If you’ve ever watched cable TV, you’ve probably seen it: an important message from Colonial Penn life insurance – featuring Alex Trebek, selling guaranteed life insurance for seniors. The commercial targets people between the ages of 50 and 85, and promises them affordable guaranteed issue life insurance with a rate lock ("Your rate can never increase for any reason."). No health questions or exam required.

Alex Trebek comes in with the kicker: Coverage options start at "less than 35 cents a day."

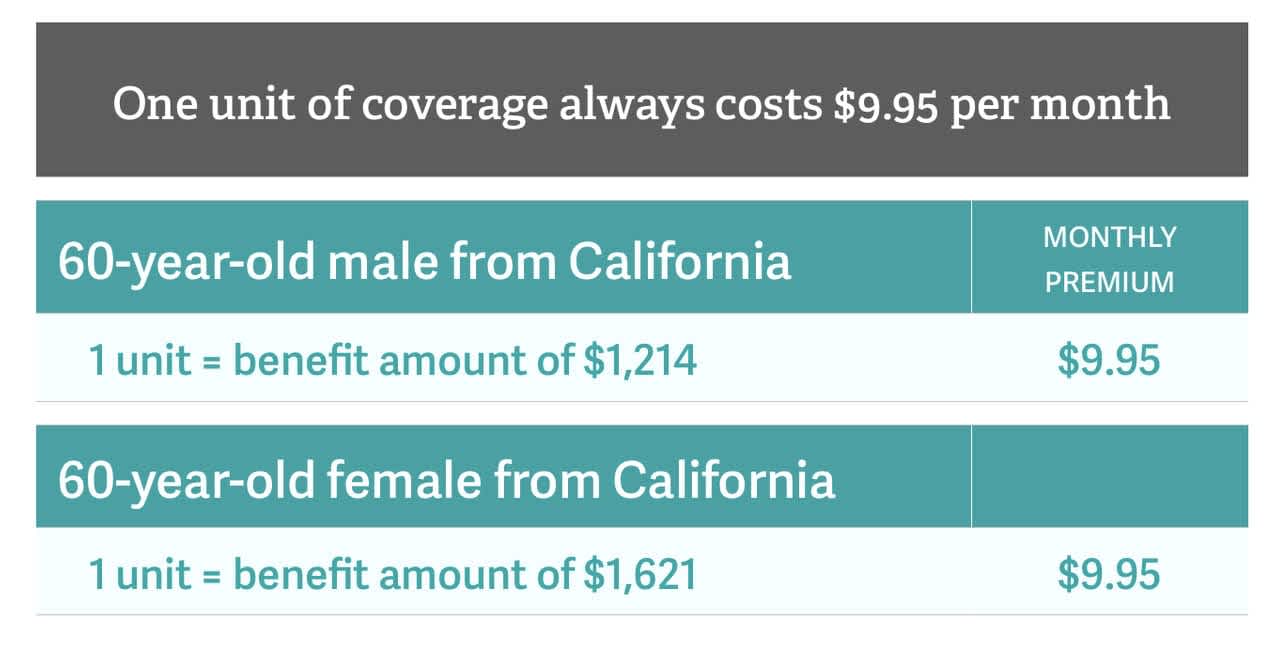

Since guaranteed life insurance doesn’t require health questions, it takes mere seconds to get Colonial Penn life insurance quotes. Here are the quotes I got at Colonial Penn when I posed as a 60-year-old couple from California looking for life insurance:

The true cost of guaranteed issue life insurance

The quotes I received are priced out per "unit" of life insurance. Colonial Penn’s guaranteed life insurance works by adjusting the benefit amount (also known as coverage) per unit based on your age, gender and location. Each unit will always be $9.95, but how much coverage you get for $9.95 will change. If you want to get more coverage, you have to buy more units.

