Car insurance for a Tesla costs more than it does for other vehicles, partly because of high repair costs. On average, we found that the cost of insurance for a Tesla is $239 per month, or $2,869 per year.

We found that the best way to get the cheapest car insurance for your Tesla is by getting Tesla’s own car insurance, if it’s available in your area. Tesla car insurance uses your car’s features to track your driving behavior and offers cheaper insurance rates to the safest drivers.

How much is insurance on a Tesla?

Insurance on a Tesla costs $239 per month, or $2,869 per year on average. That’s $101 more expensive per month than the overall average cost of car insurance, but it’s more in line with the typical cost to insure an electric vehicle. The cost of Tesla car insurance is only $33 more per month than the average cost of car insurance for an EV.

At an average of $1,030 a year, we found that State Farm is the cheapest company for most Tesla drivers (assuming that you can’t get Tesla’s own car insurance in your state).

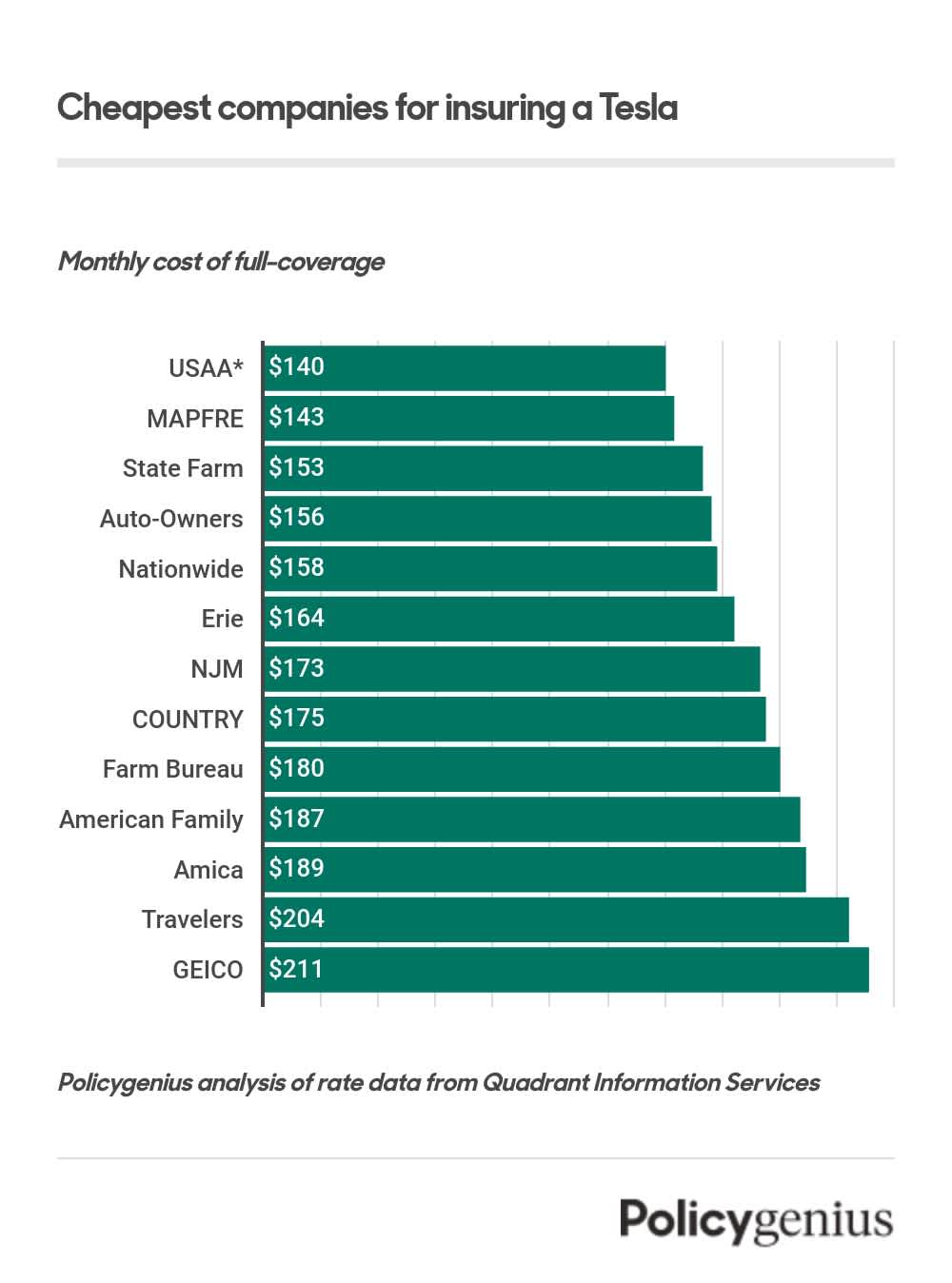

Aside from Tesla’s own insurance, USAA and MAPFRE are the cheapest companies for insuring a Tesla. However, USAA is only available to drivers who are in the military and their families, and MAPFRE is only available in 19 states.

Company | Monthly cost | Annual difference from average |

|---|---|---|

USAA* | $140 | -$1,183 |

MAPFRE | $143 | -$1,155 |

State Farm | $153 | -$1,030 |

Auto-Owners | $156 | -$993 |

Nationwide | $158 | -$971 |

Erie | $164 | -$899 |

NJM | $173 | -$789 |

COUNTRY | $175 | -$769 |

Farm Bureau | $180 | -$704 |

American Family | $187 | -$624 |

Amica | $189 | -$601 |

Travelers | $204 | -$418 |

GEICO | $211 | -$336 |

USAA is only available to members of the military, veterans, and their families.

How much is insurance for a Tesla vs. other cars?

