Most car insurance companies offer multi-car discounts for insuring more than one vehicle on the same policy, and these discounts can lower your costs by as much as 25%. There are still some standout companies when it comes to the cheapest multi-car insurance though, like Erie, Auto-Owners, and GEICO.

But if you own two or more cars and a shopping for an insurance policy to cover them, the best car insurance company for you may vary depending on where you live and what your coverage needs are. Comparing quotes can help you make sure you’re getting the best deal on multi-car insurance.

Companies with the cheapest multi-car insurance

We found that Erie is the cheapest insurance company for insuring multiple vehicles, with an average monthly rate of $153. That’s $1,839 a year, or $1,000 less than the national average rate for a multi-car policy.

USAA (if you’re affiliated with the military), Auto-Owners, GEICO, and State Farm also had some of the cheapest rates for insuring multiple cars.

Average monthly cost for a multi-car policy | |

|---|---|

$153 | |

USAA* | $155 |

$172 | |

$173 | |

$175 | |

$199 | |

$200 | |

$203 | |

Shelter | $212 |

$214 | |

$218 | |

National average | $237 |

USAA is only available if you’re a veteran, in the military, or a part of a military family.

Cheapest multi-car insurance company in every state

One of the biggest factors that affects your car insurance premiums is where you live. Here are the cheapest companies for multi-car insurance broken down by state:

State | Cheapest multi-car insurance | Monthly rate for multiple cars |

|---|---|---|

USAA | $143 | |

State Farm | $134 | |

Auto-Owners | $134 | |

USAA | $141 | |

Wawanesa | $128 | |

American National | $113 | |

GEICO | $109 | |

State Farm | $171 | |

GEICO | $147 | |

State Farm | $242 | |

Auto-Owners | $154 | |

GEICO | $136 | |

American National | $64 | |

Pekin | $94 | |

USAA | $105 | |

State Farm | $106 | |

USAA | $140 | |

GEICO | $176 | |

USAA | $221 | |

USAA | $91 | |

USAA | $118 | |

Norfolk & Dedham | $177 | |

GEICO | $148 | |

Farm Bureau | $142 | |

USAA | $141 | |

USAA | $115 | |

USAA | $127 | |

Auto-Owners | $162 | |

GEICO | $142 | |

USAA | $97 | |

GEICO | $138 | |

USAA | $129 | |

Progressive | $145 | |

Erie | $88 | |

USAA | $121 | |

USAA | $104 | |

USAA | $147 | |

State Farm | $127 | |

Erie | $136 | |

State Farm | $138 | |

American National | $99 | |

Kemper | $144 | |

USAA | $123 | |

State Farm | $153 | |

USAA | $117 | |

USAA | $108 | |

State Farm | $94 | |

PEMCO | $116 | |

USAA | $103 | |

USAA | $130 | |

American National | $102 |

How does insurance work for multiple cars?

Insuring multiple cars is pretty similar to insuring one car, except that not every car on your policy has to have identical coverage.

The liability coverage limits (for both bodily injury and property damage) and uninsured motorist coverage limits you choose will apply to every car listed on the policy, so those will all be the same for each vehicle.

But some coverages are applied per-vehicle, like comprehensive coverage and collision coverage, as well as gap insurance and rental car reimbursement. That means that you can have full coverage on one car but not the other.

And because comprehensive and collision coverage are per-car, you can also set your deductibles separately (that’s the amount of money you pay out of pocket for a claim when your car is damaged).

But claims also work the same way if you have multiple cars on the same policy, you’ll just have to specify which vehicle was in the accident when you first start the claims process.

Keep in mind that these are national average rates, so your rates may be lower (or higher) based on your location, driving history, and other factors.

Should you insure multiple cars with the same policy?

Yes, it’s almost always a good idea to insure both or all of your cars on the same car insurance policy. It’s cheaper and easier than getting a separate insurance policy for each car.

