How much is term life insurance?

Term life insurance is the cheapest way to provide your loved ones with a financial safety net in the event of your death. Term life insurance is affordable, easy to manage, and only lasts for a set period of time — usually 10 to 30 years — during the period of your life when you have your biggest expenses, like paying off a mortgage or raising children.

Term life insurance premiums are significantly lower than permanent life insurance premiums because permanent options don’t expire and come with an investment-like component called cash value, which you can borrow from while you’re still alive, in addition to the main payout.

However, 3 in 4 Americans overestimate the average cost of term life insurance, according to LIMRA’s 2023 life insurance barometer study. [1] Nearly half of those who don’t have life insurance and say they need it think life insurance is too expensive and cite that as the number one reason not to buy coverage.

Term life insurance costs are largely determined by your age and your overall health profile. In general, the younger and healthier you are, the lower your term life insurance policy rates will be.

For example, a 30-year-old female who doesn’t smoke and is in good health can expect to pay $23 per month ($264 per year) for a 20-year term life insurance policy with a $500,000 payout. Statistically, men have shorter life expectancies, so they pay more for life insurance than women do. Using the same example, a 30-year-old male with a similar profile can expect to pay $29 per month ($343 per year) for the same coverage.

Term life insurance policy rates increase as you get older — every year. If the same 30-year-old non-smoking female in good health would wait 10 years, until reaching age 40, to purchase the same $500,0000 20-year term life insurance policy, she’d have to pay $35 per month ($412 per year) — 52% more. And if she waited 20 more years, until she were 50 years old, to purchase the same 20-year term life policy with a $500,000 death benefit, the cost would increase to $78 per month ($915 per year) — 239% higher than when she was 30 years old.