Insurance for a Tesla, like other electric cars, is higher than average. But compared to the cost of other electric vehicles, especially more affordable models, the cost of insurance for a Tesla is still more expensive.

Vehicle | Average monthly cost | Average annual cost |

|---|---|---|

Tesla Model Y | $248 | $2,974 |

Tesla Model 3 | $231 | $2,771 |

Chevrolet Bolt EV | $174 | $2,085 |

Nissan Leaf | $170 | $2,040 |

→ Read more about how the type of car you have affects your insurance rates

Why is the cost of Tesla insurance so high?

Electric vehicles generally cost more to replace or repair after an accident, so they generally cost more to insure. But insurance for Teslas tends to be even higher than it is for other EVs.

Insurance for a Tesla is high (even among electric cars) because Teslas can be more difficult and costly to repair than other EVs. Like other high-end cars, you can’t repair a Tesla at any body shop. Damaged Teslas have to be repaired at a certified Tesla Service Center or by a Tesla technician that’s trained to work with the car’s high-tech systems.

The material that Tesla’s are made out of also makes the cars more expensive to repair (and insure). Like other electric vehicles, Tesla uses aluminum or an aluminum-steel hybrid for its frames to reduce its weight. While aluminum makes cars lighter, it’s a lot more expensive than steel.

→ Learn more about car insurance rates by car

Average cost to insure a Tesla in every state

There are some states where it’s cheaper to insure a Tesla than others. While the average cost of insurance for a Tesla is $239 per month, in North Carolina it costs an average of just $129 a month to insure a Tesla.

If you’re finding that insurance for a Tesla is too expensive where you live, we recommend comparing insurance quotes from more than one company before you buy a policy.

