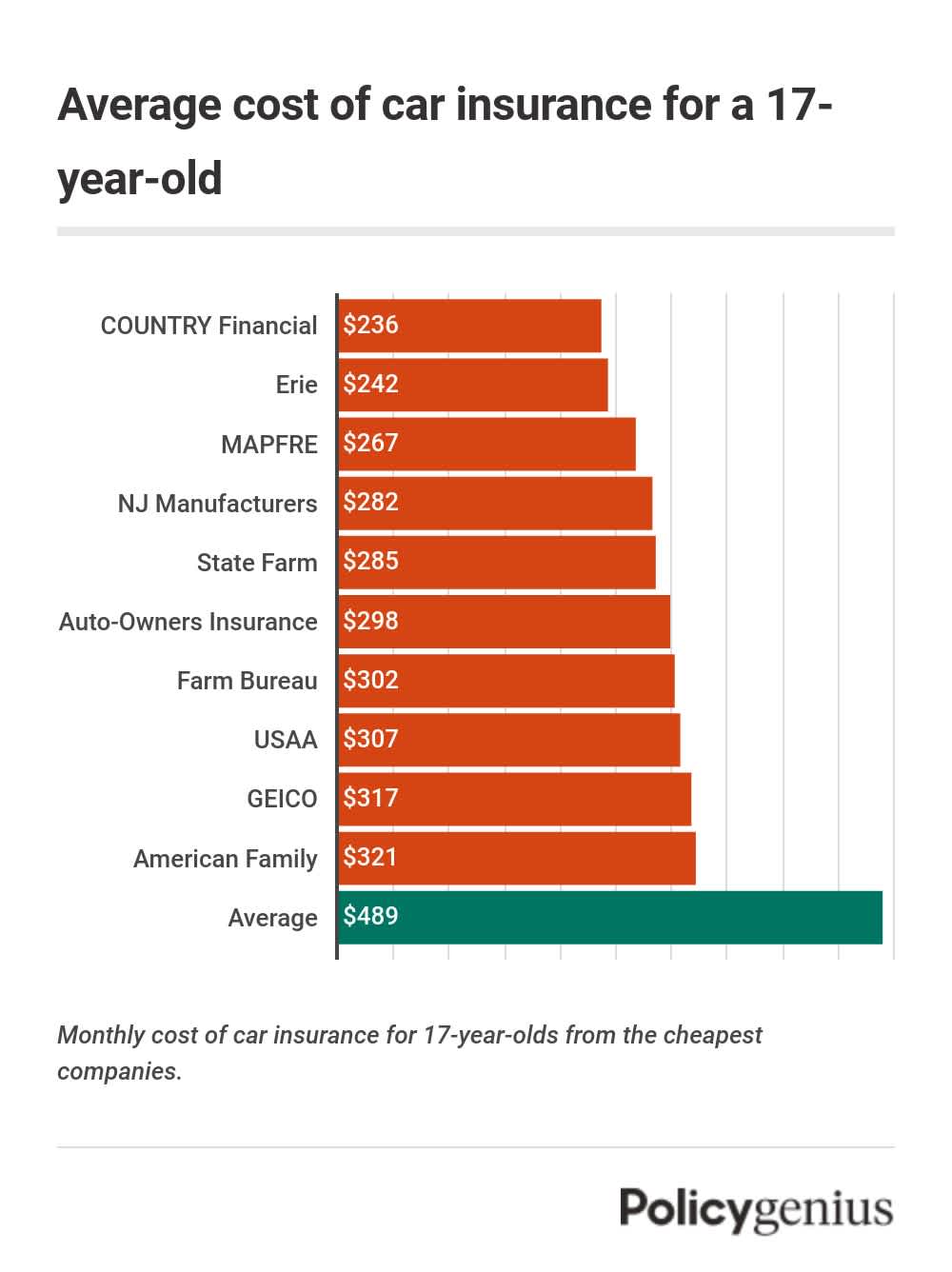

The average monthly cost of car insurance for 17-year-olds is $489, which adds up to $5,864 per year. Car insurance is cheaper for a 17-year-old than it is for a 16-year-old who’s brand new to the road, but it’s still more expensive than what most drivers pay for coverage.

