Medicare is the federal health insurance program that covers most Americans age 65 and older, as well as younger individuals with certain disabilities or health conditions. Medicare consists of four parts, with each part providing a different type of health insurance coverage.

Medicare Part D provides prescription drug coverage and it’s completely optional. It will pay for both brand-name and generic prescription drugs, but the type of medications covered vary from plan to plan.

As with other health care plans, Medicare Part D comes with monthly premiums. They apply in addition to any premiums you already pay for Medicare. Additionally, you may also have to pay copays, coinsurance, and a deductible. The exact amount for all of these costs can vary by plan, state, your income level, and what drugs you get.

However, you will need to enroll in Part D soon after you’re eligible if you want to save the most money. If you wait too long after you’re eligible to enroll, you will have to pay a penalty when you do actually enroll. That penalty results in higher monthly premium payments for the rest of your life.

Medicare Part D overview

Medicare Part D provides prescription drug coverage to Medicare recipients. You pay a monthly premium so that when you need to get prescription medication, your insurance will cover some of the cost. Part D plans are called Medicare prescription drug plans, or PDPs, and they’re administered through private health insurance companies. All of the insurance companies offering Part D plans are approved by Medicare to do so.

Getting a Medicare prescription drug plan is optional, but prescription drugs are expensive and most people would benefit from getting a PDP. Even if you don’t use any prescriptions right now, it’s best to get a plan soon after you enroll in the regular Medicare program (once you turn 65 for most people) because you will need to pay a late enrollment penalty if you’re eligible to enroll, don’t enroll, and then try to enroll later on.

Medicare parts A, B, & C

As a reminder, there are four parts of Medicare: A, B, C and D. Medicare Part A covers inpatient services, which includes hospital services that you receive as part of an overnight stay. Part B covers outpatient services, such as preventive care, doctor visits, and other medically necessary services.

Part A and Part B make up Original Medicare. Everyone is required to enroll in both parts, and even if you get a more comprehensive private plan, you will still need to pay for Parts A and B.

Medicare Part C, also called Medicare Advantage, is optional and it’s a private health insurance offered through Medicare. It works much like regular health insurance, but it’s generally less expensive because it’s part of Medicare.

Medicare Part C includes Original Medicare benefits plus some extras, usually including prescription drug coverage, known as a Medicare Advantage Prescription Drug (MAPD) plan. You usually don’t need Medicare Part D if you have a Medicare Advantage plan.

What do Medicare Part D plans cover?

Medicare Part D plans can vary greatly in what they cover, so you will need to check a plan’s individual details. You can tell what prescriptions a plan will pay for by viewing its formulary. Each plan has its own formulary that lists all of the drugs it will cover.

