The total U.S. household debt has increased by a staggering $2.9 trillion since the end of 2019. [1] Meanwhile, nearly half of American adults (46%) expect that if they died today, their loved ones would inherit their debt. That’s according to the Policygenius 2024 Financial Planning Survey, which also found that the more your household earns, the more likely you are to pass down debt when you die.

Roughly 1 in 5 who expect to pass down debt don’t have life insurance

When someone dies, loved ones only inherit debt when they co-own the debt themselves, usually because they’re a co-signer, a joint account holder, or a surviving spouse in a community property state. And if you inherit a house with an outstanding mortgage, you are also responsible for payments.

Life insurance is one way to cover shared debt in the event that one of the co-signers dies. Among people who expect their loved ones to inherit their debts if they die, 74% have some kind of life insurance coverage in the household. But 21% live in households where no one has life insurance, and 5% who expect their loved ones to inherit their debts don’t know about their household’s life insurance coverage.

Wealthier people are more likely to pass on debt

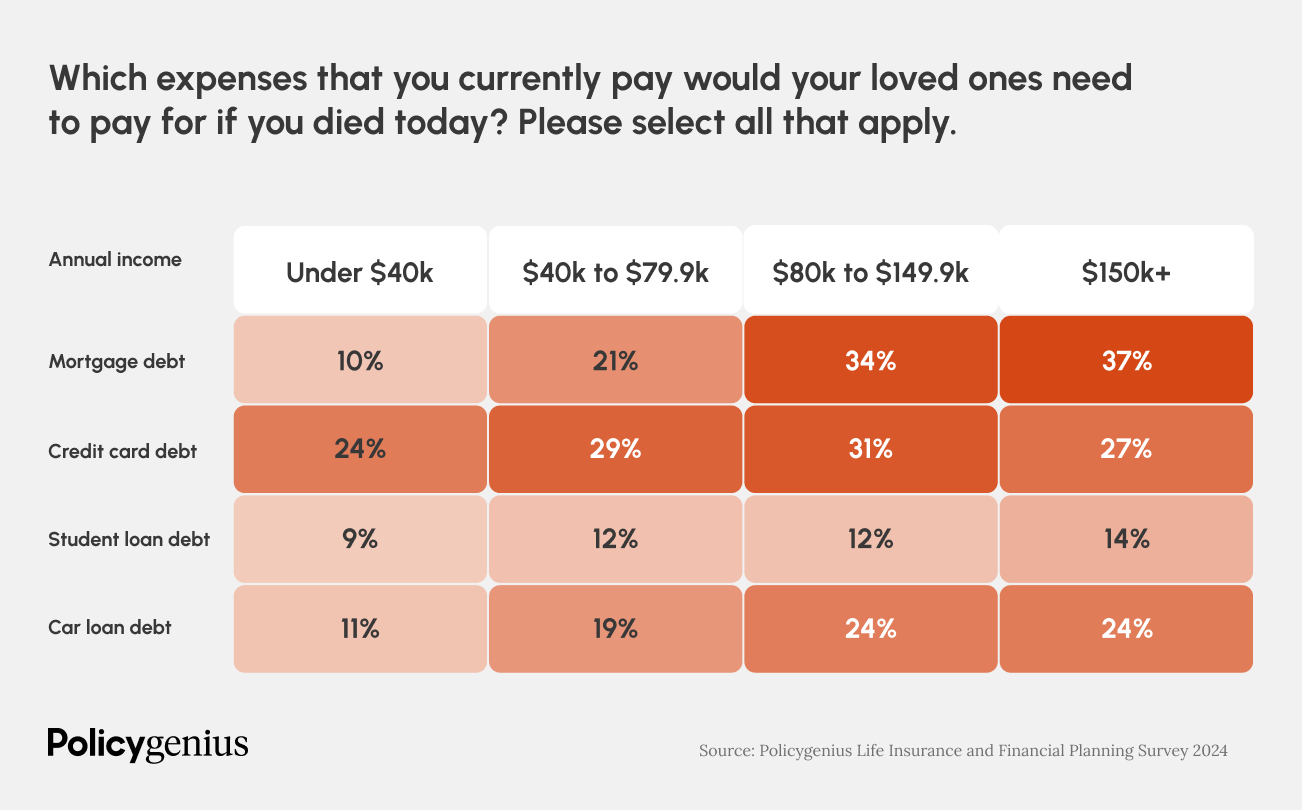

Having debt isn’t necessarily a marker of financial trouble. According to our survey, the more someone earns, the more likely they are to say their loved ones would need to pay their debts if they died today. 58% of people earning $150,000 or more per year said their loved ones would have to pay for some form of debt if they died, compared to 47% of Americans earning less than $150,000.

Wealthier people with higher credit scores can borrow money more easily for big purchases like houses, cars, and higher education, and people earning more than $150,000 are almost twice as likely (54%) to own real estate as those earning less (29%).

However, the highest-earning Americans may also be the best prepared to help their loved ones pay off debts. Only 13% of those earning at least $150,000 per year live in a household where no one has life insurance, compared to 31% of those earning less than $150,000.

The racial wealth gap is also a racial debt gap

The real estate ownership gap is even more stark when comparing white, Black, and Hispanic Americans. 37% of white Americans own real estate, compared to 15% of Black and 14% of Hispanic Americans surveyed. The racial housing gap has grown since 1960, according to Census data analyzed by Policygenius. Racial disparities in debt are closely tied to racial disparities in wealth. Black and Hispanic Americans have a harder time accessing credit to make larger purchases, like real estate, that can help them build wealth and pass it down to future generations. [2] Because of that, mortgage debt is a sign of wealth, and White Americans are more likely to expect to pass it down than Black or Hispanic Americans.

