Find the most up-to-date pricing analysis in our 2023 Home Insurance Pricing Report.

Homeowners insurance prices continue to climb in the United States amid skyrocketing inflation and natural disasters, with premiums up 12.1% compared to a year ago, according to a Policygenius analysis of internal policyholder data.

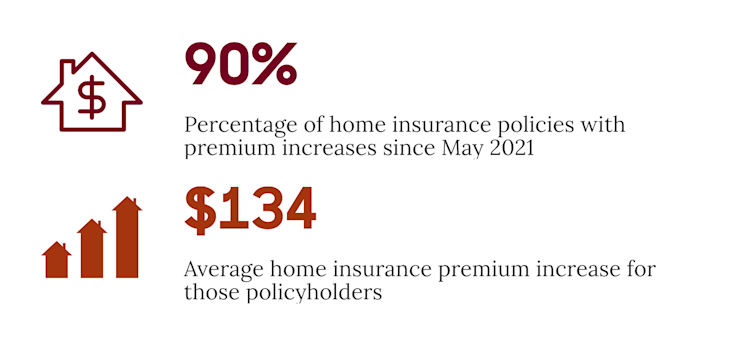

From May 2021 to May 2022, 90% of homeowners saw their quoted annual premium increase compared to the previous year. For homeowners whose premiums went up, the average increase was $134.

Home insurance prices are rising faster than inflation in many states

From May 2021 to May 2022, the price of goods and services increased by 8.6% in the U.S. — the largest 12-month increase in over 40 years, according to the Bureau of Labor Statistics. [1]

In the same time period, home insurance costs in all but one of the states we analyzed have either kept pace with or increased faster than inflation, with 13 states seeing an average rate increase over 50% higher than the current inflation rate and 3 states seeing increases more than double the rate of inflation.

Arkansas saw the highest percentage increase at 18.5%, as policyholder premiums for Policygenius customers went up an average of $228 at policy renewal. The Arkansas Insurance Department has approved six companies for rate increases higher than 10% since the beginning of the year. [2]

Washington state saw the second highest hike, with an average percentage increase of 18.1%. This increase comes after a ruling from the Washington Insurance Commissioner that temporarily banned insurance companies from factoring credit scores into rates, which in the short term, at least, led to most homeowners seeing higher rates. [3]

Texas and Colorado also saw steep increases over the last 12 months, while Oklahoma had both the highest average annual premium and average premium increase of any state. Homeowners in these areas of the country face the compounding effects of higher rebuild costs in the wake of natural disasters — an occurrence that experts refer to as “demand surge” — combined with sustained supply-driven inflation. [4]

New York saw the lowest premium increases

New York saw the lowest increase at 8%, making it the only state with an increase lower than the inflation rate. Inflation hasn’t risen as drastically in the New York City Metropolitan area as it has for the rest of the country, which may explain the lower rate of increase. [5]

Why homeowners insurance is more expensive in 2022

Home insurance costs have climbed the last year in large part because of record-high inflation and more frequent (and costly) natural disasters.

Homeowners insurance coverage limits are primarily based on how much it costs to rebuild a house. As construction costs continue to skyrocket due to delayed shipments and labor shortages, so too do home replacement costs. And this has a significant impact on homeowners insurance premiums.

Premiums are also skyrocketing in certain areas due to increasingly violent natural disasters. As we approach yet another hurricane season that experts predict will have “above average” storm activity, many home insurance providers are increasing rates to account for anticipated losses and pass some of these costs onto policyholders.

Here are the main reasons why home insurance costs have seen a sharp increase since last year.

What homeowners can do about rising insurance costs

While it may be tough for homeowners in certain states to avoid a rate increase in 2022, there are several ways to get those premiums back down.

Change home insurance companies

Homeowners should aim to re-shop their home insurance each year to make sure they aren’t missing out on more affordable or better coverage with a different provider.

Bundle home and auto insurance policies

Many major insurance companies offer homeowners anywhere from 15% to 30% off their home and auto insurance policies if they bundle the two under a single policy package.

Ask about policy discounts

Many insurance companies offer discounts to homeowners who take steps to make their home safer, as this reduces their chances of having to file a claim. Adding a security system or smart home device to your home, installing a new roof, or fitting your home with any other protective devices can all net you a substantial discount.

Consider a higher deductible

Opting for a higher policy deductible is one of the easiest ways for homeowners to lower their home insurance premiums. If you’re at fairly low risk of claims or you’ve never had to file one in the past, consider increasing your home insurance deductible.

Inflation-proof your coverage

In addition to higher premiums, inflation and rising rebuild costs could also be leaving your house underinsured. This means you may not have enough insurance to pay for a full rebuild in the event of a disaster. In light of rising inflation, it’s important to review your insurance policy at least once per year to ensure your dwelling coverage is at or above your home’s replacement cost.

Here are a few things you’ll want to check for or consider adding to your policy.

Inflation guard coverage: This automatically increases your dwelling coverage limit each year to account for rising construction costs. However, during periods of extreme inflation, these adjustments may not account for future increases, so make sure to review your limits. If you’re not sure whether your policy has inflation protection, ask your insurance agent.

Ordinance or law coverage: Increases your policy’s dwelling coverage limit to comply with local building codes. This coverage is especially important for homeowners in Florida, a state where residents are often required to demolish and completely rebuild properties that are more than 50% damaged.

Extended replacement cost coverage: Increases your policy’s dwelling coverage limit an additional percentage amount (usually 25% or 50%) in the event rebuild costs skyrocket after a natural disaster.

Methodology

Average premium increases are based on internal Policygenius data for 8,698 active home insurance policies quoted for renewal from May 20, 2021 to May 20, 2022. The percentage change in each state reflects the average difference between the original premium and the insurance carrier’s quoted renewal premium for each individual policy (final renewal premium for each policyholder may differ from the quoted premium due to policy or carrier changes).

Our analysis was limited to the 25 states for which we had a statistically significant number of policies. If a statistically significant state had outliers, or policy premiums that were abnormally higher or lower than the main cluster of values, those policies were not included in this analysis.

Image: Kelsey Louise Tyler