Once you purchase renters insurance, in order to keep the policy active you need to make regular payments to your insurance provider. These payments are called your insurance premiums. Depending on your coverage and your insurance company, you can pay your premium monthly, every six months, or you can pay it in total at the start of the policy.

Many companies will offer a discount if you sign up for an annual payment. That being said, most people pay monthly since renters insurance tends to be inexpensive, and because if you’re renting you may be likely to move more frequently. If you cancel your renters insurance after paying in full most companies will reimburse you, but this depends on your provider. You should ask your insurance provider what their reimbursement policy is before you purchase.

Unlike health insurance, which involves co-pays and out-of-pocket expenses, renters insurance is a bit more straightforward because you are dealing with two factors: premiums, which keep your policy active, and your deductible, which you may have to pay if you file a claim. But how your premiums are determined depends on a few different things.

What factors affect the price of renters insurance premiums?

Insurance providers will assess various factors to determine your premium. Some of them are out of your control but some of them, like the amount of coverage you want, is up to you.

The amount of renters insurance coverage you want

How much coverage you decide to sign up for is the biggest factor that impacts the price of your premium. Before choosing your coverage amount, you should take an inventory of all your belongings and calculate their total cost to see how much coverage you need to include in your policy.

If you want to insure expensive and valuable items like rare jewelry, you will need to set high coverage limits or add riders to your policy, which means a higher premium. A landlord might require you to get a minimum amount of renters insurance coverage, but ultimately it’s up to you which items you want to cover.

Below is an overview of the coverage most basic renters insurance policies include. You can set the limit of each type of coverage. The limits of your coverage will affect the cost of your premium.

Personal property damage coverage: Replacement or repairment of personal belongings that get damaged or stolen

Personal liability coverage: Legal costs from damage or injury

Medical payment coverage: Medical expenses for anyone injured in your apartment

Loss of use coverage: The cost of lodging and food if your home becomes uninhabitable

Your rental location

Where you live helps insurance companies determine if you are more likely or less likely to file a claim. The more likely you are to have a covered loss, the more of a risk you are for the insurance company to cover.

Weather is a major factor when it comes to the price of renters insurance premiums. For example, if you live in Alabama, you are more at-risk for extreme weather, so your premium may be higher than if you lived in Wisconsin. Insurance providers will also factor in your city and even your ZIP code to determine if you are more or less likely to file a claim.

Your rental building and history

Your building unit and size are also a factor when it comes to the price of your premium. Older buildings tend to lead to a higher premium price. Newer buildings usually mean cheaper premiums because they are less risky than older ones—they tend to have more security and safety features as well. Insurance providers also look at the amount of units in your building and if there have been any previous claims filed there.

Your renters insurance deductible

Your deductible is the amount of money you pay out-of-pocket for a claim before your coverage kicks in to cover the rest. For example, if you have a $500 deductible and there is a fire in your apartment, you will need to pay that $500 deductible first when you file a claim, and then your coverage will cover the rest of the damage, up to your coverage limits. The higher your deductible the lower your premium will be.

Actual cash value renters insurance vs. replacement cost renters insurance

When you purchase renters insurance, you will have two payment options to choose from that will determine how you get paid if you file a claim. You can either be paid the actual cash value or replacement cost value of a lost or damaged item. An actual cash value renters insurance policy will pay you the value of your belongings at the time of the claim, not the price you paid for them when you bought them nor the cost it’d pay to buy them again brand new.

Replacement cost renters insurance covers the cost of repairing or replacing the insured item with the same type or one of similar value. You have to decide between these two ways to be paid when you sign up for your policy. Replacement cost renters insurance pays out more in the event of a claim, but it also costs more.

Renters insurance discounts

You can lower your premiums by increasing safety and security features in your home. Many insurance companies will give you discounts for the following measures:

Fire and smoke alarms (sound on)

Carbon monoxide alarms

Automatic sprinklers

Burglar alarms

Deadbolt locks

Fire extinguisher

Additional riders and coverage

Basic renters insurance policies don’t fully cover big ticket items like precious jewelry or an extensive guitar collection. This means you will need to add extra coverage and riders to help protect some of the cost for these more expensive belongings.

You can add more personal liability coverage if you want to increase your level of protection for damage you’re responsible for, like property damage or another person’s injury. For example, if your dog bites someone, your liability coverage will help pay for their potential medical bills. Some insurance companies increase premiums based on dog breeds for this reason.

