Equidistant to both Philadelphia and New York City, New Jersey’s capital city has been drawing in many new residents, especially those priced out of Manhattan’s competitive housing market. Renters — as opposed to owners — now make up 62% of Trenton’s residents^, so if you’re one of them you might want to consider getting renters insurance.

Renters insurance ensures that your personal belongings are protected. There are countless reasons you should consider renters insurance if you live in Trenton, from the affordability of most renters policies to the high risk of weather-related damage and break-ins. Read on to learn more about why renters insurance makes sense for Trenton residents.

Best renters insurance companies in Trenton

INSURANCE COMPANY | MONTHLY COST - $500 DEDUCTIBLE | MONTHLY COST - $1,000 DEDUCTIBLE |

|---|---|---|

State Farm | $10.10 | $10.10 |

Allstate | $19.00 | $17.00 |

Travelers | $21.00 | $19.00 |

Stillwater | $13.58* | N/A |

Lemonade | $5.00 | $5.00 |

*Based on a $250 deductible.

Methodology: We pulled renters insurance quotes online from five of the most popular insurance companies: State Farm, Lemonade, Allstate, Travelers and Stillwater. Quotes were for policies with $500 and $1,000 deductibles for a 30-year-old male apartment renter. We deferred to the most comparable coverage amounts when identical policies were unavailable.

STATE FARM | ALLSTATE | TRAVELERS | STILLWATER | LEMONADE | |

|---|---|---|---|---|---|

Property Coverage | $20,000 | $20,000 | $30,000 | $20,000 | $20,000 |

Liability Coverage | $100,000 | $100,000 | $100,000 | $100,000 | $100,000 |

Medical payments to others | $1,000 | $1,000 | $1,000 | $2,000 | $1,000 |

Understanding renters insurance quotes

Renters insurance coverage is more than just protecting your personal property, it also protects you from being financially on the hook if someone is injured in your home, and can pay if you need to temporarily move out of your rental unit. Here’s a rundown of the basic components of a policy that you should know you're comparing renters insurance rates.

Property coverage: Reimburses you for any personal property that is destroyed, damaged, or stolen, in your apartment and outside of it.

Liability coverage: Covers legal costs if a guest is injured in your home and sues you

Medical payments to others: Covers the medical expenses if a guest is injured in your home.

Loss of use: Pays temporary living expenses if you can’t live in your rented home or apartment due to damage or repairs.

We’ve got a full explainer of what renters insurance covers here.

Is renters insurance legally required in Trenton?

Renters insurance isn’t legally mandated by the city of Trenton, but your landlord might stipulate that you get as a condition of your lease. You should read the fine print of your lease or check with your landlord if you’re not sure whether you’re required to have renters insurance.

However, even if a landlord doesn’t require renters insurance, it might be worth buying. And it can be extremely affordable: Lemonade offers a policy with a $500 deductible for only $5 a month.

Reasons to buy renters insurance in Trenton

Renters insurance is among some of the most affordable insurance coverage you can buy, and, considering your most cherished personal belongings are typically stored in your residence or storage units, renters insurance should be a no-brainer in any city.

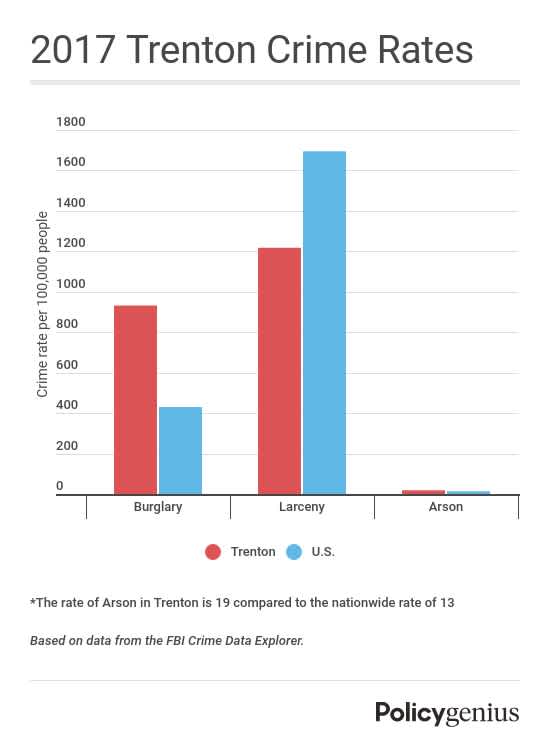

Trenton’s property crime rate is another good reason to buy renters insurance. While arson rates in Trenton are only slightly above than the national average, the rate of burglaries is nearly double.† With a renters insurance policy, you would be covered in the unfortunate event that someone breaks into your apartment and steals your things. Additionally, belongings outside of your home, including inside your vehicle or storage unit, would also be insured.

Weather in Trenton runs the gamut from freezing temperatures in the winter to a scorching summertime heat. The unpredictability of East Coast weather might be a good reason to consider renters insurance, which protects your belongings against risks like wind, lightning and hail. However, a renters insurance policy will not cover damage from hurricanes or flooding, which requires its own separate insurance.

Helpful resources

Trenton Inspections Department: Rights and obligations of tenants and landlords and information on Trenton’s rent control ordinance.

New Jersey Housing Resource Center: Housing availability, financial assistance, and housing resources for NJ residents.

Legal Services of New Jersey: Legal information manual for tenants to understand their rights and responsibilities.

† 1. U.S. Census Bureau

‡ 2. FBI CDE