Not all couples are in love with each other’s money habits.

In fact, one in five people in a relationship say their partner is financially irresponsible, according to Policygenius’ second annual Couples and Money survey.

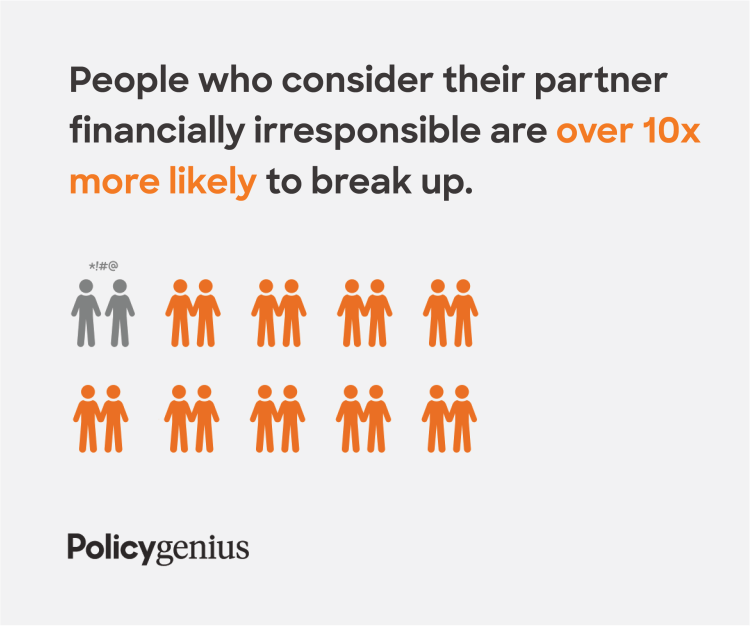

These people are more likely to end their relationship: 11% of respondents who believe their partner is bad with money say they plan to leave that partner due to financial issues. Comparatively, only 1% of people who say their partner is good with money plan to do the same.

“Money issues can create serious conflict in a relationship,” says Patrick Hanzel, a certified financial planner and advanced planning specialist at Policygenius. “That conflict can become compounded if one party wasn�’t upfront about their financial health.”

People who think their partner is bad with money are less likely to know basic facts about their significant other’s finances, the survey found. For instance, only 42% of people who say their partner is financially irresponsible know that person’s debts, compared to 66% of people with (purportedly) money-savvy partners.

Knowing a partner’s debts is important, given red ink can make it much harder to reach major money milestones, like buying a home.

“What you don’t know about your partner’s finances can hurt you,” Hanzel says. “No one wants to be blindsided by their partner’s bad credit score or outstanding bills. As scary as a money talk might seem, every couple should aim to have it sooner rather than later.”

How couples manage money

Policygenius used Google Consumer Surveys to poll 2,005 U.S. adults in a relationship about how they manage money with their partner. The survey was conducted between Aug. 21 and Aug. 30, 2019.

It found a majority of couples are tackling finances together: 78% of respondents keep and manage joint finances, while only 16% don’t know core financial facts, including salary, debts, assets, credit scores, monthly spending and retirement savings, about their partner.

But there are benefits to managing money together — notably, the process promotes transparency, which leads to trust, says Megan McCoy, licensed marriage and family therapist and secretary of the Financial Therapy Association.

Ultimately, “the more couples communicate, the better off they will be,” she adds.

Policygenius’ 2019 Couples and Money survey also found:

19% of people don’t spend any money without telling their partner and 37% were only comfortable spending up to $100 without cluing in their significant other.

46% of people pool income with their partner and 30% of people treat their partner’s debt as joint debt.

People were most likely to know their partner’s salary (70%) and least likely to know their partner’s credit score (50%) or monthly spending habits (51%).

70% of people say money doesn’t influence their relationship. Meanwhile, 3% plan to leave their partners due to money issues. Another 5% would leave their partner, but can’t afford to end the relationship.

How couples can do money better together

If your partner is bad with money, consider keeping the books.

“Every couple is different, but if there's one partner who is more financially dependable or savvy, it might make sense to have them take the reins,” Hanzel says. “The money-savvy partner can set a budget, monitor accounts and make sure the bills are paid on time, all while helping their significant other improve their financial habits."

Here are some other ways couples can avoid money issues.

Build a budget. The best way to open a line of communication is working on a budget together. Include fixed expenses, like mortgage payments, and discretionary spending. For instance, you set a limit for date nights. Track how much you’re spending and adjust when necessary.

Schedule a regular money check-in. Talking about money regularly can get couples on the same page and help them avoid negative surprises, Hanzel says. Set aside a bi-weekly or monthly time to sit down with your partner to go over expenses and track progress toward shared money goals.

Visit a professional. Some financial differences between partners are severe. In those situations, a professional can help, Hanzel says. Similar to a marriage counselor helping couples with their personal relationships, a financial adviser can help you get cross financial hurdles together.

How do kids affect the way families budget? Check out our Parents and Money white paper for more insights and tips.

Graphics by Nastia Kobzarenko