Unlike other types of insurance, your location doesn’t matter that much when you buy life insurance. Living in Florida won’t affect your life insurance rates, but details about you, like your age, medical history, family medical history, and habits, as well as the type of life insurance policy you buy, will all determine what you’ll pay.

Because location doesn’t matter when it comes to cost, our recommendations for the best life insurance companies in Florida are in line with our overall rankings for the best companies. But there are some parts of buying life insurance where state does matter, like company availability and Florida-specific life insurance regulations.

Policygenius score | Best for … | AM Best score | NAIC complaint index (indiv. life) | Cost | |

|---|---|---|---|---|---|

4.9/5 ★ | Overall, cheapest, term life, smokers, young adults | A+ | 0.43 | $ | |

4.8/5 ★ | Marijuana users | A | 0.39 | $ | |

4.9/5 ★ | Whole life | A++ | 0.11 | $$$ | |

4.1/5 ★ | Seniors | A+ | 0.31 | $$ |

Best overall life insurance company in Florida: Legal & General America

Legal & General America, which also does business as Banner Life and William Penn, is our pick for the best life insurance company in Florida. You can get cheaper-than-average rates from Legal & General America, even if you have pre-existing medical conditions that make it hard to get cheap rates at other companies.

If you have a clean medical history, you might even qualify for Legal & General America life insurance without having to take a medical exam. A no-medical exam policy can save you a lot of time when it comes to getting life insurance coverage.

Cheapest life insurance company in Florida: Legal & General America

Legal & General America has the cheapest life insurance rates overall, including in Florida, but remember: your rates aren’t affected by where you live. Your life insurance rates are based on your age, health, lifestyle, and the amount of coverage you buy.

Legal & General America can still be affordable even if you’re someone who smokes or you have a history of medical conditions like high-blood pressure or diabetes.

Best term life insurance in Florida: Legal & General America

The best company for term life insurance in Florida is Legal & General America. That’s because of Legal & General America’s flexible term options, which include term lengths up to 40 years

Term life insurance is the most straightforward type of life insurance policy — you buy coverage for a set amount of time, keep up with your payments, and then if you die while the policy is active your loved ones (beneficiaries) will receive a payment.

Best whole life insurance in Florida: MassMutual

The best whole life insurance in Florida is MassMutual, which ranks so well thanks in part to its financial stability. Whole life insurance is a kind of permanent life insurance, so it’s guaranteed to pay out when you die. MassMutual has a Superior or A++ ranking from AM Best, so you don’t have to worry about the company’s long-term health.

Your whole life insurance policy can also gain interest and even pay out dividends over time. You can also withdraw or borrow from the cash value part of your whole life policy as it grows.

Best life insurance for seniors in Florida: Prudential

If you’re one of the many Florida residents over age 60 or 65 and you’re looking for life insurance, Prudential is our pick for you. Normally life insurance for seniors is expensive, but Prudential may offer affordable rates to people 60 and over — including seniors with age-related health problems like osteoporosis and arthritis.

Best life insurance for young adults in Florida: Legal & General America

Legal & General America offers some of the cheapest life insurance rates for young adults regardless of their health profile. The company offers no-medical-exam and instant-decision options for young people who are in excellent health or have just one or two minor and well-controlled health conditions.

Best life insurance for marijuana users in Florida: Lincoln Financial

Lincoln Financial is the best life insurance for marijuana users in Florida. That’s because Lincoln Financial offers non-smoker or non-tobacco rates to marijuana users rather than classifying them as smokers, which would mean much higher rates.

Even though marijuana use is illegal in Florida, you still have to tell your life insurance company about any cannabis use when you apply for coverage. If you don’t disclose it, you put any future claims at risk.

Best life insurance for smokers in Florida: Legal & General America

Life insurance is always more expensive if you’re a smoker, but you may still be able to find affordable coverage in Florida with Legal & General America. Legal & General America also lets you re-apply for coverage (and lower your premiums) after a year of not smoking — many other insurance companies require at least two years smoke-free.

