The life insurance industry experienced dramatic changes throughout 2021. Faced with growing competition and changing customer expectations, and accelerated by the continued impacts of COVID-19, an industry once dependent on a high-touch application process requiring an in-person medical exam rapidly reinvented itself to prioritize contactless policies and digital service options.

Policygenius experts took a comprehensive look at these major shifts in the industry, drawing on our own internal data as one of the largest term life insurance distribution platforms in the U.S. — with more than $120 billion in face amount placed in force — as well as insights from other industry thought leaders.

What we found: Insurers are quickly transforming their product offerings and consumers are benefiting from the changes. Customers are paying the same — if not less — than they were a year ago for traditional term policies, and insurers’ investment in underwriting technology has made affordable no-medical-exam life insurance policies easier to access. However, unpredictable global events and a continued press for innovation will require more flexibility from the historically cautious life insurance industry.

Changes in how consumers shop for life insurance

Traditionally, buying life insurance has required hard-copy paperwork, an in-person medical exam, and a five-to-six-week wait while underwriters evaluate your application. However, what consumers expect and how they shop has changed, with online shopping and convenience at the forefront of buying preferences and COVID-19 continuing to amplify that interest.

Shoppers are seeking convenience and speed

According to Kartik Sakthivel, vice president and chief information officer of LIMRA, a not-for-profit trade organization, nine in 10 insurance executives surveyed in 2020 reported that their customers “have an increased appetite for the digital shopping experience,” a trend that continued into 2021. More and more people are looking for ways to shop for life insurance online, with many of those individuals specifically seeking a simple, contactless application process.

To accommodate the demand for online shopping, insurance companies are investing more in technology than ever, according to Mark Friedlander, director of corporate communications at the Insurance Information Institute. Many insurers have introduced convenient digital features that offer near-instant access to quote comparisons and customer service; several have developed life insurance policies that shorten the approval process — which historically took weeks to complete — and eliminate face-to-face interaction.

The most notable of these faster policy types is accelerated underwriting (AU) life insurance, a no-medical-exam option that allows consumers to apply for term life insurance using digital health information. Many consumers are more likely to purchase life insurance if an AU option is available, Sakthivel says, and “that's especially true for women and Gen X consumers.”

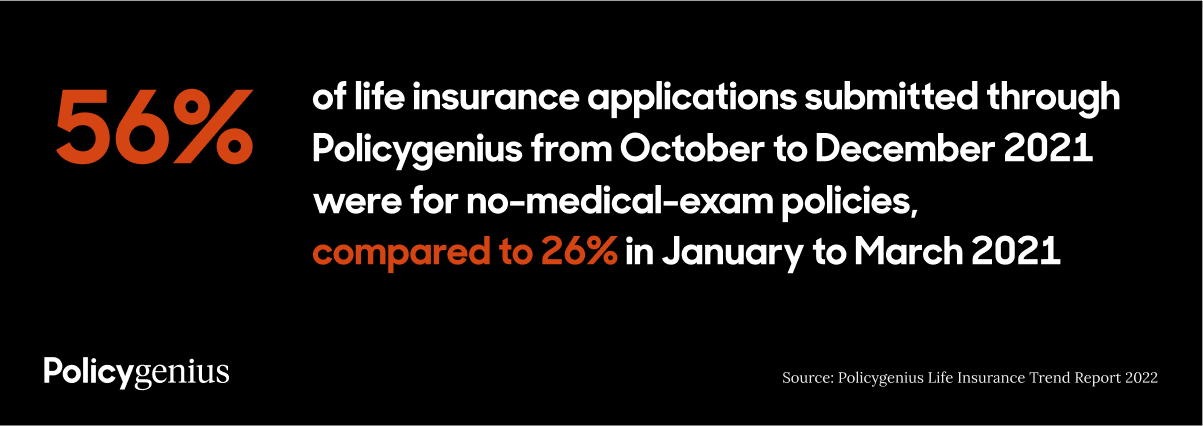

Internal Policygenius data confirms that demand for digital-first life insurance products has grown significantly, driven by a desire for speed and ongoing COVID-19 concerns (see Buying Trends in 2021, below). From October to December 2021, roughly 56% of applications submitted through Policygenius were for no-medical-exam policies, compared to 26% in January to March 2021.