On average, COUNTRY Financial has the cheapest car insurance rates for 17-year-olds, while State Farm is the cheapest national provider for 17-year-old drivers. Both companies offer car insurance coverage for 17-year-olds that’s thousands of dollars cheaper per year than average.

How much is car insurance for a 17-year-old per month?

The average cost of car insurance for a 17-year-old is $489 each month. Because of their inexperience driving compared to older people, we found that 17-year-olds pay $4,212 more each year than adult drivers (ages 30, 35, and 45 years old).

It’s still possible for 17-year-olds to get cheap car insurance. We found that COUNTRY Financial has the lowest average car insurance rates for 17-year-old drivers. Since COUNTRY doesn’t operate everywhere, State Farm has the cheapest rates for 17-year-olds among major car insurance companies.

The cost difference between the company with the cheapest and most expensive car insurance rates for 17-year-olds is $921 per month. That means without comparing the cost of coverage before buying, you risk paying thousands of dollars more for coverage each year than you’d have to.

Rank | Company | Monthly cost | Annual cost |

|---|---|---|---|

1 | COUNTRY Financial | $236 | $2,829 |

2 | $242 | $2,904 | |

3 | MAPFRE | $267 | $3,199 |

4 | NJ Manufacturers | $282 | $3,381 |

5 | $285 | $3,422 | |

6 | Auto-Owners Insurance | $298 | $3,580 |

7 | Farm Bureau | $302 | $3,627 |

8 | USAA | $307 | $3,681 |

9 | $317 | $3,809 | |

10 | $321 | $3,856 | |

11 | Kemper | $403 | $4,840 |

12 | Shelter Insurance | $433 | $5,199 |

13 | $437 | $5,242 | |

14 | $471 | $5,651 | |

15 | The Hartford | $518 | $6,221 |

16 | CSAA | $572 | $6,868 |

17 | $582 | $6,983 | |

18 | National General | $643 | $7,714 |

19 | $727 | $8,725 | |

20 | $767 | $9,204 | |

21 | Amica | $769 | $9,228 |

22 | Sentry Insurance | $772 | $9,260 |

23 | Auto Club Group | $802 | $9,622 |

24 | Mercury Insurance | $1,007 | $12,088 |

25 | Hanover | $1,156 | $13,876 |

Monthly and annual costs of car insurance for 17-year-old drivers.

Cost of car insurance for a 17-year-old compared to other ages

While car insurance is usually really expensive for 17-year-olds, it’s actually most expensive for 16-year-old drivers, since they’re the absolute newest to the road. We found that insurance costs 17-year-olds 13% less than drivers who are just one year younger.

As drivers age and gain experience behind the wheel, their costs of car insurance go down. That’s why auto insurance for 18-year-olds costs 16% less, on average, than it does for 17-year-olds. By the time a driver turns 25, average costs drop by 67% compared to the average cost for 17-year-olds.

In fact 25 is usually considered the tipping point at which young drivers age out of the highest-risk age category, and rates usually drop around then.

Monthly and annual costs of car insurance.

Why is insurance so expensive for a 17-year-old?

The cost of insurance for 17-year-olds (and other young drivers) is more expensive because of their lack of driving experience. Compared to someone who’s had their driver’s license for close to a decade or more, a 17-year-old has just one or fewer years of driving experience.

That’s why teenagers are more likely to get into accidents and make expensive claims than older drivers. Fortunately, as you gain experience driving, your rates will go down. Every year before you turn 25, your cost of coverage may drop sharply (as long as you keep your driving record clean).

