Raising a child can cost more than $12,000 a year, [1] but many Americans in the “sandwich generation” expect to financially support their parent(s) as well.

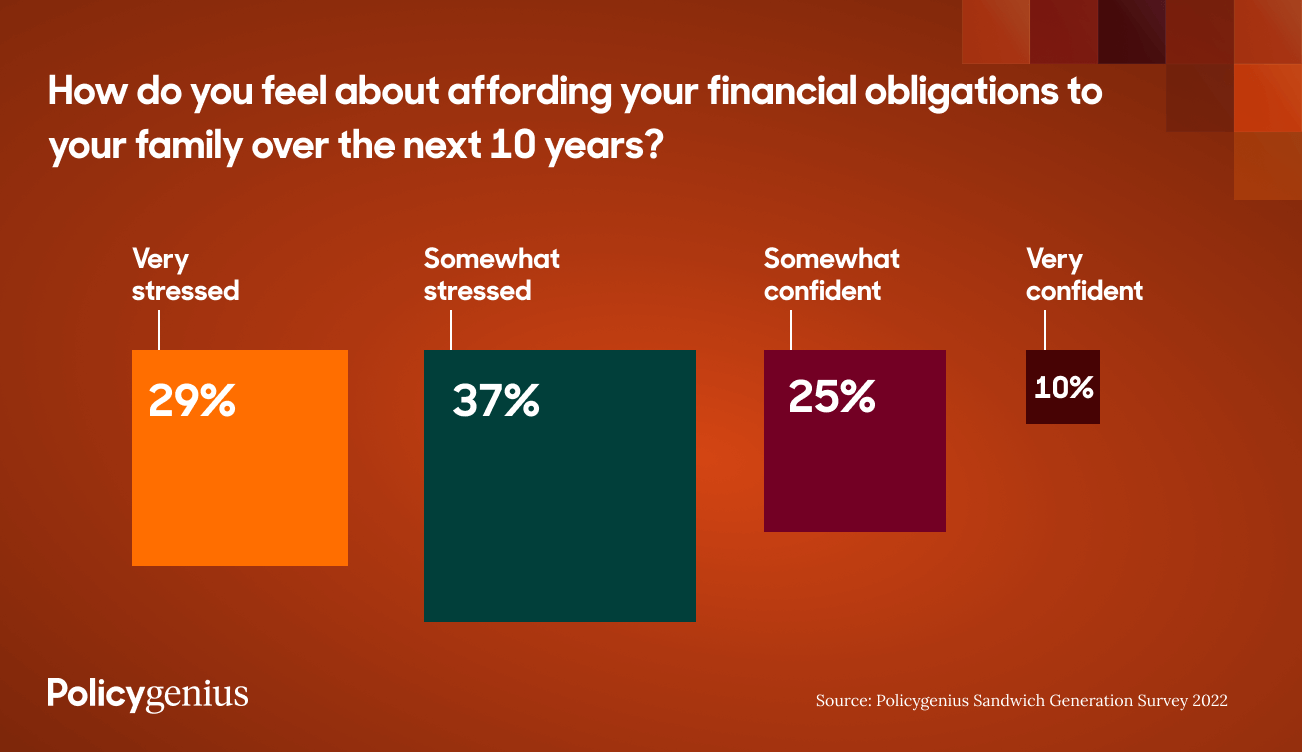

Roughly two out of three members of the sandwich generation (66%) — Americans with at least one living parent age 65 or older who are also raising or financially supporting children — feel “very stressed” or “somewhat stressed” about affording their financial obligations over the next 10 years, according to the Policygenius Sandwich Generation Survey.