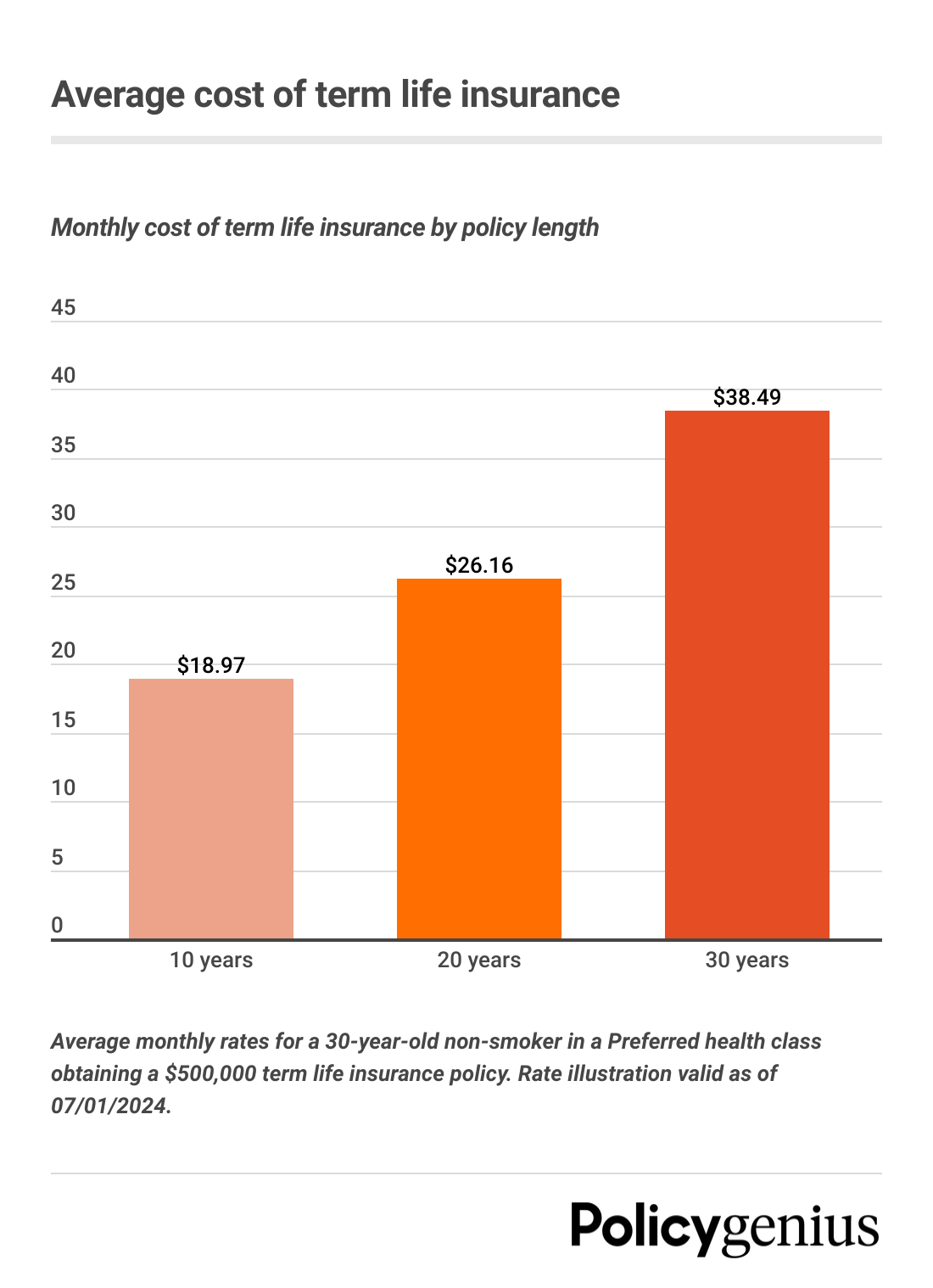

The length of your policy is another factor that affects term life insurance costs. The longer the term, the more expensive your policy will be. Following with your previous examples, if the same 30-year-old female would buy a 30-year term life insurance with a $500,000 payout instead, she’d pay $34.50 per month ($414 per year) — 50% more than she would for a 20-year term life policy.

How are term life insurance rates determined?

Life insurance companies use a combination of factors to determine the cost of life insurance for each person. Age and health are just two of the main ones. Here’s the list of all factors that come into play when insurers set term life insurance policy rates.

Your age: The average cost of term life insurance goes up by 4.9% to 9% every year you age. The reason? The chances that you’re diagnosed with a medical condition that might increase your chances of dying while your policy’s active increase as you become older. Once your policy is active, your premiums will stay the same for the duration of your coverage.

Your gender: Because women have a longer life expectancy than men, [2] they usually pay less for life insurance. Gender-nonconforming applicants won’t get higher life insurance policy rates based on gender identity, but must apply under one gender. You can learn more with our guide to life insurance for women.

Your health: The healthier you are, the less likely you are to die while your policy is active. Many insurers will require a medical exam to get an accurate picture of your health. Certain pre-existing conditions, such as heart disease, diabetes, or cancer, usually have a higher impact on your rates. Other conditions, like asthma, sleep apnea, or high blood pressure, usually have a lower impact.

Your family medical history: Life insurance companies use your family’s medical history as an indicator of your future health risks. Some life-threatening conditions — like heart disease or diabetes — can be caused by genetic diseases.

Your smoking status and/or marijuana use: If you smoke cigarettes, chew tobacco, or use e-cigarettes, you’ll pay two to three times more for life insurance. Using marijuana won’t disqualify you from getting life insurance, but your life insurance policy rates depend on the state you’re in, the type of products you use, and whether or not you have a medical prescription.

Your history of substance abuse: When you apply for life insurance, the insurer will ask about any current or past alcohol and drug use. People with a history of substance abuse will typically pay higher premiums.

Your driving record: During the application process, your insurer looks at your motor vehicle report (MVR). You’ll pay more for life insurance if you have multiple moving violations, license suspensions, or reckless driving violations, especially if they happened in the last five years.

Your lifestyle and hobbies: Insurance companies consider hobbies like scuba diving or skydiving risky, so they may result in higher premiums. Certain high-risk jobs, like being in the military or a private pilot, can also increase the cost of your policy.

Your criminal history: If you have a criminal record, you can still apply for a life insurance policy. Having misdemeanors or lesser infractions on your record usually won’t change your rates. If you have a felony conviction, getting life insurance will be more difficult and more expensive, especially in the first few years after your conviction.

Your credit history: Your credit report can affect your life insurance policy rates because insurance companies want to be sure you’ll be able to consistently pay the premiums for your policy. Insurers make a soft inquiry of your credit report as part of the application process, but this doesn’t impact your credit score.