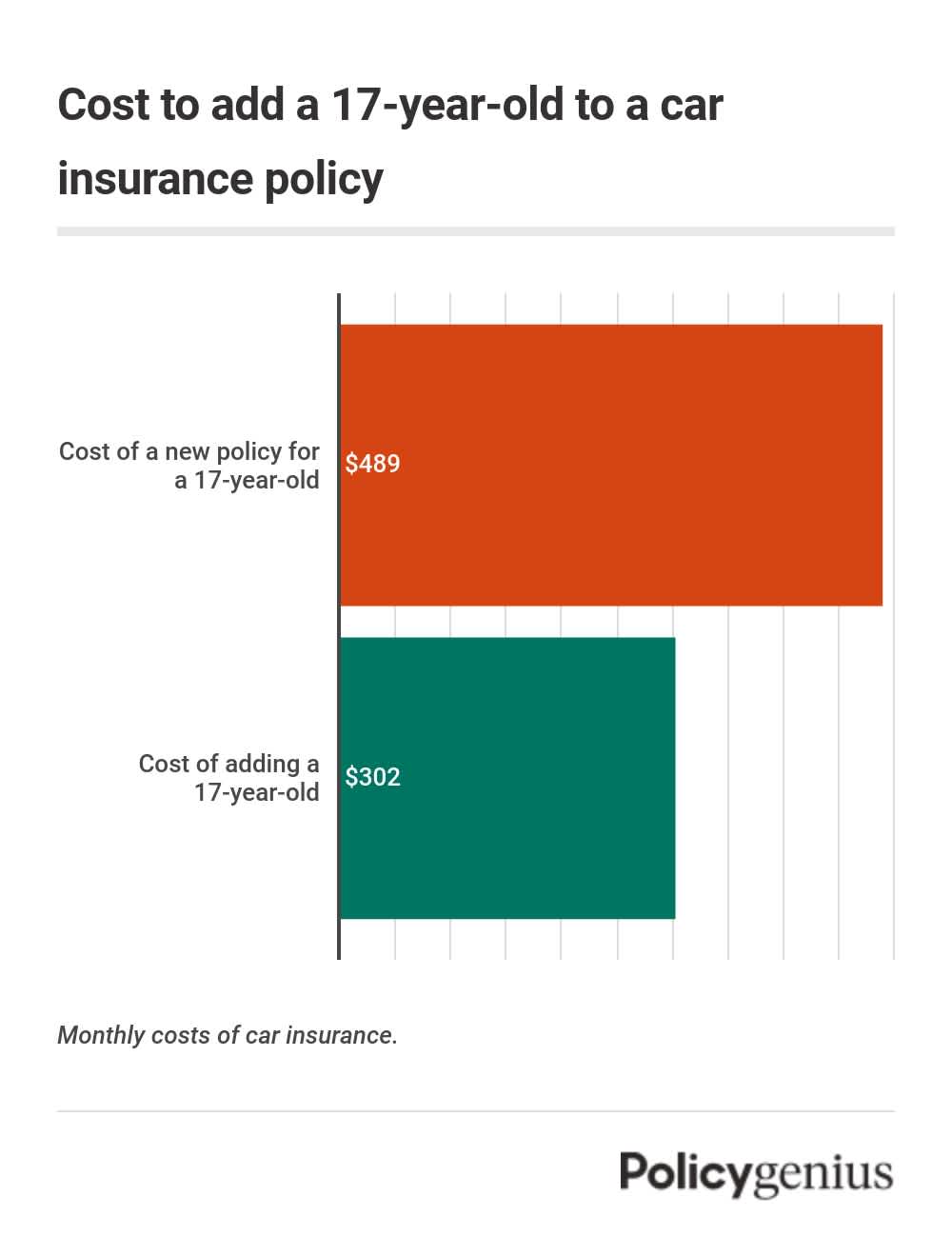

Cost of car insurance for 17-year-old drivers on a family policy

It’s much cheaper for a 17-year-old driver to join their family’s policy than it is for them to get their own coverage. We found that it costs $187 less each month to add a young driver to an existing car insurance policy than it would if they got their own coverage.

On average, the cost of car insurance for a 17-year-old who is added to their parents’ or guardians’ policy is $302 per month, or $3,625 each year.

How much is the cost of car insurance for a 17-year-old male vs. female driver?

The car insurance for 17-year-old male drivers is more expensive than it is for their female counterparts. On average, 17-year-old boys pay $64 more each month (or $765 each year) than girls of the same age.

Gender | Monthly cost | Annual cost |

|---|---|---|

Male driver | $520 | $6,238 |

Female driver | $456 | $5,473 |

Difference | $64 | $765 |

Monthly costs of car insurance for 17-year-old drivers.