More digital options to come

COVID-19 accelerated the pace at which companies adopted digital practices like online applications, e-signature, and electronic policy delivery. According to LIMRA, eight in 10 insurance executives say that their “ability to adopt digital solutions” has been sped up due to the pandemic. [1] In response to concerns about the safety of face-to-face interactions, Sakthivel says LIMRA’s member companies took two to three days — instead of a predicted four to six months — to introduce new digital service options that limited in-person interactions but still allowed life insurance operations to continue and kept customer information secure. With this accelerated digitization becoming more common, consumers can expect even more online options in the coming months and years.

Sakthivel explains that the current goal for insurers is to process about two-thirds of applications using accelerated underwriting. Eventually, he predicts that even the claims process may be completely automated: If insurers can get data when an insured individual dies, beneficiaries may be able to receive the benefit payout more quickly and without submitting death claim paperwork.

While the insurance industry is still far from fulfilling Sakthivel’s predictions, progress is happening quickly. “The race to get the consumer's attention…[has] really changed how the industry is approaching the market,” says Paul Ford, founder and managing director of DS9 Capital, a portfolio management holding company focused on insurtech.

Insurers continue to feel the impacts of COVID-19

As of January 2022, COVID-19 has caused more than 800,000 deaths across the U.S. [2] It was one of the top causes of death for Americans in 2021, and contributed to an increase in mortality rates and decrease in life expectancy worldwide. [3] [4] Unsurprisingly, it’s impacted an industry that primarily insures against death.

More life insurance buyers, but more death claims, too

The life insurance industry saw mortality rates that were 12% above average in 2020 due to COVID-19, according to Marianne Purushotham, corporate vice president, research data services at LIMRA. With higher mortality rates came higher death claims.

Research from the Insurance Information Institute showed a significant uptick in death claims due to these COVID-19 deaths in 2020: “Death benefits paid in 2020 jumped to $87.5 billion, up 15% from $76 billion in 2019, the largest increase in nearly 25 years,” Friedlander says.

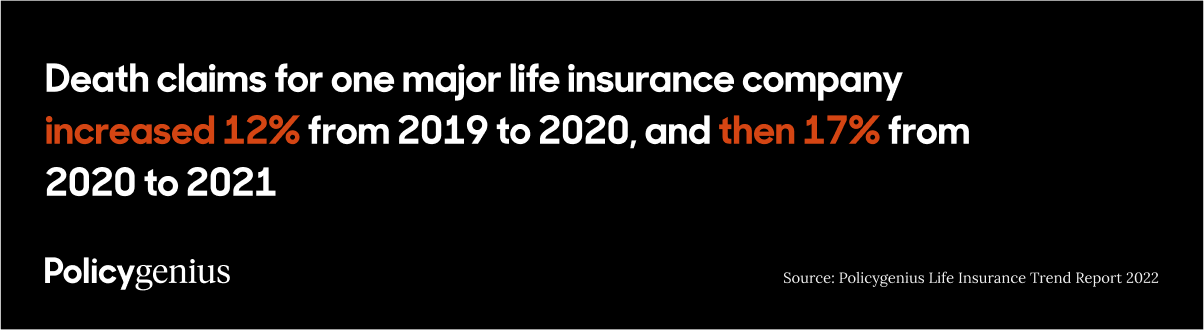

One carrier on the Policygenius platform saw a similar rise in death claims in 2020 — and an even bigger increase in 2021. Legal & General America (the parent organization of the Banner Life and William Penn life insurance companies) saw a 12% increase in death claims, measured by dollars paid, from 2019 to 2020. From 2020 to 2021, death claims increased by 17%.

Cathy Seifert, vice president at independent investment research firm CFRA Research, witnessed the same surge in death claims from insurers she’s worked with. But, she says, the increase in death claims only highlights the importance of having life insurance coverage: “The flip side is that COVID also increased the value proposition of life insurance.”

Life insurance sales data reflect this sense of urgency among consumers. In fact, Friedlander notes that, in 2020, online sales rose by 29% — the largest increase in the Insurance Information Institute’s records of online life insurance sales. Early 2021 data from LIMRA appears to confirm continued industry-wide growth: New policy purchases, which were measured using the total amount of premiums paid, increased by 18% over the first nine months of the year, [5] the largest nine-month growth in 25 years.

Stable pricing — for now

Term life insurance prices were largely unaffected by COVID-19 in 2021, despite the economic fallout and stock market volatility the pandemic continues to cause. Based on Policygenius data from April 2020 — the first full month after stay-at-home orders began in the U.S. — to April 2021, older smokers did see a surge in life insurance pricing, but pricing adjustments in May 2021 and following months brought prices back to April 2020 levels.