Most parents expect to pass on debt

Expecting to pass down debt is strongly associated with having kids, according to the survey. 60% of Americans living with children (including adult children) say their loved ones would need to pay their debts if they died today, compared to just 38% of those who don’t live with any children, regardless of age.

Among those living with children and with debt to pass down, 82% live in households with life insurance coverage, indicating that many have a plan for helping their loved ones cover their shared debts if they die.

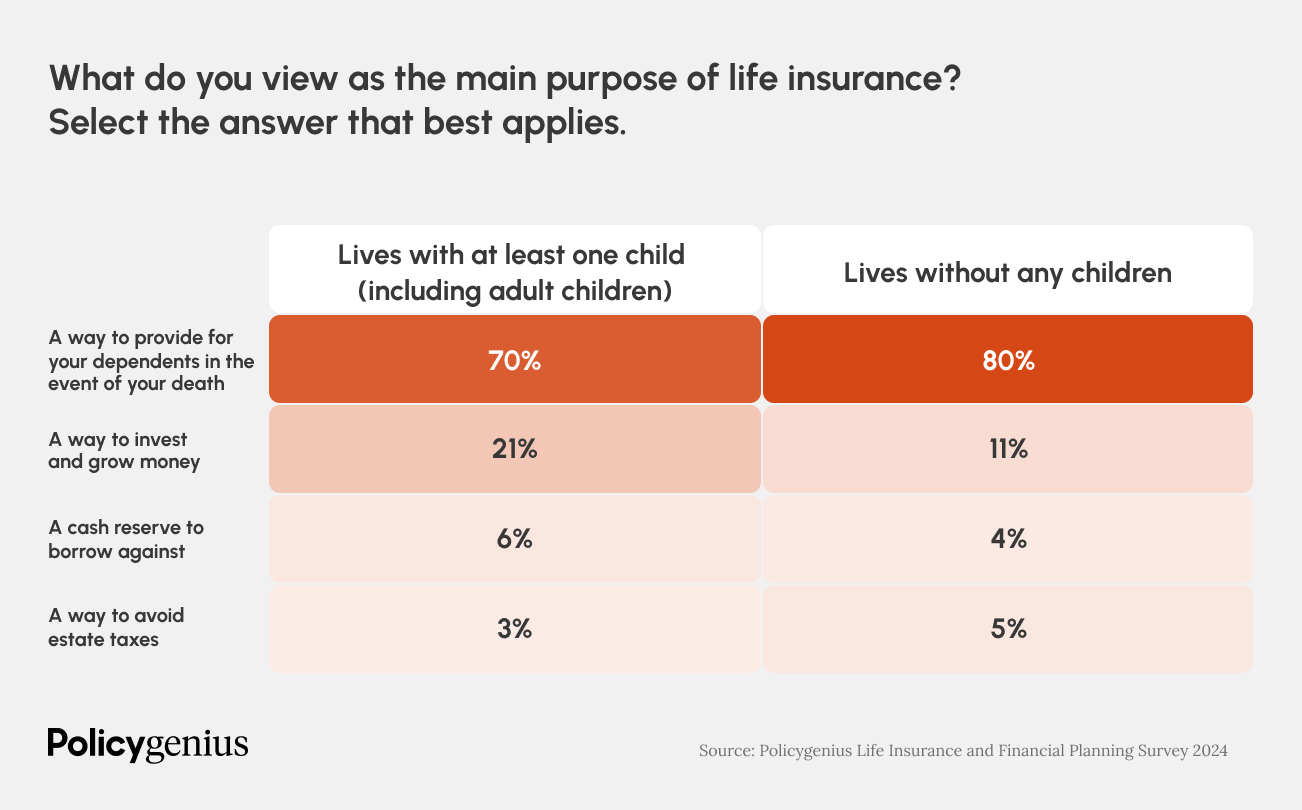

However, only 70% of those living with children view life insurance primarily as a way to provide for their dependents, compared to 80% of people without children. Instead, 23% of those living with children and expecting to pass on debt view life insurance mainly as a way to invest and grow money, which is only possible with permanent life insurance policies that accrue cash value. Some life insurance products, like whole or permanent policies, have a cash component that can be used as a way to grow money in addition to the regular death benefit.

There’s also a generation gap when it comes to views on life insurance. Millennials and Gen Z are more likely to view life insurance as an investment than baby boomers.

Not surprisingly, baby boomers, who’ve had more time to pay off debt, are less likely to say their loved ones would need to pay their debts if they died than millennials (43% vs. 52%). The biggest difference-maker was student debt, which 17% of millennials and 16% of Generation Z expect their loved ones to cover if they died today, compared to just 2% of boomers.

Methodology

Policygenius commissioned YouGov to poll 4,063 Americans 18 or older. The survey was carried out online from Oct. 16 through Oct. 19, 2023. The results have been weighted to be representative of all U.S. adults. The average margin of error was +/- 2%.

About Policygenius

Policygenius, a Zinnia company, is a one-stop insurance platform that makes it easy to compare and buy policies, get unbiased expert advice, and manage an insurance portfolio in one seamless digital experience. Alongside the intuitive enterprise technology solutions and insights offered by parent company Zinnia, an Eldridge business, Policygenius is helping create better end-to-end insurance experiences for shoppers, advisors, and insurers alike — and enabling more people to protect their financial futures along the way.

Infographics by Anna Konson