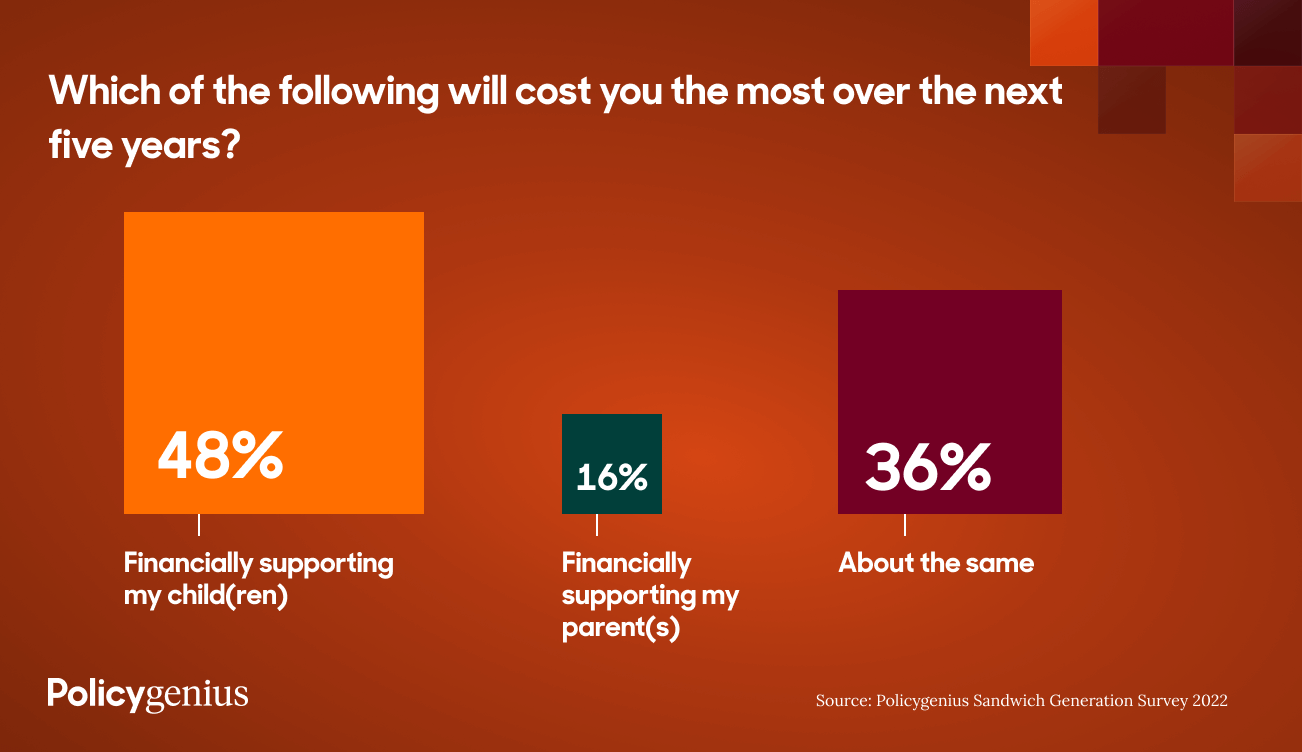

And as expensive as raising children can be, over half of the sandwich generation (52%) expects supporting their parent(s) will cost just as much — or even more — than their kids over the next five years.

Many sandwich generation members expect to financially support both their parent(s) and their children. While 36% expect financially supporting their parent(s) will cost just as much as financially supporting their children over the next five years, 16% expect supporting their parent(s) will cost even more.

More than half of the sandwich generation (52%) have provided some kind of assistance to their parent(s) in the past 12 months. For most (73%) of this group, this assistance comes in the form of logistical support like scheduling doctor’s appointments or transportation. 44% have provided financial assistance, and 55% have provided hands-on care, like helping with medical needs, bathing, or eating.

More than half of the sandwich generation is at least somewhat stressed about their financial obligations

The result of these burdens is stress.

“There’s enough complexity when it comes to the typical life goals that an average family would have, like saving for retirement or education for their children,” says Tom Massie, a certified financial planner who focuses on the sandwich generation. Many of his clients know they’ll eventually add supporting parent(s) to the mix, and “there’s a lot of stress and anxiety and uncertainty that comes along with it,” he says.

When asked how they feel about affording their financial obligations to their family over the next 10 years, 37% said they were somewhat stressed, and 29% said they were very stressed.

