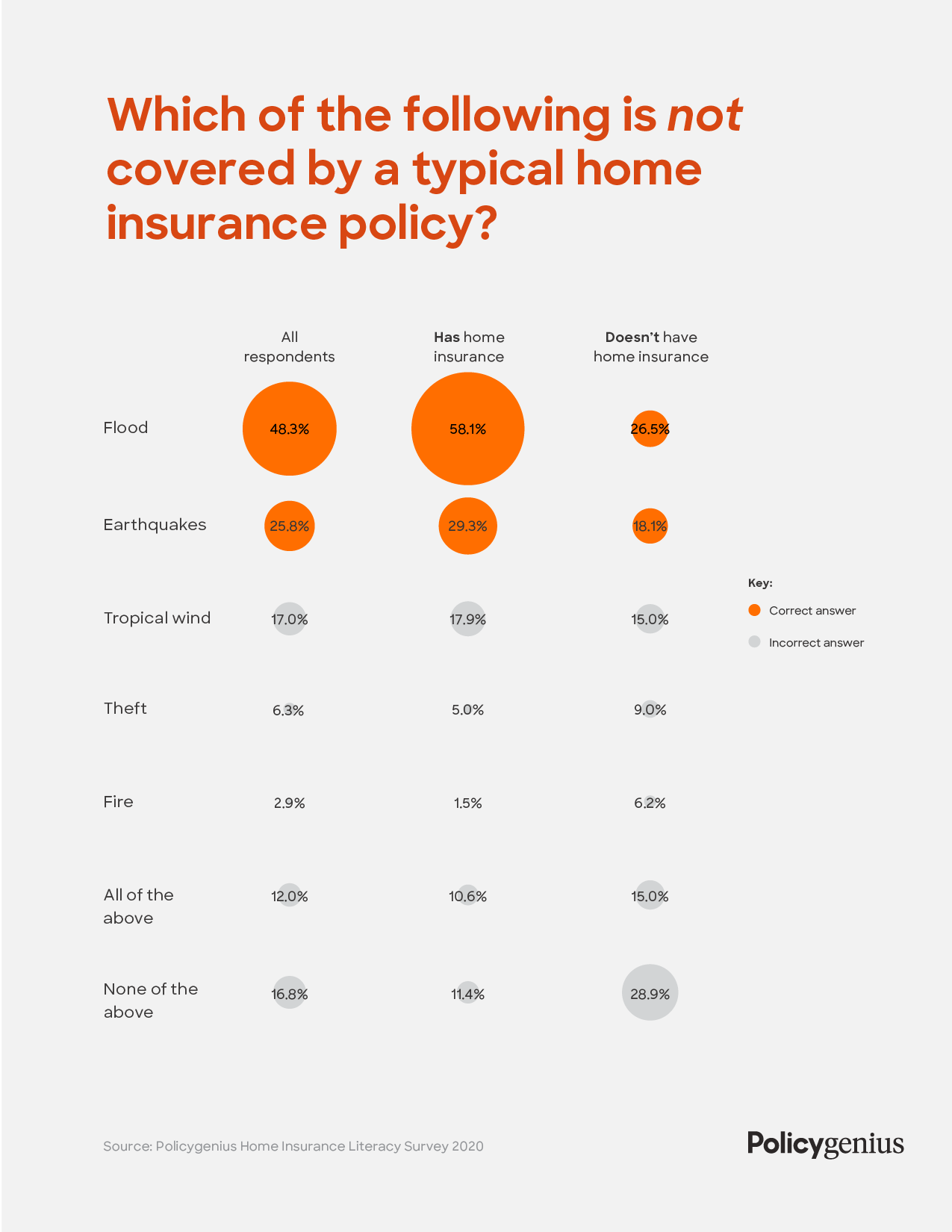

Confusion over what perils are actually covered by home insurance may also lead to some homeowners being underprotected. More than half (53.3%) of homeowners surveyed didn’t realize that floods aren’t covered by a typical homeowners insurance policy. Homeowners who live in areas at risk of flooding must purchase flood insurance — without it, any damage to their home from flooding simply isn’t covered.

More than 80% of homeowners don’t realize that earthquake damage is also not covered by a standard policy, potentially leaving them unprotected unless they purchase a separate earthquake insurance policy.

Homeowners may also not realize that any big changes to their house or its contents should be reported to their insurer, otherwise those new additions may not be covered.

More than half (53.2%) of homeowners didn’t know that they should tell their home insurance company about an expensive new piece of jewelry, and a majority of homeowners (76.1%) didn’t know that they should notify their insurance company if they get a new dog. But without reporting a new pet or adding on extra coverage for a pricey item, you may not be covered if Fido bites a neighbor or if your valuable ring is stolen.

“Just as it’s important to be made aware of any changes to your coverage or policy costs from time to time, it’s equally important that your insurer is made aware of any changes to the coverage you need in your life,” Faschi said, “whether it’s an engagement ring or a new nursery wing to the house.”

Misplaced confidence?

Despite some gaps in home insurance knowledge, most homeowners surveyed (74.1%) said they felt confident that they had enough home insurance to fully replace their home in case of a disaster. But that left more than a quarter (26%) who felt that they did not have enough coverage to replace their home, meaning they may be underinsured and underprotected.

Given the gaps in understanding about coverage and cost, even those homeowners who indicated they were confident in their coverage may actually be underprotected. So what’s the best way to ensure you have the right coverage at the right price?

Understand your needs. Before you buy a home insurance policy, understand exactly how much coverage you should get. An appraiser can give you an accurate sense of how much your home’s rebuild cost would be.

Shop around. Compare quotes from multiple insurers before you decide on a policy. Shopping around can help you be sure you couldn’t be getting more coverage at a better price from another insurer.

Take advantage of policy credits and discounts. Ask about any savings opportunities, and make sure you’re getting every discount available to you.

Re-shop regularly. When your policy term is up, don’t just automatically renew. It’s a good idea to regularly re-shop your home insurance coverage, you may be able to get a better deal.

But most of all, when it comes to shopping for home insurance, don’t go it alone. A trusted agent can help you sort through the confusing lingo and help you get the right amount of coverage, so you have the protection you need without overpaying.

“Insurance is a protection created to give you peace of mind, but it can be difficult to navigate without a thorough understanding,” Faschi said.

“A good insurance agent’s job is to give you that peace of mind when it comes to choosing the right policy and coverage for your needs,” he added. “Nobody wants to think about insurance until they have a claim, but it’s important to discuss your insurance needs beforehand and make sure that your insurance will work for you when the time comes.”