What is cash value life insurance?

The cash value of life insurance is the portion of a permanent life insurance policy that may experience tax-deferrable growth over time. The term “cash value life insurance” can refer to any life insurance policy that includes this feature. Unlike the death benefit, which your beneficiaries get when you die, the cash value of your policy can be used while you’re alive.

How does your life insurance policy earn cash value?

Every time you make a premium payment, part of the money goes toward the cost of maintaining the policy, and part goes toward the cash value. The exact distribution depends on your individual policy.

In traditional whole life insurance policies, the cash value grows at a set low interest rate determined by the insurer. In other types of cash value life insurance, it may earn interest based on a market index or mutual fund — it depends on the type of policy you have.

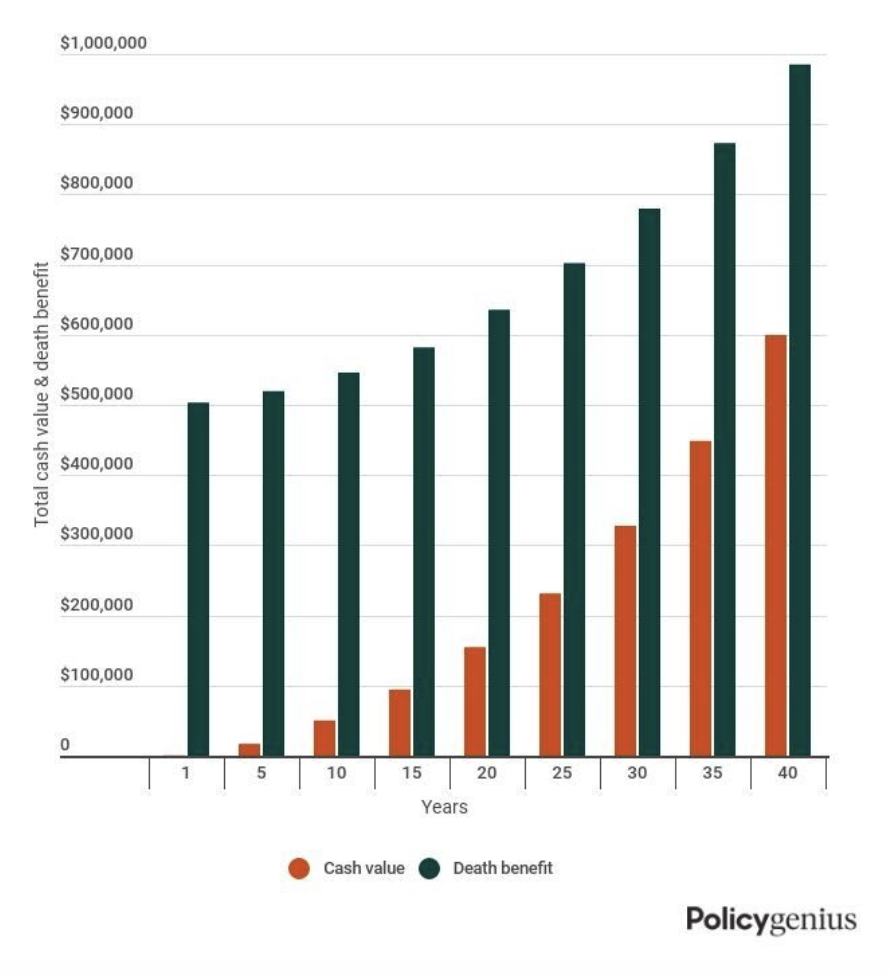

Significant cash value accumulation can take years — and even decades.

The graph below illustrates an example of how both your cash value and death benefit can increase over years of holding the policy. Some cash value life insurance policies have increasing death benefits, and some policies offered through mutual companies pay dividends, which can increase your cash value as well as your death benefit.

Example of cash value life insurance

Types of life insurance with cash value

Most types of permanent life insurance policies have a cash value component. Permanent policies last your entire life as long as you continue to pay the premiums. Below are a few of the main types of policies that have a cash value feature.