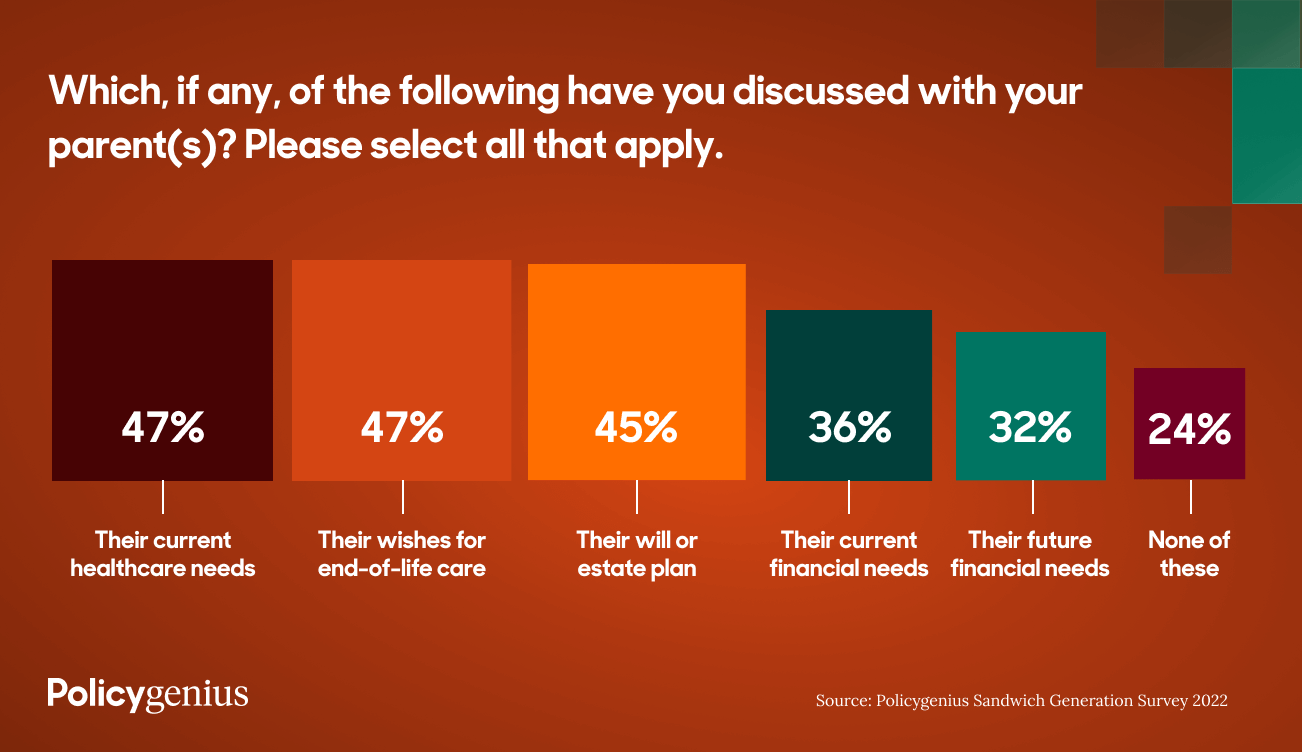

Most of the sandwich generation hasn’t discussed future financial needs with their parent(s)

Only 32% of the sandwich generation has taken the step of even discussing future financial needs with their parent(s). 24% have never had any discussions with their parent(s) about this or any other future financial issue, including their will or estate plan (which only 45% have discussed), their current health care needs (47%), their wishes for end-of-life care (47%), or their current (36%) or future (32%) financial needs.

Discussing what parent(s) want and need in terms of future health care and end-of-life care is an important precursor to making a detailed financial plan. Knowing their wishes for where they want to receive care — at home, a nursing home, or retirement community, for example — can make planning easier.

“A lot of times the conversation hasn’t happened at all, and both sides know they need to talk about this, but they don’t know how to get started,” Massie says.

Hiring an elder care consultant or a financial planner who specializes in elder care issues can help steer these discussions, he added.

