Los Angeles is home to almost 4 million people, and a good chunk of the city's inhabitants -- around 54% -- are renters.† Thats a lot of people, and if you're one of them, you should consider purchasing renter's insurance.

There are a multitude of ways your personal belongings can be damaged or stolen, and replacing it can be expensive, as Angelenos know all too well. Thankfully, renters insurance is relatively cheap, and a worthy investment if you know where to look.

Insurance Company | Monthly Cost - $500 Deductible | Monthly Cost - $1,000 Deductible |

|---|---|---|

State Farm | $12.50 | $11.25 |

Allstate | $21.00 | $19.00 |

Travelers | $16.00 | $15.00 |

Stillwater | $15.00 | $15.00 |

Lemonade | $12.34 | $10.75 |

Methodology: We pulled renters insurance quotes online from five of the most popular insurance companies: State Farm, Lemonade, Allstate, Travelers and Stillwater. Quotes were for policies with $500 and $1,000 deductibles for a 30-year-old female apartment renter. We deferred to the most comparable coverage amounts when identical policies were unavailable.

Coverage type | State Farm | Allstate | Travelers | Stillwater | Lemonade |

|---|---|---|---|---|---|

Property Coverage | $20,000.00 | $20,000 | $30,000 | $20,000 | $20,000 |

Liability Coverage | $100,000.00 | $100,000 | $100,000 | $100,000 | $100,000 |

Medical payments to others | $1,000.00 | $1,000 | $1,000 | $2,000 | $1,000 |

Understanding renters insurance quotes

Renters insurance does far more than simply cover your personal property. Here's a rundown of the basic components of a policy when you're comparing renters insurance rates.

Property coverage: Reimbursement for destroyed, damaged, lost or stolen property.

Liability coverage: Covers legal costs in the event that you’re sued if someone is injured in your home.

Loss of use: Covers temporary living expenses if your residence becomes uninhabitable.

Medical payments to others: Covers medical costs in the event that you’re sued if someone is injured in your home.

We’ve got a full explainer of what renters insurance covers here.

Is renters insurance legally required in Los Angeles?

Renters insurance is not legally required in the state of California or city of Los Angeles. However, landlords or homeowners associations may require renters insurance as a term of leasing. Always be sure to check with a landlord during the application process to find out if he or she requires tenant renters insurance.

Its also worth remembering that apartments and homes in Los Angeles are expensive to rebuild -- meaning, should your landlord come after you in the event of a fire or any tenant-induced property damage, it could put you and your bank account in hot water. Liability coverage alone minimizes this worry, and is essential for every renter in LA.

Reasons to buy renters insurance in Los Angeles

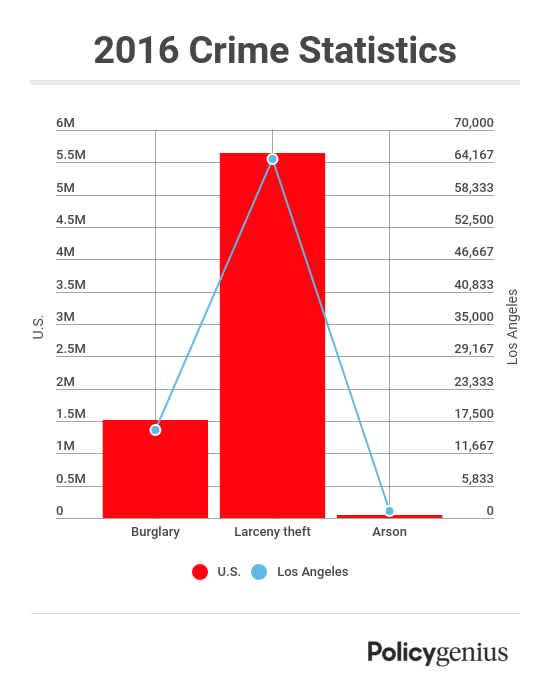

In 2016, Los Angeles experienced 15,821 burglaries and 64,739 instances of theft, according to data provided by the Los Angeles Police Department and compiled by the FBI's Crime Data Explorer.‡

With natural beauty comes natural disasters, and Los Angeles is no stranger to this phenomenon. Unfortunately, renters insurance does not cover earthquakes, mudslides, or floods. It does, however, cover forest fires, which are becoming increasingly common by the day, and reason enough to purchase renters insurance.

Helpful resources

Los Angeles tenants looking for more resources on renting and their rights should visit the following:

The Average Cost of Renters Insurance: Find out what really determines your renters insurance price -- and how that price is calculated

Housing Community Investment Department: A great resource for LA renters to understand their rights and ensure they're living under safe and appropriate conditions

Los Angeles Tenant Union: A renter-led union geared toward ensuring tenant rights, such as rent-controlled areas and anti-discriminatory housing measures are being enacted at the local level

Housing Rights Center: Free telephone and in-person counseling to both current and prospective renters regarding tenant rights and responsibilities

† 1. U.S. Census Bureau, 2016 American Community Survey 1-Year Estimates

‡ 2. FBI CDE