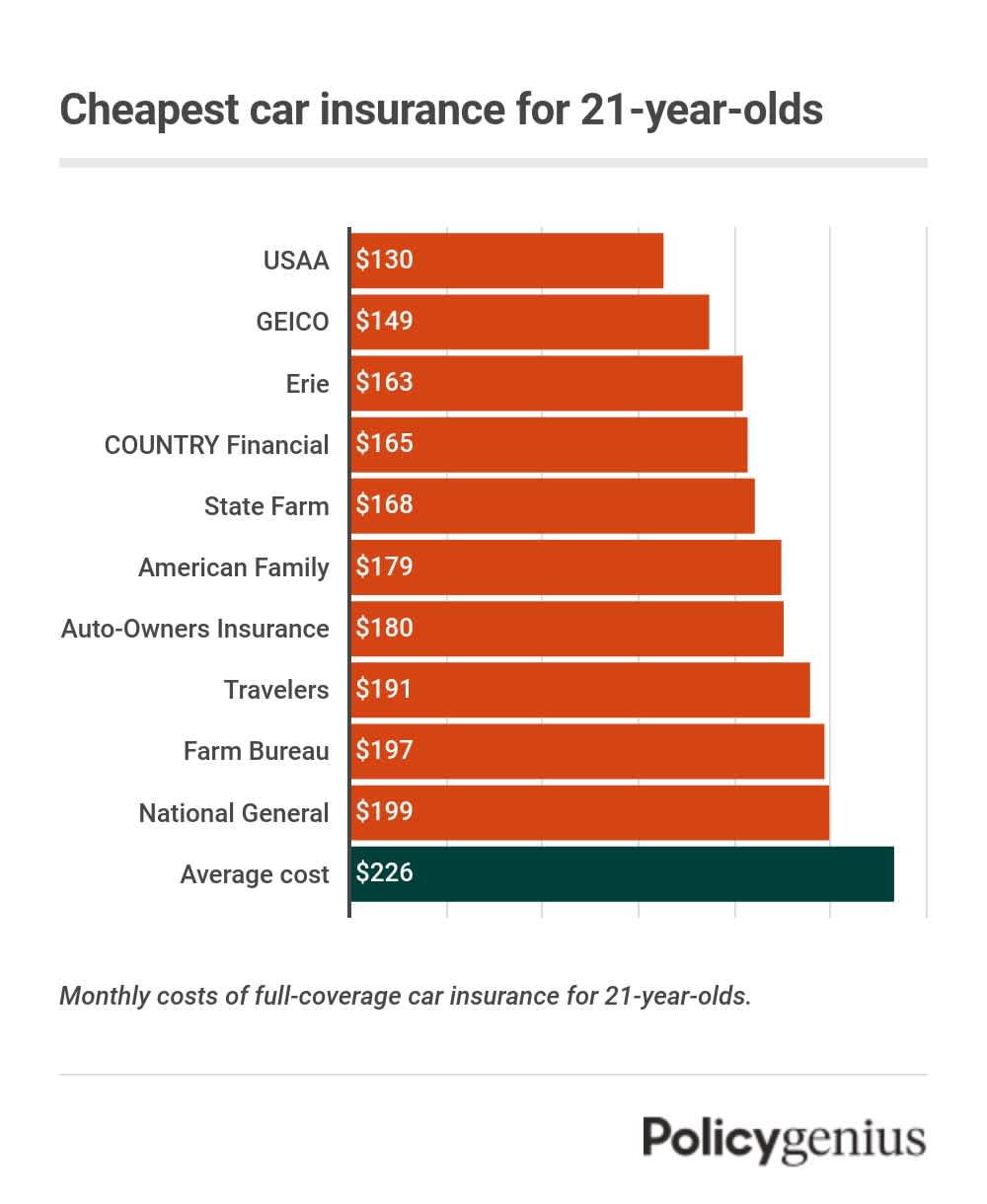

According to our analysis, the average cost of car insurance for 21-year-olds is $226 per month, or $2,708 per year. Auto insurance for a 21-year-old is more expensive than average for most older drivers, but it’s also much cheaper than car insurance for a teen driver.

USAA has the cheapest car insurance for 21-year-olds, though it’s only available to drivers who are in the armed forces or a part of a military family. GEICO is available to everyone and also has cheap auto coverage for 21-year-olds — though it’s slightly more expensive than USAA.

How much is car insurance for 21-year-olds?

The average car insurance cost for 21-year-olds is $266 each month, but rates are different with each company. Our analysis shows car insurance for 21-year-olds is cheapest with USAA. With USAA, insurance for 21-year-old drivers is $130 per month — 42% less than average.

GEICO is another company that has affordable full-coverage insurance for 21-year-olds. On average, GEICO has car insurance for 21-year-old drivers that costs $149 per month. While this is $19 more expensive each month than USAA, GEICO is still 34% cheaper than average.