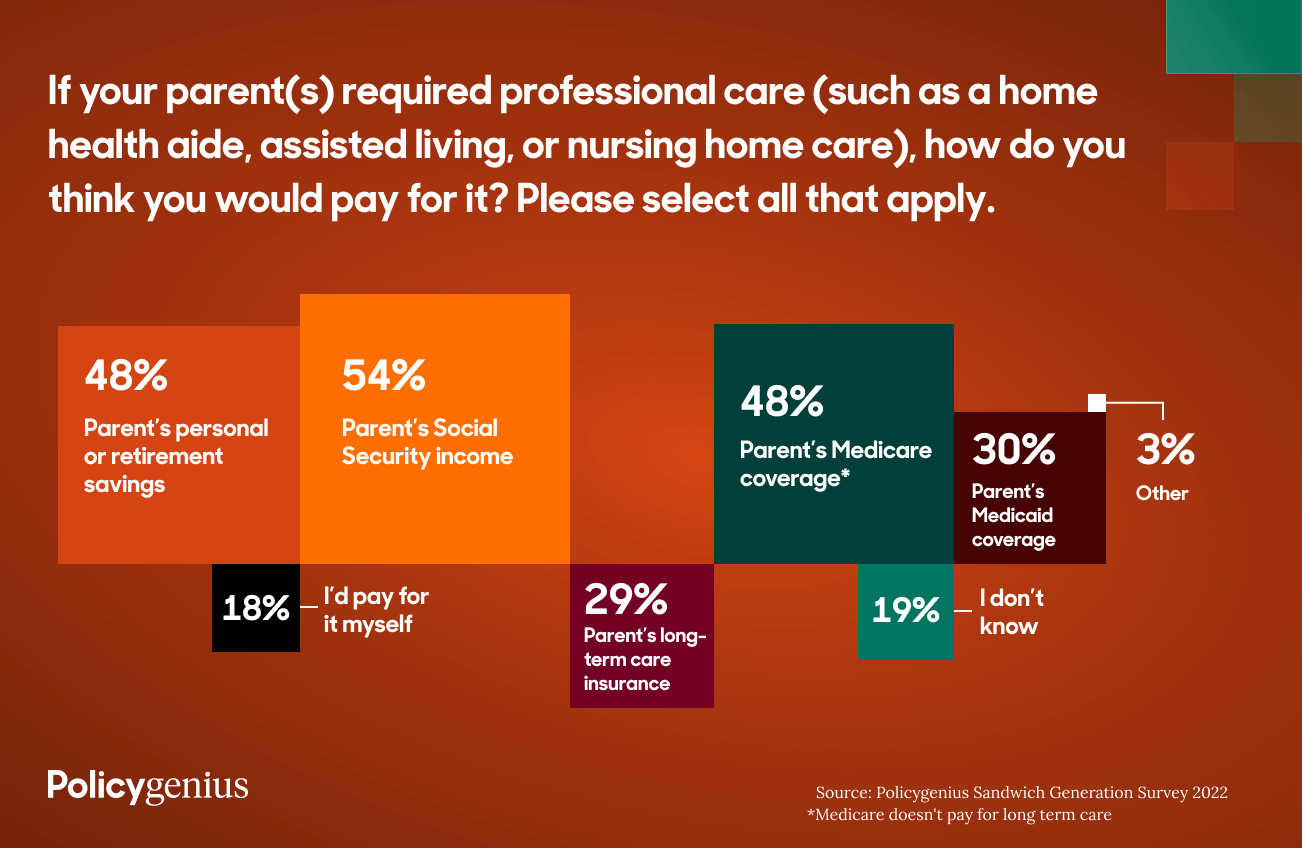

Only 29% of the sandwich generation plans to use long-term care insurance for parent(s)

While many members of the sandwich generation expect to provide some kind of support for their parent(s), they don’t have much clarity on how they would pay for it.

For example, when asked how they would pay for professional care like a home health aide, assisted living, or nursing home, 48% said they would use Medicare, the federal health insurance provided to people 65 and older. However, Medicare — and most other forms of health insurance — doesn’t pay for long-term care. [2]

30% said they would use Medicaid, a federal and state program that provides health care for lower-income Americans. But in many states, the income and asset limits are stringent. For example, in North Carolina the monthly income limit for someone 65 or older receive Medicaid is only $1,133 — and you can have no more than $2,000 in assets, not counting your home, car, furniture, clothing, and jewelry. [3]

Long-term care insurance covers these costs, but only 29% of the sandwich generation said they would rely on it to cover professional care costs. How to care for older parent(s) is a significant concern, since 70% of adults who survive to age 65 will develop “severe” long-term service and support needs before they die, while 48% will receive some paid care. [4]

33% of the sandwich generation would take on debt to care for parent(s)