State | Average monthly cost | Average annual cost |

|---|---|---|

$261 | $3,135 | |

$211 | $2,534 | |

$227 | $2,720 | |

$284 | $3,408 | |

$274 | $3,283 | |

$267 | $3,202 | |

$261 | $3,136 | |

$261 | $3,137 | |

$285 | $3,419 | |

$343 | $4,116 | |

$223 | $2,675 | |

$145 | $1,741 | |

$170 | $2,045 | |

$207 | $2,481 | |

$184 | $2,206 | |

$188 | $2,256 | |

$267 | $3,201 | |

$297 | $3,567 | |

$360 | $4,315 | |

$171 | $2,050 | |

$251 | $3,011 | |

$224 | $2,694 | |

$336 | $4,029 | |

$208 | $2,499 | |

$315 | $3,783 | |

$251 | $3,014 | |

$265 | $3,184 | |

$283 | $3,391 | |

$310 | $3,718 | |

$182 | $2,187 | |

$258 | $3,096 | |

$228 | $2,741 | |

$291 | $3,486 | |

$129 | $1,542 | |

$216 | $2,595 | |

$152 | $1,825 | |

$263 | $3,161 | |

$180 | $2,163 | |

$253 | $3,035 | |

$283 | $3,399 | |

$251 | $3,010 | |

$227 | $2,726 | |

$209 | $2,508 | |

$244 | $2,924 | |

$208 | $2,491 | |

$177 | $2,124 | |

$256 | $3,075 | |

$224 | $2,687 | |

$264 | $3,167 | |

$168 | $2,018 | |

$231 | $2,767 |

Full-coverage car insurance rates for a Tesla.

What is Tesla Insurance?

Tesla also offers its own insurance that you can buy directly from the automaker. We found that, if you can get it, Tesla Insurance is the best insurance for Teslas. That’s because Tesla Insurance uses information about your real-time driving to adjust what you pay, which means discounted rates for safe drivers.

Tesla Insurance is also our top choice for Teslas because of how convenient it is for drivers. You can purchase Tesla Insurance through the same app that you use to access and monitor your vehicle.

If your car is damaged, you can easily get assistance, submit photos of your car’s damage, and file a claim for repairs with your Tesla auto insurance using the same app.

Right now, you can only get Tesla Insurance in these states:

Arizona

California

Colorado

Illinois

Maryland

Minnesota

Nevada

Ohio

Oregon

Texas

Utah

Virginia

What does Tesla Insurance cost?

We found that Tesla Insurance is generally cheaper than going through a standard car insurance company to insure your Tesla.

If it’s available near you (and if you’re a good driver), Tesla itself estimates that drivers save between 20% and 40% with Tesla Insurance. The safest drivers could see savings of 30% to 60%.