The difference between the most expensive and cheapest car insurance companies for 21-year-olds is $460 per month. This means drivers could save $5,517 each year by comparing quotes from different companies before buying coverage.

Rank | Company | Monthly cost |

|---|---|---|

1 | USAA | $130 |

2 | $149 | |

3 | $163 | |

4 | COUNTRY Financial | $165 |

5 | $168 | |

6 | $179 | |

7 | Auto-Owners Insurance | $180 |

8 | $191 | |

9 | Farm Bureau | $197 |

10 | National General | $199 |

11 | $202 | |

12 | Average cost | $226 |

13 | Kemper | $231 |

14 | $232 | |

15 | $240 | |

16 | $245 | |

17 | $262 | |

18 | Shelter Insurance | $266 |

19 | MAPFRE | $267 |

20 | The Hartford | $283 |

21 | CSAA | $326 |

22 | Auto Club Group | $354 |

23 | Mercury Insurance | $373 |

24 | Sentry Insurance | $431 |

25 | Hanover | $590 |

Monthly cost of car insurance for 21-year-olds.

How the cost of insurance for 21-year-olds compare to other ages

The average car insurance premium for a 21-year-old driver is cheaper than for most younger drivers, but it’s more expensive than what older drivers pay. We found that car insurance for a 21-year-old is 60% cheaper than for a 16-year-old and 45% cheaper than for an 18-year-old.

Despite their years of experience driving, 21-year-olds still pay 64% more for coverage than those who are 30, 35, and 45 years old.

The cost of car insurance is more affordable for 21-year-olds than it is for drivers who are in their teens because of the years of driving that a typical 21-year-old has done. However, car insurance for new drivers who are 21 years old will be more expensive despite their age, due to a lack of time spent behind the wheel.

How much is insurance for 21-year-old male and female drivers?

Car insurance is more expensive for male drivers than it is for female drivers. On average, we found that car insurance for a 21-year-old male is $27 more expensive per month ($319 per year) than it is for female drivers.

Gender | Monthly cost | Annual cost |

|---|---|---|

Male driver | $239 | $2,867 |

Female driver | $212 | $2,548 |

Difference | $27 | $319 |

While rates for male drivers are more expensive at each of the 10 cheapest companies for 21-year-olds, the difference is smallest at GEICO. Male drivers pay only $3 more per month at GEICO than their female counterparts. At Erie and State Farm, the gap is the largest.

Company | Difference | Male drivers | Female drivers |

|---|---|---|---|

GEICO | $3 | $144 | $141 |

USAA | $8 | $135 | $127 |

American Family | $10 | $201 | $191 |

COUNTRY Financial | $10 | $185 | $174 |

Auto-Owners Insurance | $19 | $159 | $140 |

Travelers | $20 | $198 | $178 |

Farm Bureau | $25 | $208 | $182 |

National General | $32 | $279 | $247 |

Erie | $39 | $184 | $146 |

State Farm | $39 | $219 | $179 |

Monthly costs of car insurance at the 10 cheapest companies for 21-year-olds.

→ Read more about how gender affects the cost of car insurance

How much is car insurance for a 21-year-old in each state?

While the average insurance cost for 21-year-old drivers is $226 per month, the cost you pay depends on where you live, among other factors. We found that rates for a 21-year-old can vary by as much as $322 per month depending on their state.

North Carolina is the cheapest state for 21-year-olds. On average, drivers pay $96 per month for coverage in the state. Conversely, Louisiana is the most expensive state at $418 per month.

State | Monthly cost | Annual cost |

|---|---|---|

$236 | $2,830 | |

$185 | $2,215 | |

$224 | $2,689 | |

$237 | $2,840 | |

$233 | $2,791 | |

$229 | $2,752 | |

$267 | $3,202 | |

$275 | $3,301 | |

$247 | $2,969 | |

$351 | $4,211 | |

$242 | $2,902 | |

$100 | $1,200 | |

$162 | $1,939 | |

$205 | $2,457 | |

$163 | $1,955 | |

$149 | $1,782 | |

$208 | $2,492 | |

$302 | $3,627 | |

$418 | $5,021 | |

$171 | $2,056 | |

$275 | $3,303 | |

$263 | $3,160 | |

$329 | $3,943 | |

$188 | $2,250 | |

$227 | $2,725 | |

$224 | $2,689 | |

$263 | $3,158 | |

$216 | $2,594 | |

$288 | $3,457 | |

$195 | $2,341 | |

$315 | $3,781 | |

$198 | $2,372 | |

$276 | $3,316 | |

$96 | $1,157 | |

$183 | $2,200 | |

$146 | $1,748 | |

$256 | $3,074 | |

$196 | $2,347 | |

$236 | $2,833 | |

$280 | $3,361 | |

$245 | $2,937 | |

$201 | $2,409 | |

$188 | $2,261 | |

$257 | $3,085 | |

$214 | $2,565 | |

$161 | $1,935 | |

$189 | $2,267 | |

$225 | $2,703 | |

$241 | $2,897 | |

$141 | $1,695 | |

$201 | $2,409 |

Cost of full-coverage car insurance for 21-year-olds.