Car insurance companies use lots of data to figure out your odds of getting into a car accident, and car insurance is more expensive for teenage boys than girls because of the higher number of claims involving male drivers. But some states don’t allow gender-based differences in insurance costs, including:

California

Hawaii

Massachusetts

Michigan

North Carolina

Pennsylvania

Cheapest car insurance companies for 17-year-olds by gender

While car insurance costs 17-year-old male drivers $64 more per month than it does female drivers, this difference changes by company. The cheapest company for male drivers compared to female drivers is COUNTRY, where the difference between what male and female drivers pay is just $19 per month.

Company | Difference | Male driver | Female driver |

|---|---|---|---|

COUNTRY Financial | $19 | $245 | $226 |

NJ Manufacturers | $23 | $293 | $270 |

USAA | $24 | $319 | $295 |

American Family | $29 | $369 | $340 |

GEICO | $31 | $333 | $302 |

Monthly costs of car insurance for 17-year-old drivers.

Cost of car insurance for 17-year-olds by state

On average, insurance costs 17-year-olds $489 per month — but rates depend on where you live, along with other factors. The average cost of car insurance in the least expensive state is $9,925 per year cheaper than in the most expensive state.

Hawaii is the cheapest state for 17-year-old car insurance. On average, young drivers pay $117 per month for coverage in Hawaii, where setting rates based on age is against the law. In Louisiana, where rates are already some of the highest in the U.S., the cost of car insurance for 17-year-olds is $944 per month — more than $11,000 per year.

State | Monthly cost | Annual cost |

|---|---|---|

$565 | $6,785 | |

$373 | $4,477 | |

$504 | $6,046 | |

$518 | $6,219 | |

$422 | $5,068 | |

$517 | $6,202 | |

$661 | $7,929 | |

$715 | $8,585 | |

$585 | $7,016 | |

$789 | $9,466 | |

$529 | $6,346 | |

$117 | $1,399 | |

$372 | $4,464 | |

$435 | $5,214 | |

$320 | $3,836 | |

$297 | $3,562 | |

$426 | $5,109 | |

$633 | $7,596 | |

$944 | $11,324 | |

$331 | $3,974 | |

$537 | $6,445 | |

$527 | $6,325 | |

$629 | $7,552 | |

$342 | $4,105 | |

$488 | $5,860 | |

$447 | $5,370 | |

$571 | $6,853 | |

$433 | $5,194 | |

$658 | $7,897 | |

$383 | $4,600 | |

$779 | $9,345 | |

$419 | $5,023 | |

$521 | $6,250 | |

$226 | $2,716 | |

$439 | $5,271 | |

$320 | $3,841 | |

$569 | $6,822 | |

$432 | $5,187 | |

$506 | $6,077 | |

$721 | $8,649 | |

$508 | $6,091 | |

$408 | $4,898 | |

$441 | $5,290 | |

$537 | $6,445 | |

$534 | $6,410 | |

$319 | $3,832 | |

$413 | $4,959 | |

$501 | $6,011 | |

$499 | $5,983 | |

$361 | $4,330 | |

$403 | $4,841 |

COUNTRY Financial has the cheapest average rates for 17-year-old drivers. Car insurance from COUNTRY costs $253 less each month than average, or $3,036 per year. However, since COUNTRY only offers coverage in 19 states, not everyone will be able to take advantage of its cheap rates.

Those who live in the states where COUNTRY operates can find coverage options in addition to cheap costs for 17-year-olds. Drivers can add these extra forms of coverage to their policy:

New car replacement for models four years old or newer

Emergency roadside protection worth up to $100

$800 for food, lodging, and transportation if you’re stranded away from home

Personal effects coverage if your belongings are stolen out of your car

COUNTRY also offers young drivers discounts, like savings for completing a short road safety test, maintaining a high GPA, and completing a defensive driving course.

Cheapest car insurance for 17-year-olds in every state

While COUNTRY has the cheapest car insurance for 17-year-olds, it’s the most affordable company in just three states — Alabama, Nevada, and Oregon. State Farm is actually the cheapest car insurance for 17-year-olds in 10 states, which is the most of any one provider.

USAA is also the cheapest car insurance 17-year-olds in a number of states. But it’s only available to members of the military and their families, so it’s not an option for many drivers.

