Life insurance policies can intersect with your relationship with your siblings in multiple ways. You could both receive money if someone in your family dies, like a parent. You could also name your sibling as a beneficiary on your own life insurance policy. You can also take out a life insurance policy on your sibling’s life in some circumstances.

In every case, here’s what you and your siblings need to know about sharing the benefits or life insurance so you can ensure financial protection for your family.

How life insurance payouts work with siblings

If your parent or anyone else names you as a beneficiary on their life insurance policy, you’re not required to share that money with anyone, even a sibling.

Most people name their spouse as their primary beneficiary, but if your parent is divorced, widowed, or single, it’s likely they’ll name their adult children as their life insurance beneficiaries.

If you have a life insurance policy for yourself or are listed as a beneficiary on someone else’s policy, it’s helpful to understand how beneficiaries work.

Primary vs. contingent life insurance beneficiaries

A primary beneficiary is the person who receives the death benefit payout when you die. You can name more than one primary beneficiary, and decide how much each beneficiary will receive.

A contingent beneficiary — also called a secondary beneficiary — is next in line. If your primary beneficiaries pass away before or at the same time as you, the contingent beneficiary collects the death benefit.

As with primary beneficiaries, you can name more than one contingent beneficiary and assign a percentage of your insurance payout to each person. Make sure that you tell your beneficiaries about the policy because they must take steps to file a claim after you die to receive the payout.

→ Learn more about life insurance beneficiaries

Sharing life insurance proceeds with siblings

You’re not required to share any life insurance benefit that you receive with your sibling. It’s the insured person’s decision as to who receives the death benefit of their life insurance policy and how much they’ll get.

Even if the policy belongs to your parent, uncle, aunt, grandparent, or sibling, if you’re named as a beneficiary, the payout will be sent directly to you. If you have a brother or sister who wasn’t named as a beneficiary, they’ll have no legal right to claim the money.