Whole life insurance is one of the most popular types of cash value policies. Its cash value grows at a fixed rate set by your insurer.

Universal life insurance is a more flexible type of permanent life insurance policy because you can increase or decrease how much you pay toward your premiums, and eventually use your cash value to pay those premiums.

Variable life insurance allows you to base your cash value growth on various funds offered by the insurance company, though variable life insurance isn't a form of direct investment in the market. You may earn more interest this way than you would with a whole life policy, but you take on much more risk.

Variable universal life insurance (VUL) is a type of universal life policy in which the cash value grows based on the performance of funds of your choosing. It also has flexible premiums.

Indexed universal life insurance (IUL) is a type of universal life policy in which the cash value changes based on a market index.

Guaranteed issue life insurance is a type of whole life insurance policy that offers smaller coverage amounts meant to be used for end-of-life expenses, such as funeral costs. Many guaranteed issue policies have a cash value component, but it�’s not the main purpose of the policy.

Pros of cash value life insurance

Coverage lasts your entire life. You don’t have to worry about coverage expiring (as long as you don’t surrender your policy or let it lapse) because cash value policies are permanent.

Cash value life insurance can be used to offset estate tax. If your estate falls into the qualifying bracket for estate tax — $13.61 million in 2024 — the life insurance death benefit can be used to offset taxes and guarantee an inheritance for your beneficiaries.

Cash value gains are tax-deferred. Cash value life insurance can provide another tax-deferred growth vehicle if you’re already maximizing contributions to other accounts, like a 401(k) or Roth IRA.

Cons of cash value life insurance

It’s more expensive. Cash value life insurance is much more expensive than a comparable term life insurance policy. If your primary goal is to put a financial safety net in place for your family during your prime earning years, other life insurance products — including term life insurance — can get the job done at a cheaper price.

Cash value can take time to build. In order to accumulate significant cash value, it can take years and sometimes decades. With a cash value policy, it’s important to be certain you’ll be able to pay the premiums for the life of the policy in order to receive the full benefit.

Cash value is not paid to beneficiaries. When you die, your cash value typically stays with the insurance company. Your beneficiaries will still receive the death benefit.

Other options could yield higher rates of return and more flexibility. Investing directly in the market allows you to control how much you put in at any given time.

How to use the cash value from your life insurance

There are several different ways you’re able to use cash value, including:

Paying your premiums. Some insurance policies — like universal life insurance — allow you to use your cash value to pay premiums.

Take out a loan against the cash value. You’re able to take a loan out against your cash value, but you have to pay it back, or it will be deducted from the death benefit if you were to die.

Withdraw funds from your cash value. You can also withdraw money from the cash value. If you withdraw money without paying it back, it’s typically subtracted from the final death benefit. It’s best to confirm the specific terms of your policy before making a withdrawal.

Surrender the policy for cash. If you find you no longer need your policy, you can surrender the policy in exchange for your cash value, minus any surrender fees. If you surrender the policy before 10 or so years, you’d likely have to pay fees to your insurer. Plus, surrendering your policy means you’d no longer have life insurance coverage.

Is cash value life insurance right for you?

Cash value life insurance might be right for you if you have:

Permanent coverage needs, such as lifelong dependents

Complex estate planning goals

Maximized contributions to other tax-advantaged accounts

There are many different life insurance policies that include a cash value component, so it ultimately depends on the type of policy you purchase.

Since many cash value policies are significantly more expensive than other products, like term life insurance, many people choose to cover their financial obligations with a term life policy and then invest the difference separately.

This allows them to choose how much they invest, instead of being tied to a steep premium. Cash value life insurance policies often have high surrender rates because they’re expensive to maintain, so it’s important to think through cost before purchasing.

If you’re not sure which type of life insurance is best for you, a Policygenius expert can help you compare options from top insurers for free.