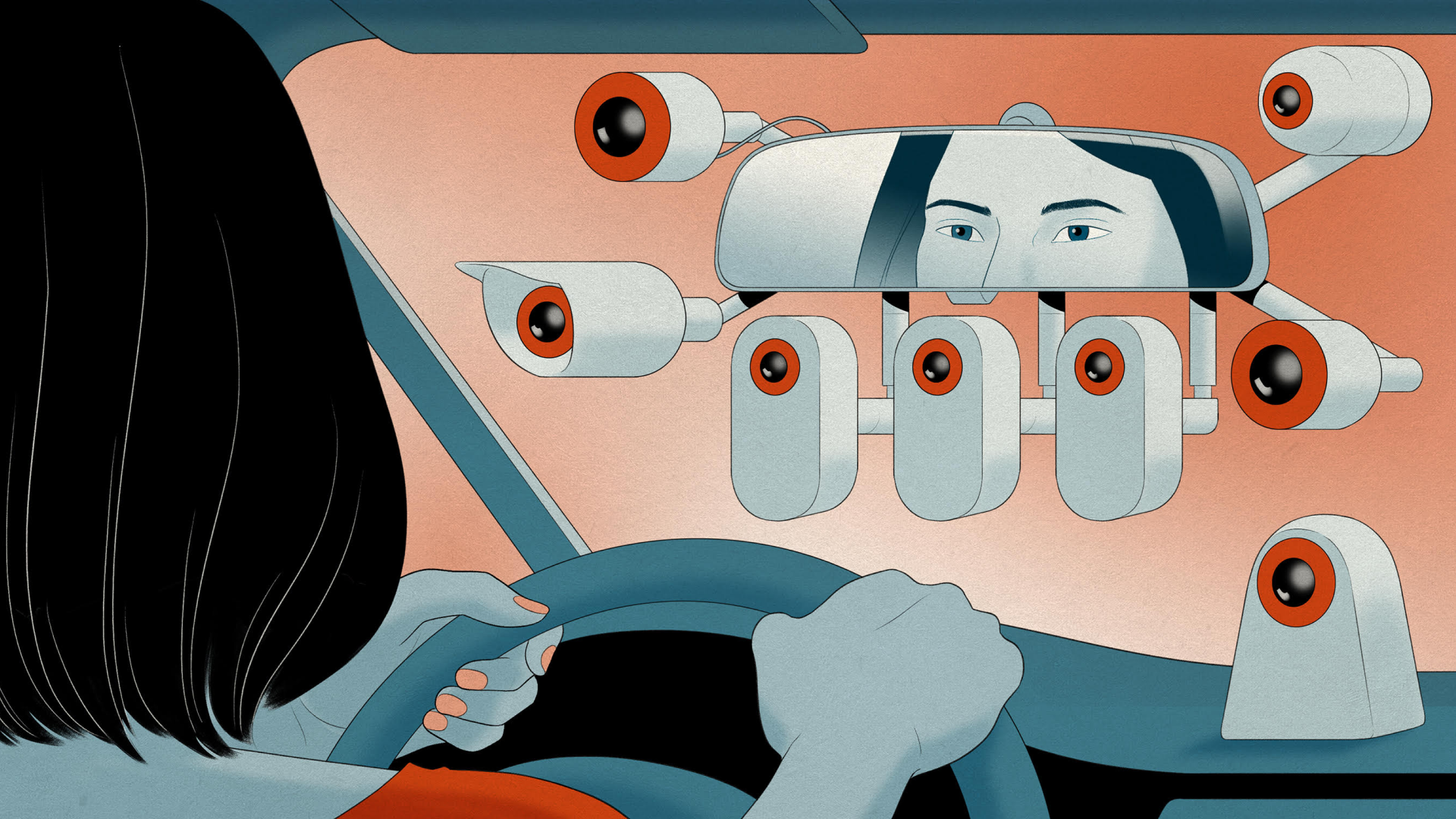

Even though home insurance rates are rising faster than inflation and the cost of car insurance continues to increase, most Americans still refuse to install data-sharing devices in their homes or cars in exchange for insurance discounts, according to the second annual Policygenius Home & Auto Insurance Technology Survey.

For the second year in a row, we asked Americans with auto, homeowners, and/or renters insurance which advanced data-monitoring devices — like dashboard cameras and doorbell cameras — they’d be willing to use if their insurance company gave them a discount for doing so.

Like last year, the majority of Americans still say “no discount is worth” installing these devices, even as insurance costs are rising in 2022.

