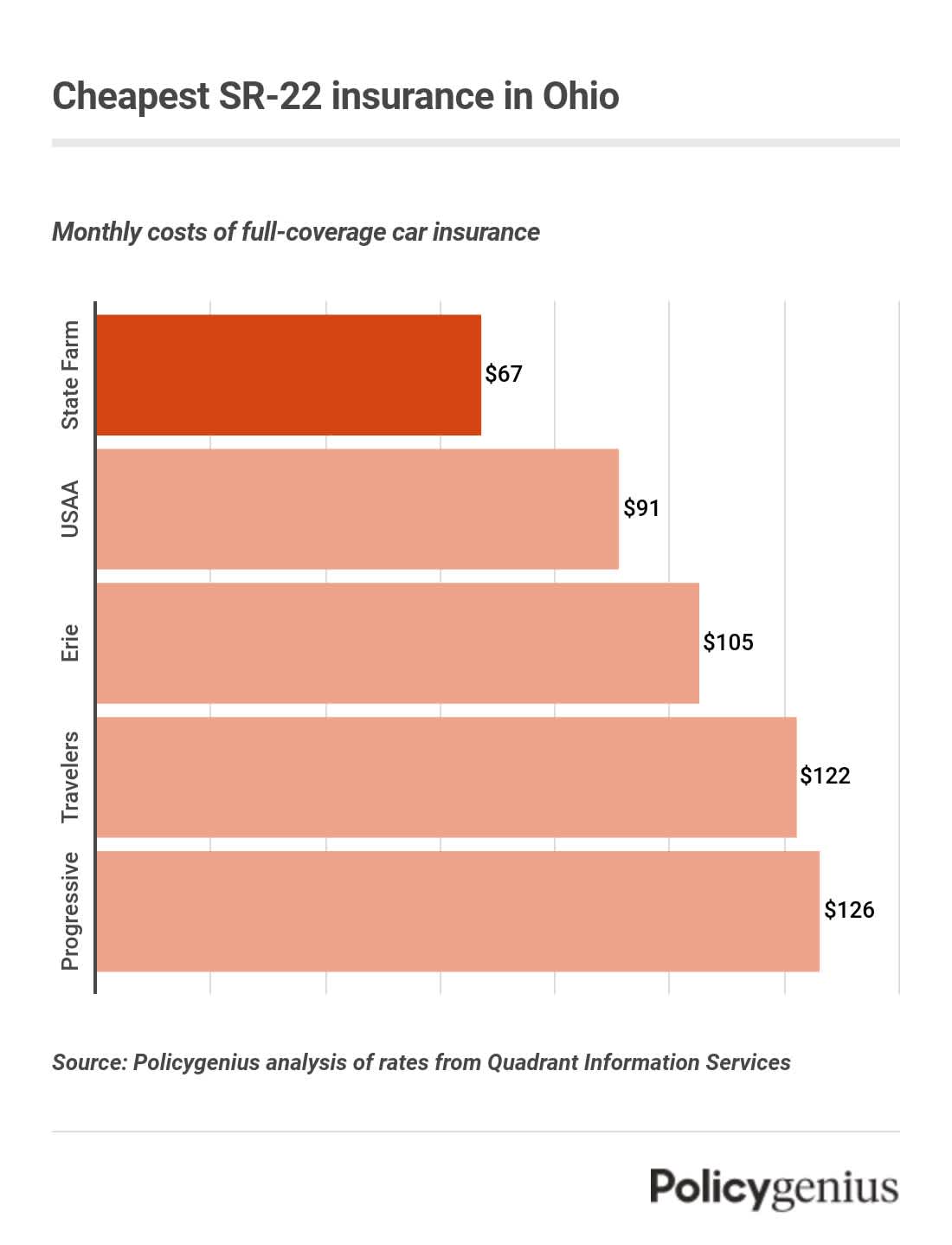

Cheapest SR-22 insurance in Ohio

State Farm has the cheapest SR-22 insurance in Ohio, with an average cost of $67 per month or $799 a year. That’s 59% cheaper than the average car insurance rate for high-risk drivers in Ohio ($1,948 per year).

USAA and Erie both have cheaper-than-average rates for SR-22 insurance in Ohio. SR-22 insurance also requires a small filing fee on top of the increase to your normal premium.

To avoid paying more than you have to for SR-22 insurance, be sure to compare quotes from different companies before buying.

Company | Average monthly cost for SR-22 insurance | Average annual cost for SR-22 insurance |

|---|---|---|

State Farm | $67 | $799 |

USAA | $91 | $1,090 |

Erie | $105 | $1,257 |

Travelers | $122 | $1,462 |

Progressive | $126 | $1,512 |

GEICO | $128 | $1,534 |

Auto-Owners | $128 | $1,541 |

American Family | $129 | $1,551 |

Grange Mutual | $134 | $1,611 |

Nationwide | $152 | $1,830 |

What is SR-22 insurance in Ohio?

SR-22 insurance isn’t really a separate kind of car insurance. An SR-22 is a document that your car insurance company files for you that proves to your state’s Department of Motor Vehicles that you have car insurance.

In Ohio, you’ll have to get an SR-22 (and pay any fines the state requires) if your license is suspended due to a violation like a DUI, reckless driving, or serious accident. You may also have to get an SR-22 in Ohio if you refuse a sobriety test.

You usually have to carry SR-22 insurance in Ohio for three to five years depending on the reason for your license suspension. If you let your SR-22 insurance lapse, you’ll have to pay additional fines and maintain special coverage for even longer.

Minimum insurance limits in Ohio

In Ohio, an SR-22 proves to your state that you have at least the minimum amount of insurance required by law, which in Ohio is:

$25,000 per person and $50,000 per accident in bodily injury liability coverage

$25,000 per accident in property damage liability coverage

How to get SR-22 insurance in Ohio

It’s not hard to get SR-22 insurance in Ohio. Once your license is suspended, you can follow these steps to get it SR-22 insurance so it can be reinstated:

Shop around and get coverage: Before you get covered, be sure to compare quotes from different car insurance companies to find the one with the cheapest SR-22 insurance for you.

Plan to pay more fees: Your insurance company will file your SR-22 electronically with Ohio’s DMV, but you’ll have to pay a filing fee (the amount depends on the insurer).

Wait for confirmation you’re good to drive: It takes 72 hours for your SR-22 to file in Ohio, so wait for a notification from the DMV or insurance company before getting back on the road.

Non-owner SR-22 insurance in Ohio

In Ohio, your license may be suspended even if you don’t own a car. This could happen after you commit a violation in a borrowed or rented car. If this happens to you, you may have to get non-owner SR-22 insurance.

Non-owner car insurance is a barebones policy for people who don’t own cars, and it usually just includes the basic liability coverage you need to drive. You can still attach the SR-22 form to it just like with regular car insurance.

A non-owner SR-22 still reinstates your license, and it tends to cost less since the coverage is so limited. But not all car insurance companies in Ohio offer non-owner insurance, so you may have fewer options if you’re looking for non-owner coverage, and you won’t be able to get quotes online.