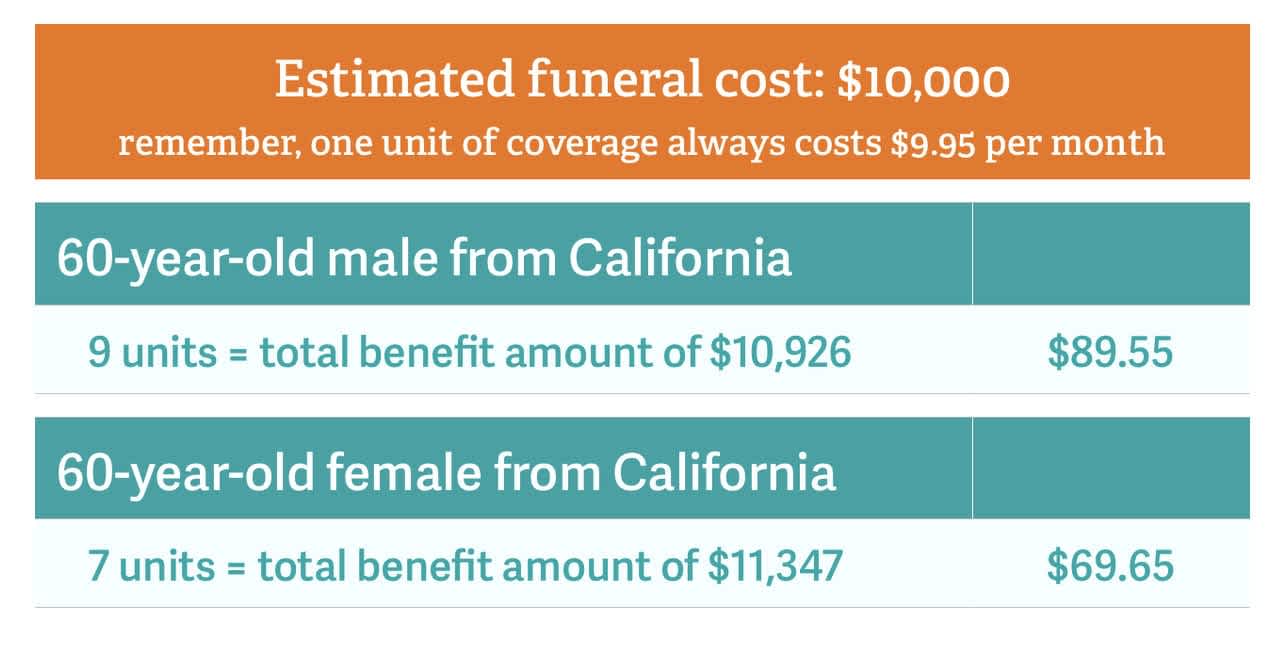

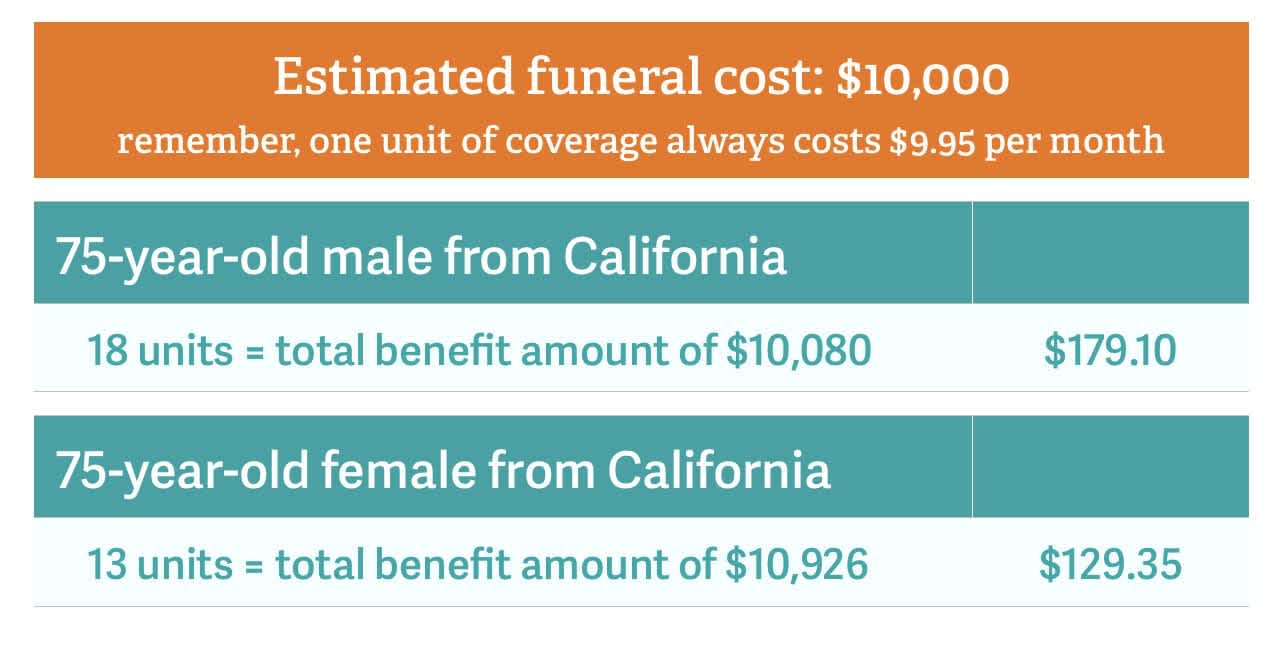

Guaranteed life insurance used to be called "burial insurance" – basically, get enough coverage so any costs associated with your death are covered. The average funeral in America costs anywhere between $7,000 and $10,000.

How many units would our hypothetical 60-year-old couple need to buy before their respective funerals are covered?

