How much is life insurance?

Term life insurance costs on average $30 per month ($360 per year) for a 20-year term life policy with a $500,000 payout for a 30-year–old male with few health conditions, and $23 per month ($276 per year) for a 30-year-old female with a similar profile.

Permanent life insurance policies like whole life and universal life insurance cost significantly more than term life because they don’t expire and come with an investment-like component called cashe value, which allows you to use funds from your policy while you’re still alive.

A 30-year-old male in overall good health can expect to pay $472 per month ($5,664 per year) for a whole life insurance policy with a $500,000 payout. A 30-year-female with a similar profile can expect to pay $408 per month ($4,896 per year) for the same whole life policy.

The cost of life insurance is mainly based on your life expectancy — as well as the type of life insurance and coverage amount you want to buy. Insurers consider your age, gender, health, hobbies, and medical history to determine how risky you are to insure — and, in turn, how much you’ll have to pay for your coverage. In general, the younger and healthier you are, the lower your life insurance rates will be.

We compared life insurance rates based on age and gender, term length, and coverage amount using real-time prices offered by some of the top insurers in the country through Policygenius. If you want a quote for your specific situation, connect with one of our agents to get started.

Average term life insurance rates

Term life insurance is the cheapest life insurance option. It offers basic protection and lasts only for a set period of time — usually 10 to 30 years — and then it expires. If all you need is to provide a financial safety net for your loved ones in your absence, term life is right for you.

Term life insurance policy rates by age

The monthly rates below are based on a 20-year term life insurance policy with a $500,00 payout for people with few health conditions and who don’t smoke.

Age | Gender | $250,000 coverage amount | $500,000 coverage amount | $1 million coverage amount |

|---|---|---|---|---|

20 | Female | $15.01 | $22.65 | $33.63 |

Male | $19.18 | $30.20 | $47.51 | |

30 | Female | $15.17 | $22.98 | $36.90 |

Male | $18.19 | $29.32 | $48.89 | |

40 | Female | $21.66 | $35.27 | $60.65 |

Male | $25.39 | $42.94 | $75.24 | |

50 | Female | $43.92 | $78.29 | $139.50 |

Male | $56.69 | $102.50 | $188.29 | |

60 | Female | $107.83 | $194.16 | $354.51 |

Male | $149.38 | $268.04 | $499.98 |

Methodology: Average monthly rates are calculated for male and female non-smokers in a Preferred health classification obtaining a 20-year $250,000, $500,000, or $1,000,000 term life insurance policy. Life insurance averages are based on a composite of policies offered by Policygenius from Brighthouse Financial, Corebridge Financial, Foresters Financial, Legal & General America, Lincoln Financial, Mutual of Omaha, Pacific Life, Protective, Prudential, Symetra, and Transamerica, and the Policygenius Life Insurance Price Index, which uses real-time data from leading life insurance companies to determine pricing trends. Rates may vary by insurer, term, coverage amount, health class, and state. Not all policies are available in all states. Rate illustration valid as of 10/01/2024.

Term life insurance policy rates for smokers

Smokers usually pay two to three times more for coverage when compared to non-smokers, because smoking is considered a health risk. Below are monthly rates for a 20-year, $500,000 term life policy for people who smoke but have no additional health complications.

Age | Gender | $250,000 coverage amount | $500,000 coverage amount | $1 million coverage amount |

|---|---|---|---|---|

20 | Female | $35.71 | $60.59 | $101.32 |

Male | $44.50 | $76.43 | $132.34 | |

30 | Female | $38.52 | $65.75 | $117.20 |

Male | $46.90 | $80.95 | $143.89 | |

40 | Female | $62.74 | $113.40 | $207.38 |

Male | $78.26 | $145.39 | $266.49 | |

50 | Female | $137.94 | $257.05 | $465.89 |

Male | $188.09 | $351.50 | $660.83 | |

60 | Female | $320.17 | $617.51 | $1,123.64 |

Male | $461.29 | $887.93 | $1,642.70 |

Methodology: Rates are calculated for male and female smokers in a Preferred Tobacco health classification, obtaining a $250,000, $500,000, or $1,000,000 20-year term life insurance policy. Life insurance averages are based on a composite of policies offered by Policygenius from Corebridge Financial, Legal & General America, Pacific Life, and Transamerica, and the Policygenius Life Insurance Price Index, which uses real-time data from leading life insurance companies to determine pricing trends. Rates may vary by insurer, term coverage amount, health class, and state. Not all policies available in all states. Rate illustration valid as of 10/01/2024.

Term life insurance policy rates by term length

These monthly rates are based on a 10-year, 20-year, or 30-year, $500,000 term life policy for a 30-year-old with few health conditions and who doesn’t smoke.

Term length | Average cost for female policyholders | Average cost for male policyholders |

|---|---|---|

10 years | $16.72 | $21.13 |

20 years | $22.99 | $29.32 |

30 years | $34.52 | $42.45 |

Methodology: Average monthly rates are calculated for 30-year-old male and female non-smokers in a Preferred health classification buying a 10-year, 20-year, and 30-year $500,000 term life insurance policies. Life insurance averages are based on a composite of policies offered by Policygenius from Legal & General America, Brighthouse Financial, Corebridge Financial, Foresters Financial, Lincoln Financial, Mutual of Omaha, Pacific Life, Protective, Prudential, Symetra, and Transamerica, and the Policygenius Life Insurance Price Index, which uses real-time data from leading life insurance companies to determine pricing trends. Rates may vary by insurer, term, coverage amount, health class, and state. Not all policies are available in all states. Rate illustration valid as of 10/01/2024.