Life insurance is federally regulated, so insurance companies can’t issue discounts. But since each insurer has different guidelines when it comes to pricing, you might get cheaper rates with one company than another depending on your profile

The best way to get a policy at the best price for you is to apply through an independent broker like Policygenius, who can help you compare life insurance quotes across multiple insurance companies at the same time.

Read more about the best term life insurance companies

Term life insurance rates by term length

Age | Gender | 10-year term | 20-year term | 30-year term | 40-year term |

|---|---|---|---|---|---|

20 | Female | $17.39 | $22.65 | $30.97 | $41.70 |

Male | $22.52 | $30.20 | $40.53 | $52.95 | |

30 | Female | $16.71 | $22.98 | $34.52 | $46.75 |

Male | $21.13 | $29.32 | $42.45 | $63.47 | |

40 | Female | $23.98 | $35.27 | $54.87 | $108.73 |

Male | $29.28 | $42.94 | $68.28 | $142.74 | |

50 | Female | $51.80 | $78.29 | $129.12 | N/A |

Male | $63.97 | $102.50 | $174.15 | N/A | |

60 | Female | $107.24 | $194.16 | N/A | N/A |

Male | $144.34 | $268.04 | N/A | N/A |

Methodology: Average monthly rates are calculated for 30-year-old male and female non-smokers in a Preferred health classification buying a 10-year, 20-year, or 30-year $500,000 term life insurance policy. Life insurance averages are based on a composite of policies offered by Policygenius from Brighthouse Financial, Corebridge Financial, Foresters Financial, Legal & General America, Lincoln Financial, Mutual of Omaha, Pacific Life, Protective, Prudential, Symetra, and Transamerica, and the Policygenius Life Insurance Price Index, which uses real-time data from leading life insurance companies to determine pricing trends. Rates may vary by insurer, term, coverage amount, health class, and state. Not all policies are available in all states. Rate illustration valid as of 10/01/2024.

20-year term life insurance rates by age

Age | Gender | $250,000 coverage amount | $500,000 coverage amount | $1 million coverage amount |

|---|---|---|---|---|

20 | Female | $15 | $23 | $34 |

Male | $19 | $29 | $48 | |

30 | Female | $15 | $23 | $37 |

Male | $18 | $29 | $49 | |

40 | Female | $22 | $35 | $61 |

Male | $25 | $43 | $75 | |

50 | Female | $44 | $78 | $139 |

Male | $57 | $102 | $188 | |

60 | Female | $108 | $194 | $355 |

Male | $149 | $268 | $500 |

Methodology: Average monthly rates are calculated for male and female non-smokers in a Preferred health classification obtaining a 20-year $250,000, $500,000, or $1,000,000 term life insurance policy. Life insurance averages are based on a composite of policies offered by Policygenius from Brighthouse Financial, Corebridge Financial, Foresters Financial, Legal & General America, Lincoln Financial, Mutual of Omaha, Pacific Life, Protective, Prudential, Symetra, and Transamerica, and the Policygenius Life Insurance Price Index, which uses real-time data from leading life insurance companies to determine pricing trends. Rates may vary by insurer, term, coverage amount, health class, and state. Not all policies are available in all states. Rate illustration valid as of 09/01/2024.

30-year term life insurance rates by age

Age | Gender | $250,000 coverage amount | $500,000 coverage amount | $1 million coverage amount |

|---|---|---|---|---|

20 | Female | $19.43 | $30.97 | $49.32 |

Male | $24.42 | $40.53 | $66.57 | |

30 | Female | $21.06 | $34.52 | $57.04 |

Male | $25.29 | $42.45 | $71.88 | |

40 | Female | $31.99 | $54.87 | $97.32 |

Male | $39.62 | $68.28 | $122.41 | |

50 | Female | $70.40 | $129.12 | $232.24 |

Male | $94.32 | $174.15 | $315.50 |

Methodology: Average monthly rates are calculated for male and female non-smokers in a Preferred health classification obtaining a 30-year $250,000, $500,000, or $1,000,000 term life insurance policy. Life insurance averages are based on a composite of policies offered by Policygenius from Brighthouse Financial, Corebridge Financial, Foresters Financial, Legal & General America, Lincoln Financial, Mutual of Omaha, Pacific Life, Protective, Prudential, Symetra, and Transamerica, and the Policygenius Life Insurance Price Index, which uses real-time data from leading life insurance companies to determine pricing trends. Rates may vary by insurer, term, coverage amount, health class, and state. Not all policies are available in all states. Rate illustration valid as of 10/01/2024.