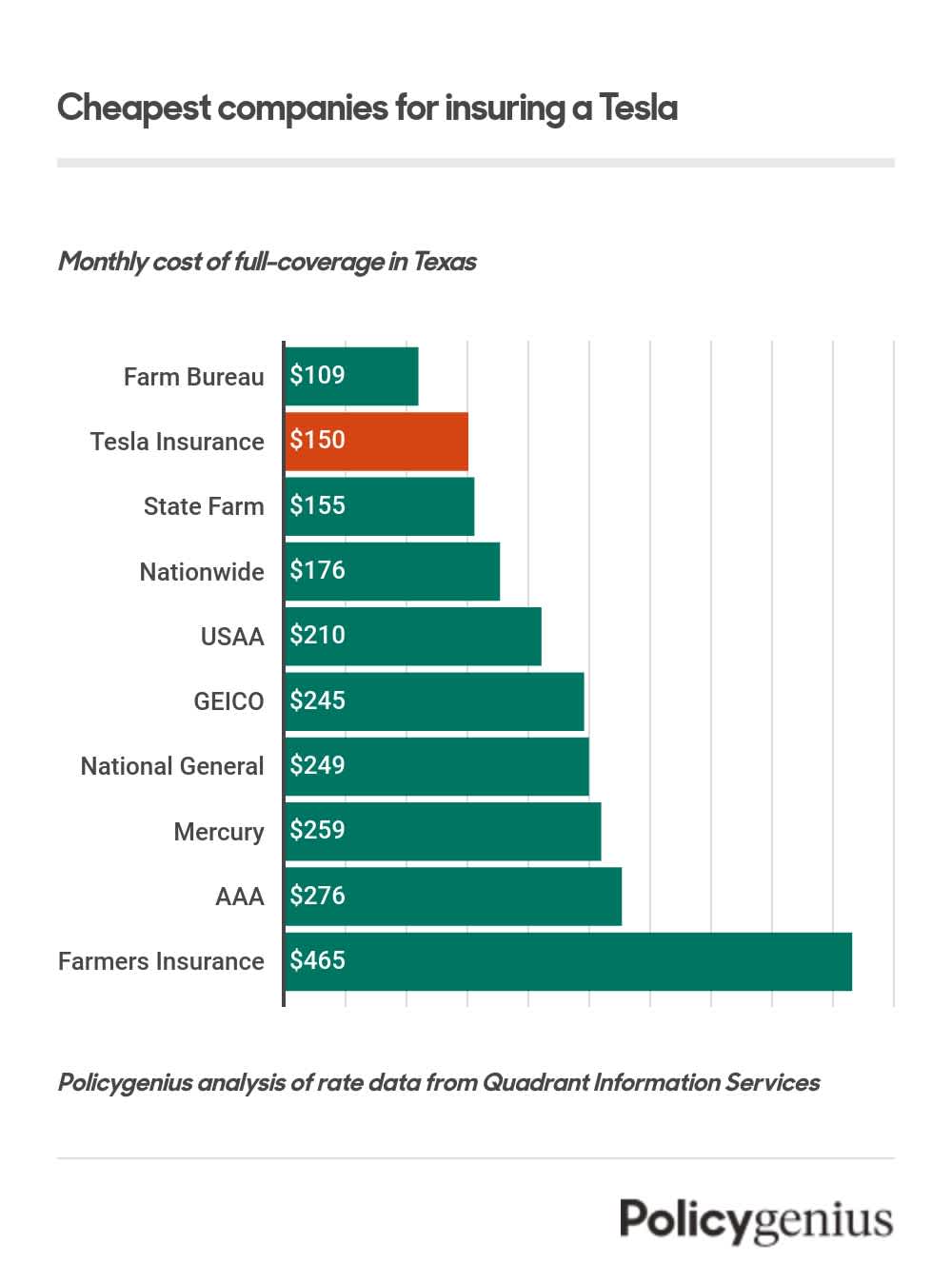

In our analysis of car insurance rates for Teslas in Texas, we found that Tesla Insurance is one of the cheapest options in the state. Tesla Insurance was $953 cheaper than the average rate to insure a Tesla in Texas.

As of October 2022, Tesla only underwrites its own insurance policies in Colorado, Oregon, and Virginia. That means that in other states where you can get Tesla Insurance, Tesla partners with another insurance company for its policies.

How does Tesla insurance work?

Tesla Insurance sets your rates primarily on your real-time driving behaviors, just like other usage-based insurance programs. Rates also depend on how much you drive, which model you have, where you live, your coverage, and how many Teslas you own.

When you sign up for Tesla Insurance, Tesla will monitor your driving using your vehicle’s built-in software. Every month your insurance premium changes based on what’s called your Safety Score.

Your Safety Score shows up as a number on a scale of 0 to 100. It’s calculated based on five factors that tell Tesla how likely it is that you’ll be in a collision. These are:

Your number of forward collision warnings per 1,000 miles

How often you brake suddenly instead of gradually

Your speed while turning and changing lanes

The amount of time you spend driving too closely to the car in front of you

How often your Autopilot system disengages because you’re inattentive

If you drive poorly over the month, your Safety Score will decrease and your rates will go up. With Tesla Insurance, most drivers are expected to have a Safety Score of at least 80. Under that, the cost of Tesla car insurance will get noticeably more expensive.

Drivers in California can’t get a Safety Score, even though Tesla Insurance is available. California drivers will just lose out on the telematics discount part of Tesla Insurance, but can still monitor their policy and make claims from their car’s app.

Methodology

We found the cost of Tesla car insurance by analyzing public rate data from every ZIP code in the country. Our rates were provided by Quadrant Information Services, and were for a 30-year-old male driver’s 2017 Toyota Camry with 10,000 miles per year. The policy was for:

Bodily injury liability: $50,000 per person, $100,000 per accident

Property damage liability: $50,000 per accident

Uninsured/underinsured motorist: $50,000 per person, $100,000 per accident

Comprehensive: $500 deductible

Collision: $500 deductible

We found the cost of Tesla Insurance using a sample driver living in Texas. In Texas, the company Redpoint Mutual underwrites Tesla Insurance. We calculated the average cost to insure a Tesla in Texas using the same coverage limits as our national analysis.