Year over year, more Americans opt for privacy over insurance discounts

Like last year, in 2022 a majority of Americans (65% to 77%, depending on the device) said they would not use devices or apps that sent information to their insurance companies or third parties, even if doing so would earn them a significant discount. But in some categories, the percentage of Americans who said “no” was even higher than last year, when 57% to 67% (depending on the device) said they would not opt in.

For example, the number of Americans who said they would not install a smart doorbell camera that shares facial recognition data with third parties went up by 10 percentage points between 2021 and 2022. Last year, 67% of Americans said no discount would be worth this, but in 2022, even with rising homeowners insurance costs, the figure was 77%.

More than two-thirds of American drivers say “no way” to data-collecting apps and dashcams

Auto insurance companies have long given discounts for having a good driving record, but new technology makes it possible to monitor your driving habits in real time — and many insurance companies offer savings to customers who opt in.

Telematics discounts require an app or device that shares your driving location, time on the road, speed, and braking data with your insurance company. The insurer then uses the data to set the cost of your premiums, based on usage and safe driving.

Back in 2021, 58% of Americans said “No, no discount is worth this,” when asked if they would use an app that collects data about their driving behavior and location for a discount on their car insurance. In 2022 — despite widespread insurance premium increases — 68% of Americans said they would not install telematics, an increase of 10 percentage points.

Only 32% said they would use telematics if they were offered a discount, and of those drivers, 67% said they would only download an app that collected data about their driving behavior if it lowered their rates by more than half. (Policygenius has found that drivers save an average of 20% on their car insurance with telematics programs.) A mere 11% said they would download an app regardless of the discount size.

According to a 2021 J.D. Power survey, 16% of auto insurance customers said they have opted in to their insurer’s telematics program. [1]

We also asked Americans about dashboard cameras. No car insurance companies on Policygenius’s best car insurance companies of 2022 offer dashcam discounts to everyday drivers. But some insurers do offer dashcam discounts to commercial clients; for example, RLI Insurance — a niche U.S.-based insurer that specializes in property and casualty policies — offers large trucking and specialty commercial drivers a 5% discount when they use Samsara dashcams. [2]

Over two-thirds (68%) of Americans said they would not use a live dashboard camera that records their driving for any discount amount. Of those who said they would install a dashcam, nearly three-quarters (74%) said they would only do it if it cut their bill by at least half. Just 9% of Americans would be willing to install a dashcam to monitor their driving regardless of the discount’s amount.

Most Americans don’t want discounts in exchange for data-collecting tech in their homes

Homeowners insurance companies have historically offered a discount to customers who have a security system installed, but some insurers are now offering discounts for smart home devices, too.

The devices and programs work differently per insurer. For example, the smart home program from Nationwide uses the Notion smart monitoring system to detect water leaks, smoke/carbon monoxide alarm sounds, extreme temperature changes, and doors and windows opening and closing.

Homeowners get alerts when the sensors detect something, but so does Nationwide (though the data is for research and analytics, and not used in underwriting or as claims evidence). The kit costs $75 to $100 to install, and Nationwide offers customers a 10% discount on a portion of their coverage, resulting in $50 of savings per year on average. [3]

We found that 65% of Americans believe no discount is worth installing a smart home device like a doorbell camera, water sensor, or smart thermostat for a discount if these devices shared data with their insurance companies. (In 2021, 57% said “No, no discount is worth this.”)

Of the 35% of homeowners and renters who said they would install such a device, 69% would only do it for a discount of half their bill or more. Only 11% said they would install smart devices for a discount of any amount.

We also asked specifically about smart doorbell cameras that share facial recognition data with third parties. Consumer Reports recently confirmed that as of July 2022, all top manufacturers share camera and doorbell video footage with law enforcement without a warrant or user permission. [4]

Over three-quarters (77%) of Americans said they would not install a smart doorbell camera that shares facial recognition data with third parties in exchange for lower home insurance or renters insurance rates. This percentage has increased 10% since last year, when 67% said “No, no discount is worth this.”

This year, 23% would install these smart doorbell cameras, but 68% of people willing to install them would only do so if the cost of their home insurance was cut at least in half. Only 8% of all respondents said they would install a video doorbell that shared facial recognition with third parties for any discount amount.

Methodology

Policygenius commissioned Google Surveys to poll a nationally representative sample of 1,500 home, auto, or renters insurance policyholders (“Americans,” in the article) aged 25 and older, from July 18, 2022 to Aug. 10, 2022.

The average margin of error for 2022 responses is +/- 5.5%. For 2021 data, it is +/- 3.2%. For more details, see Google Surveys’ methodology. Percentages were rounded to the nearest whole number, so some totals may not add up to 100.