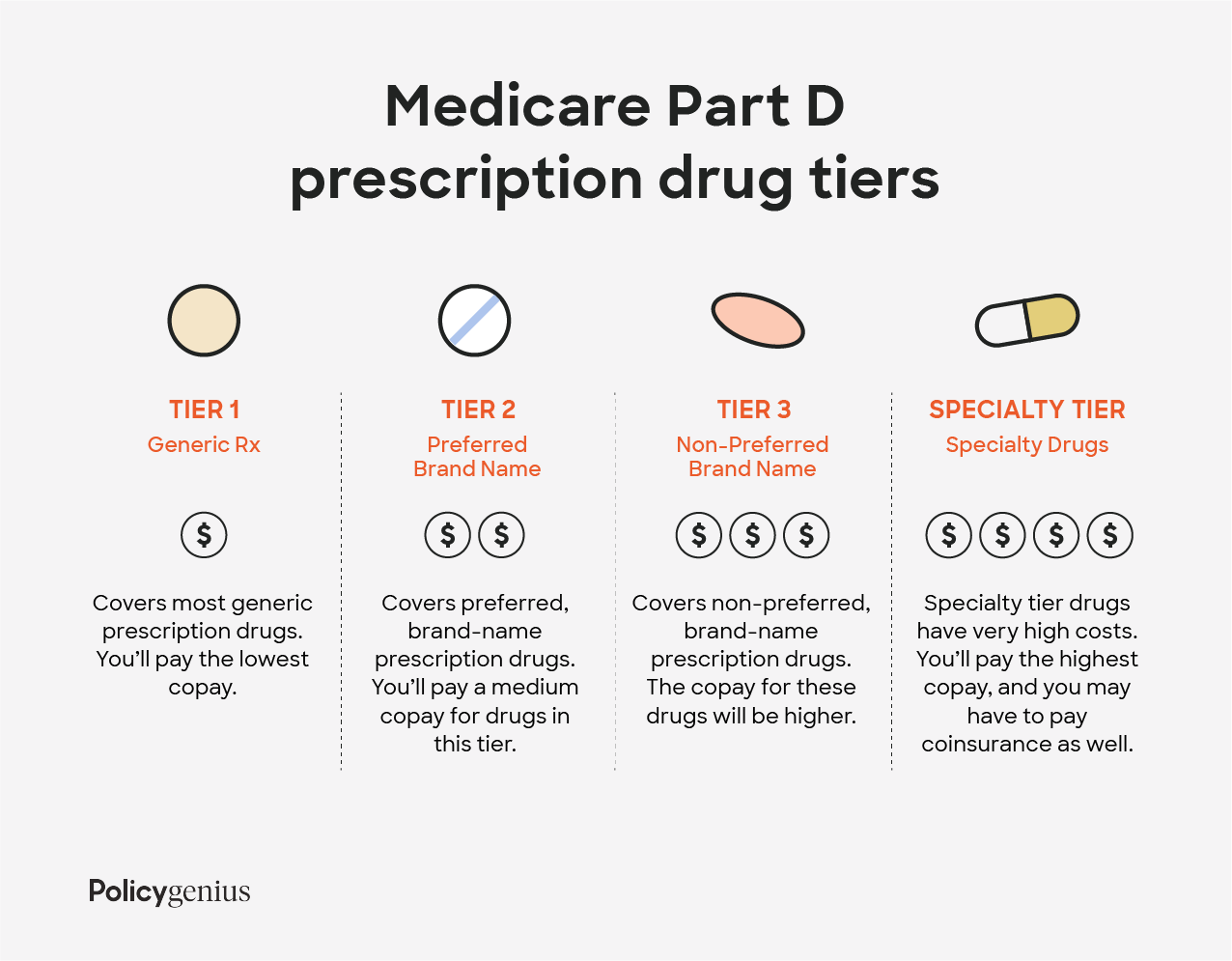

Most plans break their covered drugs into tiers so that it’s easier to understand how much they will cost you. The prices you pay are based on a drug’s tier, with higher tiers requiring a higher copay. Tiers are generally divided into generic drugs, preferred brand-name drugs, non-preferred brand-name drugs, and drugs that are very expensive.

Here’s an example of the tiers for a Medicare Part D plan:

Tier 1: lowest copay and includes most generic prescription drugs

Tier 2: medium copay and includes preferred, brand-name prescription drugs

Tier 3: higher copay and includes non-preferred, brand-name prescription drugs

Specialty tier: highest copay and includes very high cost prescription drugs

Each state has a preferred drug list (PDL), which is a list of drugs and medications that Part D will reimburse without the need for prior authorization, usually generic versions of brand-name drugs. These medications are selected because of their combination of effectiveness and affordability. Getting a prescription medication that isn’t in the PDL will come with a higher cost and your doctor will need to get approval for Medicare to cover its cost.

If your doctor thinks that you need a certain drug that’s on a higher (more expensive) tier, even though there’s a similar, less expensive option, you may be able to file an exception and ask your plan to charge a lower copay.

How much does Medicare Part D cost?