Consumers will likely continue to see price stability while the insurance industry waits to gather more data about COVID-19’s impact on mortality rates. “Life insurers determine premium changes based on long-term trends. The increasing volume of Americans getting a coronavirus vaccine and new treatments that are being introduced should continue to reduce COVID-related fatalities,” Friedlander says. The potential for reduced COVID-related deaths means that the impact on insurers — and therefore on consumers — remains unpredictable.

But with COVID-19 showing no signs of disappearing, Ford says that insurers will probably do some repricing in the next three to five years to account for the risk of pandemic-related illness. Ultimately, says Purushotham, the impact of COVID-19 on life insurance pricing will depend on whether the effects on mortality are long-term or short-term.

Buying trends in 2021

A spotlight on no-medical-exam life insurance

The marketplace has experienced a surge in insurance companies offering no-medical-exam life insurance — and accelerated underwriting options in particular — that satisfy the growing demand for quick, contactless coverage.

“We went from having three [AU options] in early 2020 to seven in 2021, with more on the horizon for 2022,” says Eloise Spinello, associate director of account management at Policygenius. “More insurers are adjusting to demand by offering no-med options that account for all health classes as well, rather than reserving these options for only the healthiest applicants.”

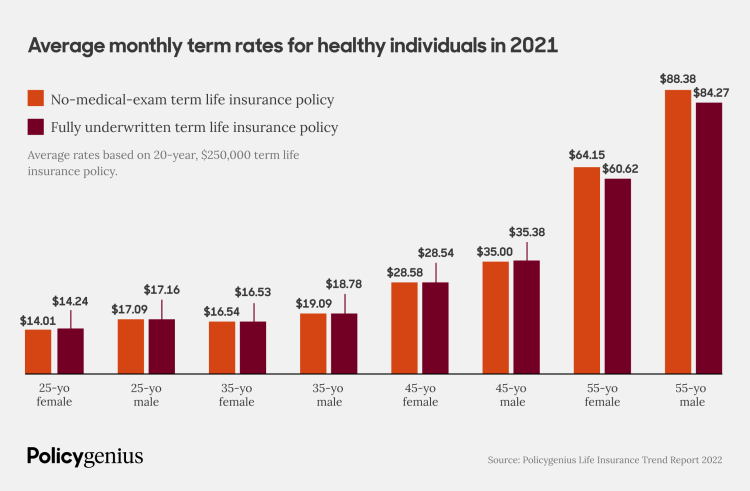

In addition to their convenience, accelerated underwriting policies are frequently one of the most affordable options for shoppers. Policygenius Life Insurance Price Index data from the last year shows that no-medical-exam term insurance policies are competitively priced compared to term policies requiring a full medical exam — and some applicants even paid less for no-medical-exam term coverage. For example, 25-year-old females buying $250,000 in coverage paid 1.6% less in 2021 for a no-medical-exam term policy than they did for a traditional policy.

Methodology: The prices displayed above are drawn from the Policygenius Life Insurance Price Index, based on internal actuarial rate tables for the 10 major life insurance carriers that offer policies through the Policygenius marketplace from January 2021 to December 2021. Rates are based on 20-year term policies providing $250,000 in coverage. Rates reflect the following 10 carriers: AIG, Banner Life, Brighthouse, Lincoln Financial, Mutual of Omaha, Pacific Life, Protective, Prudential, SBLI, and Transamerica. Actual prices and policy availability may vary.

As consumers age, the price of life insurance goes up, and that's true of no-medical-exam policies, too — in the case of AU, 55-year-old females buying $250,000 in coverage paid 5.5% more for AU than a traditional policy in 2021. “Older applicants present more risk to the life insurance company,” Spinello says. “In accelerated underwriting processes, an insurance company is no longer benefiting from a new physical exam as a part of their risk assessment for a population where it may have more implications, so pricing for an older applicant reflects this when comparing policy types.”

For many consumers, the added convenience of an AU policy often outweighs any additional cost. “Instant decisions are a big factor for some of our customers. Other customers mention upfront that they don’t want the medical exam, so that’s another major driver,” Spinello says. “Even when no-med policies are slightly more expensive, say $5 to $10 more per month, customers are still opting for those because of the quicker turnaround time.”

