Cheapest SR-22 insurance in California

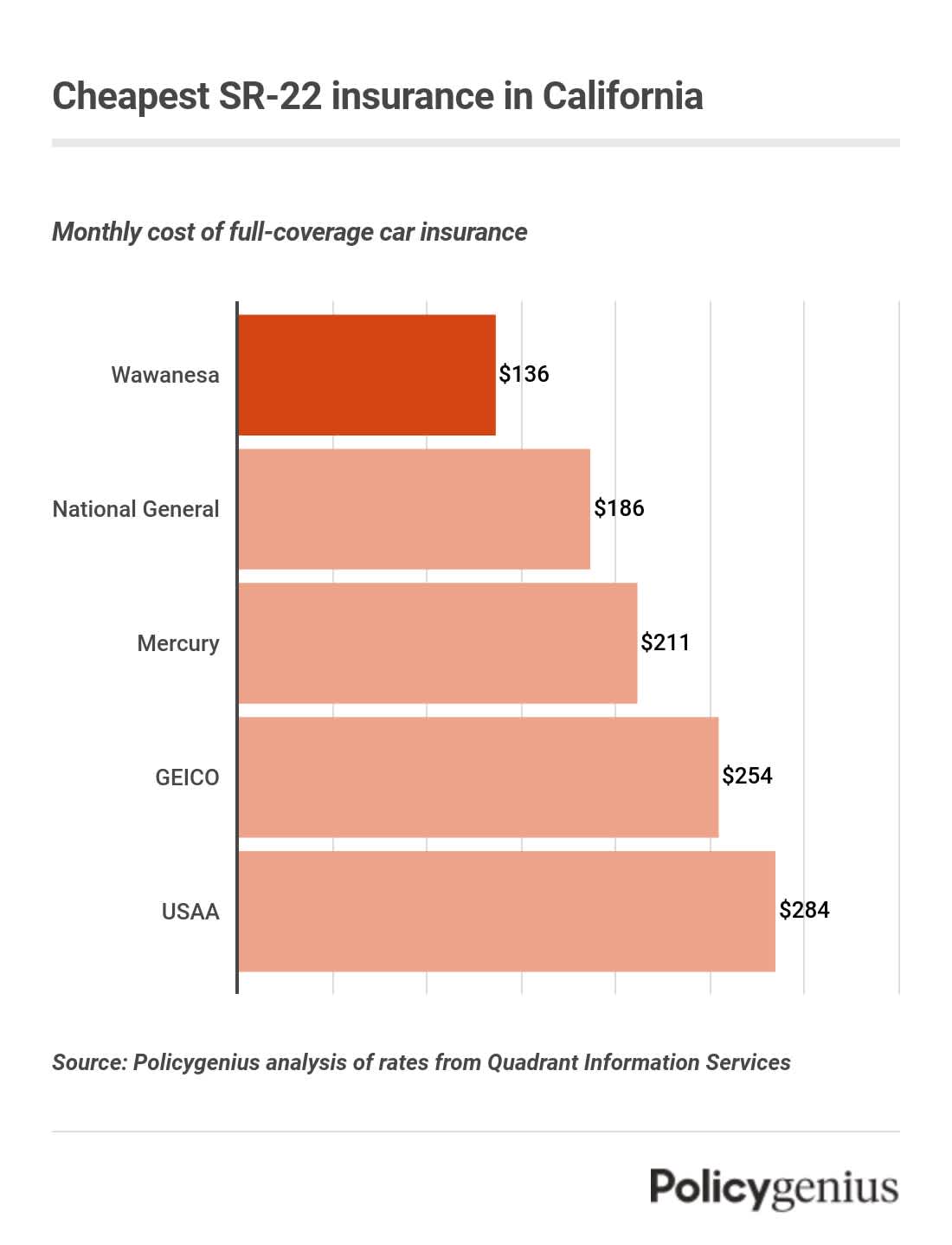

Wawanesa has the cheapest SR-22 insurance in California, at an average cost of $136 per month or $1,632 a year. That’s 67% cheaper than the statewide average, which is $4,881 a year.

The other companies that offer cheap insurance in California if you need an SR-22, include National General and Mercury. But car insurance with an SR-22 costs much more than average and rates can vary widely, so be sure to compare rates before picking a policy.

Company | Average monthly cost of SR-22 insurance | Average annual cost of SR-22 insurance |

|---|---|---|

Wawanesa | $136 | $1,632 |

National General | $186 | $2,229 |

Mercury | $211 | $2,529 |

GEICO | $254 | $3,047 |

USAA | $284 | $3,410 |

Kemper | $299 | $3,590 |

Progressive | $330 | $3,955 |

Travelers | $332 | $3,984 |

Farmers | $357 | $4,280 |

What is SR-22 insurance in California?

SR-22 insurance isn’t actually a kind of car insurance, it’s a form that your insurance company files for you that proves you have an active policy. An SR-22 in California must show that you have at least the following amounts of coverage:

Bodily injury liability (BIL): $15,000 for injury per person, $30,000 per accident

Property damage liability (PDL): $5,000 per accident

You may be required to have SR-22 insurance after a license suspension or a serious violation. In California, some of the reasons your license may be suspended include being in an accident without insurance, getting a DUI, reckless driving, racing, or getting too many points on your license in a short period of time.

California usually requires SR-22 insurance for at least a few years, but the exact time depends on your violation. Your insurance company will notify the state if you drop your coverage early and you’d face fines and need an SR-22 for longer.

How to get SR-22 insurance in California

Once you know that you need an SR-22, you can follow these steps to find affordable SR-22 car insurance in California:

Find a company that offers coverage: Not every company will cover you once you’re a high-risk driver. You may have to shop around to find coverage, especially if your previous insurance company drops you.

Pay your reissue fee: California may require you to pay a fee if your license was suspended. For example, after a DUI the fee is $125, but the amount depends on the reason for the suspension.

Wait for your SR-22 to process: It takes a few days for your SR-22 to process. You’ll be notified when it’s filed, so wait for notification before getting on the road.

Non-owner SR-22 insurance in California

If you have a license but not a car of your own, you may need to get non-owner SR-22 insurance if your license is suspended or you commit a driving violation.

Non-owners insurance has basically the same coverage as a regular car insurance policy, aside from comprehensive and collision coverage (since there’s no car to protect). A non-owners SR-22 policy usually has lower limits than regular insurance, so it may be cheaper.