What you pay for a Medicare Part D plan will vary based on your specific plan, what state you live in, and your income. There are a few costs you should understand because most plans have them:

a premium that you pay each month to keep your plan active

a deductible, which is the amount you need to spend before insurance starts covering your costs

copays and coinsurance that you pay each time you fill a prescription

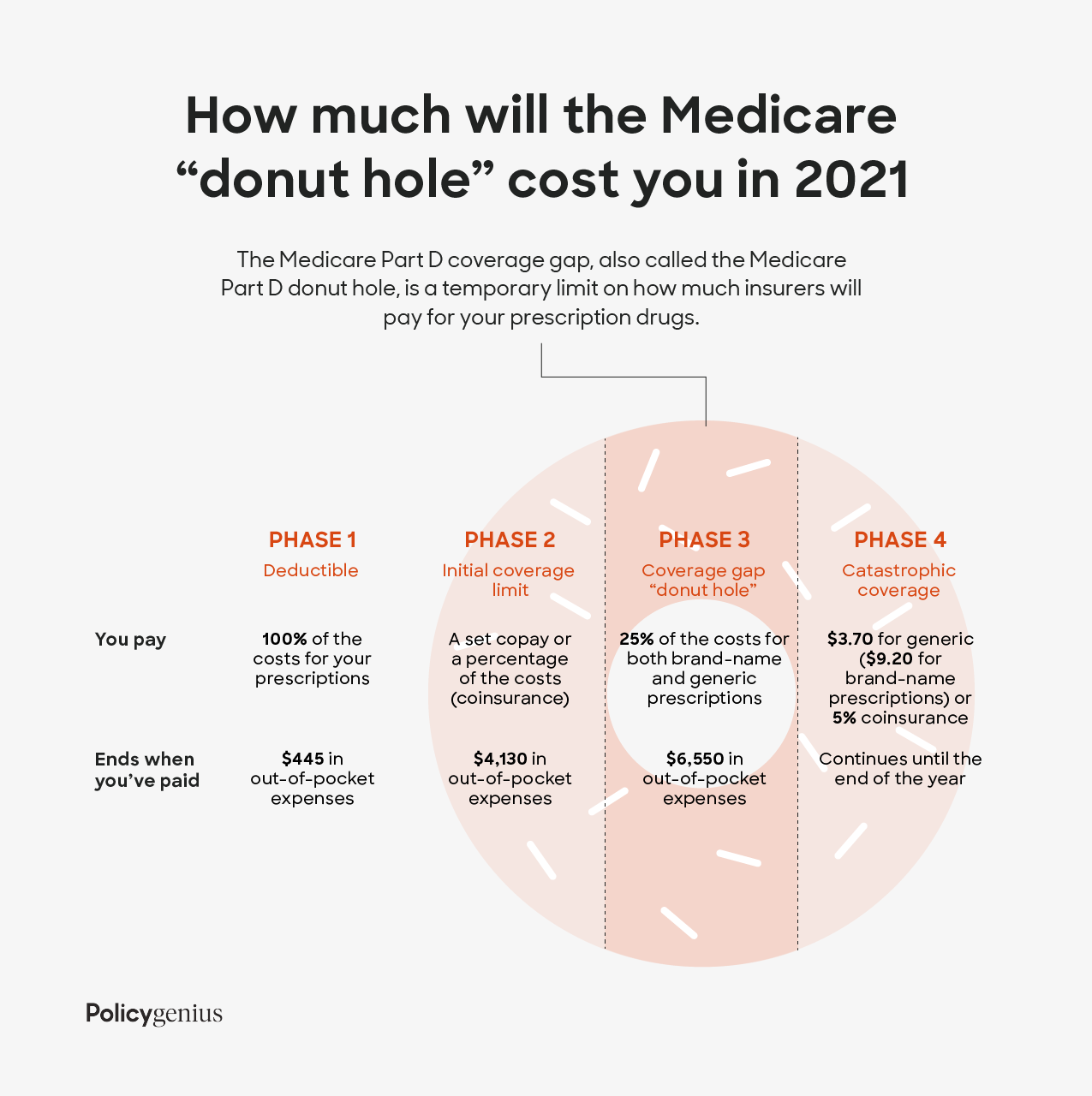

Most Medicare drug plans also have a coverage gap (also called the “donut hole”), which is a temporary limit on what the drug plan will pay for drugs. Low-income individuals can avoid the coverage gap if they receive Medicare Extra Help. Extra Help covers most or all of your premiums, copays, coinsurance, and deductible.

