Charlotte is a major city and commercial hub, home to about 860,000 people and a handful of Fortune-500 companies. Its big-city vibrancy and low cost of living make it a popular city for renters, and just about all of them should be asking themselves: do I need renters insurance?

There’s no shortage of ways your personal belongings can be damaged or stolen in Charlotte. Thankfully, renters insurance helps alleviate these worries, and is often a smart and affordable option if you find the right company. Read on to learn more about why renters insurance makes sense for Charlotte residents.

Best renters insurance in Charlotte

Insurance Company | Monthly Cost - $500 Deductible | Monthly Cost - $1,000 Deductible |

|---|---|---|

State Farm | N/A ‡ | $7.83 |

Allstate | $13.00 | $13.00 |

Travelers ⤈ | N/A | N/A |

Stillwater | $11.33 | $10.08 |

Lemonade† | N/A | N/A |

‡ $500 deductible option not available † Not available in Charlotte ⤈ Online quotes not available

Methodology: We pulled renters insurance quotes online from five of the most popular insurance companies: State Farm, Lemonade, Allstate, Travelers and Stillwater. Quotes were for policies with $500 and $1,000 deductibles for a 30-year-old male apartment renter. We deferred to the most comparable coverage amounts when identical policies were unavailable.

Coverage type | State Farm | Allstate | Travelers‡ | Stillwater | Lemonade† |

|---|---|---|---|---|---|

Property Coverage | $20,000 | $20,000.00 | N/A | $20,000 | N/A |

Liability Coverage | $100,000.00 | $100,000.00 | N/A | $100,000 | N/A |

Medical payments to others | $1,000.00 | $1,000.00 | N/A | $2,000 | N/A |

‡ Online quotes not available

† Not available in Charlotte

Understanding renters insurance quotes

Did you know that, if you’re forced to move because your apartment becomes uninhabitable due to water damage, fire damage, or wind damage, renters insurance will provide you and your family with additional expenses to deal with the loss? This is referred to as “loss of use”, and is one of the many perks of having a renters insurance policy.

What this means, is, if you normally spend $400 a month on groceries for your family, renters insurance may write you a check for $500 instead, since you’ll be forced to eat out instead of cook. Loss of use may also supply funds for hotel expenses and additional car mileage if the need arises.

Here’s a rundown of the components you should look for in a policy when comparing renters insurance rates.

Property coverage: reimbursement for lost, stolen, or damaged property.

Liability coverage: covers legal expenses in the event someone is injured in your residence and they sue you.

Loss of use: covers temporary living expenses if your residence becomes uninhabitable.

Medical payments to others: covers medical costs in the event someone is injured in your residence and requires medical treatment.

We’ve got a full explainer of what renters insurance covers here.

Is renters insurance legally required in Charlotte?

While landlords and management companies are allowed to make renters insurance a requirement as terms for signing a lease, it is not currently law in Charlotte or the state of North Carolina to purchase renters insurance.

And while that may be the case, it's worth remembering that -- although renters insurance isn’t a legal requirement, it may save you a legal headache at the end of the day.

Reasons to buy renters insurance in Charlotte

Renters insurance is among the most affordable types of insurance to buy, and also provides you with peace of mind. This is especially true if you live alone and need to travel for work. And considering most of your important and expensive personal belongings are in your residence or storage unit, it only makes sense to ensure they’re protected.

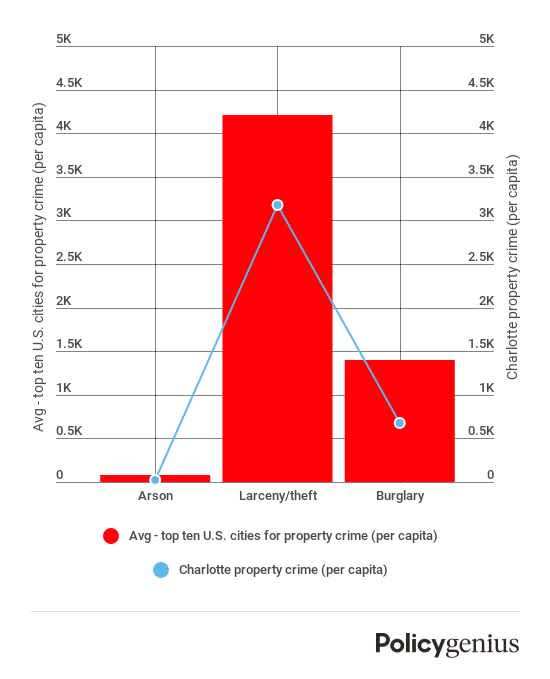

Charlotte, like every city, deals with property crime, and while property crime in general is down across the board in Charlotte, it still deals with its fair share of larceny and theft, having seen that category spike in recent years.† Probability of property crime is one of the better reasons to consider renters insurance, and if you don’t live in a tightly secure building or unit, you may want to start looking at options.

Weather and natural hazards are another reason to consider renters insurance. While the weather in Charlotte tends to cooperate for most of the year, residents still experience the occasional tornado, freezing temperatures during the winter, and a phenomenon ostensibly unique to the Carolinas — ice storms.‡

If you lose power during an ice storm and all your food goes to waste, renters insurance may provide reimbursement, so long as your policy includes loss of use coverage.

Helpful resources

Charlotte residents with the itch to learn more about renters rights and resources should check out the following:

Action NC: Charlotte-based group that works to ensure everyone has access to high quality and affordable rental housing

Legal Aid NC: Provides legal aid and information for North Carolina tenants

NC Consumers Council: Rights and responsibilities resource for both tenants and landlords

† FBI CDE