This summer, many Americans are experiencing the effects of climate change in their own backyards, including flooding in Wyoming, intense heat waves across the U.S., and early-season wildfires in California and Arizona.

To better understand how American homeowners are grappling with the climate crisis — and how they’re preparing for it to get worse — we asked 1,348 homeowners with insurance policies about their experiences with extreme weather, their home insurance, and their expectations for the next 30 years (the length of a typical mortgage) for the Policygenius Climate Change Survey.

Homeowners under age 35 are the most concerned about climate change — and the most prepared to act

Younger homeowners (18 to 34) are particularly apprehensive about extreme weather caused by climate change, with nearly three-quarters (72%) expecting their homes to be damaged by extreme weather in the next 30 years.

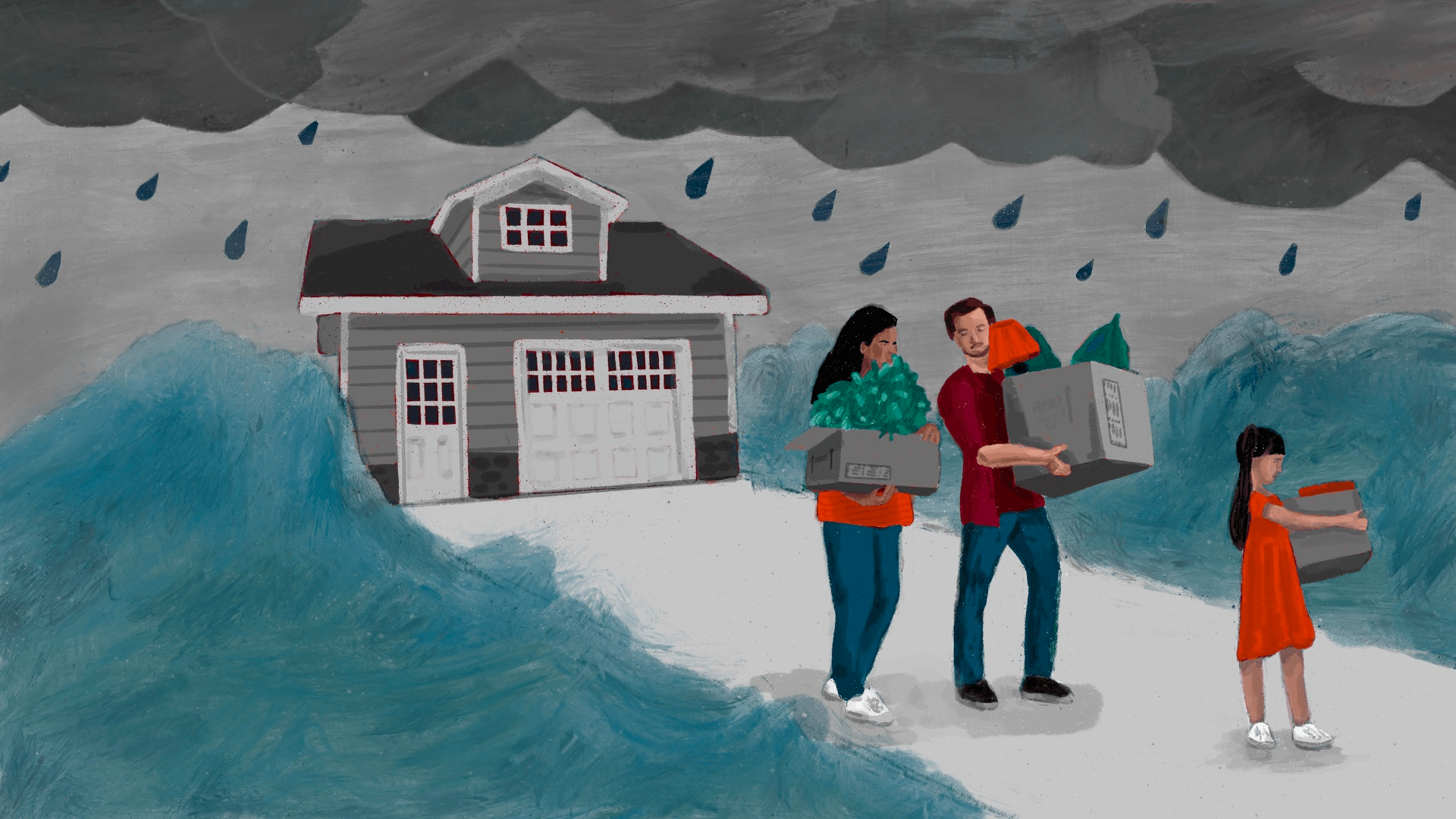

Younger homeowners are also more likely to say they’ll need to move to reduce the effects of climate change on their lives. Nearly two in three (64%) said they expect to move due to climate-induced extreme weather in the next 30 years, and this percentage was even higher for younger homeowners with children: Over three quarters (77%) of young homeowners with children under 18 years of age expect to move in the next 30 years due to climate change.

Finally, younger homeowners are also more likely to report experiencing — or knowing someone who has already experienced — the effects of extreme weather. More than half (56%) of young homeowners said their home has been damaged by extreme weather, versus 31% of all homeowners. And around three in five (60%) say they know someone whose home has been damaged by extreme weather — compared to 48% of all homeowners. Studies have found a correlation between age and personal network size, with younger people having larger personal networks [1] , which may explain their higher rates of knowing someone whose home was damaged by extreme weather, but not why they would have more firsthand experience.

Many homeowners don’t have enough insurance for rebuilding or flooding

As natural disasters continue to worsen due to climate change, many homeowners report not having enough insurance to pay for a full rebuild of their homes after a total loss: One in three (33%) said they either don’t have enough coverage, or weren’t sure if they did.

The remaining 67% believe they do have enough coverage for a full rebuild, a percentage which was fairly consistent across ages, regions, and income levels (though it dipped to 58% for homeowners with household incomes below $40,000).