Term life insurance rates by age without a medical exam

No-exam life insurance can be a good fit for you if you have few or no health issues and you want to skip the medical exam that’s a standard part of the life insurance application process. These policies allow you to get covered faster and are as affordable — if not more — than traditional term life insurance policies.

Age | Gender | $250,000 coverage amount | $500,000 coverage amount | $1 million coverage amount |

|---|---|---|---|---|

20 | Female | $15.01 | $22.65 | $33.63 |

Male | $19.18 | $30.20 | $47.51 | |

30 | Female | $15.17 | $22.98 | $36.90 |

Male | $18.19 | $29.32 | $48.89 | |

40 | Female | $21.66 | $35.27 | $60.65 |

Male | $25.39 | $42.94 | $75.24 | |

50 | Female | $43.92 | $78.29 | $139.50 |

Male | $56.69 | $102.50 | $188.29 |

Methodology: Average monthly rates are calculated for male and female non-smokers in a Preferred health classification obtaining a 20-year $250,000, $500,000, or $1,000,000 term life insurance policy. Life insurance averages are based on a composite of policies that offer no-exam application offered by Policygenius from Brighthouse Financial, Foresters Financial, Legal & General America, Pacific Life, and Transamerica, and the Policygenius Life Insurance Price Index, which uses real-time data from leading life insurance companies to determine pricing trends. Rates may vary by insurer, term, coverage amount, health class, and state. Not all policies are available in all states. Rate illustration valid as of 07/01/2024.

Learn more about the best no-medical-exam life insurance companies of 2025

How much term life insurance do you need?

The amount of life insurance you get should be enough to cover all of your family’s current and future expenses, like mortgage payments and bills.

One easy rule of thumb is that your coverage should be roughly 10 to 15 times your annual income. For example, if you make $100,000 per year, you’ll likely need around $1 million to $1.5 million in life insurance coverage.

We can also do the math for you. You can use our coverage calculator to calculate how much life insurance coverage you need to protect your family.

How long should your term life insurance last?

Most people need term life coverage that lasts 20 to 30 years. Insurers also offer shorter and longer terms — from 10 years up to 40 years. How long your life insurance should last will depend on your financial needs.

How to choose your term length

The best term length for your policy will depend on the reason you’re seeking financial protection.

If you have a 20-year mortgage, for example, you’ll want at least a 20-year term life insurance policy to cover your mortgage payments.

If you have young children, you should factor in how many years you’ll have to support them until they’re financially independent.

If you’re 35 and hoping to retire by 65, a 30-year term life insurance policy could cover you until you retire.

The longer your term, the more expensive your life insurance policy rates will be. A 30-year life insurance quote is higher than a 20-year life insurance quote because you’re securing the same rate for a longer period of time. At the same time, if you know you need coverage for the next 30 years, it’ll usually be cheaper to buy a 30-year policy in the first place, compared to buying a 20-year policy first and then a 10-year policy.

A licensed agent at Policygenius can work with you through the application process so you can find coverage at the right price and term length for your needs.

Call us at 1-800-608-2192 to connect with a Policygenius agent and get started on your application, or follow the link below.

Common life insurance term lengths

Learn more about how to calculate your term length

How can you get lower term life rates?

Different life insurance companies have different criteria for determining life insurance policy rates based on factors like your age and health. To find the cheapest rates, you can compare quotes from multiple companies.

Here are some other ways to lower the cost of term life insurance.

Apply early. Life insurance is cheapest when you’re young with few health conditions, so buying a policy in your 20s or 30s can save you money.

Consider paying annually. Many insurers give a small discount to applicants who agree to pay yearly instead of monthly. If you can afford to pay your life insurance premiums annually, you may get a discount up to 5%.

Opt for a shorter term or less coverage. Longer policies or policies with greater payouts are more expensive than shorter policies or policies with smaller death benefits. It’s best to have some kind of policy in place, even if it’s not technically the full amount you need.

Manage your health conditions. If you have a pre-existing condition, following a treatment plan prescribed by your physician can help you get lower rates. For example, this could look like taking prescribed medications or seeing a therapist if recommended.

Stop smoking. The cost of term life insurance is two to three times higher for smokers than it is for non-smokers. To pay non-smoker rates, you’d need to quit using nicotine products at least one year before applying for life insurance.