→ Read more about how the cost of coverage changes by location and driver

Best cheap car insurance for 21-year-olds: GEICO

GEICO is the best car insurance company for 21-year-olds. The average cost of auto insurance from GEICO is $149 per month, which makes it the second-most affordable option for 21-year-olds behind USAA. Unlike USAA, GEICO offers cheap coverage to the general public in all 50 states and the District of Columbia.

GEICO’s discounts also make it good car insurance for 21-year-olds. While rates are already cheap, GEICO allows them to save by owning a vehicle with safety features, completing a safety course, being affiliated with a partner group or employer, and more.

Cheapest car insurance for 21-year-olds in every state

USAA is also the cheapest car insurance company for 21-year-olds in 25 states. Keep in mind, though, that it’s only available to active and retired members of the military and their families.

GEICO is the cheapest auto insurance for 21-year-olds in 14 states — the most behind USAA. State Farm, Farm Bureau, and a few other companies are the most affordable option in the remaining 12 states.

State | Cheapest company | Monthly cost |

|---|---|---|

Alabama | GEICO | $120 |

Alaska | GEICO | $97 |

Arizona | Root | $95 |

Arkansas | USAA | $109 |

California | Wawanesa | $120 |

Colorado | American National | $111 |

Connecticut | GEICO | $122 |

Delaware | USAA | $152 |

District of Columbia | USAA | $138 |

Florida | GEICO | $207 |

Georgia | USAA | $133 |

Hawaii | GEICO | $65 |

Idaho | American National | $74 |

Illinois | GEICO | $101 |

Indiana | USAA | $89 |

Iowa | State Farm | $101 |

Kansas | USAA | $113 |

Kentucky | GEICO | $145 |

Louisiana | USAA | $185 |

Maine | GEICO | $77 |

Maryland | USAA | $95 |

Massachusetts | USAA | $129 |

Michigan | GEICO | $125 |

Minnesota | Farm Bureau | $124 |

Mississippi | USAA | $102 |

Missouri | USAA | $87 |

Montana | USAA | $108 |

Nebraska | USAA | $141 |

Nevada | GEICO | $118 |

New Hampshire | USAA | $97 |

New Jersey | GEICO | $146 |

New Mexico | USAA | $105 |

New York | Progressive | $136 |

North Carolina | GEICO | $56 |

North Dakota | USAA | $100 |

Ohio | USAA | $97 |

Oklahoma | USAA | $115 |

Oregon | COUNTRY Financial | $115 |

Pennsylvania | GEICO | $136 |

Rhode Island | State Farm | $150 |

South Carolina | American National | $89 |

South Dakota | State Farm | $153 |

Tennessee | USAA | $105 |

Texas | Farm Bureau | $122 |

Utah | GEICO | $100 |

Vermont | USAA | $102 |

Virginia | USAA | $98 |

Washington | USAA | $125 |

West Virginia | USAA | $120 |

Wisconsin | USAA | $84 |

Wyoming | USAA | $116 |

Cost of full-coverage car insurance for 21-year-olds.

How to save money on car insurance as a 21-year-old

Although car insurance is more expensive for 21-year-olds than older drivers, it’s still possible to get affordable coverage. The most reliable way you can be sure to get the lowest rate is by comparing quotes from your area. You can also take the following steps to save money:

Don’t get a separate policy: As long as you live at home or are away at school (and your parents allow it) it’s cheaper to join your parents’ car insurance policy than it is to get a separate policy.

Check for discounts you could be eligible for: Most companies offer at least a handful of discounts to drivers. Some even have special discounts that could apply specifically to 21-year-olds drivers. These include discounts for being away at college, maintaining a high grade point average, and for completing a special driving course for young people.

Reconsider the amount of coverage you need: You may not need full coverage if your car is more than a decade old. If your vehicle is worth less than your deductible, you wouldn’t be able to make a claim after a total loss.

Sign up for a usage-based driving program: Most companies — and all major insurance providers — allow drivers to sign up for a few days of monitored driving in exchange for the chance at lower rates. If you’re a safe driver with good habits, you could significantly reduce your rates with one of these programs.

Methodology

Policygenius found the cost of car insurance for 21-year-olds by analyzing rates from every ZIP code in all 50 states and the District of Columbia. These rates were provided by Quadrant Information Services for a full coverage policy with the following coverage limits:

Bodily injury liability: 50/100

Property damage liability: $50,000

Uninsured/underinsured motorist: 50/100

Comprehensive: $500 deductible

Collision: $500 deductible

Our sample vehicle was a 2017 Toyota Camry LE driven 10,000 miles/year. Some carriers may be represented by affiliates or subsidiaries. Rates provided are a sample of costs. Your actual quotes may differ.