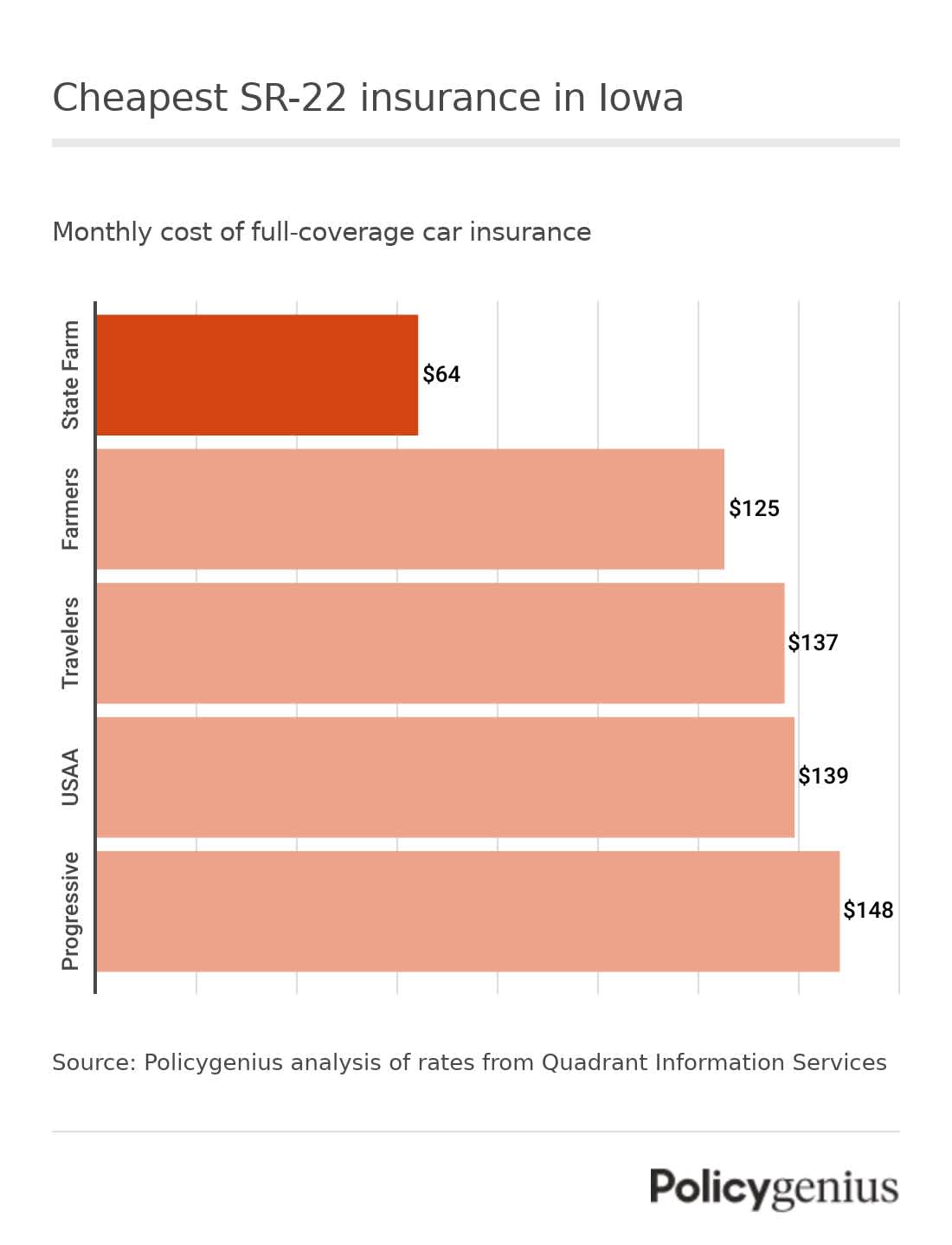

Cheapest SR-22 insurance in Iowa

Our analysis found that State Farm has the cheapest SR-22 insurance in Iowa. On average, SR-22 insurance from State Farm costs just $64 per month, or $773 a year. That’s $1,230 cheaper than average in the state.

Iowa drivers can also find cheap SR-22 insurance from Pekin, Travelers, and USAA. Since rates can vary by company, you should compare quotes before buying.

Company | Average monthly cost of SR-22 insurance | Average annual cost of SR-22 insurance |

|---|---|---|

State Farm | $64 | $773 |

Pekin | $125 | $1,497 |

Travelers | $137 | $1,638 |

USAA | $139 | $1,664 |

Progressive | $148 | $1,779 |

West Bend Mutual | $152 | $1,825 |

IMT | $158 | $1,899 |

American Family | $165 | $1,975 |

What is SR-22 insurance in Iowa?

SR-22 insurance is not actually a kind of car insurance. Instead, an SR-22 is a form that your insurance company files for you to prove to the state that you’re insured. In Iowa, you have to have at least the following amounts of insurance with an SR-22:

Bodily injury liability (BIL): $20,000 per person, $40,000 per accident

Property damage liability (PDL): $15,000 per person

Under Iowa law, you may have to get an SR-22 after you’re caught driving without insurance or after a serious driving violation, especially an OWI. Iowa requires that you carry SR-22 for two years after your most recent license suspension.

How to get SR-22 insurance in Iowa

You can follow these steps to find affordable SR-22 car insurance in Iowa after a suspension or violation:

Find companies offering SR-22 insurance: Not all companies offer SR-22 insurance because of the risk of covering high-risk drivers. This means you may have to check around with a few companies before finding coverage.

Pay other fees and penalties: You may face additional penalties, too. These include fines and, in the case of an OWI-related offense, a drinking driver course and substance abuse evaluation. [1]

Wait for your SR-22 to process: It can take a couple of days for your SR-22 to process, but if it’s taking longer than you expected to get a confirmation, be sure you’ve paid all the necessary fines.

Once you no longer need to have an SR-22, you’ll have to visit the Iowa Department of Transportation to get a duplicate, non-SR-22 license.

Non-owner SR-22 insurance in Iowa

Even if you don’t have a car of your own, you may still have to get SR-22 insurance after your license is suspended or you get an OWI. Non-owner SR-22 insurance is a special policy for people without cars, but it’s harder to find than regular SR-22 car insurance.

Non-owners insurance has basically the same coverage as a regular policy. The only differences are that non-owner SR-22 coverage doesn’t have comprehensive or collision coverage (since you don’t own a car to protect), and it usually has lower limits.

You won’t be able to get quotes online, so you may need to call multiple companies or work with an agent to find a company that will offer you non-owner car insurance with an SR-22.