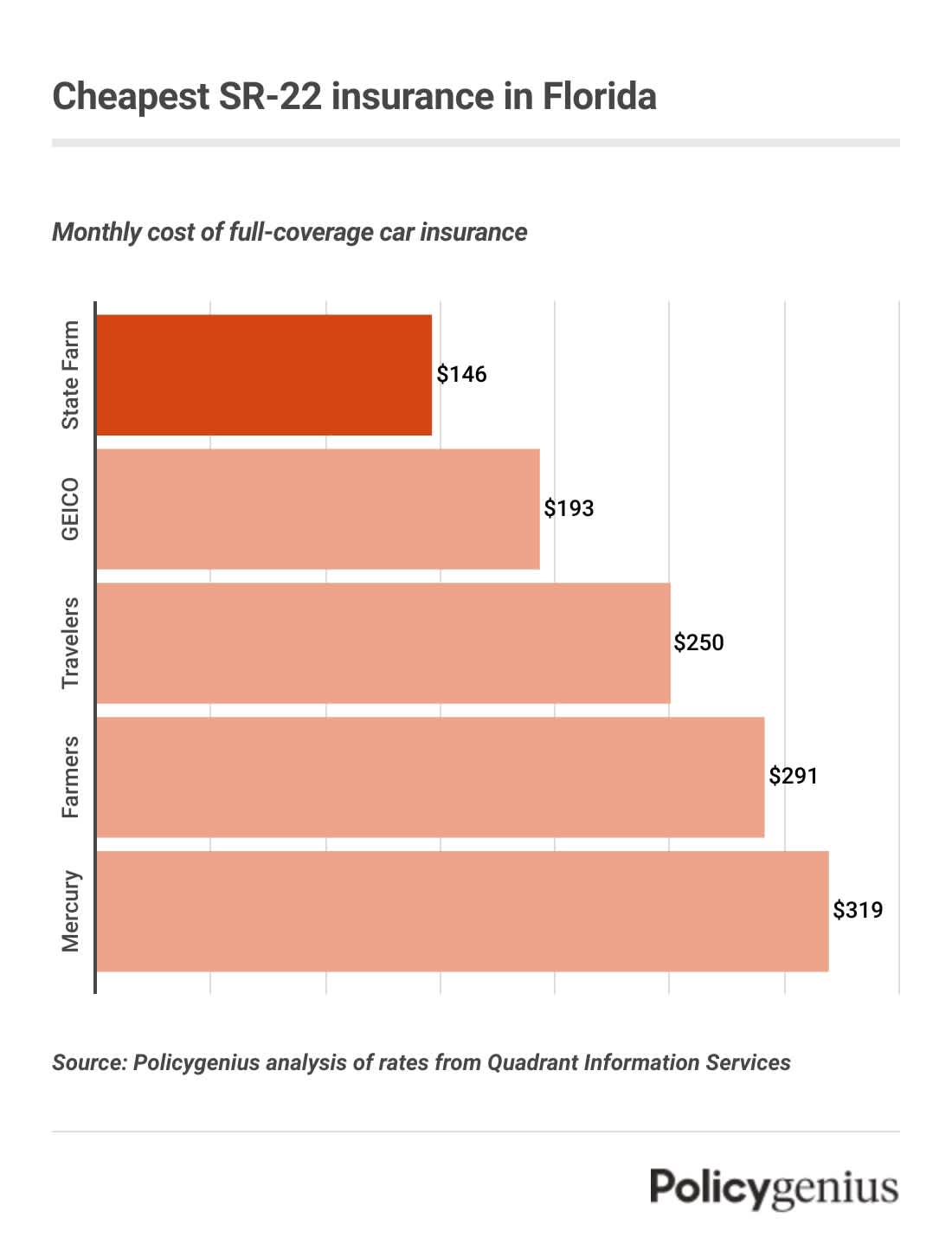

Cheapest SR-22 insurance in Florida

The cheapest company for SR-22 insurance in Florida is State Farm, with an average cost of $146 per month, or $1,753 a year. That’s $2,363 cheaper than the average cost of SR-22 insurance in Florida, which is $4,116 per year.

On average, Florida’s high-risk drivers face some of the highest SR-22 insurance rates in the country. But we found that with State Farm, GEICO, Travelers, and a few other car insurance companies have cheaper-than-average rates for Florida drivers who need an SR-22.