Read more about the cost of Medicare.

Medicare Part D premiums in 2023

Your monthly premium is the amount you need to pay each month in order to continue receiving coverage from your prescription drug plan. Premiums vary by plan but the average basic monthly premium for a Part D plan in 2023 is $31.50, down from $32.08 in 2022.

If you make more than a certain amount, you will have to pay a higher premium. The extra amount you pay is based on what’s known as an income-related monthly adjustment amount (IRMAA). The IRMAAs for 2023 were determined by your income on your 2021 tax returns. The table below shows how much you can expect to pay.

2023 Medicare Part D Premiums by filing status and income

Single | Joint | Married filing separately | What you pay in 2022 |

|---|---|---|---|

$97,000 or less | $194,000 or less | $97,000 or less | your plan's premium |

$97,000 to $123,000 | $194,000 to $246,000 | not applicable | $12.20 + your plan's premium |

$123,000 to $153,000 | $246,000 to $306,000 | not applicable | $31.50 + your plan's premium |

$153,000 to $183,000 | $306,000 to $366,000 | not applicable | $50.70 + your plan's premium |

$183,000 to $500,000 | $366,000 to $750,000 | $97,000 to $403,000 | $70.00 + your plan's premium |

$500,000 or more | $750,000 or more | $403,000 or more | $76.40 + your plan's premium |

Remember that these premiums are just for Part D and they apply in addition to your Part A and Part B premiums. The premium for 2023 Part B plans is $164.90 (down from $170.10 in 2022), or more for those with higher incomes. And check out our guide to choosing your tax filing status.

Medicare Part D deductible in 2023

Your annual deductible is the amount of money that you need to pay out of pocket before your insurance will start to pay some of your drug costs. At the start of a new year, your spending resets and you will need to meet your deductible again for your insurer to cover costs.

Deductibles vary by plan and some plans don’t even have one. The maximum legal deductible for a Medicare plan is $505 in 2023, up from $480 in 2022.

Copays and coinsurance

A copay is a set amount of money that you pay each time you get a prescription or other service. Copays vary by plan and by the type of drug you get. In general, generic prescription drugs have the lowest copays. Name-brand drugs have higher copays, but their costs also depend on whether the specific drug is on your state’s preferred drug list or not. Specialty drugs and other high-cost drugs will have the highest copays.

With coinsurance, you pay a percentage of the drug’s cost. Even if you get two drugs with the same coinsurance, the final amount you pay depends on drug prices. Coinsurance varies by plan, by drug, and also based on whether or not you’ve reached your plan’s coverage gap (more on that next).

What is the Medicare Part D coverage gap in 2023?

The Medicare Part D coverage gap, also called the Medicare Part D donut hole, is a temporary limit on how much insurers will pay for your prescription drugs. In 2023, you will enter the coverage gap once you and your insurer have spent a combined $4,660 on prescriptions. This includes copays and coinsurance payments you make, but doesn’t include your premiums.

To get out of the coverage gap — meaning your plan will start covering drug costs again — you will need to reach a total spending level for the year. In Medicare, that’s known as the true out-of-pocket limit, or TrOOP costs, and it includes your copays, coinsurance, and deductibles. In 2023, the TrOOP threshold is $7,400. Once you spend that much, you automatically get catastrophic coverage. Catastrophic coverage gives you reduced copays and coinsurance for the rest of the year.

Most people enter the coverage gap at some point during the year. Once you do, Medicare will pay for a certain percentage of your drugs and you will have to pay the rest. How much Medicare covers depend on whether you get a generic or brand-name drugs.