That’s more expensive than the price advertised for a pretty small amount of coverage.

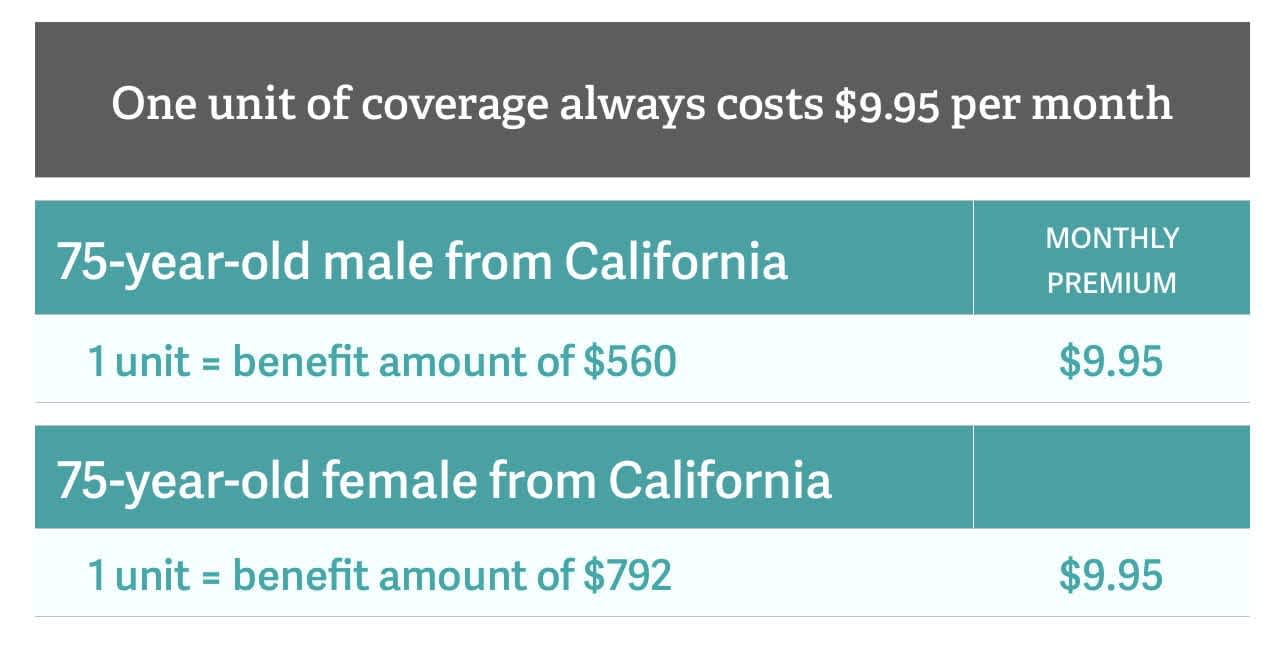

But what if you’re older, living on a limited fixed income and with health conditions that would prevent you from qualifying for traditional life insurance? Let’s take a look at how much Colonial Penn’s guaranteed life insurance would cost a 75-year-old couple:

If you die within two years of buying your guaranteed life insurance policy, you don’t get the full death benefit amount. Instead, Colonial Penn will refund the premiums you’ve paid. It’s not the benefit that people will be expecting, but it’s better than no refund at all.

Here's how to know if guaranteed issue life insurance is worth it.

Who might need guaranteed issue life insurance?

For the most part, people looking at guaranteed life insurance might not have any other options because fully underwritten life insurance would be too expensive for them.

The selling points of guaranteed life insurance specifically target those who are elderly, in poor health and living on a limited income. Guaranteed issue life insurance is more costly, but at least there will be enough money to bury you and maybe even give your kids or grandkids a small inheritance.

Options besides guaranteed issue life insurance

If you’re over 50 but haven’t retired yet, it may make more sense to funnel money into your retirement accounts than it does to buy guaranteed life insurance. Put aside $84 every month and you’ll have enough cash to cover your final expenses in ten years.

If you’re in decent health, you may still be able to get traditional term life insurance, which requires health questions and usually a quick medical exam. If you qualify, traditional life insurance will always be a more cost-effective option than guaranteed acceptance life insurance. We can help you easily compare term life insurance quotes across companies here.

You can also look into simplified issue life insurance. Simplified issue life insurance offers life insurance that doesn’t require a medical exam, but still requires you to answer health history questions. You can be declined if you don’t meet the eligibility criteria.

Finally, final expense insurance may be a viable option. It's similar to guaranteed issue life insurance in that it's a relatively small coverage amount, but it's more than you'll typically get with guaranteed issue. And since there are some health qualifications, it may be more affordable.

For a deeper dive into getting life insurance when you're in less than perfect health, visit our special explainer on the topic.