Some benefits of insuring more than one car on the same policy include:

You can pay one combined monthly or annual premium

You’ll probably qualify for a multi-car or multi-vehicle discount

If both of your cars are damaged in the same incident you may just have to pay a single deductible

Some companies let you stack, or combine, certain coverages across more than one vehicle.

Insuring more than one driver on the same policy

Insurance companies typically require every driver in your household to be listed on your car insurance policy, and if you have both multiple cars and multiple drivers, you’ll have to assign a primary driver to each vehicle.

Expect your rates to go up if you have a high-risk driver, like a new teenage driver or someone with a spotty record, in your household.

How much is multi-car insurance?

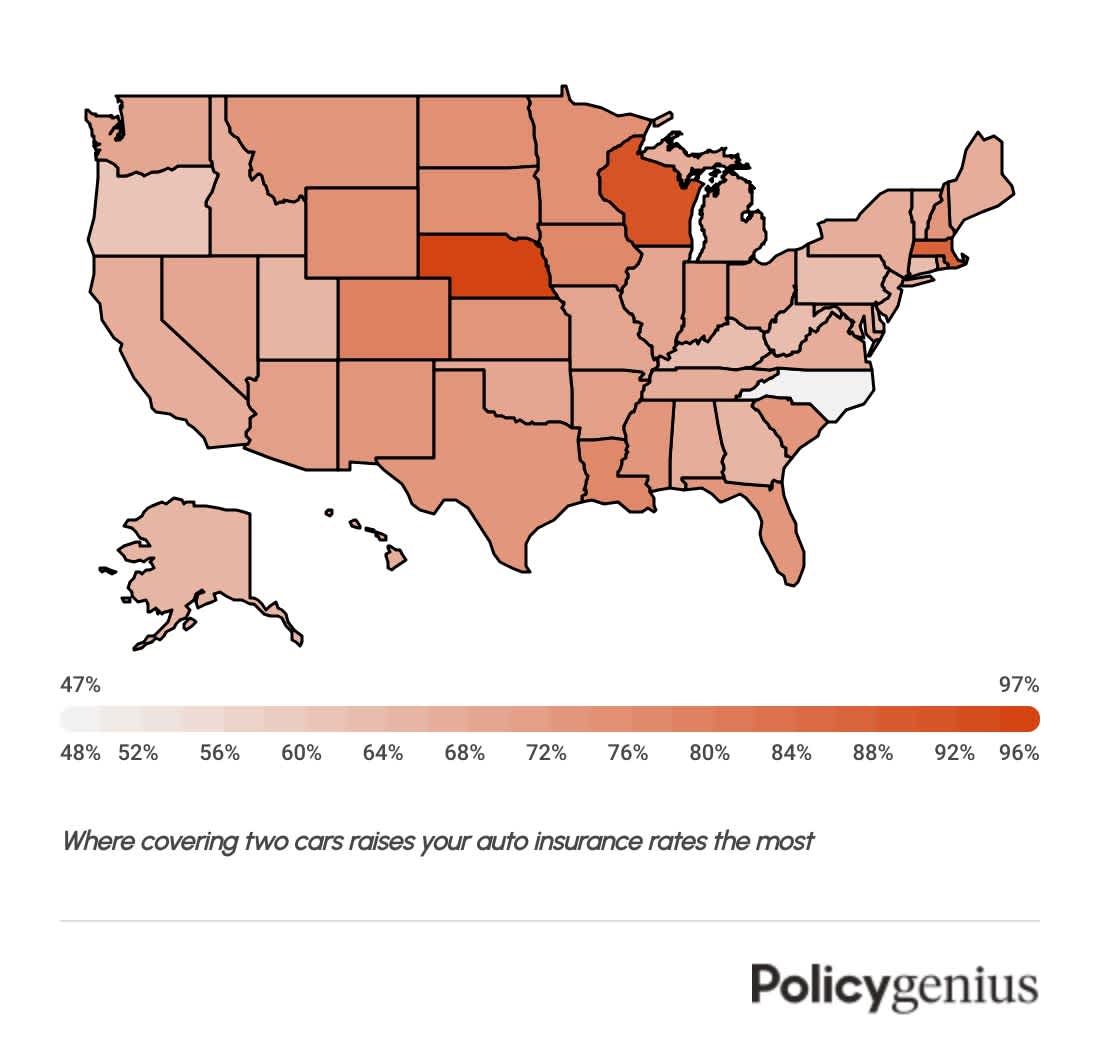

The average cost of multi-car insurance is $237 a month or $2,839 a year for a policy that covers two cars. That’s $1,201 more expensive per year than the cost of insurance for a single car, or an increase of 73%.�

Your rates may vary, though, depending on things like your age, location, driving history, and the make and models of the different cars on your policy.

State | Monthly cost insurance for one cars | Monthly cost of insurance for two cars |

|---|---|---|

Alabama | $148 | $246 |

Alaska | $116 | $191 |

Arizona | $133 | $225 |

Arkansas | $145 | $249 |

California | $154 | $256 |

Colorado | $156 | $280 |

Connecticut | $154 | $252 |

Delaware | $176 | $286 |

District of Columbia | $152 | $265 |

Florida | $236 | $408 |

Georgia | $137 | $224 |

Hawaii | $140 | $233 |

Idaho | $93 | $155 |

Illinois | $113 | $191 |

Indiana | $103 | $176 |

Iowa | $98 | $173 |

Kansas | $131 | $225 |

Kentucky | $184 | $298 |

Louisiana | $212 | $375 |

Maine | $94 | $157 |