Your credit score

Insurance providers will check your credit history and debt before they calculate your premium price. If you have a satisfactory credit score, your premiums will likely be lower because you are a lower risk to insure as a client. If you have a history of making claims some companies may raise your premiums, but not always.

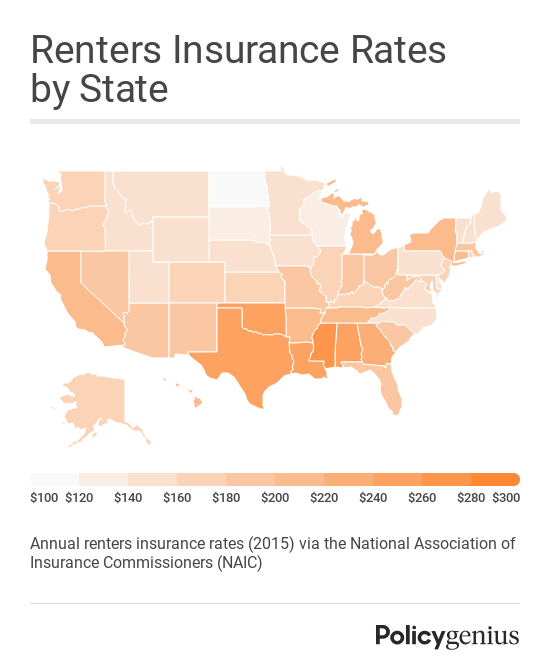

What’s the average cost of renters insurance for each state?

The average renters insurance rates varies from state to state, but as of 2015, renters insurance ranged from a high of $262 a year in Mississippi to a low of $114 a year in North Dakota, according to a 2017 report by the National Association of Insurance Commissioners (NAIC)

Average Annual Premium by State, 2015

State | Avg Annual Premium |

|---|---|

Alabama | $242 |

Alaska | $172 |

Arizona | $191 |

Arkansas | $214 |

California | $202 |

Colorado | $166 |

Connecticut | $201 |

Delaware | $156 |

District of Columbia | $158 |

Florida | $195 |

Georgia | $226 |

Hawaii | $201 |

Idaho | $155 |

Illinois | $173 |

Indiana | $183 |

Iowa | $146 |

Kansas | $177 |

Kentucky | $172 |

Louisiana | $249 |

Maine | $147 |

Maryland | $161 |

Massachusetts | $196 |

Michigan | $203 |

Minnesota | $144 |

Mississippi | $262 |

Missouri | $180 |

Montana | $147 |

Nebraska | $149 |

Nevada | $189 |

New Hampshire | $150 |

New Jersey | $171 |

New Mexico | $191 |

New York | $202 |

North Carolina | $154 |

North Dakota | $114 |

Ohio | $185 |

Oklahoma | $242 |

Oregon | $166 |

Pennsylvania | $156 |

Rhode Island | $179 |

South Carolina | $192 |

South Dakota | $121 |

Tennessee | $210 |

Texas | $241 |

Utah | $149 |

Vermont | $155 |

Virginia | $153 |

Washington | $169 |

West Virginia | $186 |

Wisconsin | $132 |

Wyoming | $153 |

United States | $188 |

How to pay renters insurance premiums

As we mentioned, you can pay renters insurance annually or monthly. Here are both options broken down in greater detail:

Monthly: On average, renters insurance in the United States cost just over $15 a month. If you pay monthly, you can cancel your coverage without worrying about reiumbursment like you would if you paid annually.

Semi-annually: Most leases are 12 to 18 months, but you can get renters insurance without a lease. You can also get renters insurance as a short-term guest or subletter.

Annually: Renters insurance paid up front requires a lump sum payment of the total cost. However, if you pay upfront you may get a discount, depending on your insurance provider. Meaning paying annually can save you money in the long run. Many insurance providers will reimburse you for the amount remaining if you cancel your policy.

The method by which you pay your premiums depends on your insurance provider, but most major providers accept bank transfers, credit cards, and authorized checks as payment methods.

What happens if I don’t pay my renters insurance premium?

Your insurance company is required to give you a 30-day grace period before canceling your policy. If you don’t pay the premiums you owe within that 30-day grace period then you lose coverage. If that happens, you will have a lapse in coverage.

You should definitely try to avoid this as much as possible. If you have a lapse in coverage, then none of your belongings will be protected and you no longer have any liability coverage (you might also be in violation of your lease if you landlord requires renters insurance).