How is life insurance different in Florida

Even though where you live doesn’t affect what you pay for life insurance, there are some life insurance laws and regulations that are unique to Florida.

Contestable period: If you die during the contestable period, your insurance company can deny a claim if it discovers you misrepresented yourself when you applied. The contestable period in Florida is two years.

Free look period: This is the time you have to cancel your life insurance policy and receive a full refund. The free look time in Florida is 14 days after buying a policy.

Guaranty fund: The Florida Life & Health Insurance Guaranty Association steps in when a life insurance company becomes financially unstable. If this happens, your life insurance benefits are covered for up to $300,000.

Grace period: If you miss a payment, you have 30 days to pay your premium before your insurance company can drop your coverage in Florida.

Time allowable to settle a claim: Florida life insurance companies have to start to pay interest on an unsettled claim starting the day after they receive proof of your death.

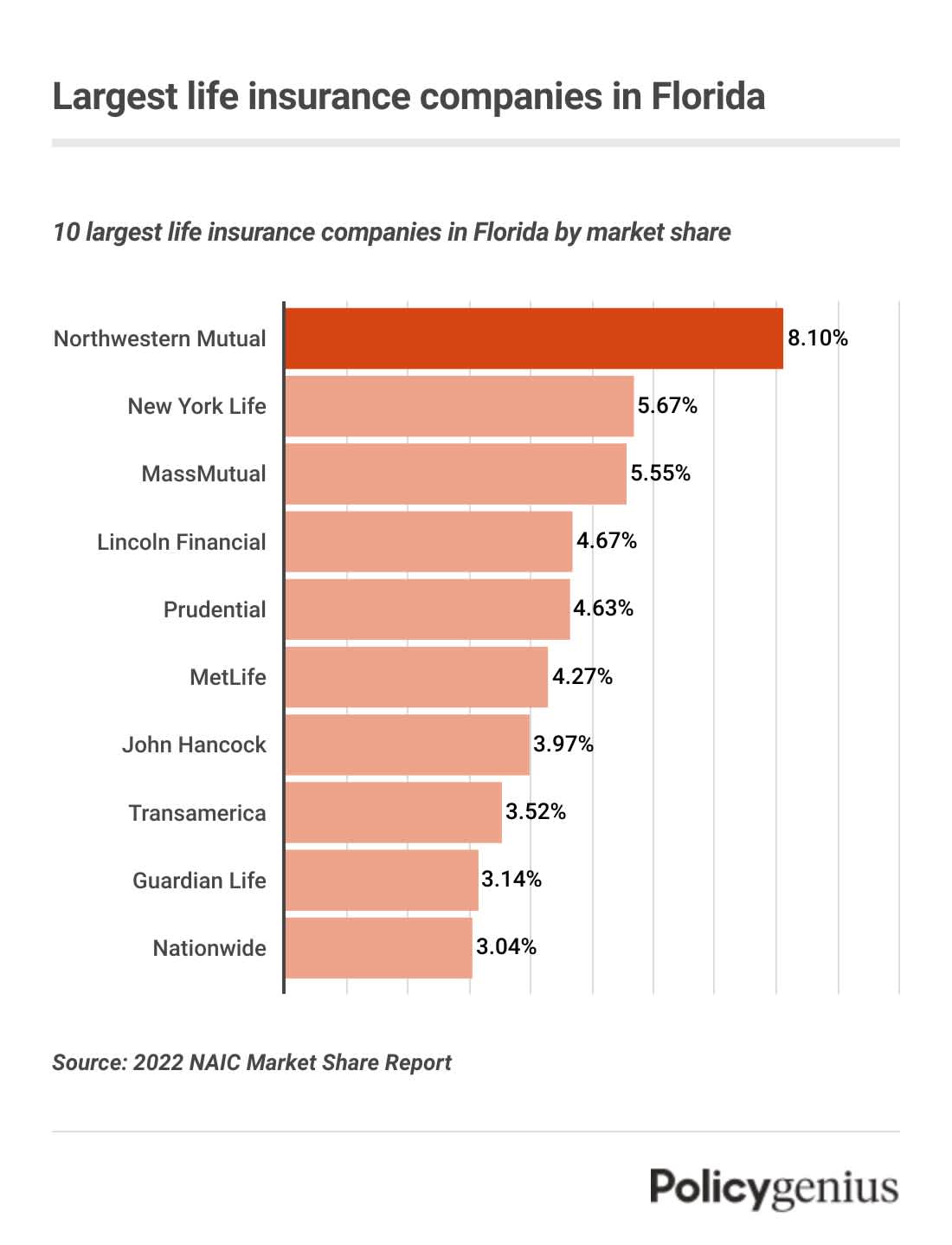

Largest life insurance companies in Florida

Many of the country’s largest life insurance companies offer coverage in Florida — though they may do business through a subsidiary company. Here are the largest life insurance companies in the Sunshine State by market share.

Company | Market share in Florida |

|---|---|

Northwestern Mutual | 8.10% |

New York Life | 5.67% |

MassMutual | 5.55% |

Lincoln Financial | 4.67% |

Prudential | 4.63% |

MetLife | 4.27% |

John Hancock | 3.97% |

Transamerica | 3.52% |

Guardian Life | 3.14% |

Nationwide | 3.04% |

What happens if a life insurance company goes bankrupt in Florida

It’s rare for life insurance companies to go bankrupt, but the state of Florida has protections in place just in case. If your life insurance company goes bankrupt, the state’s Life and Health Insurance Guaranty Association will cover part of your policy.

The association covers up to $300,000 of your death benefit, and up to $100,000 of your net cash surrender value — the amount you could get from selling your policy before you die.