Demographic trends in 2021

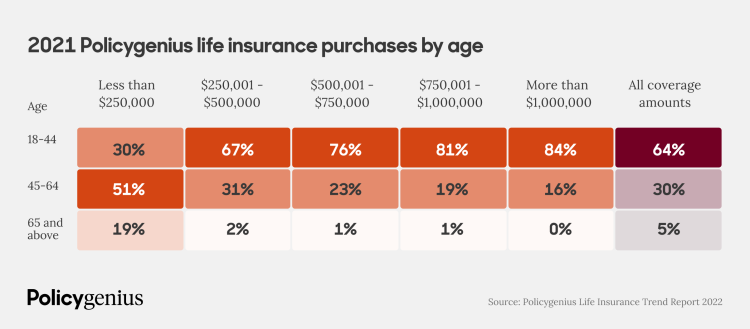

Policygenius data shows that overall, applicants below age 45 made up the biggest group of life insurance buyers in the Policygenius marketplace in 2021, accounting for nearly two-thirds (64%) of policies sold.

Methodology: Data above is based on the percent of policies purchased for 10 life insurance carriers that offered policies through the Policygenius marketplace at the time of writing. Data reflects the following 10 carriers: AIG, Banner Life, Brighthouse, Lincoln Financial, Mutual of Omaha, Pacific Life, Protective, Prudential, SBLI, and Transamerica. Policy types include 10- to 40-year term policies providing varying coverage amounts. Percentages are rounded to the nearest whole number and sums may add up to more than 100.

This reflects a trend in the life insurance market as a whole. According to Friedlander, 2020 life insurance sales “were largely driven by younger age groups” and there was a year-over-year increase of 7.9% in life insurance sales for policyholders 44 and under from 2019 to 2020, the last year for which he has complete data.

The numbers aren’t surprising, given the life stage these individuals are in. Compared to other age groups, people under 45 often have a greater need to own life insurance: While older Gen Xers and Baby Boomers are further along in paying off their mortgages and child raising, millennials (currently 25 to 40 years old) and younger Gen Xers are still starting families and buying homes. In addition, more millennials have student loan debt than adults in any other generation, while Gen X has the largest total amount of debt. [6]

In terms of amount of coverage purchased through Policygenius in 2021, people age 18 to 44 bought the vast majority (84%) of policies exceeding $1 million in coverage, and 81% of policies with coverage amounts from $750,001 to $1 million. Older Gen Xers and Baby Boomers — people age 45 to 64 — bought only 16% of policies over $1 million in coverage, and those 65 and over didn’t buy any of these policies.

Compared to other demographics, Gen Xers and Baby Boomers also bought less coverage overall through Policygenius in 2021: 85% of policies bought by people over 65 and 87% of the policies bought by people age 45 to 64 were for under $250,000.

Pricing trends in 2021

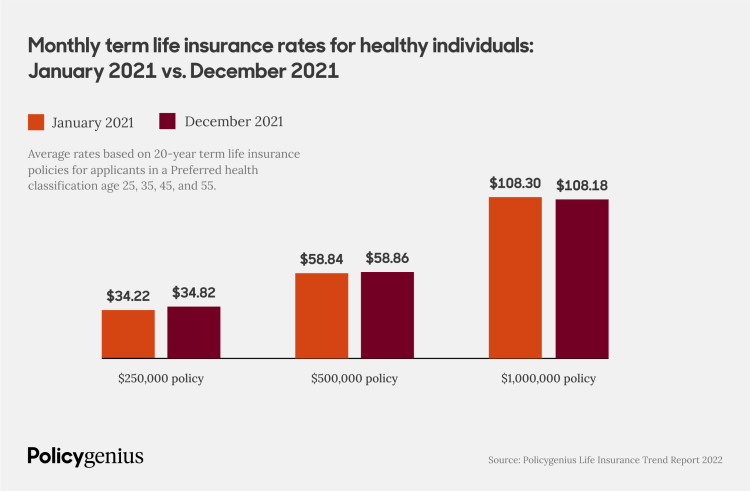

The annual rate of inflation in the U.S. hit 6.2% in October 2021, a three-decade high, [7] yet life insurance prices stayed consistent throughout the year, with only nominal changes from January to December. Though insurers made strategic pricing adjustments, the impact was minimal and mostly beneficial to consumers.

Methodology: The prices displayed above are based on the Policygenius Life Insurance Price Index, based on internal actuarial rate tables for 20-year term policies that were offered through the Policygenius marketplace at the time of writing: AIG, Banner Life, Brighthouse, Lincoln Financial, Mutual of Omaha, Pacific Life, Protective, Prudential, SBLI, and Transamerica. Average premiums are a composite of rates offered in January 2021 and December 2021. Rates are based on applicants with a Preferred health classification. Actual prices and policy availability may vary.