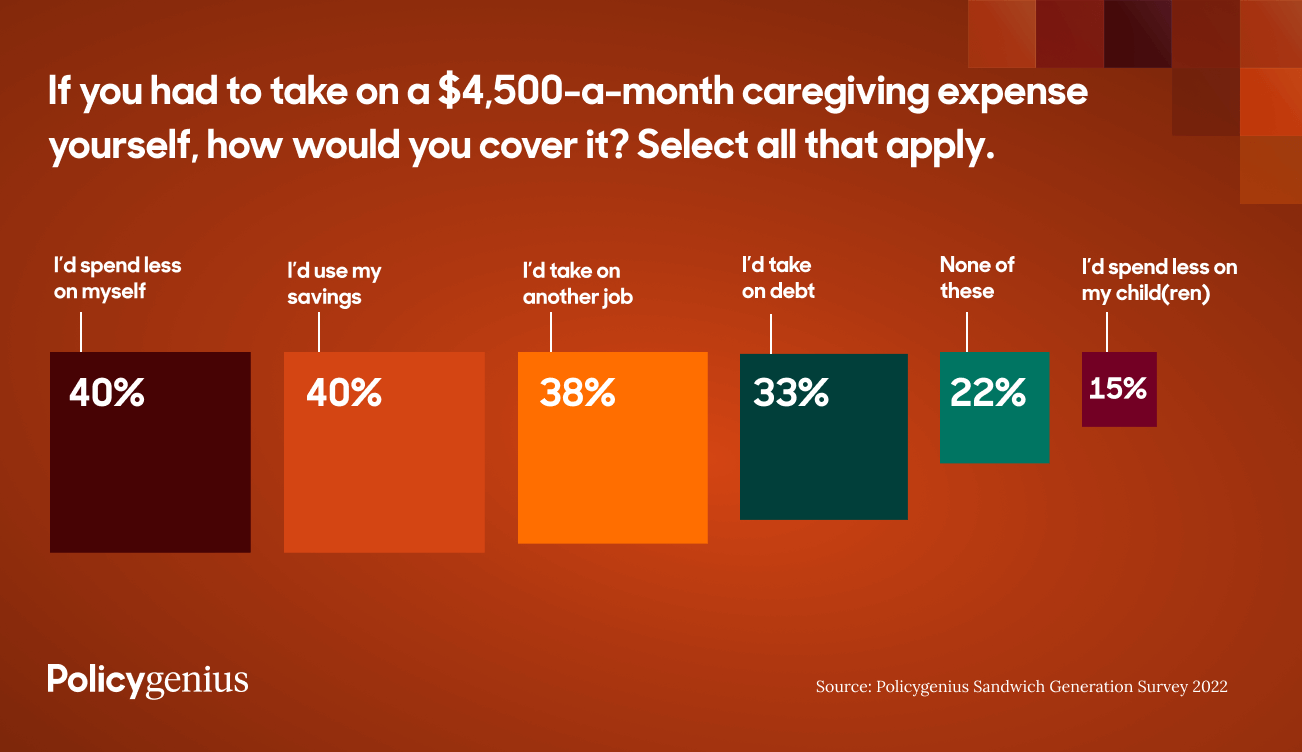

The median cost of an assisted living facility in the U.S. was $4,500 a month in 2021. [5] When asked how they would cover this cost if they had to pay $4,500 a month in caregiving expenses out-of-pocket, 33% of the sandwich generation said they would take on debt. Few people would give up any support for their children — only 15% said they would spend less on their kids to cover this expense.

