Miami is known for its beaches, nightlife, and high proportion of renters. In fact, a staggering 68% of Miamians are renters, and if you’re in this group, you should probably consider purchasing renters insurance.

Renters insurance ensures that your personal belongings are protected. There are countless reasons you should consider renters insurance if you live in Miami, from rate affordability to the high risk of weather-related damage to break-ins.. Read on to learn more about why renters insurance makes sense for anyone who calls Miami home.

Best renters insurance companies in Miami

Insurance Company | Monthly Cost - $500 Deductible | Monthly Cost - $1,000 Deductible |

|---|---|---|

State Farm† | N/A | N/A |

Allstate† | N/A | N/A |

Travelers‡ | N/A | N/A |

Stillwater | $49.58 | $46.17 |

Lemonade† | N/A | N/A |

†Not available in Miami

‡Online quotes not available Methodology: We pulled renters insurance quotes online from five of the most popular insurance companies: State Farm, Lemonade, Allstate, Travelers and Stillwater. Quotes were for policies with $500 and $1,000 deductibles for a 30-year-old male apartment renter. We deferred to the most comparable coverage amounts when identical policies were unavailable.

Coverage type | State Farm | Allstate | Travelers | Stillwater | Lemonade |

|---|---|---|---|---|---|

Property Coverage | N/A | N/A | N/A | $20,000 | N/A |

Liability Coverage | N/A | N/A | N/A | $100,000 | N/A |

Medical payments to others | N/A | N/A | N/A | $2,000 | N/A |

†Not available in Miami

‡Online quotes not available

Understanding renters insurance quotes

Renters insurance is about far more than just protecting your personal property. Here’s a rundown of the components you should look for in a policy when comparing renters insurance rates.

Property coverage: reimbursement for lost, stolen, or damaged property.

Liability coverage: covers legal expenses in the event someone is injured in your residence and they sue you.

Loss of use: covers temporary living expenses if your residence becomes uninhabitable.

Medical payments to others: covers medical costs in the event someone is injured in your residence and requires medical treatment.

We’ve got a full explainer of what renters insurance covers here.

Is renters insurance legally required in Miami?

While renters insurance isn’t required in Miami or the state of Florida, landlords and management companies may include a provision in the lease that requires renters insurance as a condition for signing.

This practice is completely legal, and South Florida landlords would actually be doing renters a favor in requiring renters insurance, considering the erratic weather the region experiences during hurricane season.

Reasons to buy renters insurance in Miami

Renters insurance is among the most affordable insurance types to buy, and also provides you with peace of mind by protecting your personal belongings both inside and outside your residence. This is especially true for Miami residents, who experience a high volume of property crime.

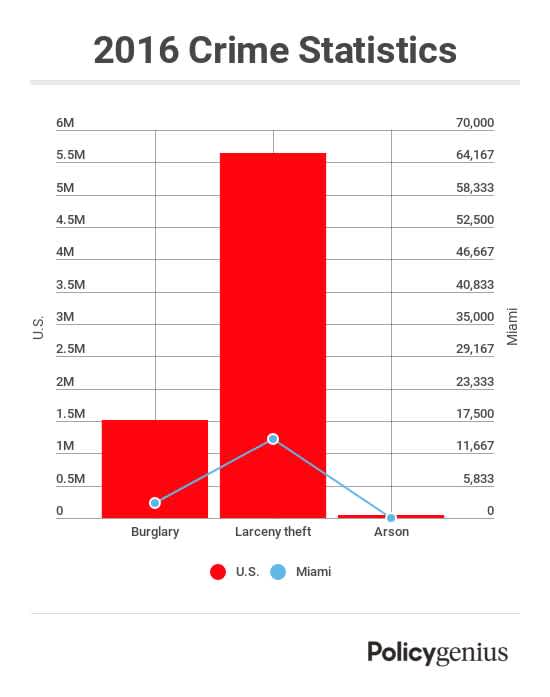

In fact, property crime rates are about 70% higher in Miami than the national average, and while instances of burglary have decreased by almost half over the last five years, larceny theft levels have stayed about the same, according to the FBI’s Crime Data Explorer.†

As for weather, Miami residents don’t need a reminder of the toll it takes on their city, especially during hurricane season. Miami averages about seven and a half inches of rain per month during hurricane season -- June 1st through November 30th‡ -- and although base renters insurance policies won’t cover certain perils like flood damage, it will cover other hurricane perils like windstorms and hail.

Helpful resources

Miami residents looking for information on renters rights and resources should peep the following:

Local Tenants Rights, Laws, and Protections: Resource for Floridian renters to find any and all information about tenant rights

Public Housing and Community Development: Affordable housing resource for Miami-Dade residents to find housing availability and have their housing-related questions answered

Renters Rights Handbook: Excellent in-depth resource for Miami residents to understand the full scope of their rights as tenants

Community Justice Project: Provides legal aid for Miami renters

† FBI CDE