Average no-medical-exam term life insurance rates

No-medical-exam policies let you skip the medical test that’s a standard part of the life insurance application process, which means you can get coverage faster. These monthly rates are based on a 20-year, $500,000 no-exam term life policy for people with few health conditions and who don’t smoke.

Age | Gender | $250,000 coverage amount | $500,000 coverage amount | $1 million coverage amount |

|---|---|---|---|---|

20 | Female | $15.01 | $22.65 | $33.63 |

Male | $19.18 | $30.20 | $47.51 | |

30 | Female | $15.17 | $22.98 | $36.90 |

Male | $18.19 | $29.32 | $48.89 | |

40 | Female | $21.66 | $35.27 | $60.65 |

Male | $25.39 | $42.94 | $75.24 | |

50 | Female | $43.92 | $78.29 | $139.50 |

Male | $56.69 | $102.50 | $188.29 | |

60 | Female | $107.83 | $194.16 | $354.41 |

Male | $149.29 | $268.04 | $499.98 |

Methodology: Average monthly rates are calculated for male and female non-smokers at a Preferred health classification obtaining a 20-year $500,000 life insurance policy. Life insurance averages are based on a composite of no-medical-exam policies offered through Policygenius from Brighthouse Financial, Legal & General America, Transamerica, and Pacific Life. Rates may vary by insurer, term, coverage amount, health class, and state, and the Policygenius Life Insurance Price Index, which uses real-time data from leading life insurance companies to determine pricing trends. Not all policies available in all states. Issuance of a term life insurance policy without a medical exam is subject to product availability and your eligibility, and may depend upon your truthful answers to a health questionnaire. Rate illustration valid as of 10/01/2024.

Explore more life insurance term rates

Average whole life insurance rates

Whole life insurance doesn’t expire and comes with a cash value savings component that lets you borrow money while you’re still alive. It’s significantly more expensive than term life, but it can be worth it in certain scenarios — for example, if you’re looking to complement your estate planning or investment portfolio, or if you have dependents that require lifelong care.

Age | Gender | $250,000 coverage amount | $500,000 coverage amount | $1 million coverage amount |

|---|---|---|---|---|

20 | Female | $146 | $287 | $545 |

Male | $169 | $334 | $639 | |

30 | Female | $206 | $408 | $801 |

Male | $238 | $472 | $920 | |

40 | Female | $296 | $588 | $1,161 |

Male | $355 | $706 | $1,372 | |

50 | Female | $462 | $920 | $1,826 |

Male | $543 | $1,081 | $2,117 | |

60 | Female | $772 | $1,540 | $3,065 |

Male | $903 | $1,802 | $3,556 |

Methodology: Whole life insurance rates are calculated for male and female non-smokers in a Preferred Plus health classification obtaining a $250,000, $500,000, or $1,000,000 whole life insurance policy fully paid up at age 100 offered by Policygenius through MassMutual. Individual rates will vary as specific circumstances will affect each customer’s rate. Rate illustration valid as of 10/01/24.

Whole life insurance rates for smokers

Age | Gender | $250,000 coverage amount | $500,000 coverage amount | $1 million coverage amount |

|---|---|---|---|---|

20 | Female | $179 | $352 | $686 |

Male | $218 | $432 | $842 | |

30 | Female | $256 | $505 | $992 |

Male | $304 | $602 | $1,187 | |

40 | Female | $377 | $748 | $1,475 |

Male | $464 | $922 | $1,794 | |

50 | Female | $599 | $1,193 | $2,366 |

Male | $715 | $1,426 | $2,794 | |

60 | Female | $995 | $1,985 | $3,953 |

Male | $1,213 | $2,420 | $4,778 |

Methodology: Approximate monthly rates are calculated in a Preferred Smoker health classification, based on a $1 million whole life insurance policy paid up at age 100 offered by Policygenius through MassMutual. Individual rates may vary by insurer, coverage amount, health class, and state. Not all policies available in all states. Rate illustration valid as of 10/01/2024.

Explore more whole life insurance rates

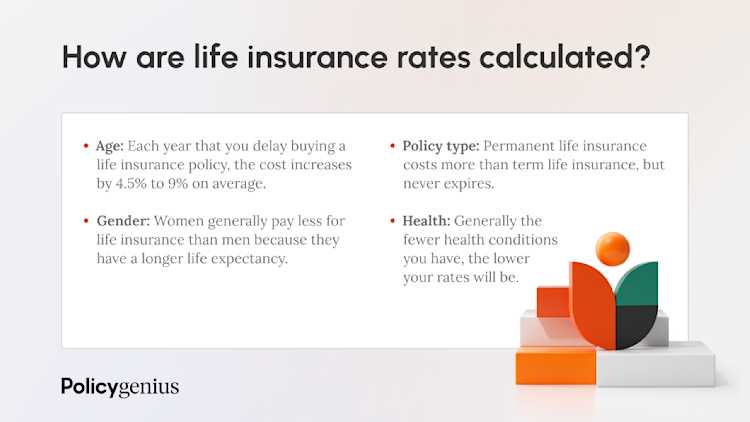

How are life insurance rates calculated?

Life insurance rates are determined by four main factors:

Learn more about how insurers set your rates based on your health