According to Seifert, pricing stability is due in part to the low-interest-rate environment that has impacted the annuity industry and “compressed margins” for insurers. In response, many insurers suspended or sold off their annuity business contracts to focus on growing their traditional life insurance business — and growing that business requires staying competitive on price to draw in new customers.

“There are a lot of backend changes and movements [among insurers] — competitively, strategically, and financially that offset or limit the impact to the consumer,” Seifert says.

While these factors have led to more competition in the term life insurance space, whole life policyholders haven’t reaped the same benefits. Low interest rates have narrowed the margins on whole life policies for insurers, translating into costlier coverage and less cash value growth for policyholders. “There will always be pressure on conservative growth instruments like savings accounts, CDs, and money markets during times of low interest rates,” says Elia Weg, certified financial planner and Policygenius sales associate. “Whole life insurers will inevitably face similar pressures.”

The future of life insurance

As technology advances and the continuing pandemic forces actuaries to reevaluate their mortality predictions, providers and consumers alike can expect more changes to life insurance in the future. Experts see a path ahead for the life insurance industry focused on balancing quick progress with existing business needs.

Sakthivel sees insurers employing a multi-pronged strategy to remain competitive. They’ll be focused on using data and technology partners to make underwriting faster and easier for customers and to modernize the way they do business.

Sakthivel even imagines a future in which insurers pivot from assessing applicants based on a one-time interview and exam to a more proactive approach of “continual underwriting” that allows for premium changes based on a customer’s lifestyle data. For example, he suggests that your insurer could view your fitness data and reward you with lower premiums for regular exercise.

Broad social developments have already changed how the life insurance industry does business, and insurers’ rapid adaptation to COVID-19 restrictions proves that even legacy providers can and will adjust.

“Customers want instant feedback, instant results, and efficiency reigns supreme,” says Mike Hogan, senior manager of the life case management team at Policygenius. “Even before the pandemic started, and likely after it ends, the way life insurance applicants shop will continue to focus on those principles: getting the coverage they need, as fast as possible, with as little fuss as possible."

Methodology

Internal Policygenius data is based on the 10 major carriers that were offered through the Policygenius marketplace at the time of writing: AIG, Banner Life, Brighthouse, Lincoln Financial, Mutual of Omaha, Pacific Life, Protective, Prudential, SBLI, and Transamerica.

Term life insurance prices are based on internal actuarial rate tables for the same 10 life insurance carriers.

No-medical-exam life insurance prices are based on internal actuarial rate tables for seven no-medical-exam life insurance carriers that offered policies through the Policygenius marketplace at the time of writing: Banner Life, Brighthouse, Lincoln Financial, Mutual of Omaha, Prudential, SBLI, and Transamerica.

Prices represent the average monthly life insurance premium for each sample customer profile for males and/or females ages 25 to 55 for term policies of $250,000 to $1 million. Monthly averages are based on products available through Policygenius for the indicated profile; rates for those products may vary by state, and not all products are available in all states. Individual rates may vary, depending on age, gender, state, health profile, and other eligibility criteria.

Expert sources

Paul Ford, founder and managing director of DS9 Capital

Mark Friedlander, director of corporate communications at the Insurance Information Institute

Zachary Nagel, vice president of direct marketers at life insurer Legal & General America

Marianne Purushotham, corporate vice president, research data services at LIMRA

Kartik Sakthivel, vice president and chief information officer of LIMRA

Cathy Seifert, vice president at CFRA Research

Additional contributors

Sam Gilbert, data analyst at Policygenius

D’Shai Hendricks, senior analytics manager at Policygenius

Mike Hogan, licensed life insurance agent and senior manager of the life case management team at Policygenius

Anthony Provenzano, licensed life insurance agent and senior manager of life sales at Policygenius

Sean Rogers, licensed life insurance agent and operations manager at Policygenius

Eloise Spinello, licensed life insurance agent and associate director of account management at Policygenius

Barbara Stekas, Ph.D., data scientist at Policygenius

Elia Weg, CFPⓇ, licensed life insurance agent, and sales associate at Policygenius

About Policygenius

Policygenius transforms the insurance journey for today’s consumer, providing a one-stop platform where customers can compare options from top insurance carriers, get unbiased expert advice, buy policies, and manage their insurance portfolio, in one seamless, integrated experience. Our proprietary technology platform integrates with the leading life, disability, and home and auto insurance carriers and delivers an exceptional digital experience for both consumers and insurance carriers. Since 2014, our content, digital tools and experts have served as a resource for millions of people on their insurance journey, and we have sold more than $150 billion in coverage.