Only half of the sandwich generation has life insurance

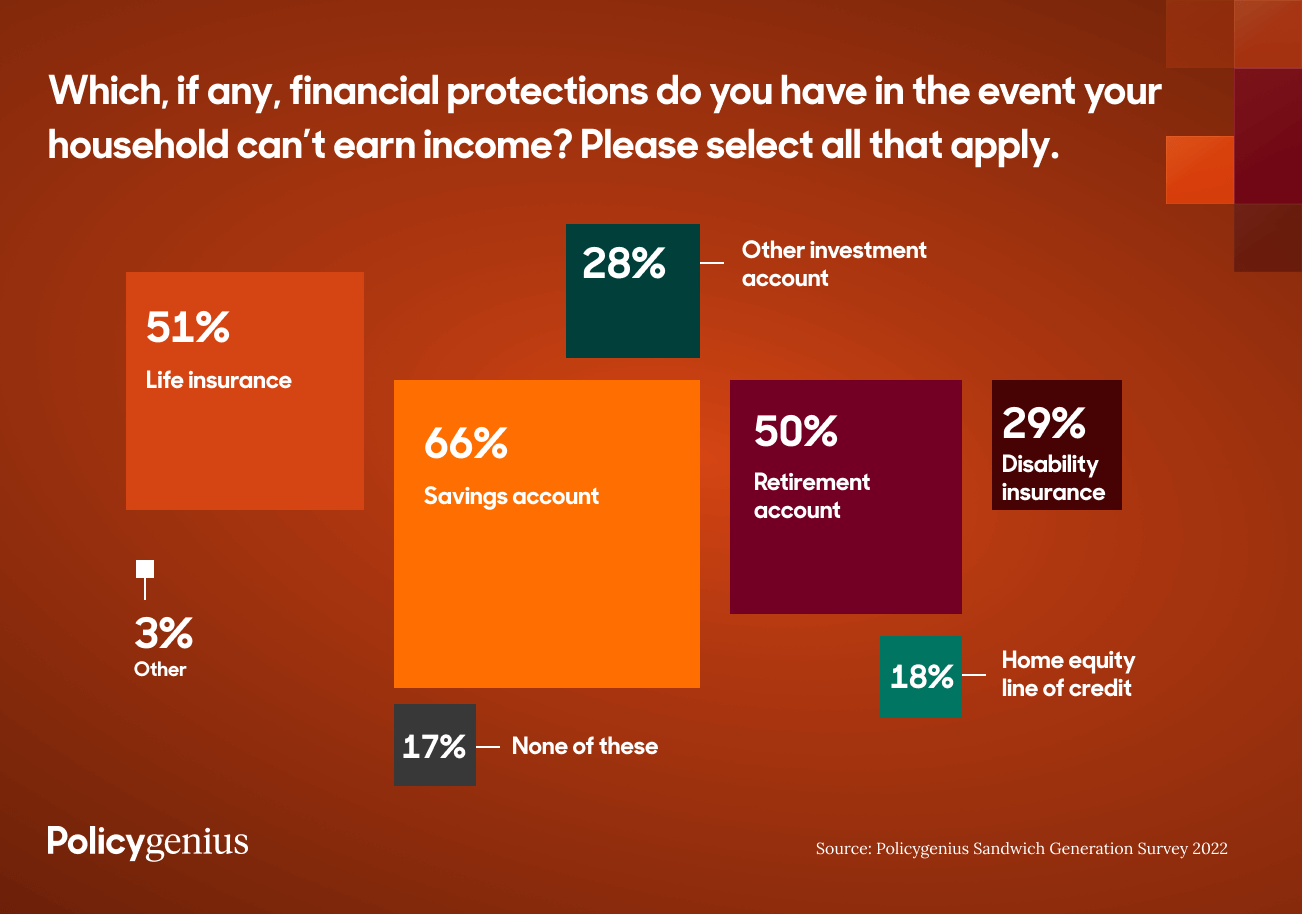

While they’re aware of their looming financial responsibilities, many members of the sandwich generation lack key protections in the event they can��’t earn income. For example, 49% of the sandwich generation doesn’t have life insurance. If you die while a life insurance policy is active, life insurance can financially protect your children and your parent(s). (In general, experts say your life insurance coverage should be 10 to 15 times your income.)

In the event their household was unable to earn income, 66% of the sandwich generation have a savings account to rely on, and 50% would draw on a retirement account. Only 29% have disability insurance, which provides a safeguard in case you become too sick or injured to work.

Methodology

Policygenius commissioned YouGov to poll 2,368 Americans 18 or older, of whom 310 confirmed 1) having a living parent age 65 or older and 2) either being the parent or guardian of a child under the age of 18, or giving financial support to an adult child age 18 or older in the last 12 months. Members of this group are referred to as the “sandwich generation” in this report. The survey was carried out online from Nov. 7 through Nov. 9, 2022. The results have been weighted to be representative of all U.S. adults. The margin of error was between +/-3% and +/-6% depending on the question. Percentages were rounded to the nearest whole number, so some totals may not add up to 100.

Graphics: Nastia Kobzarenko