Cheapest SR-22 insurance in South Carolina

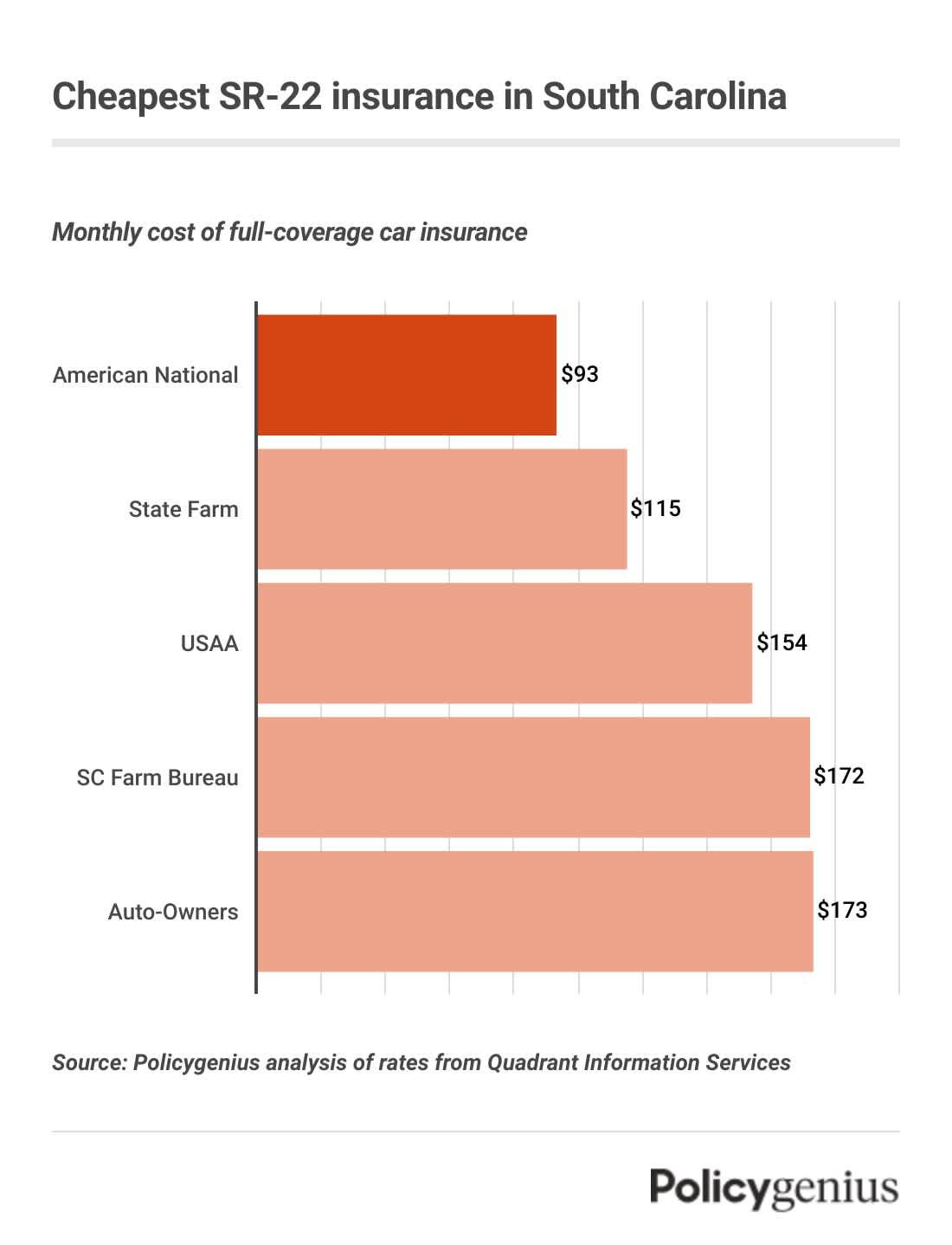

We found that American National has the cheapest SR-22 insurance in South Carolina. American National offers SR-22 insurance for an average of $93 per month, or $1,117 a year, 64% cheaper than the statewide average.

State Farm and USAA, are among the other companies that offer cheap coverage in South Carolina for drivers who need an SR-22. Since the cost of SR-22 insurance depends on the company, you should compare your rates before getting insurance.

Company | Average monthly cost of SR-22 insurance | Average annual cost of SR-22 insurance |

|---|---|---|

State Farm | $115 | $1,386 |

USAA | $154 | $1,844 |

South Carolina Farm Bureau | $172 | $2,066 |

Auto-Owners | $173 | $2,076 |

Travelers | $177 | $2,120 |

American Family | $182 | $2,190 |

GEICO | $207 | $2,482 |

Allstate | $240 | $2,881 |

What is SR-22 insurance in South Carolina?

An SR-22 is not a type of car insurance, it’s a form that your insurance company files with the state of South Carolina to prove you have insurance. If you’re required to have an SR-22 in South Carolina, you need at least the following amounts of car insurance:

Bodily injury liability (BIL): $25,000 per person, $50,000 per accident

Property damage liability (PDL): $25,000 per accident

You may be required to get SR-22 insurance after a license suspension or a serious driving violation, like being caught driving without insurance or driving under the influence of alcohol or drugs.

In fact, you will need an SR-22 on your record to get a provisional license as a part of South Carolina’s mandatory ADSAP substance abuse program after a DUI or DUAC.

Needing an SR-22 makes it more expensive to get insurance, but letting your coverage lapse during the time an SR-22 is required means more fines and a license suspension, so it’s important to find coverage.

How to get SR-22 insurance in South Carolina.

If you need to get SR-22 insurance in South Carolina, you should take the following steps:

Find a company that will offer you coverage: Not every company covers drivers with a serious violation on their records, so you may have to shop around before you will find one that offers SR-22 insurance.

Don’t let your coverage lapse: In most cases, you need an SR-22 for at least three years. If you let your coverage lapse, you’ll be unable to drive and be fined or even face prison time.

Enroll in any state-required programs: If you’re required to get SR-22 insurance because of an alcohol-related violation, you may also have to sign up for ADSAP (and pay the necessary fees) to regain your driver’s license.

Non-owner SR-22 insurance in South Carolina

Let’s say that you don’t own a car, but you have a license, and you’re pulled over for a DUI or your license is suspended. You may still be required to get an SR-22, but since you don’t have a car, you may need to get a non-owner SR-22 policy.

A non-owners policy offers the same basic coverage as a regular policy and allows you to get your driving privileges back. It’s even slightly cheaper than standard coverage since it has lower limits than a regular policy.

It may be harder for high-risk drivers to find non-owner SR-22 insurance, since not every company offers it. An independent agent can help you shop around to find the coverage you need.