It’s always a good idea to compare quotes from different companies before buying to find the company with the cheapest SR-22 insurance for you.

Company | Average monthly cost of SR-22 insurance | Average annual cost of SR-22 insurance |

|---|---|---|

State Farm | $146 | $1,753 |

GEICO | $193 | $2,315 |

Travelers | $250 | $2,999 |

Farmers | $291 | $3,486 |

Mercury | $319 | $3,825 |

UAIC | $344 | $4,133 |

What is SR-22 insurance in Florida?

SR-22 insurance isn’t actually a type of car insurance. It’s actually a form that your car insurance company files with the state to prove you have car insurance that meets the minimum coverage requirements.

In Florida, drivers who need SR-22 must have the following amounts of coverage, at a minimum:

Bodily injury liability (BIL): $10,000 per person, $20,000 per accident

Property damage liability (PDL): $10,000 per accident

Personal injury protection (PIP): $10,000 per accident

SR-22 insurance in Florida has higher minimum coverage requirements than normal car insurance for drivers with clean records. If you need an SR-22 in Florida, you’ll have to get a minimum amount of bodily injury liability coverage, which isn’t required for most Florida drivers.

You may need to get an SR-22 in Florida if your license is suspended for getting too many points. You can get points on your license for driving violations like reckless driving, running a red light, speeding, or leaving the scene of a crash without sharing your information.

Florida laws may require you to have an SR-22 on file for up to three years. If you let your car insurance lapse during the time when you’re supposed to maintain an SR-22, you’ll have to pay a fine and carry an SR-22 for even longer.

Cheapest FR-44 insurance in Florida

Florida is one of two states (the other is Virginia) that sometimes requires an FR-44 form instead of an SR-22. Like an SR-22, an FR-44 is a form that your insurance company files for you, except an FR-44 is usually for more serious violations like a DUI or are involved in a serious accident

We found that GEICO has the cheapest FR-44 insurance in Florida, with an average cost of $149 per month or $1,793 a year — $1,282 cheaper than average.

Company | Average monthly cost of FR-44 insurance | Average annual cost of FR-44 insurance |

|---|---|---|

GEICO | $149 | $1,793 |

State Farm | $155 | $1,865 |

Travelers | $220 | $2,640 |

Nationwide | $220 | $2,642 |

Farmers | $275 | $3,297 |

Mercury | $288 | $3,455 |

UAIC | $290 | $3,484 |

Allstate | $301 | $3,613 |

AIG | $312 | $3,747 |

National General | $351 | $4,216 |

FR-44s in Florida also have higher coverage requirements than SR-22s. Someone with an FR-44 must have at least the following minimum amounts of car insurance:

Bodily injury liability (BIL): $100,000 per person, $300,000 per accident

Property damage liability (PDL): $50,000 per accident

Personal injury protection (PIP): $10,000 per accident

How to get SR-22 or FR-44 insurance in Florida

If your license has been suspended in Florida and the state is requiring you to get either an SR-22 or FR-44, here are the steps to follow:

Shop around and get covered: Since car insurance rates are so expensive in Florida, it’s best to compare quotes before you get covered to find the lowest price for either SR-22 or FR-44 insurance. You probably won’t be able to get quotes online, so you may have to call car insurance companies or agents directly.

Plan to pay a fee: Your insurance company will file your SR-22 or FR-44 for you after you buy coverage, but expect to pay a filing fee as a part of your policy’s premiums. Usually the fee is around $25.

Wait for your license to be reinstated: You should wait for confirmation from your insurance company or the Florida DMV that the state has received the form and your license is no longer suspended before you drive, otherwise you risk even more legal penalties.

Non-owner SR-22 or FR-44 insurance in Florida

People who don’t own a car may still have to get SR-22 or FR-44 insurance if they committed a violation in a borrowed or rented car.

In this case, you’d have to get non-owners SR-22 or FR-44 insurance. Non-owners insurance is a basic policy for people who don’t own a car. It usually includes only the minimum amount of insurance you’d need to meet the requirements of an SR-22 or FR-44 in Florida.

Non-owners SR-22 and FR-44 insurance both work almost exactly like a regular policy, but they’re cheaper since neither includes comprehensive or collision coverage (and since people who don’t own cars usually drive less than people who do).