Per capita vs. per stirpes death benefits

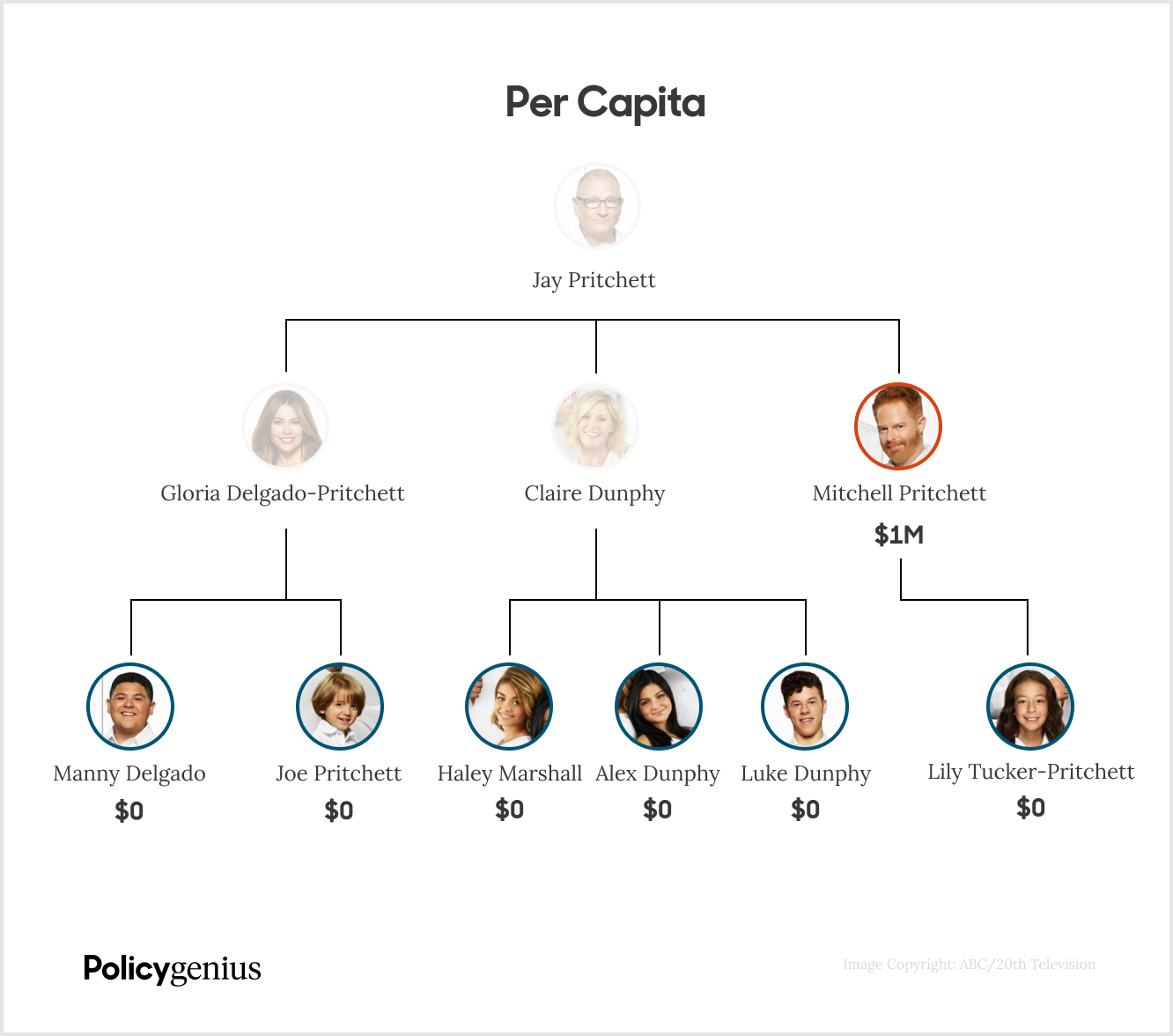

The life insurance policyholder has the option to choose a per capita or per stirpes death benefit payout.

By default, most policies are per capita, meaning the death benefit is split equally between living beneficiaries. A per stirpes payout allows the death benefit to be split between living beneficiaries and any deceased beneficiaries’ heirs.

Here is a visualization of how the two payouts differ:

Life insurance with no remaining beneficiaries

If the insured person dies and their beneficiaries are not able to claim the death benefit, then the insurance company pays out the sum to the deceased’s estate. This most commonly happens if the beneficiaries die before the insured.

Once the death benefit becomes part of the estate, it’ll be subject to estate taxes. A judge will decide who gets the money in probate court, which can take months or years.

They may rule that siblings evenly split the death benefit, or may favor one sibling over another if they had financially relied on the deceased.

Does a beneficiary have to share proceeds with a sibling?

In most cases, no. If you’re a named beneficiary on someone’s life insurance policy, you’ll receive the amount specified in the policy directly and it will be legally yours. You won’t need to share it with anyone unless you choose to.

If you receive part of a death benefit indirectly, either through a trust or through a per stirpes payout, you may have to share the payout with a sibling, but this will be outlined in the terms of the trust or policy.

Can I name my sibling as a life insurance beneficiary?

In some situations, it makes sense to designate your sibling as a beneficiary of your own life insurance policy. If you have any financial ties to your sibling, you won’t have any problem listing them as a beneficiary.

You might name a sibling as your beneficiary if they:

Take care of your aging parents

Care for your children

Have a disability

Co-signed a loan with you

Rely on your financial support or income

Will manage your affairs after you die

Naming a child as a life insurance beneficiary

We advise against naming a minor child as your life insurance beneficiary because they won’t be able to receive the death benefit directly.

Life insurance companies are regulated by state law and are prohibited from paying out a death benefit directly to anyone who has not reached the age of majority. The age of majority is 18 in every state except Alabama and Nebraska, where it’s 19, and Mississippi, where it’s 21.

To ensure your death benefit is used the way you intended, the best option is to set up a trust.

If you can’t set up a trust, a simpler option would be to name your adult sibling as a contingent beneficiary so they’ll be able to claim the death benefit and provide for your children if both you and your spouse die.

Can I buy life insurance for my sister or brother?

If you and your siblings are tied together financially in any way – such as having shared debt, assets, or bills – it could make sense for you to take out a life insurance policy on them. In order to do so, you must be able to prove that you have a financial connection with your sibling and they have to consent to this coverage. You can’t take out life insurance on your brother or sister (or anyone else) without their knowledge.

The bottom line

Accounting for family members, including siblings, in your financial plan is smart. Naming a sibling as a beneficiary of your own policy makes sense in certain situations, as does taking out a policy for them and naming yourself as the beneficiary.

Sharing life insurance proceeds from a parent’s life insurance policy with your sibling is common and the life insurance company will distribute the death benefit according to the policy.