While our 2020 Home Insurance Literacy Survey found a higher percentage (74%) of homeowners were confident they had enough coverage to replace their homes, that survey also found nearly half of homeowners (49%) didn’t know how to calculate the coverage amount for their home, which likely means even people who think they’re covered for a full rebuild are, in fact, not.

This insurance coverage gap appears to be even wider when it comes to flooding, as the vast majority of homeowners reported they didn’t have flood insurance despite the fact that flooding impacts 99% of U.S. counties [2] and is a factor in 90% of all natural disasters. [3] In our survey, just 21% of homeowners said they had purchased flood insurance, which is consistent with findings from the National Flood Insurance Program, the main provider of flood insurance in the U.S.

However, the flood insurance gap appears to be smaller among younger homeowners, as just under half (49%) of homeowners age 18 to 34 said they had purchased flood insurance.

Homeowners insurance does not cover flood damage, yet in our 2020 survey, over half (53%) of homeowners didn’t know that. Many homeowners are required to have flood insurance if they live in a high-risk flood zone with a mortgage on their home. However, data from First Street Foundation found that nearly 6 million homes at substantial risk of flooding aren’t required to have flood insurance based on current guidelines. [4]

Homeowners in the South have been hit hardest by extreme weather — and they expect it to get even worse

According to our survey, homeowners in the South are the most likely to have experienced or know someone who has suffered home damage from extreme weather. Around 37% have suffered damage to their home due to extreme weather, versus 31% of all homeowners. And more than half of Southern homeowners (54%) know someone whose home has been damaged by extreme weather, versus 48% of all homeowners.

When thinking about the future, over half (52%) of homeowners in the South expect their homes to be damaged by climate change–related extreme weather in the next 30 years. However, under one-third (31%) of Southern homeowners said they’d move in the next 30 years due to climate change, comparable with rates in the West (32%) and the Northeast (28%).

Methodology

All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 1,348 insured homeowners. The survey was carried out online between 13th - 17th May 2022. The figures have been weighted and are representative of all US adults (aged 18+) who own homes and are insured.