How to find a lost life insurance policy in Florida

If you’re a family member of someone who’s died or you’re an executor of an estate, you can find a lost life insurance policy in Florida by using the National Association of Insurance Commissioners’s Life Insurance Policy Locator Service.

Average life insurance rates in Florida

The cost of life insurance depends on lots of individual factors, including your age, health, and the length and benefit amount of your policy. It doesn’t depend, though, on where you live, so Florida residents should look at average rates by age, gender, and coverage amount rather than by state.

Based on Policygenius data from 2023, the average monthly premium for a healthy 35-year-old in Florida buying a $500,000, 20-year term life insurance policy is $26 a month for women and $31 a month for men.

Age | Gender | $250,000 coverage amount | $500,000 coverage amount | $1 million coverage amount |

|---|---|---|---|---|

20 | Female | $15 | $23 | $34 |

Male | $19 | $29 | $48 | |

30 | Female | $15 | $23 | $37 |

Male | $18 | $29 | $49 | |

40 | Female | $22 | $35 | $61 |

Male | $25 | $43 | $75 | |

50 | Female | $44 | $78 | $139 |

Male | $57 | $102 | $188 | |

60 | Female | $108 | $194 | $355 |

Male | $149 | $268 | $500 |

Methodology: Average monthly rates are calculated for male and female non-smokers in a Preferred health classification obtaining a 20-year $250,000, $500,000, or $1,000,000 term life insurance policy. Life insurance averages are based on a composite of policies offered by Policygenius from Brighthouse Financial, Corebridge Financial, Foresters Financial, Legal & General America, Lincoln Financial, Mutual of Omaha, Pacific Life, Protective, Prudential, Symetra, and Transamerica, and the Policygenius Life Insurance Price Index, which uses real-time data from leading life insurance companies to determine pricing trends. Rates may vary by insurer, term, coverage amount, health class, and state. Not all policies are available in all states. Rate illustration valid as of 09/01/2024.