A basic homeowners insurance policy does not cover damage caused by earthquakes. To actually cover your home and belongings from the direct effects of a quake, you’ll need a separate earthquake insurance policy.

Earthquake insurance covers your home, personal belongings, and additional living expenses (if you can’t live in your home after a quake) in the event of an earthquake.

Is earthquake insurance worth it?

Not all earthquakes cause catastrophic damage. In fact, of the 10,000 earthquakes that occur in southern California each year, most are so small that the average person doesn’t even notice them. [1]

Add to this the high premiums that come with earthquake insurance in high-risk zones near fault lines, and many people decide to skip out on coverage. But just like any other natural disaster, all it takes is one large earthquake to cause extensive structural damage to your home, leaving you with tens or even hundreds of thousands of dollars in necessary repairs.

Here are a few pros and cons to help you decide if earthquake insurance is worth it for you.

Do I need earthquake insurance?

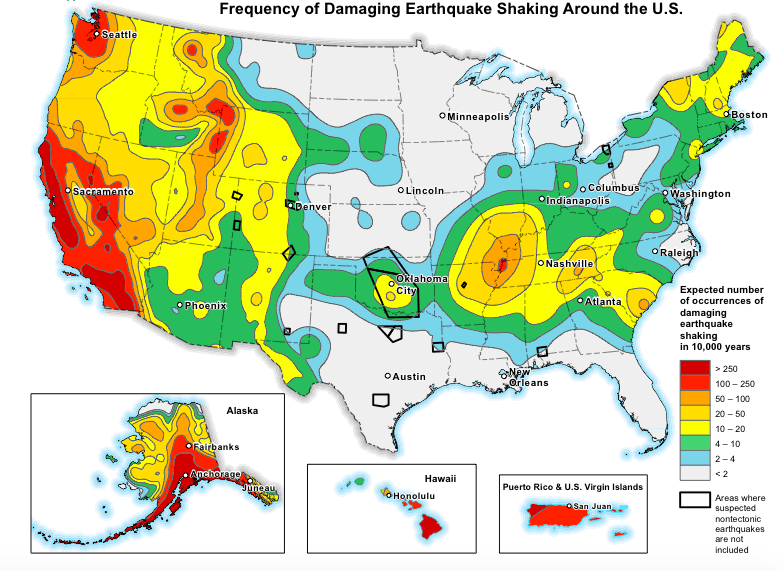

If you're on the fence about whether earthquake insurance makes sense for you, start by taking a look at your home's earthquake risk. You can get an idea of how close you live to a fault line by looking at the National Seismic Hazard Map.

You might live closer to a fault line than you originally thought. You also may want to consider how much fracking goes on in your area as well. Fracking (and the wastewater disposal from fracking) can cause or exacerbate seismic activity by adding pressure to tectonic faults. [2] From there, you can weigh the risks against the premiums to decide if earthquake insurance makes sense for your home and finances.

Seismic hazards map courtesy of the U.S. Geological Survey

Homes in certain parts of California, Alaska, Oregon, Washington, Nevada, and Hawaii are at particularly high risk of earthquake damage, and tremors are also becoming common in parts of Texas and Oklahoma where fracking is common. [3]

Be sure to ask your homeowners insurance agent about whether or not it’s necessary for you to purchase earthquake coverage.

What happens if you don’t have earthquake insurance?

Homeowners insurance doesn’t cover “earth movement,” including damage directly caused by earthquakes. So if you don’t have earthquake coverage, then you’ll have to cover any earthquake damage out of pocket. If the quake is declared a “major disaster” by the federal government, affected residents may be eligible for a limited amount of public assistance funds.

How to decide if earthquake insurance is worth it

The United States Geological Survey (USGS) includes a list of factors that you should consider when evaluating your earthquake insurance needs, including: [4]

Your home’s proximity to an active fault

Frequency of earthquakes in your region

How long it’s been since the last earthquake

Your home’s construction type — if it’s a stone or brick home, it has a higher probability of being damaged by an earthquake

The soil condition and slope of the land

Whether or not your home is built specifically to withstand earthquakes

The cost of earthquake insurance and policy factors like the deductible amount

Do I need earthquake insurance if I live on the East Coast?