State | Cheapest company | Monthly cost |

|---|---|---|

Alabama | COUNTRY Financial | $195 |

Alaska | Umialik | $240 |

Arizona | Auto-Owners Insurance | $230 |

Arkansas | Farm Bureau | $241 |

California | Wawanesa | $172 |

Colorado | American National | $217 |

Connecticut | Kemper | $311 |

Delaware | State Farm | $318 |

District of Columbia | Erie | $239 |

Florida | GEICO | $336 |

Georgia | Auto-Owners Insurance | $215 |

Hawaii | GEICO | $74 |

Idaho | American National | $157 |

Illinois | Pekin | $186 |

Indiana | Indiana Farmers Mutual | $162 |

Iowa | State Farm | $169 |

Kansas | American Family | $247 |

Kentucky | State Farm | $329 |

Louisiana | USAA | $351 |

Maine | Auto-Owners Insurance | $146 |

Maryland | USAA | $256 |

Massachusetts | USAA | $261 |

Michigan | GEICO | $225 |

Minnesota | Farm Bureau | $193 |

Mississippi | USAA | $241 |

Missouri | USAA | $177 |

Montana | State Farm | $230 |

Nebraska | Farmers Mutual of Nebraska | $212 |

Nevada | COUNTRY Financial | $243 |

New Hampshire | Auto-Owners Insurance | $152 |

New Jersey | GEICO | $197 |

New Mexico | USAA | $219 |

New York | American Family | $225 |

North Carolina | State Farm | $132 |

North Dakota | North Star | $221 |

Ohio | USAA | $181 |

Oklahoma | American Farmers and Ranchers | $199 |

Oregon | COUNTRY Financial | $167 |

Pennsylvania | GEICO | $244 |

Rhode Island | State Farm | $239 |

South Carolina | American National | $216 |

South Dakota | State Farm | $247 |

Tennessee | State Farm | $198 |

Texas | Farm Bureau | $179 |

Utah | GEICO | $287 |

Vermont | Auto-Owners Insurance | $158 |

Virginia | Farm Bureau | $203 |

Washington | State Farm | $284 |

West Virginia | State Farm | $203 |

Wisconsin | USAA | $188 |

Wyoming | USAA | $252 |

Monthly and costs of car insurance for 17-year-old drivers.

How to save money on car insurance for 17-year-old drivers

While car insurance costs for 17-year-olds are higher than average, there are still ways that young drivers can save money on car insurance. If your quotes are too high as you shop for coverage — or if you’re paying too much for a current policy — you should:

Join or stay on an existing policy: Because it’s cheaper to add a young driver to a family policy, it’s a good idea to remain on an existing policy for as long as you can — if you’re able.

Shop for discounts: Many companies have discounts that can help 17-year-old drivers lower their rates. You can usually save by completing a driving safety course, signing up for a monitored driving program that’s specifically designed for teens, and by maintaining a high grade point average.

Consider switching to usage-based or per-mile insurance: Most providers offer usage-based programs. Usually this means a period of monitored driving, where an app tracks your speed, braking, and other habits behind the wheel. Afterwards, your rate could be reduced significantly (as long as you drove safely).

The best way to make sure you’re getting the best rate is by comparing quotes from the top insurance companies in your area and re-shopping when it’s close to your policy’s end. This way, you can be sure you’re getting the lowest price for your driving history, age, and location.

Methodology

Policygenius found the cost of car insurance for 17-year-olds driving using rates provided by Quadrant Information Services for every ZIP code in all 50 states plus Washington, D.C. for a 2017 Toyota Camry LE driven 10,000 miles per year. These rates represent the average cost for 16- and 18-year-olds, and were for full coverage with the following coverage limits:

Bodily injury liability: $50,000 per person, $100,000 per accident

Property damage liability: $50,000 per accident

Uninsured/underinsured motorist: $50,000 per person, $100,000 per accident

Comprehensive: $500 deductible

Collision: $500 deductible

To find the cost of adding a 17-year-old driver to an existing policy, we calculated the average cost of adding a 16-year-old driver to a family’s policy, then we applied the percentage difference between 16- and 17-year-old drivers to this figure.