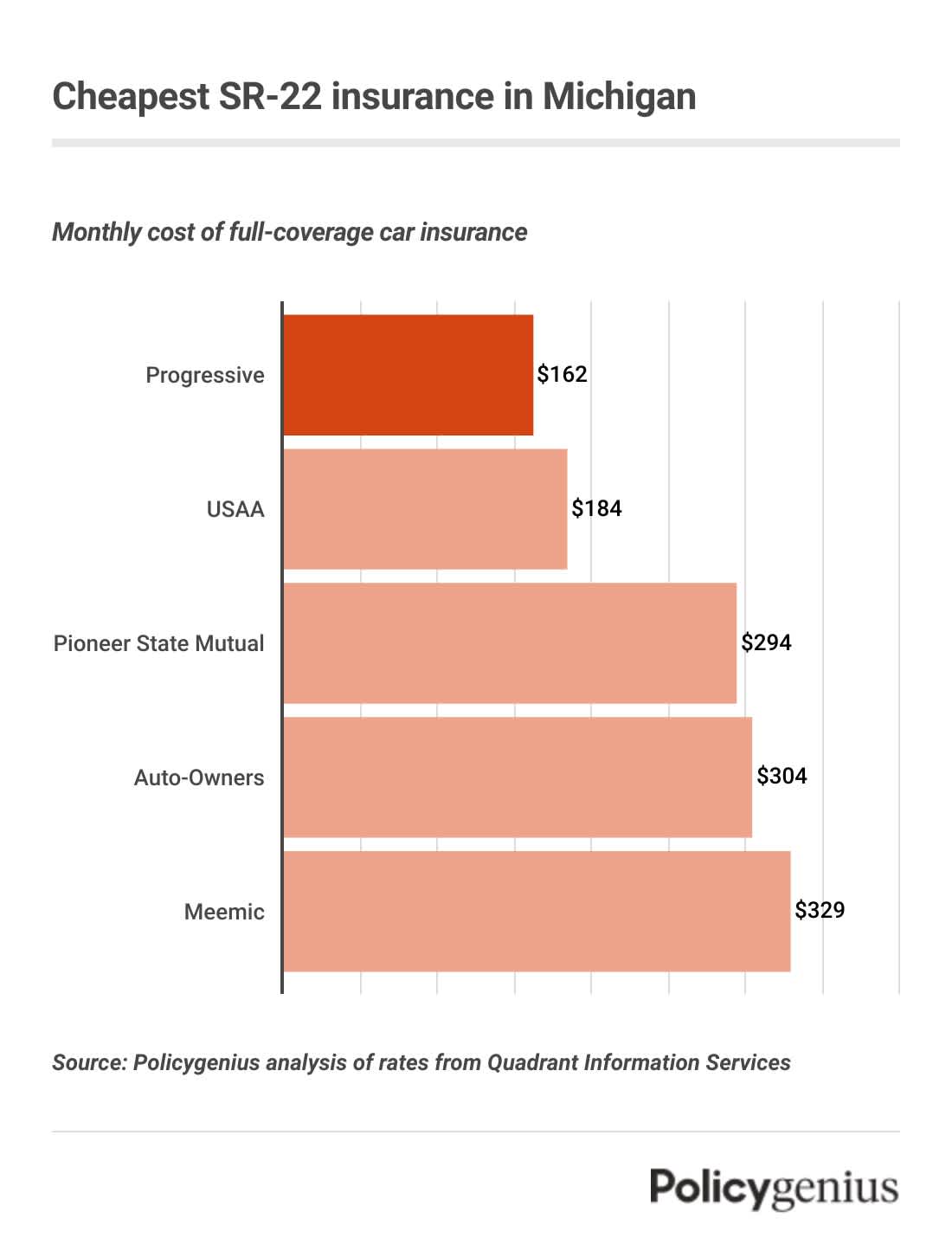

Cheapest SR-22 insurance in Michigan

Progressive has the cheapest SR-22 insurance in Michigan. On average, Progressive costs $162 per month or $1,945 a year for high-risk drivers. That’s $2,736 cheaper than average.

Drivers in Michigan can also get cheap SR-22 insurance from USAA (if they’re in the military or a part of a military family) and Pioneer State Mutual. Cost depends on the driver, so make sure to compare rates before buying a policy.

Company | Average monthly cost of SR-22 insurance | Average yearly cost of SR-22 insurance |

|---|---|---|

Progressive | $162 | $1,945 |

USAA | $184 | $2,204 |

Pioneer State Mutual | $294 | $3,533 |

Auto-Owners | $304 | $3,651 |

Meemic | $329 | $3,952 |

Farm Bureau | $339 | $4,069 |

GEICO | $343 | $4,114 |

What is SR-22 insurance in Michigan?

SR-22 insurance isn’t a type of car insurance. It’s actually just a form that your insurance company files on your behalf that proves you have car insurance. An SR-22 in Michigan must show you have at least:

Bodily injury liability (BIL): $20,000 per person, $40,000 per accident

Property damage liability (PDL): $10,000 per accident

Not everyone in Michigan needs SR-22 insurance. Michigan requires an SR-22 if you’re caught driving without car insurance, or after another serious violation, like if you get too many points on your license or if you’re caught drinking and driving.

SR-22 insurance in Michigan for non-residents

Under Michigan law, drivers who don’t live in the state or have moved out of Michigan still need to file an SR-22 if they’re caught driving without insurance. If you don’t, your license will still be suspended until an insurer in your state files an out-of-state SR-22 for you.

How to get SR-22 insurance in Michigan

The first step for drivers who need an SR-22 is to check with their current car insurance company. If you don’t have car insurance already or your current car insurance company won’t file an SR-22 for you, follow these steps to get SR-22 insurance in Michigan:

Find companies offering coverage: Not every company offers SR-22 insurance. Just to be safe, you should plan to spend extra time shopping around.

Pay any fines (and avoid having to pay twice): You’ll have to pay a fine of at least $500 if you’re caught without insurance in Michigan, so you’ll need to pay it before you can get your license back. If you let your SR-22 insurance lapse, you’ll have to pay the fine a second time.

Request a license reinstatement hearing: Don’t assume that just because you have an SR-22 that you can get back on the road. Michigan requires some drivers to request a hearing before they can start driving again. You may receive a notice from the state, but if you don’t you can check on the Michigan Secretary of State website to see if you need a hearing.

Non-owner SR-22 insurance in Michigan

Non-owner insurance is basic auto insurance for drivers who don’t own their own car. If your license is suspended and you don’t own a car, a non-owner SR-22 policy can help you reinstate your license.

It’s usually cheaper to get an SR-22 with non-owners insurance because non-owners insurance has lower limits than a typical policy. It also doesn’t include any of the coverage you need if you own a car, like comprehensive or collision.

Not every company offers non-owners insurance, and even fewer offer non-owner SR-22 insurance. Also, non-owner insurance usually isn’t available online, only by phone. If you’re in Michigan, you should plan to check with a few companies before you find a policy.