Even though earthquakes are much more common on the West Coast than the East Coast, they still happen. The one plus side is that since earthquakes are much more uncommon in these areas, earthquake insurance is typically cheaper.Homeowners on the East Coast can likely purchase earthquake insurance for less than $0.50 per $1,000 of coverage, according to the Insurance Information Institute. This means earthquake insurance on a $500,000 house would cost around $250 per year.

How much does earthquake insurance cost?

In California, every $100,000 of earthquake coverage will cost you $500 to $1,000 in annual premiums.

Here’s an example.

Say you own a home that would cost $400,000 to rebuild at today's construction and labor prices. That means you're looking at earthquake insurance costing you anywhere from $2,000 to $4,000 per year.

Other factors that go into determining your rates include:

Your home’s age and location

Your home’s foundation — slab or raised

Your deductible — the higher your deductible, the lower your rates

The construction type of your home — frame or masonry

When we ran a sample quote for earthquake insurance through the California Department of Insurance, we found that masonry homes cost a staggering $2,000 more to insure annually than frame homes. [5]

How do earthquake insurance deductibles work?

When you file a claim for earthquake damage to your home, you’ll have to pay your policy deductible before your insurance will kick in to cover the rest. Earthquake policies generally use “percentage” deductibles, which means you’ll pay a percentage of your home’s coverage amount rather than a fixed dollar amount.

Most insurers give you the option of earthquake deductibles between 5% and 25%. If you file a claim for damage to your home’s structure and belongings, most insurers will make you pay separate deductibles for the dwelling and personal property portions of your policy.

Here’s an example of how earthquake deductibles work on a specific policy.

Dwelling coverage | Personal property coverage | Total | |

|---|---|---|---|

Coverage limits | $200,000 | $100,000 | - |

Deductible | 15% | 2% | - |

Damages | $100,000 | $80,000 | $180,000 |

Amount you’re responsible for | $30,000 | $2,000 | $32,000 |

Amount insurer is responsible for | $70,000 | $78,000 | $148,000 |

In this example, the structure of the home is insured for $200,000 with a 15% deductible, and the personal belongings are insured for $100,000 with a 2% deductible.

If the home and belongings incurred $100,000 and $80,000 in earthquake damage, respectively, the policyholder would be responsible for paying $32,000 in deductibles before they’d be reimbursed the remaining $148,000 of the loss.

Why are earthquake deductibles so high?

Earthquakes are powerful enough to level entire homes and buildings. This makes insuring them a considerably high-risk endeavor for insurance companies. To cover the potentially significant losses from a major quake, insurance companies need to charge higher deductibles.

What does earthquake insurance cover?

Earthquake insurance covers the cost of rebuilding your home or replacing your belongings after an earthquake or the aftershocks that follow. It may also cover damage from a volcanic eruption that is triggered by an earthquake. If your home is damaged by an earthquake and you don’t have this coverage, you’ll likely have to pay for repairs entirely out of your own pocket.

A standard earthquake policy consists of the following coverages:

Coverage | What does it cover? |

|---|---|

Repairs to house and attached structures, such as a garage or porch | |

Your personal belongings, including electronics, clothing, and TVs | |

If your home is uninhabitable after an earthquake, ALE covers the cost of things like temporary lodging and meals while you’re away | |

Building code upgrade (optional coverage) | If local building code requires new homes to be built with certain structural upgrades, this covers any additional rebuild or repair costs that are needed to meet those requirements |

Emergency repairs (optional coverage) | Immediate repairs to stabilize your home or personal property in order to prevent further damage in the wake of an earthquake |

Where can I buy earthquake insurance?

Earthquake insurance is available through both major insurance providers and specialized earthquake insurers. Coverage can be purchased as an optional home insurance endorsement or as a separate earthquake insurance policy.

If you live in California, you can purchase earthquake insurance through the California Earthquake Authority — a privately funded, publicly managed entity that provides coverage to state residents who live near high-risk fault lines. Its free earthquake insurance pricing calculator can give you an idea of how much an earthquake policy might cost you in California.