Maryland | $151 | $251 |

Massachusetts | $158 | $296 |

Michigan | $206 | $342 |

Minnesota | $120 | $210 |

Mississippi | $144 | $250 |

Missouri | $134 | $226 |

Montana | $155 | $268 |

Nebraska | $134 | $264 |

Nevada | $186 | $315 |

New Hampshire | $103 | $178 |

New Jersey | $187 | $307 |

New Mexico | $124 | $214 |

New York | $188 | $314 |

North Carolina | $88 | $130 |

North Dakota | $119 | $208 |

Ohio | $86 | $145 |

Oklahoma | $145 | $245 |

Oregon | $122 | $196 |

Pennsylvania | $141 | $230 |

Rhode Island | $154 | $267 |

South Carolina | $169 | $293 |

South Dakota | $129 | $226 |

Tennessee | $113 | $187 |

Texas | $151 | $262 |

Utah | $129 | $212 |

Vermont | $115 | $192 |

Virginia | $95 | $158 |

Washington | $148 | $251 |

West Virginia | $93 | $150 |

Wisconsin | $140 | $267 |

Wyoming | $120 | $209 |

How to get car insurance for multiple cars

If you already have car insurance , adding a second (or third) car to your policy is easy, and you can usually do it over the phone or online.

And if you’re shopping for a new policy, here’s how to find quotes for multi-car insurance and choose the company that’s best for you in five simple steps:

Car insurance companies with multi-policy discounts

Most companies offer car insurance discounts if you insure more than one vehicle on the same policy. Here is a list multi-vehicle discount by company:

Company name | Multi-vehicle discount? |

|---|---|

Allstate | Yes |

American Family | Yes |

Amica | Yes (up to 25%) |

Auto Club (AAA) | Yes |

Auto-Owners Insurance | Yes |

COUNTRY Financial | Yes |

CSAA | Yes |

Erie | Yes (up to 25%) |

Farm Bureau | Yes |

Farmers | Yes |

GEICO | Yes (up to 25%) |

The Hartford | Yes |

Kemper | Yes |

Nationwide | Yes |

Progressive | Yes (12% on average) |

Shelter | Yes |

State Farm | Yes |

Travelers | Yes |

USAA | Yes |