For Medicare to cover the cost of brand-name drugs, you have to fill your prescription at a pharmacy or order through the mail. And even though you only pay 25%, 95% of the cost will count toward your out-of-pocket limit.

The Medicare Part D coverage gap can get confusing, so make sure to check your plan’s details and to reach out to your insurance company if you have questions.

Medicare Part D late enrollment penalty

Medicare prescription drug coverage is optional, but it’s best to opt into it soon after you are enrolled in Medicare. If you are eligible to enroll in Part D, you don’t enroll for 63 days or more, and then you try to enroll in a Part D plan, you will have to pay the late enrollment penalty.

To avoid the penalty, you need to enroll within 62 days of the end of your initial enrollment period (IEP). Initial enrollment starts three months before your 65th birthday, includes the month of your 65th birthday, and then ends three months after the month of your 65th birthday. You will also pay the penalty if you unenroll from a Part D plan for 63 or more days and then you re-enroll.

The Medicare Part D late enrollment penalty is 1% of the national base beneficiary premium ($33.37 in 2022) multiplied by the number of months you were eligible for but went without prescription drug coverage. That amount gets rounded to the nearest $0.10 and added to your monthly premium.

Situations that don’t result in a penalty

You can avoid the late enrollment fee if you have certain other types of prescription drug coverage. These are officially called creditable prescription drug coverage plans and they include coverage from the following:

A current or former employer or union

TRICARE

The Indian Health Service

The Department of Veterans Affairs (VA)

A Medicare Advantage plan (Part C)

Other individual health insurance coverage

Your plan is required to tell you each year if it’s creditable coverage. If you have one of these types of coverage and then you leave it for 63 or more days before joining a Part D plan, you will have to pay the late enrollment penalty.

How to enroll in Medicare Part D

First, you need to enroll in Original Medicare (Part A and Part B). If you aren’t automatically signed up — meaning you’re 65 but not yet receiving federal retirement benefits — you can enroll in Medicare by visiting your local Social Security office, calling 1-800-772-1213, or completing an online application at the Social Security Administration website.

Then you can find Medicare Part D plans in your area through the Medicare website. When you choose a plan, the site will direct you to the insurer’s website because you have to purchase plans directly from insurers.

However, you can only get a Medicare Part D plan during certain times of the year. New Medicare beneficiaries have a seven-month period that starts three months before their 65th birthday. This is your initial enrollment period. Outside of that, there are three other times you can enroll:

Medicare open enrollment runs from October 15 to December 7 each year. It’s also called the annual election period (AEP).

Special enrollment occurs after a major life event, like a move or loss of coverage. It’s also known as a special election period (SEP).

If you have Medicare Advantage (Part C), the Medicare Advantage disenrollment period (MADP) allows you to drop Medicare Advantage, and revert to Original Medicare. Then you can enroll in a Medicare Part D plan. The MADP is January 1 to February 14.

Learn more on how and when to apply for Medicare.

Should I get a Medicare Part D plan?

If you have Original Medicare but you don’t have prescription drug coverage, you should purchase a Medicare Part D plan. Make sure to enroll as soon as you’re eligible so you can avoid the late penalty.

If you have prescription drug coverage through an employer, union, or trade group, check to see if their plan covers more than the Medicare Part D plans you can buy in your area. (Visit the Medicare website and search for plans in your area to check.) For most people, workplace coverage terminates for good once they buy a Part D plan.

When you should consider Medicare Part D:

You have no other prescription drug coverage

Original Medicare and Medicare Part D are cheaper than your other coverage

You qualify for Extra Help, a program that helps low-income Americans pay Part D prescription drug costs

You have Medicare Supplement Insurance (Medigap); Medigap policies can no longer be sold with prescription drug coverage

When you can possibly skip Medicare Part D:

You have prescription drug coverage through Medicare Advantage

You have better prescription drug coverage through a past or current employer

You get better coverage through other federal programs or agencies, including the VA, TRICARE or the Federal Employee Health Benefits (FEHB) Program