Looking to move to the beautiful coastal city of San Diego? You’ll join the 1.3 million people who call the southwestern California locale home. You should also look into getting renters insurance.

Although San Diego is mostly a safe city, renters insurance helps protect your property not only from crime but also from elemental perils like fire and wind. Even if you think your belongings are secure, renters insurance adds to your peace of mind and can be purchased on the cheap.

Best renters insurance companies in San Diego

Insurance Company | Monthly Cost - $500 Deductible | Monthly Cost - $1,000 Deductible |

|---|---|---|

State Farm | $10.83 | $10.83 |

Allstate | $16.00 | $15.00 |

Travelers | $17.00 | $16.00 |

Stillwater | $15.00 | $15.00 |

Lemonade | $11.34 | $10.34 |

Methodology: We pulled renters insurance quotes online from five of the most popular insurance companies: State Farm, Lemonade, Allstate, Travelers and Stillwater. Quotes were for policies with $500 and $1,000 deductibles for a 30-year-old female apartment renter. We deferred to the most comparable coverage amounts when identical policies were unavailable. N/A denotes quotes were not available online.

Coverage type | State Farm | Allstate | Travelers | Stillwater | Lemonade |

|---|---|---|---|---|---|

Property Coverage | $20,000.00 | $20,000 | $30,000 | $20,000 | $20,000 |

Liability Coverage | $100,000.00 | $100,000 | $100,000 | $100,000 | $100,000 |

Methodology: We pulled renters insurance quotes online from five of the most popular insurance companies: State Farm, Lemonade, Allstate, Travelers and Stillwater. Quotes were for policies with $500 and $1,000 deductibles for a 30-year-old female apartment renter. We deferred to the most comparable coverage amounts when identical policies were unavailable. N/A denotes quotes were not available online.

|

State Farm | Allstate | Travelers | Stillwater | Lemonade |

|---|---|---|---|---|---|

Property Coverage | $20,000 | $20,000 | $30,000 | $20,000 | $20,000 |

Liability Coverage | $100,000 | $100,000 | $100,000 | $100,000 | $100,000 |

Understanding renters insurance quotes

Renters insurance covers more than just your stuff. Here’s a rundown of the basic components of a renters policy.

Property coverage: Reimbursement for destroyed, damaged, lost or stolen property.

Liability coverage: Covers legal costs in the event that you’re sued if someone is injured in your home.

Medical payments to others: Covers medical costs in the event that you’re sued if someone is injured in your home.

For a deep dive on what renters insurance covers, head here.

Is renters insurance legally required in San Diego?

While renters insurance is not required by law in San Diego, your landlord does reserve the right to require you to get it as a condition of signing the lease. Make sure you look for renters insurance rates while you go apartment hunting to make sure the stuff you’re bringing with you will be covered. For the low cost of between $10 and $20 per month, you can make sure you’re not paying out of pocket if an expensive item of yours is damaged.

Reasons to buy renters insurance in San Diego

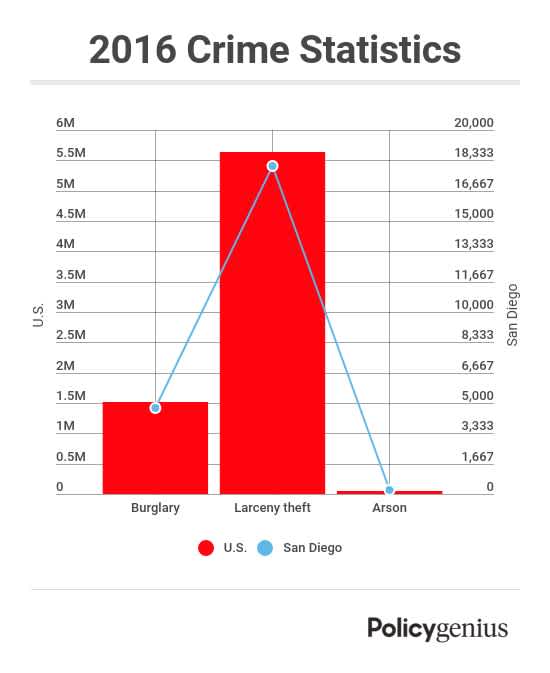

You don’t want to be on the hook for the cost of your stuff if it’s destroyed or stolen. Renters insurance can help replace those items. In San Diego, there were 4,743 burglaries in 2016, along with 18,042 thefts and 239 cases of arson, according to the FBI’s Crime Data Explorer.†

San Diego typically has a mild to beautiful climate throughout the year, although renters insurance will help if there’s ever a major windstorm that destroys property inside your home, such as recent effects of El Niño.

Renters insurance will protect from rain that comes in through the roof and walls, but not from flooding, for which you’ll need additional flood coverage.

You may also want to look into earthquake insurance, which isn’t included in basic renters insurance policies. You may need a renters insurance policy to cover your stuff from theft and a separate earthquake insurance policy for “earth movement” hazards.

Helpful resources

San Diego tenants looking for more resources on renting and their rights should visit the following:

The Average Cost of Renters Insurance: Find out how your renters insurance rates specifically are determined.

Tenants Legal Center: Resources and assistance fort tenants in San Diego.

San Diego County Bar Association: Information on the rights you have a tenant in relation to your landlord.

† FBI CDE